Master WACC Calculations: 6 Essential Techniques for Finance Professionals

Ever felt like WACC calculations are a labyrinth you’re unable to navigate? Mastering WACC calculations can seem daunting, but it’s crucial for financial decision-making.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience assisting clients with financial management, I often encounter struggles specifically with WACC. Understanding the weighted average cost of capital components is key to overcoming these hurdles.

In this article, you’ll discover a comprehensive approach to mastering WACC calculations. We’ll cover everything from understanding WACC components to applying them in real-world scenarios. You’ll learn about the WACC formula explained, WACC calculation examples for beginners, and even advanced WACC techniques for finance experts.

Let’s dive in and explore how WACC impacts capital structure optimization and company valuation.

The Struggles with WACC: A Deeper Dive

Navigating WACC calculations can feel like solving a complex puzzle. Many small business owners face significant challenges in understanding these computations, often struggling with mastering WACC calculations.

In my work, I often see people missing out on valuable opportunities because they can’t accurately calculate their Weighted Average Cost of Capital (WACC). This often leads to poor investment decisions and financial analyses, highlighting the importance of WACC in financial decision-making.

The consequences can be severe. Inaccurate WACC calculations can result in missed investments and misjudged project viability, underscoring the need for understanding common mistakes in WACC calculations.

Understanding and mastering WACC is crucial for sound financial management. Let’s explore this further, including the WACC formula explained and its components.

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in mastering WACC calculations:

- Understand WACC components and their importance: Break down each component of the weighted average cost of capital and its role in WACC.

- Practice WACC formula calculation in Excel: Learn to calculate WACC using Excel for practical application, avoiding common mistakes in WACC calculations.

- Learn to interpret WACC in financial analysis: Understand how WACC impacts financial decision-making and company valuation.

- Study real-world WACC examples across industries: Analyze WACC variations in different sectors, exploring WACC analysis for different industries.

- Apply WACC in discounted cash flow analysis: Integrate WACC into DCF calculations, comparing WACC vs. required rate of return.

- Use WACC to evaluate investment opportunities: Assess investments based on WACC and explore WACC and capital structure optimization.

Let’s dive in to master WACC calculations!

1: Understand WACC components and their importance

Understanding WACC components is essential for accurate financial analysis and decision-making, especially when mastering WACC calculations.

Actionable Steps:

- Create a visual diagram: Map out each component of WACC, such as cost of equity and cost of debt, for better retention and to understand the WACC formula explained.

- Write a brief essay: Explain how each component impacts the overall WACC to deepen your understanding of weighted average cost of capital components.

- Review recent market reports: Analyze trends affecting WACC components to stay updated with market conditions and improve your WACC calculation examples for beginners.

Explanation: These steps matter because they help you grasp the intricacies of WACC and its components, which are crucial for sound financial management and understanding the importance of WACC in financial decision-making.

For example, creating a visual diagram can clarify complex concepts, while writing essays enhances retention. Additionally, staying updated with market trends through recent reports, such as those from Succession Plus, ensures your calculations remain relevant when mastering WACC calculations.

Key components of WACC include:

- Cost of equity

- Cost of debt

- Market value of equity

- Market value of debt

Mastering WACC components sets a solid foundation for further financial analysis and using WACC in company valuation.

2: Practice WACC formula calculation in Excel

Practicing WACC formula calculation in Excel is crucial for mastering WACC calculations and ensuring practical application and accuracy.

Actionable Steps:

- Set up the WACC calculation in Excel: Follow a step-by-step guide to input the necessary data and formulas for weighted average cost of capital components.

- Complete practice problems: Use Excel to solve a set of WACC calculation examples for beginners and reinforce your learning.

- Validate your results: Compare your Excel calculations with industry benchmarks or case studies to avoid common mistakes in WACC calculations.

Explanation: These steps matter because they help you build proficiency in using Excel for financial modeling and mastering WACC calculations.

For instance, following a guide ensures you input data correctly, and comparing results with benchmarks ensures accuracy in WACC analysis for different industries.

This practical approach aligns with industry trends and standards, as highlighted in Sourcetable’s guide on Excel for WACC.

These exercises will enhance your ability to apply WACC calculations effectively and understand the importance of WACC in financial decision-making.

3: Learn to interpret WACC in financial analysis

Interpreting WACC in financial analysis is crucial for making informed financial decisions and evaluating investment opportunities. Mastering WACC calculations is essential for effective financial management.

Actionable Steps:

- Read case studies: Examine how WACC influenced key business decisions. This helps you understand its practical impact and the importance of WACC in financial decision-making.

- Conduct a mock analysis: Assess a potential project using WACC to gauge its viability. Practice makes perfect, especially with WACC calculation examples for beginners.

- List common errors: Identify and explain frequent mistakes in interpreting WACC. This helps you avoid similar pitfalls and understand common mistakes in WACC calculations.

Explanation: These steps matter because they help you apply WACC in real-world scenarios and enhance decision-making. Understanding the weighted average cost of capital components is crucial for accurate analysis.

For instance, reading case studies deepens your understanding of the WACC formula explained in context, while conducting mock analyses builds practical skills. Staying aware of common errors also ensures accuracy in your evaluations, which is vital when using WACC in company valuation.

According to AFP Online, mastering WACC is vital for accurate capital budgeting and financial management. This includes understanding WACC and capital structure optimization.

These practices will help you confidently interpret WACC in various financial analyses, including WACC analysis for different industries.

4: Study real-world WACC examples across industries

Studying real-world WACC examples across industries helps you understand diverse applications and variations in mastering WACC calculations.

Actionable Steps:

- Research various industry examples: Compare WACC calculations across different sectors to identify key differences and enhance your understanding of the WACC formula explained.

- Analyze industry-specific factors: Read expert analyses or conduct interviews to learn about factors affecting WACC in different industries, focusing on weighted average cost of capital components.

- Reflect on your findings: Write a short report on how these examples can inform your financial strategy and improve your WACC calculation examples for beginners.

Explanation: These steps matter because they provide practical insights into how WACC varies by industry. This knowledge helps you tailor your calculations to specific contexts, emphasizing the importance of WACC in financial decision-making.

For instance, you can read expert analyses on Succession Plus to deepen your understanding. These practices ensure your WACC calculations are accurate and relevant across different sectors, aiding in mastering WACC calculations.

Industry factors that can affect WACC include:

- Market volatility

- Regulatory environment

- Industry growth rates

This section’s insights will empower you to apply WACC effectively in your industry, improving your WACC analysis for different industries.

5: Apply WACC in discounted cash flow analysis

Applying WACC in discounted cash flow (DCF) analysis is vital for accurate valuation and investment decisions, making it a crucial step in mastering WACC calculations.

Actionable Steps:

- Attend a DCF analysis workshop: Participate in a webinar or workshop to learn the fundamentals of DCF and its relationship with WACC, including the WACC formula explained.

- Perform a DCF analysis using your data: Integrate WACC into your DCF calculations with your own business data for practical application, exploring weighted average cost of capital components.

- Compare your results with industry standards: Validate your DCF outcomes by comparing them with publicly available reports or case studies, considering WACC analysis for different industries.

Explanation: These steps matter because they enhance your ability to perform accurate valuations and understand the importance of WACC in financial decision-making.

Participating in workshops ensures you grasp DCF fundamentals, while using your data makes the learning experience practical, helping you avoid common mistakes in WACC calculations.

Comparing your results with industry standards ensures accuracy. For instance, AFP Online emphasizes the importance of mastering WACC calculations for precise capital budgeting.

These practices will help you confidently apply WACC in DCF analysis and make informed investment decisions, recognizing the role of WACC in company valuation.

6: Use WACC to evaluate investment opportunities

Using WACC to evaluate investment opportunities is crucial for making informed and strategic financial decisions. Mastering WACC calculations is essential for effective investment evaluation.

Actionable Steps:

- Develop a checklist for evaluating investments: Create criteria based on WACC to assess the viability of potential investments, incorporating the WACC formula explained.

- Write a case study: Analyze an investment decision influenced by WACC to understand its practical application and the importance of WACC in financial decision-making.

Explanation: These steps matter as they provide a structured approach to using WACC in investment evaluation. Developing a checklist ensures consistency, while writing a case study deepens understanding of weighted average cost of capital components.

According to Sourcetable, mastering WACC is vital for accurate investment assessment.

Key considerations when using WACC for investment evaluation:

- Compare project return to WACC

- Assess risk-adjusted returns

- Consider long-term strategic value

This section will help you make better investment decisions using WACC, including WACC calculation examples for beginners and advanced WACC techniques for finance experts.

Partner with Alleo on Your Financial Mastery Journey

We’ve explored the challenges of mastering WACC calculations, how solving them benefits your business, and the steps to achieve it. But did you know you can work directly with Alleo to make this journey easier and faster? Our expertise in WACC formula explained and weighted average cost of capital components can accelerate your learning.

With Alleo, setting up an account is simple. Start with a free 14-day trial—no credit card required. This trial allows you to explore WACC calculation examples for beginners and advanced WACC techniques for finance experts.

Create a personalized plan tailored to your WACC learning goals. Alleo’s AI coach provides affordable, tailored coaching support, offering full sessions like any human coach. We can guide you through the importance of WACC in financial decision-making and help you avoid common mistakes in WACC calculations.

The coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications. This support is crucial when learning about WACC and capital structure optimization or using WACC in company valuation.

Ready to get started for free? Let me show you how to begin mastering WACC calculations and understanding WACC analysis for different industries!

Step 1: Logging in or Creating an Account

To begin your journey in mastering WACC calculations with personalized AI coaching, simply Log in to your account or create a new one to access Alleo’s tailored financial management support.

Step 2: Choose Your WACC Mastery Goal

Select “Setting and achieving personal or professional goals” to focus on mastering WACC calculations, which will help you make more informed financial decisions and improve your business’s financial management.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area to tackle WACC calculations head-on, aligning perfectly with your goal to master financial analysis and make informed investment decisions.

Step 4: Starting a coaching session

Begin your WACC mastery journey with an intake session to establish your personalized learning plan, setting clear goals and milestones for mastering WACC calculations with your AI coach.

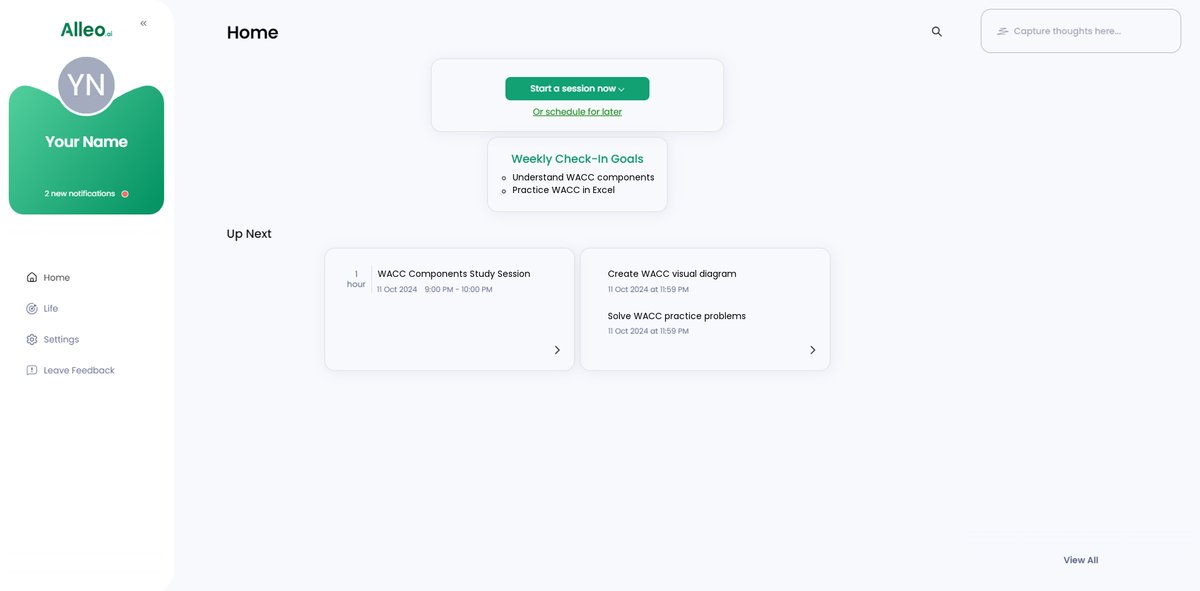

Step 5: Viewing and Managing Goals After the Session

After your WACC coaching session, you’ll find your discussed goals conveniently displayed on the app’s home page, allowing you to easily track and manage your progress in mastering WACC calculations.

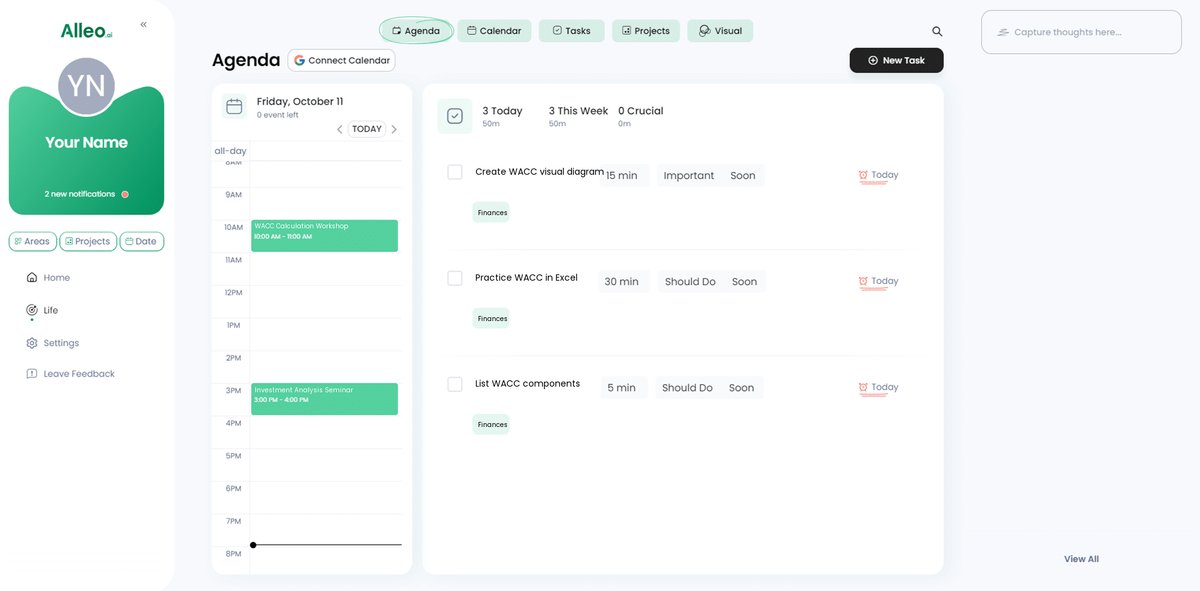

Step 6: Adding events to your calendar or app

Schedule your WACC learning activities in Alleo’s calendar and task features to track your progress, ensuring you stay on top of your financial mastery journey while solving complex calculations.

Wrapping Up Your WACC Journey

We’ve covered a lot, haven’t we? Mastering WACC calculations doesn’t have to be overwhelming.

Remember, understanding each weighted average cost of capital component, practicing calculations, and interpreting results are crucial steps. It’s all about breaking it down into manageable parts.

By studying real-world WACC calculation examples and applying WACC in discounted cash flow analysis, you can make informed decisions. Evaluating investment opportunities becomes more straightforward with a solid grasp of WACC and its importance in financial decision-making.

Take the first step towards mastering WACC. You don’t have to do it alone.

With Alleo, you get tailored coaching and support. Let’s make this journey easier together.

Try it for free today and transform your financial management skills, including mastering WACC calculations and avoiding common mistakes in WACC analysis.