7 Powerful Strategies for Late Bloomers to Balance Career and Family Finances

Have you ever found yourself torn between pursuing your career dreams and managing family responsibilities, wondering if true financial independence is achievable? Balancing career, family, and finances can be a complex challenge, especially for those experiencing a career transition later in life.

As a life coach, I’ve helped many women navigate these challenges. In my experience, balancing personal financial goals with family duties is a common struggle, particularly for older professionals seeking work-life balance.

In this article, you’ll discover actionable strategies to create a comprehensive financial plan, prioritize retirement savings, explore flexible work arrangements, develop new skills, and communicate openly about finances with your family. These tips are especially valuable for those focusing on financial planning for delayed success.

Let’s dive in and transform your financial journey together, addressing key aspects of balancing career, family, and finances.

Understanding the Struggles of Balancing Career and Family Finances

Finding harmony between career aspirations and family duties can be overwhelming. Many women in relationships often share that prioritizing family over career earlier in life adds layers of complexity to their financial planning now, especially when it comes to balancing career and family finances.

For example, several clients report feeling stuck because they postponed their financial goals to focus on family. In my experience, this delay often makes catching up seem daunting, particularly for those navigating career transitions as late bloomers.

Moreover, the challenge isn’t just financial; it’s emotional. Balancing the needs of your family while trying to advance your career can lead to stress and guilt, impacting work-life balance for older professionals.

By addressing these pain points, we can create a roadmap to help you achieve financial independence, including retirement strategies for late bloomers and savings strategies for delayed professionals.

Creating Your Financial Roadmap for Success

Overcoming this challenge of balancing career, family, and finances requires a few key steps. Here are the main areas to focus on to make progress:

- Create a comprehensive financial plan: Assess your entire financial situation and set clear long-term goals, especially important for those pursuing career transition for late bloomers.

- Prioritize retirement savings: Increase retirement contributions and diversify your investments, crucial for retirement strategies for late bloomers.

- Explore flexible work arrangements: Negotiate remote work options or consider part-time opportunities to improve work-life balance for older professionals.

- Develop new skills through online courses: Enhance qualifications with certification programs and free resources, aiding in career advancement for older adults.

- Network for career opportunities: Join professional associations and seek mentorship to support balancing career, family, and finances.

- Set realistic short-term financial goals: Create a savings plan and track your progress, essential for financial planning for delayed success.

- Communicate openly about finances with family: Schedule regular discussions and involve everyone in family budgeting for late career starters.

Let’s dive in!

1: Create a comprehensive financial plan

Creating a comprehensive financial plan is crucial to balancing career and family finances effectively, especially for those focused on work-life balance for older professionals.

Actionable Steps:

- Conduct a full financial audit: Review all your income, expenses, debts, and assets to understand your financial position, which is essential for balancing career and family finances.

- Set long-term financial goals: Define clear, achievable milestones for retirement strategies for late bloomers, education funds, and debt management for late bloomers.

- Use budgeting tools: Implement apps or spreadsheets to track and manage your finances effectively, aiding in family budgeting for late career starters.

Explanation:

These steps matter because they provide a solid foundation for financial stability. By auditing your finances, setting goals, and using budgeting tools, you can take control of your financial future, which is crucial when balancing career and family finances.

This approach aligns with industry trends that emphasize comprehensive financial planning for long-term success, particularly important for those experiencing career transition for late bloomers. For more insights, check out this article on strategies to prepare for life after work.

Lastly, taking these steps can reduce financial stress and help you achieve your goals more efficiently, supporting savings strategies for delayed professionals.

2: Prioritize retirement savings

Prioritizing retirement savings is essential for securing your future financial independence, especially when balancing career, family, and finances.

Actionable Steps:

- Increase retirement contributions: Allocate a percentage of each paycheck to retirement accounts to build a solid nest egg, a crucial step in financial planning for delayed success.

- Diversify investments: Include a mix of stocks, bonds, and other assets to reduce risk and maximize growth, which is particularly important for late career changers.

- Take advantage of employer matches: Ensure you contribute enough to get the full match from your employer’s retirement plan, an essential strategy for late bloomers.

Explanation:

These steps matter because they create a robust foundation for your retirement. Increasing contributions and diversifying investments align with trends that emphasize the importance of comprehensive financial planning for delayed professionals.

Additionally, taking advantage of employer matches can significantly boost your retirement savings. For further insights, see this article on late financial independence journeys.

Ensuring your retirement savings are on track helps you achieve long-term financial goals while balancing career, family, and finances, which is crucial for work-life balance for older professionals.

3: Explore flexible work arrangements

Exploring flexible work arrangements can help you balance career aspirations with family responsibilities, which is crucial when balancing career, family, and finances.

Actionable Steps:

- Negotiate remote work options: Discuss the possibility of working from home or having flexible hours with your employer, supporting work-life balance for older professionals.

- Consider part-time or freelance opportunities: Seek roles that offer flexibility and align with your skills, ideal for career transition for late bloomers.

- Research family-friendly companies: Target your job search towards organizations known for supporting work-life balance and financial planning for delayed success.

Explanation:

These steps matter because they provide a way to maintain career progress while managing family duties. Flexible work options are increasingly popular and can reduce stress, especially for those balancing career, family, and finances.

According to a LinkedIn article, many professionals find that flexible work arrangements improve their work-life balance. Implementing these steps can help you achieve your financial and career goals while prioritizing family, which is essential for time management for career and family.

Exploring flexible work arrangements can be a game-changer for balancing your career and family life, particularly for late career starters focusing on family budgeting and retirement strategies.

4: Develop new skills through online courses

Developing new skills through online courses can significantly enhance your career prospects and personal growth, especially when balancing career, family, and finances.

Actionable Steps:

- Enroll in online certification programs: Enhance your qualifications by obtaining certifications in areas relevant to your career goals, ideal for career transition for late bloomers.

- Participate in webinars and virtual workshops: Stay updated with industry trends and acquire new skills through interactive sessions, supporting work-life balance for older professionals.

- Utilize free educational resources: Access platforms like Coursera, Khan Academy, or LinkedIn Learning for valuable skill development, perfect for time management for career and family.

Explanation:

These steps matter because continuous learning keeps you competitive and adaptable in the job market. By enhancing your skills, you can open up new career opportunities and stay relevant, which is crucial when balancing career, family, and finances.

For more insights on the benefits of lifelong learning, visit this article on adults going to college for the first time.

Key benefits of online learning include:

- Flexibility to learn at your own pace, supporting work-life balance for older professionals

- Access to a wide range of subjects and expertise, aiding career advancement for older adults

- Cost-effective compared to traditional education, beneficial for family budgeting for late career starters

Embracing these learning opportunities can help you achieve both your career and financial goals while balancing family responsibilities and supporting financial planning for delayed success.

5: Network for career opportunities

Networking for career opportunities is essential to enhance your professional growth and open new doors, especially when balancing career, family, and finances.

Actionable Steps:

- Join professional associations: Connect with peers in your industry and attend relevant networking events, which can be valuable for career transition for late bloomers.

- Utilize social media: Engage with industry leaders and participate in discussions on platforms like LinkedIn, focusing on work-life balance for older professionals.

- Seek mentorship: Find mentors who can provide guidance and support for your career development and financial planning for delayed success.

Explanation:

These steps matter because building a strong professional network can lead to job opportunities and career advancements, crucial for balancing career, family, and finances.

Engaging with industry leaders and peers keeps you informed about trends and opportunities. Additionally, mentorship can provide invaluable advice and support for career advancement for older adults.

For more insights, check out this article on work-life balance and professional success.

Networking can significantly boost your career prospects while balancing family responsibilities and implementing effective time management for career and family.

6: Set realistic short-term financial goals

Setting realistic short-term financial goals is crucial for balancing career, family, and finances while maintaining financial stability.

Actionable Steps:

- Create a savings plan: Allocate funds for emergency savings, vacations, and other short-term needs, focusing on savings strategies for delayed professionals.

- Track progress: Regularly review and adjust your financial goals to stay on track, especially important when balancing career and family finances.

- Reward yourself: Celebrate small financial milestones to stay motivated, which is essential for work-life balance for older professionals.

Explanation:

These steps matter because they provide achievable targets that can help maintain financial health and reduce stress while balancing career, family, and finances.

By setting and tracking short-term goals, you can create a sense of accomplishment and maintain motivation, which is crucial for career advancement for older adults.

For more insights on financial planning, check out this article on financial tips for veterinary graduates.

Examples of short-term financial goals:

- Building an emergency fund

- Paying off a specific debt, focusing on debt management for late bloomers

- Saving for a family vacation while balancing career and family finances

Achieving short-term financial goals can build a strong foundation for long-term success, especially when balancing career, family, and finances.

7: Communicate openly about finances with family

Open communication about finances is vital for balancing career, family, and finances, helping to align family goals and reduce financial stress.

Actionable Steps:

- Schedule regular family meetings: Discuss financial goals, budgets, and any concerns openly to ensure everyone is on the same page when balancing career and family finances.

- Involve children in budgeting: Teach them about money management and involve them in setting family financial goals, which is especially important for late career starters.

- Address financial challenges together: Work as a team to find solutions and support each other’s financial aspirations, particularly crucial for older professionals managing work-life balance.

Explanation:

These steps matter because open communication fosters trust and ensures that everyone understands the family’s financial priorities, which is essential when balancing career and family finances.

By involving the entire family, you create a supportive environment where financial decisions are made collectively, benefiting late bloomers in their career transition.

For more insights on the importance of financial discussions, check out this article on additional financial resources.

Open communication can lead to better financial decisions and a more cohesive family unit, crucial for those balancing career, family, and finances.

Partner with Alleo on Your Financial Journey

We’ve explored the challenges of balancing career and family finances, and the steps to achieve it. But did you know you can work directly with Alleo to make this journey easier and faster?

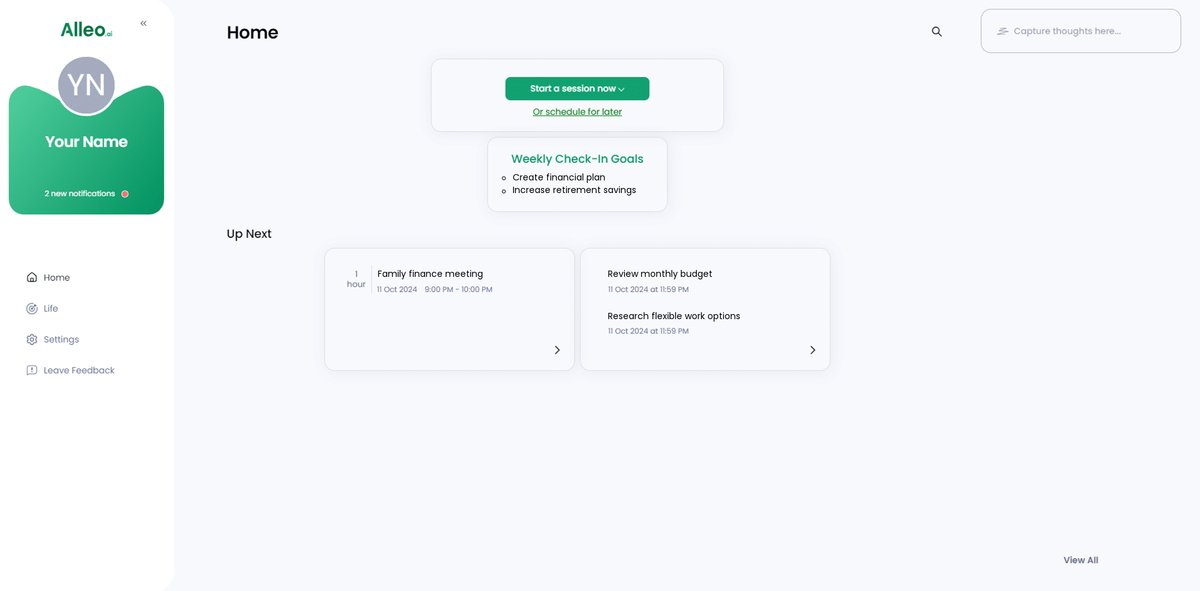

Alleo provides personalized coaching that helps you set and track your financial and career goals, especially for those balancing career and family finances. Creating an account is easy.

You can start by setting up a personalized plan that addresses your specific challenges, including work-life balance for older professionals and financial planning for delayed success.

Our AI coach will follow up on your progress and handle any changes. You’ll stay accountable through text and push notifications, helping you manage time effectively for career and family.

Ready to get started for free? Let me show you how to begin balancing career and family finances!

Step 1: Log In or Create Your Alleo Account

To begin your journey towards financial independence, log in to your existing Alleo account or create a new one to access personalized coaching and goal-tracking tools.

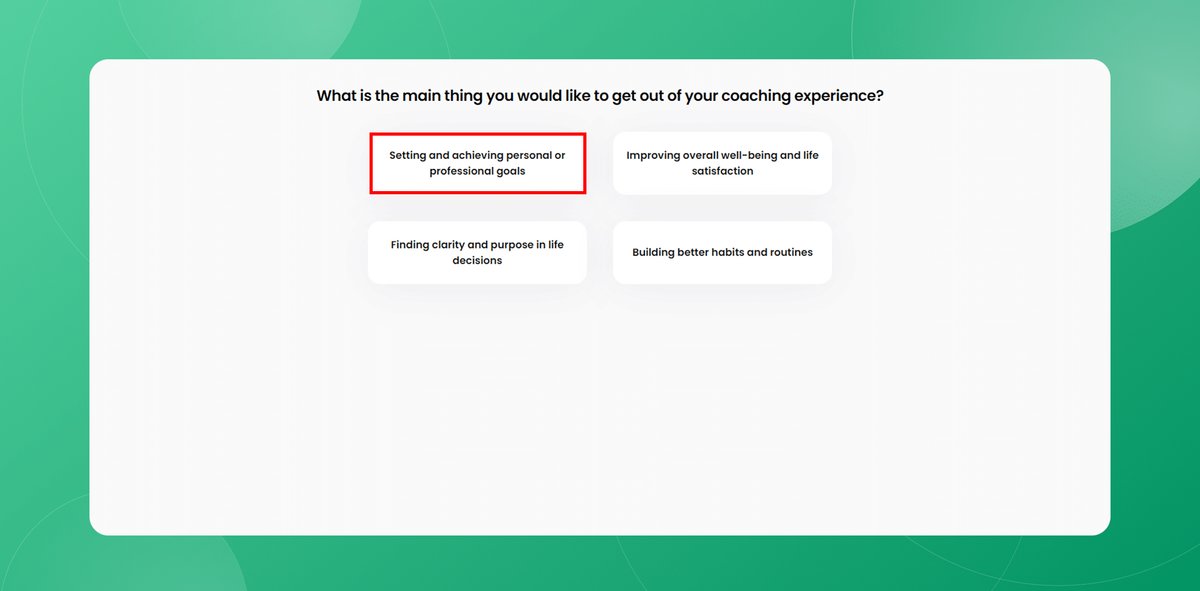

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” to align your career aspirations with your family responsibilities, helping you create a balanced path towards financial independence and personal fulfillment.

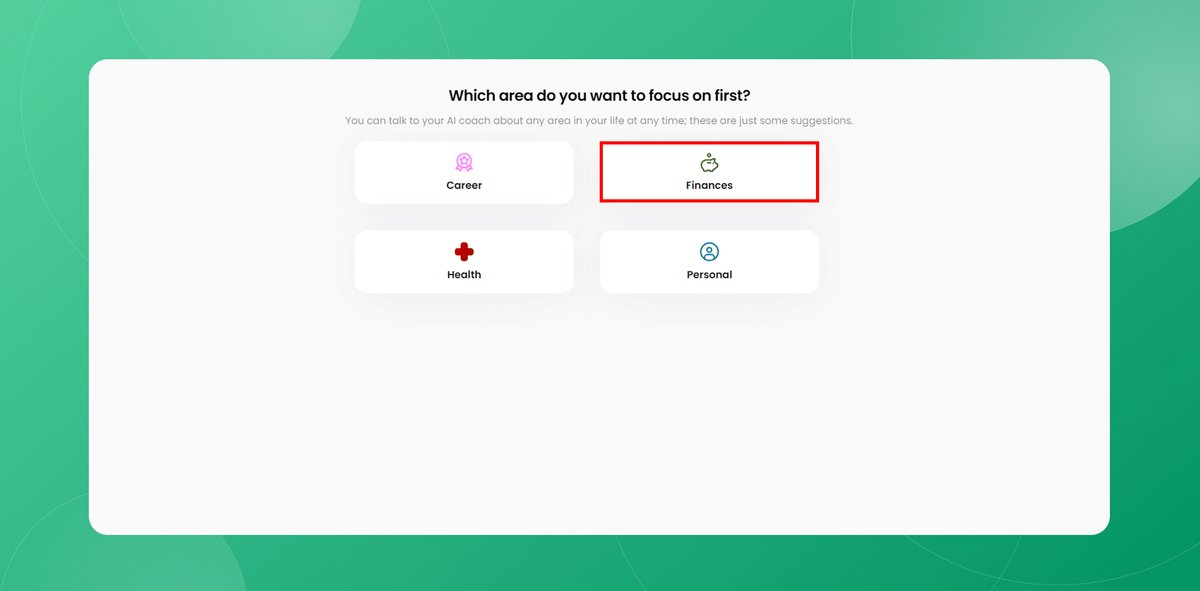

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area in the Alleo AI coach to address the challenges of balancing career and family financial responsibilities discussed in the article. This selection will provide you with tailored guidance and strategies to improve your financial planning, prioritize savings, and achieve a better work-life balance.

Step 4: Starting a Coaching Session

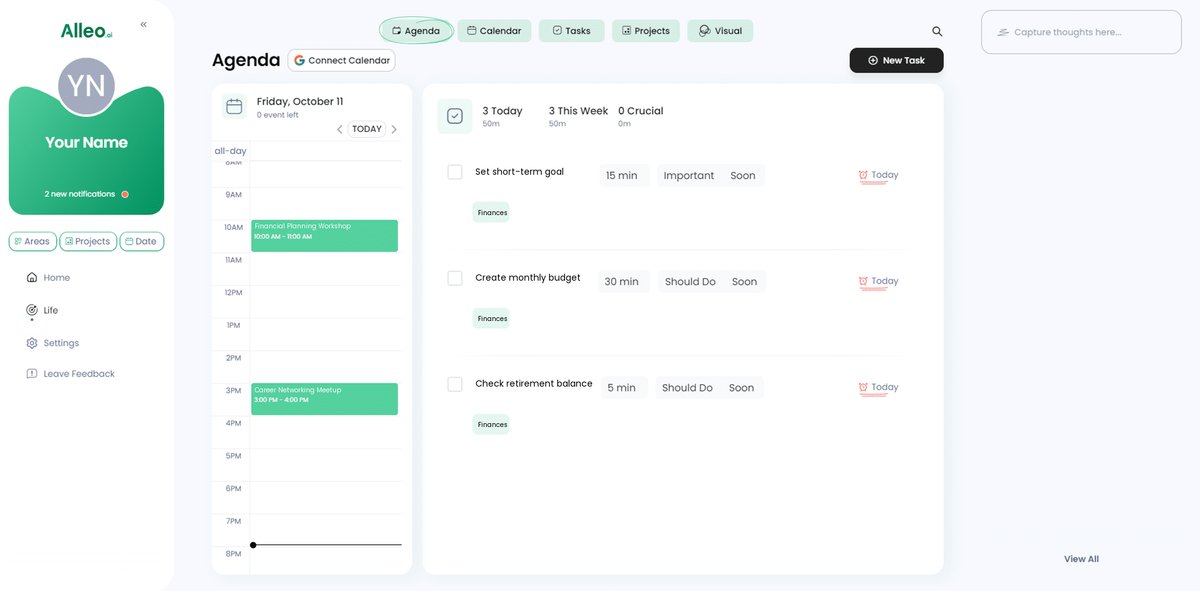

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your career and family financial goals to create a personalized plan that aligns with the strategies outlined in this article.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the app’s home page to view and manage the financial and career goals you discussed, allowing you to track your progress and stay accountable on your journey to balance work and family life.

Step 6: Adding events to your calendar or app

Track your progress in balancing career and family finances by adding key financial milestones and goal-related tasks to your calendar or app, allowing you to visualize your journey and stay accountable to your financial plan.

Empower Your Financial Future

Balancing career and family finances is no easy task. However, with the right strategies, you can achieve financial independence while managing work-life balance for older professionals.

By creating a comprehensive financial plan, prioritizing retirement strategies for late bloomers, and exploring flexible work arrangements, you set yourself up for success. Developing new skills and networking can also open new doors for career advancement for older adults.

Remember, setting realistic short-term goals and communicating openly with your family are crucial steps in family budgeting for late career starters.

You don’t have to do this alone. Alleo can help you manage and achieve your financial and career goals seamlessly, even if you’re considering career transition for late bloomers.

Take the first step today. Sign up for Alleo and transform your financial journey towards balancing career and family finances.