7 Powerful Techniques to Transform Investor Communications for Startup CEOs

Are you struggling to improve startup investor communications and keep your investors confident and engaged due to unclear communications?

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, clear and effective communication with VCs is key to maintaining investor trust and building investor confidence.

In this article, you’ll discover specific investor relations strategies to improve startup investor communications, including:

- Establishing a regular update schedule for financial updates for investors

- Creating data-driven KPI dashboards for startup growth metrics reporting

- Personalizing thank-you notes as part of fundraising communication techniques

Let’s dive into these startup CEO best practices for transparency in startup reporting.

The Real Impact of Poor Investor Communications

Let’s face it, unclear investor communications can lead to serious problems. Many clients initially struggle with maintaining transparency in startup reporting, which can erode shareholder confidence and trigger investor exodus.

This often makes it tough to attract new capital, hampering efforts to improve startup investor communications.

I’ve seen that poor communication can also result in vague statements about stock splits and relisting processes. These ambiguities can create confusion and mistrust among investors, highlighting the need for effective communication with VCs.

In my experience, the pain of losing investor trust is profound and hard to recover from, emphasizing the importance of building investor confidence.

Remember, clear communication is not just a nicety; it’s a necessity for startup CEO best practices.

Overcoming this challenge requires a few key steps to improve startup investor communications. Here are the main areas to focus on to make progress and enhance your investor relations strategies.

- Establish regular monthly investor update schedule: Set consistent communication through monthly updates, a crucial aspect of effective communication with VCs.

- Create data-driven KPI dashboards for transparency: Use data visualization for clear and transparent reporting, essential for startup growth metrics reporting.

- Personalize thank-you notes to key stakeholders: Show appreciation through personalized messages, building investor confidence.

- Develop a comprehensive investor data room: Organize essential documents in an accessible data room, aiding in transparency in startup reporting.

- Implement AI-driven CRM for investor management: Use AI tools to track and improve investor relations, a startup CEO best practice.

- Host quarterly investor Q&A webinars: Engage investors with regular, informative webinars, a key fundraising communication technique.

- Craft clear narratives around milestones & strategy: Develop compelling stories about your company’s progress, crucial for startup pitch deck tips and investor meeting preparation.

Let’s dive in to improve startup investor communications!

1: Establish regular monthly investor update schedule

Regular updates are crucial for maintaining investor confidence and transparency, helping improve startup investor communications.

Actionable Steps:

- Set a consistent schedule: Choose a specific day each month for sending updates. Use calendar tools to set reminders for effective communication with VCs.

- Create a template: Develop a standard format for updates. Include key metrics, milestones, and company news to enhance transparency in startup reporting.

- Ensure timely delivery: Schedule updates in advance to avoid delays. Use automated tools to streamline the process and improve startup investor communications.

Explanation: Regular monthly updates help build trust and keep investors informed about your progress, a key aspect of investor relations strategies.

Consistent communication can reduce misunderstandings and enhance investor relations, which is crucial for building investor confidence.

According to Visible.vc, regular updates are essential for maintaining strong investor relations and improving startup investor communications.

This structured approach ensures you stay on track and keeps investors engaged and confident in your leadership, aligning with startup CEO best practices.

2: Create data-driven KPI dashboards for transparency

Transparent communication through data-driven KPI dashboards is crucial for building investor trust and can significantly improve startup investor communications.

Actionable Steps:

- Identify key performance indicators: Select KPIs that align with your investors’ priorities and interests, focusing on startup growth metrics reporting.

- Utilize data visualization tools: Use tools to create clear and easy-to-understand dashboards for your KPIs, enhancing transparency in startup reporting.

- Regularly update dashboards: Ensure that KPI dashboards are updated frequently to reflect the latest data, a key aspect of effective communication with VCs.

Key benefits of data-driven KPI dashboards:

- Enhanced transparency and trust

- Easier tracking of company performance

- Improved decision-making for investors

Explanation: These steps help maintain transparency and keep investors informed about your progress. Data-driven dashboards enhance credibility and foster trust, which are essential investor relations strategies.

According to Lazo, maintaining transparency through regular updates is crucial for investor relations.

Effective KPI dashboards not only showcase your company’s growth but also demonstrate your commitment to clear communication, a key startup CEO best practice to improve startup investor communications.

3: Personalize thank-you notes to key stakeholders

Personalizing thank-you notes to key stakeholders is essential for building strong, lasting relationships and can significantly improve startup investor communications.

Actionable Steps:

- Identify key stakeholders: Make a list of those who have significantly contributed to your company’s success, including investors and VCs.

- Customize your notes: Use specific examples or anecdotes that highlight their impact and relevance, demonstrating transparency in startup reporting.

- Send thank-you notes regularly: Schedule these notes periodically to show consistent appreciation and build investor confidence.

Explanation: Personalizing thank-you notes demonstrates genuine appreciation and strengthens bonds with key stakeholders, which is crucial for effective communication with VCs.

This approach can enhance investor relations strategies by showing that you value their contributions and is one of the startup CEO best practices.

According to FundsforNGOs, expressing gratitude through personalized notes can significantly improve investor trust and loyalty, which is vital for fundraising communication techniques.

Next, we’ll explore how to develop a comprehensive investor data room, an essential component to improve startup investor communications.

4: Develop a comprehensive investor data room

Having a well-organized investor data room is crucial for maintaining transparency and professionalism, and is a key strategy to improve startup investor communications.

Actionable Steps:

- Organize essential documents: Collect and categorize key documents like financial reports, strategic plans, and legal agreements for easy access, enhancing transparency in startup reporting.

- Ensure user-friendly access: Set up a secure, user-friendly platform where investors can easily navigate and find information, supporting effective communication with VCs.

- Regularly update the data room: Keep the data room current by adding the latest reports and milestones to reflect ongoing progress, facilitating financial updates for investors.

Explanation:

A comprehensive investor data room demonstrates professionalism and helps build investor confidence.

Regular updates ensure transparency and showcase your startup growth metrics reporting.

According to Lazo, maintaining an organized data room can streamline due diligence and enhance the fundraising communication techniques.

This approach will keep your investors informed and confident in your company’s direction, aligning with startup CEO best practices for investor relations strategies.

5: Implement AI-driven CRM for investor management

AI-driven CRM tools can significantly enhance your investor relationship management and improve startup investor communications.

Actionable Steps:

- Choose an AI-driven CRM tool: Select a CRM that integrates well with your existing systems and meets your specific needs for effective communication with VCs.

- Track investor interactions: Use the CRM to monitor and record investor preferences, interactions, and engagement levels, supporting your investor relations strategies.

- Leverage AI insights: Utilize the AI capabilities to tailor your communications and improve relationship management based on data-driven insights, enhancing transparency in startup reporting.

Explanation:

Implementing an AI-driven CRM helps streamline and personalize investor communications. This ensures that your interactions are relevant and timely, ultimately fostering better relationships and building investor confidence.

According to TrustFinta, AI tools can automate and enhance various aspects of investor management, increasing efficiency and engagement in startup fundraising communication techniques.

This approach will help you stay organized and maintain strong connections with your investors, supporting startup CEO best practices for improving startup investor communications.

6: Host quarterly investor Q&A webinars

Hosting quarterly investor Q&A webinars is vital for improving startup investor communications and maintaining open and transparent communication with your investors.

Actionable Steps:

- Schedule quarterly webinars: Plan a specific date and time each quarter for these sessions. Use scheduling tools to set reminders and invite investors in advance, enhancing your investor relations strategies.

- Prepare a detailed agenda: Create an agenda that covers key topics, recent developments, and any upcoming milestones. Ensure it is comprehensive and addresses potential investor questions, incorporating effective communication with VCs.

- Record and share webinars: Record the sessions and share the recordings with investors who couldn’t attend. This ensures everyone stays informed, promoting transparency in startup reporting.

Best practices for effective investor Q&A webinars:

- Anticipate and prepare for tough questions

- Use visual aids to enhance understanding, similar to startup pitch deck tips

- Follow up with personalized responses post-webinar, demonstrating startup CEO best practices

Explanation:

Regular Q&A webinars allow you to directly address investor concerns and provide financial updates for investors on company progress. This transparency can strengthen investor confidence and improve startup investor communications.

According to GoingVC, maintaining consistent communication is crucial for strong founder-investor relationships.

Implementing these webinars fosters a collaborative environment and keeps your investors engaged, supporting effective fundraising communication techniques and startup growth metrics reporting.

7: Craft clear narratives around milestones & strategy

Crafting clear narratives around milestones and strategy is crucial for improving startup investor communications and maintaining investor confidence and engagement.

Actionable Steps:

- Develop a compelling narrative: Tie your company’s milestones and strategic goals together in a cohesive story, enhancing your startup pitch deck tips.

- Use storytelling techniques: Make the narrative engaging and relatable through examples and anecdotes, improving effective communication with VCs.

- Continuously refine the narrative: Update the narrative based on investor feedback and company progress, incorporating startup growth metrics reporting.

Elements of a powerful investor narrative:

- Clear vision and mission statement

- Concrete examples of progress and success

- Future growth projections and plans

Explanation:

These steps are essential for building a strong connection with your investors. Engaging narratives help investors understand your vision and the journey towards achieving your goals, which is key to improve startup investor communications.

According to Columbia Business School, strategic storytelling is an important aspect of enhancing market valuation.

Clear narratives make your milestones more meaningful and highlight your strategic direction effectively, contributing to transparency in startup reporting and building investor confidence.

Enhance Investor Communications with Alleo

We’ve explored the challenges of improving startup investor communications and discussed several investor relations strategies. But did you know you can work directly with Alleo to make this journey easier and faster?

Setting up an account with Alleo is simple. Start by signing up for a free 14-day trial—no credit card required. This is an excellent opportunity to boost your startup pitch deck tips and enhance transparency in startup reporting.

Alleo’s AI coach will help you create a personalized plan tailored to your investor communication needs. The coach will guide you through establishing a regular update schedule, creating data-driven dashboards, and more, all aimed to improve startup investor communications and build investor confidence.

Alleo will keep you accountable with progress checks, text, and push notifications, ensuring you maintain effective communication with VCs and adhere to startup CEO best practices.

Ready to get started for free? Let me show you how to enhance your fundraising communication techniques and investor meeting preparation!

Step 1: Log In or Create Your Account

To begin improving your investor communications with Alleo, Log in to your account or create a new one to access our AI coach and personalized guidance.

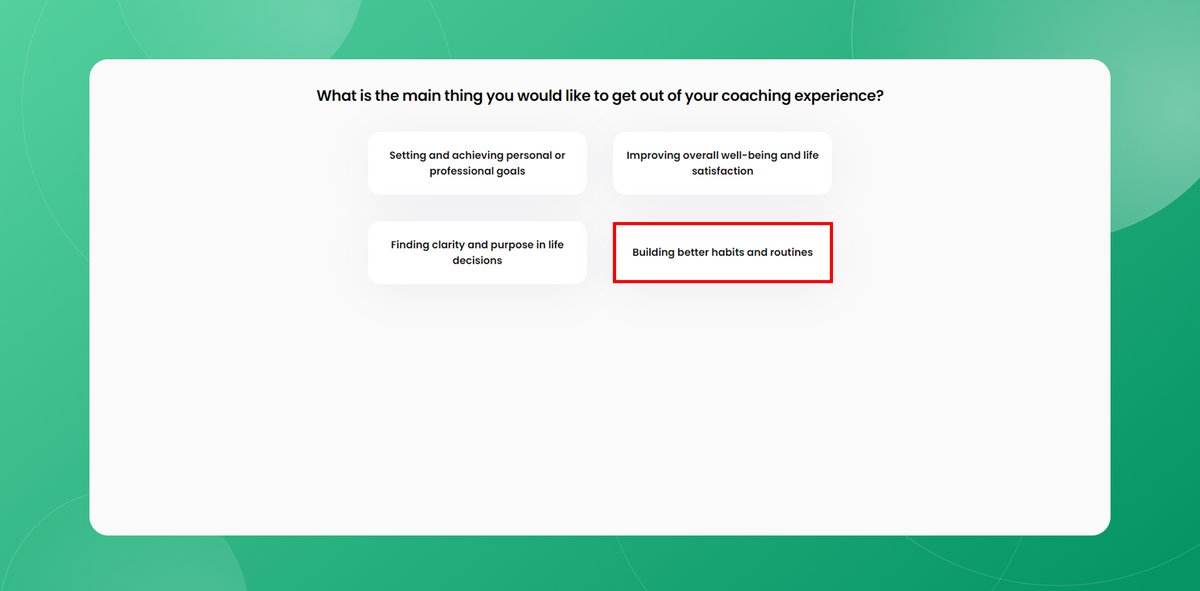

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to develop consistent practices for investor communications, helping you establish regular updates and maintain transparency with your stakeholders.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to improve your investor communications and financial management skills, directly addressing the challenges outlined in the article about maintaining investor confidence and transparency.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an initial intake session, where our AI coach will help you develop a customized plan to enhance your investor communications strategy.

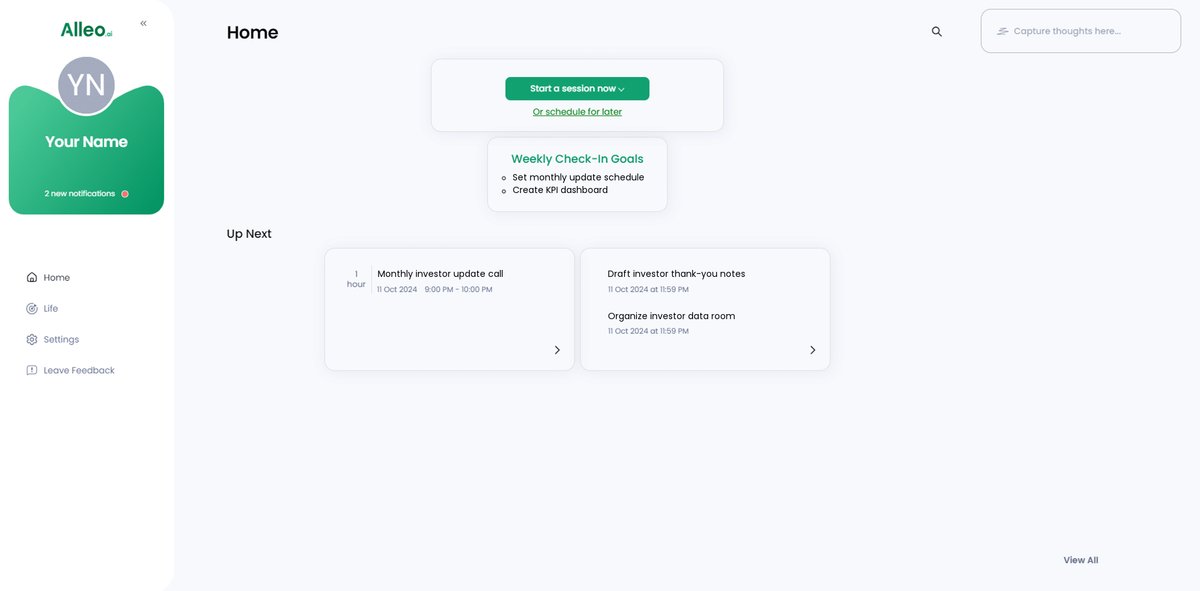

Step 5: Viewing and Managing Goals After the Session

After your coaching session, open the Alleo app to find your investor communication goals displayed on the home page, allowing you to easily track and manage your progress.

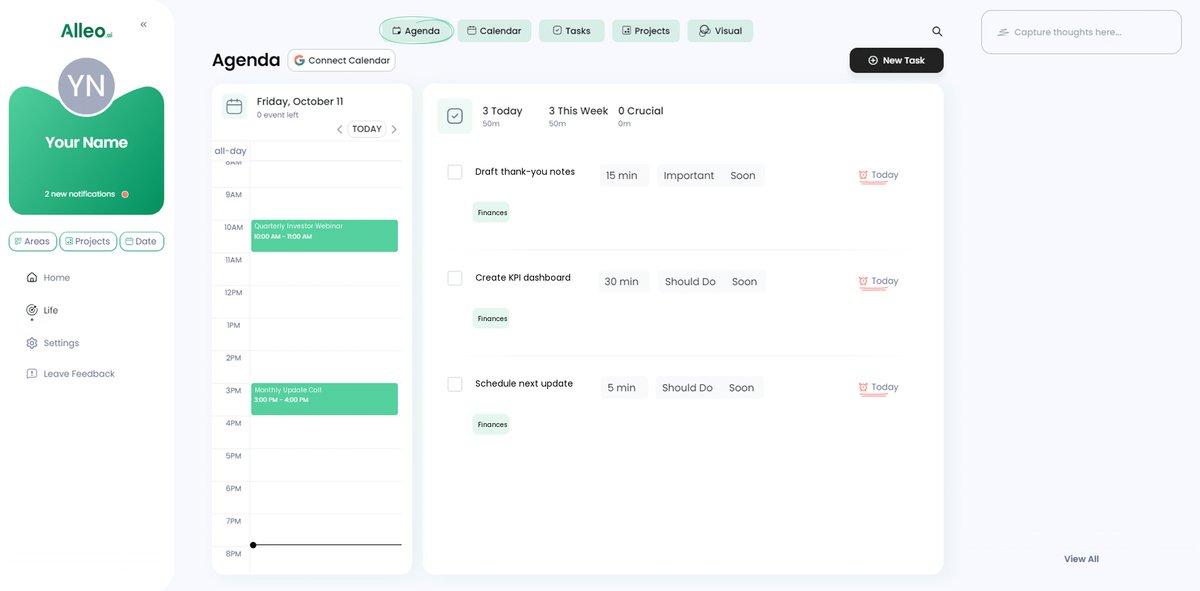

Step 6: Adding Events to Your Calendar or App

Use the Alleo app’s calendar feature to add your investor update schedules, webinar dates, and thank-you note reminders, helping you track progress and stay accountable as you improve your investor communications.

Bringing It All Together: Effective Investor Communications

Improving startup investor communications is crucial for maintaining trust and attracting new capital.

You now have a roadmap with actionable steps to improve startup investor communications.

Empathize with your investors. Show them you value their support through effective communication with VCs.

Remember, clear communication is a necessity, not just a nicety, when it comes to investor relations strategies.

Take these steps seriously and watch your investor relations transform with improved transparency in startup reporting.

By implementing these strategies, you’ll maintain transparency and build stronger relationships, enhancing your startup pitch deck tips.

Don’t let poor communication be your downfall in fundraising communication techniques.

Try Alleo for free. Let us help you make this journey smoother and improve startup investor communications.

Ready to improve your investor communications? Start today with Alleo and enhance your startup growth metrics reporting.