4 Proven Strategies for Ottawa Contractors to Overcome Cash Flow Challenges

What if you couldn’t pay your employees or subcontractors on time, causing delays and strained relationships? This is a common challenge in managing construction cash flow in Ottawa.

As a life coach, I’ve seen many small business owners in Ottawa struggle with cash flow issues, particularly in the construction industry. The impact on their operations and relationships can be significant, highlighting the need for effective financial planning for contractors.

In this article, we’ll explore effective strategies to manage cash flow in the Ottawa construction industry. You’ll learn about progress billing, diversifying revenue, utilizing accounting software for construction project budgeting, and negotiating payment terms to improve accounts receivable management for contractors.

Let’s dive into these working capital solutions for contractors and cost control strategies in construction projects.

Diving Deeper into the Cash Flow Crisis

The reality is, cash flow issues can cripple your business operations. In Ottawa, construction contractors often face the harsh consequences of payment delays when managing construction cash flow.

This can mean not being able to pay your employees or subcontractors on time, highlighting the importance of cash flow management for construction projects.

Imagine the stress of explaining to your team why their paychecks are late. These delays can lead to strained relationships and erode trust, a common challenge in the Ottawa construction industry.

Moreover, project timelines suffer, causing further complications. I’ve seen many clients struggle with this, leading to missed deadlines and lost opportunities. Effective financial planning for contractors is crucial to avoid such situations.

It’s crucial to address these issues head-on. Understanding the depth of the problem is the first step towards finding a solution for managing construction cash flow in Ottawa.

Overcoming this challenge of managing construction cash flow in Ottawa requires a few key steps. Here are the main areas to focus on to make progress in cash flow management for construction:

- Implement Accurate Progress Billing Systems: Set up a Schedule of Values (SOV) and regularly update clients, crucial for construction project budgeting.

- Diversify Revenue Streams for Financial Stability: Explore additional services and partner with local businesses to address seasonal cash flow issues in construction.

- Utilize Accounting Software for Cash Flow Tracking: Choose the right software and set up regular financial reviews to improve accounts receivable management for contractors.

- Negotiate Favorable Payment Terms with Clients: Discuss terms before starting projects and offer early payment discounts, a key aspect of financial planning for contractors in Ottawa.

Let’s dive into these strategies for managing construction cash flow in Ottawa!

1: Implement accurate progress billing systems

Managing construction cash flow in Ottawa effectively starts with accurate progress billing systems.

Actionable Steps:

- Set up a Schedule of Values (SOV): Create an itemized list of project activities and assign costs to each, crucial for construction project budgeting.

- Regularly update clients on project progress: Schedule bi-weekly meetings to discuss progress and billing updates, addressing Ottawa construction industry challenges.

- Use software tools to automate progress billing: Invest in and train your team on relevant billing software for effective cash flow management for construction.

Explanation:

Implementing these steps ensures transparency and timely payments. Accurate progress billing helps you avoid cash flow issues by keeping clients informed and payments on track, essential for managing construction cash flow Ottawa.

Using tools like Procore can streamline this process, ensuring you stay on top of your financials and improve accounts receivable management for contractors.

Key benefits of accurate progress billing:

- Improved cash flow predictability, addressing seasonal cash flow issues in construction

- Enhanced client trust and communication

- Reduced payment delays and disputes, supporting working capital solutions for contractors

Taking these steps can significantly improve your cash flow management, setting the stage for business stability and growth in the Ottawa construction industry.

2: Diversify revenue streams for financial stability

Expanding your revenue sources can provide a buffer against market fluctuations and enhance financial stability for managing construction cash flow in Ottawa.

Actionable Steps:

- Explore additional services or products: Conduct market research to identify new opportunities like maintenance services or consultancy, addressing Ottawa construction industry challenges.

- Partner with local businesses: Attend networking events to find potential partners for collaborative ventures, improving working capital solutions for contractors.

- Offer seasonal promotions or discounts: Plan and market seasonal offers in advance to boost cash flow during slow periods, addressing seasonal cash flow issues in construction.

Explanation:

Diversifying revenue streams can help mitigate risks associated with relying on a single income source. By exploring new services or products, you open up additional revenue channels for effective cash flow management for construction in Ottawa.

Collaborating with local businesses can create mutually beneficial opportunities. Seasonal promotions can attract more clients during off-peak times, ensuring steady construction project budgeting and improving accounts receivable management for contractors.

According to Summit Cover, diversifying revenue streams effectively can provide a buffer against market fluctuations.

Taking these steps can significantly improve your financial stability and help you manage cash flow more efficiently in the Ottawa construction industry.

3: Utilize accounting software for cash flow tracking

Using accounting software is vital for accurately tracking and managing construction cash flow in Ottawa. It’s a crucial aspect of cash flow management for construction businesses.

Actionable Steps:

- Choose the right accounting software: Identify software that is user-friendly, cost-effective, and has necessary features for managing construction cash flow in Ottawa.

- Set up regular financial reviews: Schedule monthly financial review meetings with your accountant to monitor cash flow and address Ottawa construction industry challenges.

- Use software to forecast future cash flow: Input historical data and run projections to anticipate cash flow needs and improve financial planning for contractors.

Explanation:

These steps help ensure you stay on top of your financial situation in the Ottawa construction industry. Using tools like QuickBooks aids in managing invoices, bills, and payroll efficiently, which is crucial for managing construction cash flow in Ottawa.

Regular reviews and forecasting prevent surprises and allow you to plan for future expenses, ensuring steady cash flow and addressing seasonal cash flow issues in construction.

Essential features to look for in accounting software for managing construction cash flow in Ottawa:

- Real-time financial reporting for effective cost control strategies in construction projects

- Customizable invoicing templates to improve accounts receivable management for contractors

- Integration with bank accounts and other business tools for comprehensive working capital solutions for contractors

Implementing these steps can enhance your financial control and stability in the Ottawa construction industry.

4: Negotiate favorable payment terms with clients

Negotiating favorable payment terms with clients is crucial for managing construction cash flow in Ottawa and maintaining steady financial health in your construction business.

Actionable Steps:

- Discuss payment terms before starting a project: Ensure clear agreements are in place and include these terms in the initial contract to support cash flow management for construction projects.

- Offer early payment discounts: Provide a 2-5% discount for payments made within 10 days to incentivize timely payments, addressing seasonal cash flow issues in construction.

- Implement a phased payment schedule: Break down payments into milestone-based installments to ensure consistent working capital solutions for contractors.

Explanation:

These steps help you secure timely payments, reducing the risk of cash flow disruptions in the Ottawa construction industry. Clear agreements and phased schedules ensure clients understand their financial commitments, supporting effective construction project budgeting.

Early payment discounts incentivize quick payments, improving your cash flow stability. According to Multifamily Loans, structured payment terms can significantly benefit both parties, ensuring smoother financial planning for contractors.

Taking these steps can greatly enhance your cash flow management in Ottawa, setting you up for financial success and helping overcome construction industry challenges.

Partner with Alleo to Master Cash Flow Management

We’ve explored the challenges of managing construction cash flow in Ottawa’s construction industry and steps to overcome them. But did you know you can work directly with Alleo to make this journey easier and faster for cash flow management for construction?

Alleo offers affordable, tailored coaching support to solve cash flow issues and address Ottawa construction industry challenges. With full coaching sessions like any human coach and a free 14-day trial, you can start without a credit card to improve your financial planning for contractors.

Set up your account, create a personalized plan, and work with Alleo’s coach to tackle cash flow challenges in the Ottawa construction industry. The coach follows up on your progress, handles changes, and keeps you accountable via text and push notifications, helping you master construction project budgeting and cost control strategies.

Ready to get started for free? Let me show you how to improve your approach to managing construction cash flow in Ottawa!

Step 1: Access Your Alleo Account

To begin mastering your cash flow management, log in to your existing Alleo account or create a new one to start your free 14-day trial without needing a credit card.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start creating a structured approach for managing your cash flow effectively, helping you establish consistent practices that will keep your finances on track and your business operations running smoothly.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area to address cash flow challenges in your construction business, allowing Alleo to provide targeted strategies for improving billing systems, diversifying revenue, and negotiating better payment terms.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session to create a personalized plan for managing your construction business’s cash flow challenges.

Step 5: Viewing and managing goals after the session

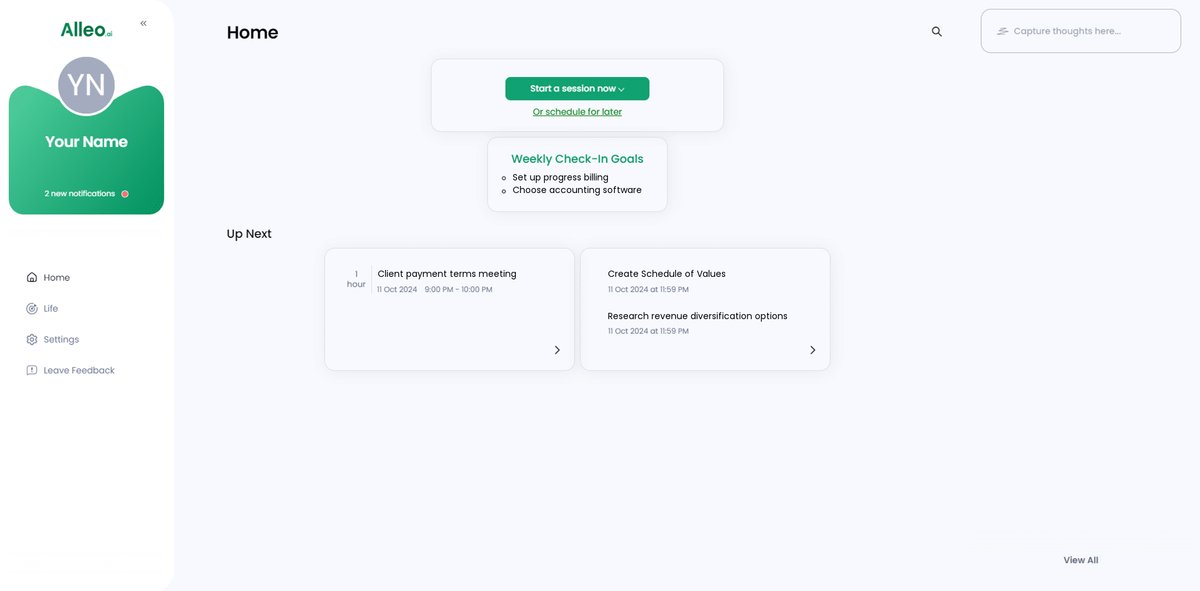

After your coaching session on cash flow management, you’ll find your discussed goals conveniently displayed on the app’s home page, allowing you to easily track and manage your progress towards improving your business’s financial stability.

Step 6: Adding events to your calendar or app

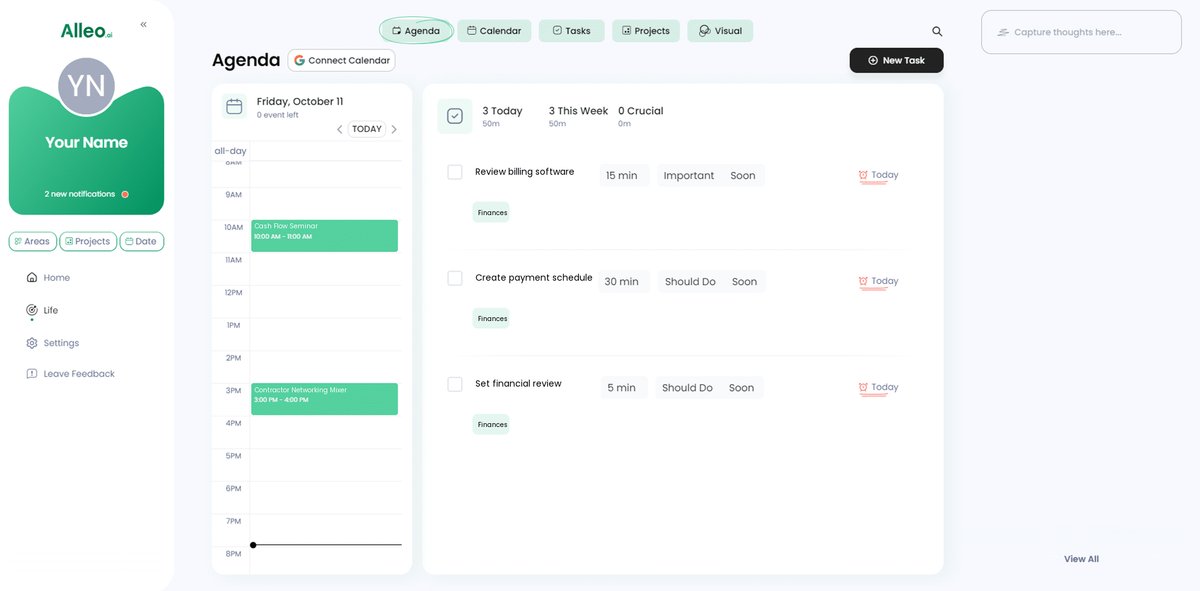

Use the calendar and task features in the Alleo app to schedule and track your progress on implementing cash flow management strategies, such as setting up regular financial reviews or negotiating payment terms with clients.

Taking Control of Your Cash Flow

Managing construction cash flow in Ottawa is crucial for your business’s success. We’ve discussed several strategies to help you overcome these challenges in the Ottawa construction industry.

By implementing accurate progress billing, diversifying revenue streams, and using accounting software, you can improve your financial stability. Negotiating favorable payment terms will also ensure consistent cash flow management for construction projects.

Remember, you’re not alone in this. Many small business owners face similar seasonal cash flow issues in construction.

With the right approach to financial planning for contractors, you can turn things around.

Finally, consider partnering with Alleo for personalized coaching support. It’s a great way to stay on track and achieve your construction project budgeting goals.

Take the first step today towards managing construction cash flow in Ottawa. You can do this!