How to Build Credibility as a Finance Professional with an Unconventional Background: Your Path to Success

Are you a startup founder with a unique background, perhaps in bartending or content writing, now stepping into the world of finance? Building finance credibility with an unconventional background can be challenging, but it’s not impossible.

As a life coach, I’ve helped many professionals navigate these challenges and overcome imposter syndrome in finance. In my experience helping clients stand out in competitive industries, I often encounter the struggle of building credibility, especially when transitioning to the finance industry.

In this article, we will explore how to build credibility as a finance professional with an unconventional background. You’ll discover strategies like leveraging micro-credentials, developing finance-focused side projects, and strategic networking for finance professionals. We’ll also discuss how to leverage diverse experiences in finance and develop financial expertise to build trust in financial services.

Let’s dive in and explore how you can successfully navigate unconventional career paths in finance while building finance credibility with an unconventional background.

Understanding the Credibility Challenge in Finance

Stepping into finance from an unconventional background can be daunting. Many clients initially struggle with the credibility gap when building finance credibility with an unconventional background.

You may have honed valuable skills in other fields, but convincing investors of your finance acumen is tough. Leveraging diverse experiences in finance can be challenging for those transitioning into the industry.

Credibility is crucial in finance. Investors and stakeholders need to trust your decisions. Building trust in financial services is essential for professionals from unconventional career paths in finance.

Without a conventional background, building this trust can feel like an uphill battle. Overcoming imposter syndrome in finance is a common challenge for career changers.

I often see clients benefit from strategic approaches. Leveraging micro-credentials, developing finance-focused side projects, and networking for finance professionals are key. Financial certifications for career changers can also boost credibility.

These strategies can transform your investor relations and aid in developing financial expertise.

Navigating this transition requires careful planning. Let’s explore how to build that credibility, focusing on personal branding for finance professionals and enhancing soft skills in finance careers.

Your Roadmap to Building Credibility in Finance

Overcoming this challenge of building finance credibility with an unconventional background requires a few key steps. Here are the main areas to focus on to make progress in your finance industry transition:

- Leverage micro-credentials in finance: Enroll in recognized finance-related programs and showcase your financial certifications for career changers.

- Develop a finance-focused side project: Create and maintain a blog or podcast to demonstrate your expertise and aid in developing financial expertise.

- Network with industry professionals strategically: Attend key events and seek mentorship from seasoned professionals to boost your networking for finance professionals.

Let’s dive in to explore how these steps can help in building trust in financial services and leveraging diverse experiences in finance!

1: Leverage micro-credentials in finance

Leveraging micro-credentials in finance is essential for building finance credibility with an unconventional background. This approach can significantly aid in a finance industry transition.

Actionable Steps:

- Research and enroll in accredited finance programs: Identify and sign up for reputable finance-related micro-credential programs, which are valuable for those pursuing unconventional career paths in finance.

- Complete certifications in key areas: Focus on certifications in financial data analytics, risk management, and investment strategies to develop financial expertise.

- Showcase your achievements: Update your LinkedIn profile and resume with these new certifications. Highlight them in investor meetings to build trust in financial services.

Explanation: These steps matter because they provide you with recognized credentials that validate your skills in finance. They also allow you to keep up with industry trends, like the growing importance of data analytics in decision-making, which is crucial for building finance credibility with an unconventional background.

According to AFP Online, leveraging financial data analytics is crucial for strategic decision-making.

Key benefits of micro-credentials in finance:

- Validate your expertise in specific finance areas

- Stay current with industry trends and technologies

- Enhance your credibility with potential employers and clients, leveraging diverse experiences in finance

With these credentials, you’ll be better positioned to build trust with investors and stakeholders, even when transitioning from an unconventional background to finance.

2: Develop a finance-focused side project

Developing a finance-focused side project can demonstrate your expertise and build credibility in the finance industry, especially when building finance credibility with an unconventional background.

Actionable Steps:

- Start a financial blog or podcast: Select a niche within finance that you are passionate about. Regularly publish insightful content to showcase your expertise and aid in your finance industry transition.

- Engage in real-world financial projects: Offer to analyze financial statements for local businesses or startups. Document your process and results to exhibit your skills and leverage diverse experiences in finance.

- Participate in finance-related forums: Contribute to discussions on platforms like Reddit or LinkedIn. Share your insights and engage with industry professionals, enhancing your networking for finance professionals.

Explanation: These steps are crucial because they allow you to demonstrate your expertise in a concrete way, even when pursuing unconventional career paths in finance.

By creating and sharing valuable content, you can build a portfolio that showcases your skills and aids in developing financial expertise.

According to Georgia Tech Professional Education, practical skills application is essential for career advancement.

With these projects, you’ll be better positioned to gain trust and attract investors, even with an unconventional background, thus building trust in financial services and overcoming imposter syndrome in finance.

3: Network with industry professionals strategically

Strategic networking is crucial for building credibility as a finance professional with an unconventional background. When transitioning into the finance industry, leveraging diverse experiences can set you apart.

Actionable Steps:

- Attend finance industry events: Register for key conferences and workshops. Prepare a concise elevator pitch to introduce yourself and your goals, highlighting your unique path to building finance credibility with an unconventional background.

- Connect with finance professionals on LinkedIn: Reach out to seasoned experts. Request informational interviews to gain insights and build relationships, focusing on networking for finance professionals.

- Join finance-focused online communities: Participate in discussions on platforms like LinkedIn or Reddit. Share your expertise and engage with industry peers, demonstrating your commitment to developing financial expertise.

Explanation: These steps matter because they help you build a strong professional network in finance. By engaging with industry leaders, you can gain valuable insights and establish trust in financial services.

According to KKR, having a network of expert resources is vital for supporting investments and career growth.

Effective networking strategies for finance professionals transitioning from unconventional career paths:

- Cultivate genuine relationships based on mutual interests

- Offer value to your connections before asking for favors

- Follow up consistently to maintain and strengthen relationships

This strategic approach to networking will set you apart and enhance your credibility in the finance industry, even with an unconventional background.

Partner with Alleo on Your Finance Journey

We’ve explored the challenges of building credibility in finance with an unconventional background. Solving these challenges can transform your investor relations and help you in building finance credibility with an unconventional background.

But did you know you can work directly with Alleo to make this journey easier and faster, especially when transitioning into the finance industry?

Setting up an account with Alleo is simple. Create a personalized plan tailored to your finance goals, perfect for those pursuing unconventional career paths in finance.

Alleo’s AI coach will guide you through obtaining micro-credentials, developing finance projects, and strategic networking for finance professionals, all crucial for building trust in financial services.

Alleo keeps you accountable with text and push notifications. The coach follows up on your progress and handles changes, helping you leverage diverse experiences in finance.

You’ll receive practical advice and support anytime, aiding in developing financial expertise and overcoming imposter syndrome in finance.

Ready to get started for free? Let me show you how!

Step 1: Log In or Create Your Alleo Account

To begin your journey in building finance credibility, log in to your Alleo account or create a new one to access personalized guidance and support.

Step 2: Choose Your Finance Career Focus

Select “Setting and achieving personal or professional goals” to define your finance career objectives, aligning your unconventional background with specific areas like financial analysis or investment strategies to build credibility in the industry.

Step 3: Selecting the life area you want to focus on

Choose “Career” as your focus area to address your finance credibility challenges, allowing Alleo’s AI coach to provide targeted guidance on leveraging micro-credentials, developing finance projects, and strategic networking in the financial industry.

Step 4: Starting a coaching session

Begin your finance journey with Alleo by scheduling an intake session, where you’ll work with your AI coach to create a personalized plan tailored to your unique background and finance goals.

Step 5: Viewing and managing goals after the session

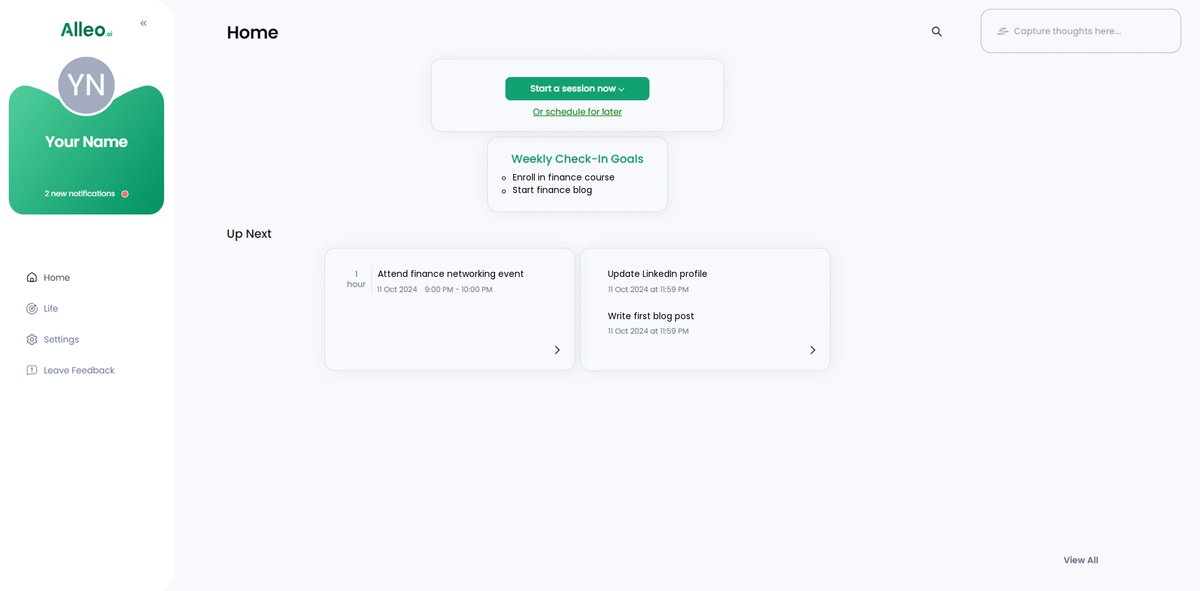

After your coaching session, open the Alleo app to find your discussed finance-related goals displayed on the home page, where you can easily track and manage your progress towards building credibility in the industry.

Step 6: Adding events to your calendar or app

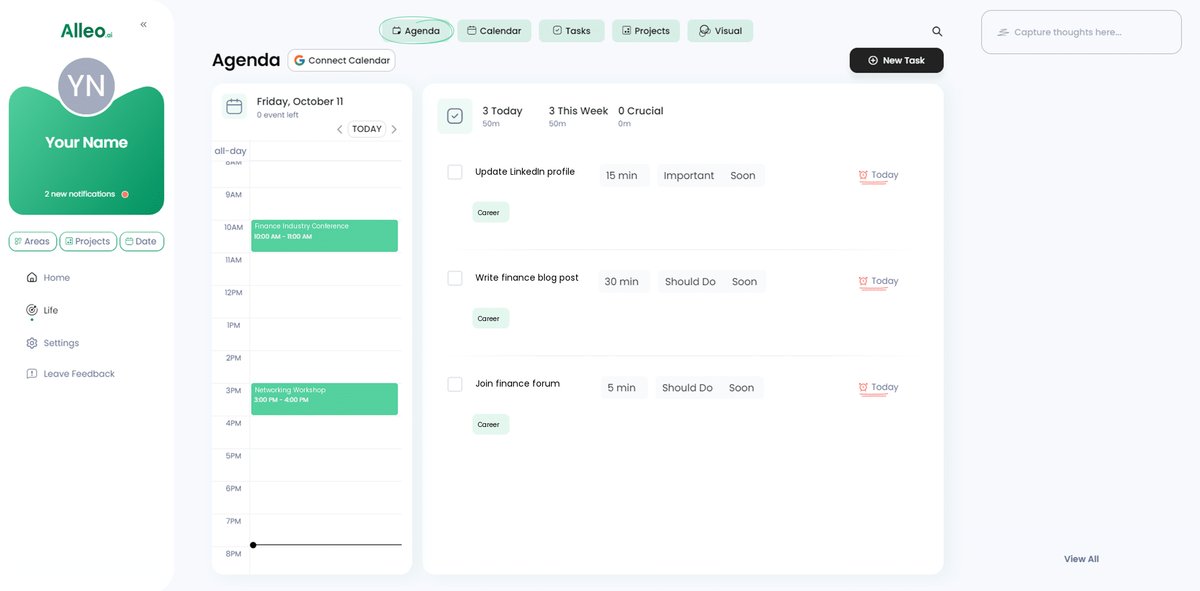

Use Alleo’s calendar and task features to schedule and track your finance-related activities, such as attending industry events, completing micro-credentials, or working on your side projects, helping you stay organized and accountable in your journey to build credibility in the finance industry.

Bringing It All Together

Transitioning into finance from an unconventional background is challenging, but it’s entirely possible. You have the tools and strategies to build credibility in the finance industry, even with diverse experiences.

Remember, leveraging micro-credentials, developing finance-focused side projects, and networking for finance professionals are your keys to success. Stay committed to these steps, and you’ll see results in building finance credibility with an unconventional background.

I know it can be daunting, but you’re not alone in this journey. Alleo is here to help you set goals and stay on track as you navigate unconventional career paths in finance.

With the right approach and Alleo’s support, you can achieve your finance goals and overcome imposter syndrome in finance. Ready to get started on building trust in financial services?

Try Alleo for free today to start developing financial expertise!