5 Game-Changing Strategies for Stay-at-Home Parents Pursuing Financial Independence

Imagine a world where stay-at-home parents don’t just survive financially, but thrive independently. Financial independence for stay-at-home parents is not just a dream, but an achievable reality.

As a life coach, I’ve helped many individuals navigate the complexities of financial planning for stay-at-home parents. I often see the unique challenges stay-at-home parents face in this journey towards financial independence.

In this post, you’ll discover strategies to build a support network, find flexible side hustles for stay-at-home parents, and stay motivated on your path to financial independence. We’ll explore budgeting tips for single-income households and passive income ideas that can help you achieve your financial goals.

Let’s dive in and explore how stay-at-home parents can achieve financial independence while balancing childcare and financial goals.

Understanding the Unique Challenges of Stay-at-Home Parents

Becoming a stay-at-home parent pursuing financial independence can feel isolating. Many single women face a lack of support networks, which can lead to reduced motivation in their journey towards financial independence for stay-at-home parents.

In my experience, people often find it hard to stay financially independent without a community. Isolation can make it difficult to maintain the drive needed to achieve financial goals, especially when balancing childcare and financial goals.

Several clients report feeling overwhelmed by the dual pressures of parenting and financial planning for stay-at-home parents. Without a support system, the journey can seem daunting, particularly when it comes to budgeting tips for single-income households.

So, how do you overcome these challenges on the path to financial independence for stay-at-home parents?

Let’s explore actionable strategies next.

Roadmap to Achieving Financial Independence as a Stay-at-Home Parent

Overcoming this challenge requires a few key steps. Here are the main areas to focus on for financial independence for stay-at-home parents to make progress.

- Join online FI/RE communities for support: Engage with virtual groups and webinars to build connections and learn budgeting tips for single-income households.

- Start a local meetup for like-minded parents: Organize regular meetings for mutual support and discuss investing strategies for families with one income.

- Create a savings goal tracker with rewards: Track progress and celebrate milestones in building emergency funds as a stay-at-home parent.

- Find flexible side hustles that fit your schedule: Discover remote work opportunities for stay-at-home parents and monetize skills.

- Participate in financial independence challenges: Join savings challenges and budgeting workshops to enhance financial planning for stay-at-home parents.

Let’s dive into these strategies for achieving financial independence for stay-at-home parents!

1: Join online FI/RE communities for support

Participating in online FI/RE communities can provide invaluable support for stay-at-home parents pursuing financial independence. These communities offer resources for financial planning for stay-at-home parents and strategies for achieving financial independence.

Actionable Steps:

- Join popular FI/RE forums: Research and become a member of active FI/RE communities on platforms like Reddit or Facebook. Engage with at least three posts per week to build meaningful connections and learn about budgeting tips for single-income households.

- Attend webinars and virtual events: Participate in monthly webinars hosted by FI/RE experts. Take notes and implement at least one piece of advice from each session, such as investing strategies for families with one income.

- Share your financial journey: Create a detailed post about your financial goals and progress in the community. Respond to comments and connect with others with similar aspirations, including those interested in side hustles for stay-at-home parents.

Key benefits of joining online FI/RE communities include:

- Access to diverse perspectives and experiences

- Continuous learning through shared resources on passive income ideas for stay-at-home parents

- Accountability and motivation from like-minded individuals pursuing financial independence for stay-at-home parents

Explanation:

These steps are essential because they help you connect with a supportive network, which can significantly boost your motivation and provide practical advice on financial independence for stay-at-home parents.

Online communities such as ChooseFI offer valuable insights and foster a sense of belonging among members, including discussions on remote work opportunities for stay-at-home parents.

Engaging with these communities ensures you stay informed about industry trends and best practices in financial independence, including frugal living tips for financial independence.

Taking these actions will help you feel less isolated and more empowered to achieve your financial goals, such as building emergency funds as a stay-at-home parent.

2: Start a local meetup for like-minded parents

Creating a local meetup for stay-at-home parents can provide essential support and inspiration for your financial independence journey. This approach is particularly beneficial for those pursuing financial independence for stay-at-home parents.

Actionable Steps:

- Organize an initial meetup: Use platforms like Meetup.com to create an event for local stay-at-home parents interested in financial planning. Schedule the first meeting at a local café or park.

- Plan regular meetings: Set a schedule for monthly meetups with a mix of social and educational activities. Invite guest speakers to discuss financial topics relevant to the group, such as budgeting tips for single-income households and investing strategies for families with one income.

- Create a support group: Form a private online group for ongoing support and communication between meetups. Share resources and tips weekly to keep the group engaged, covering topics like side hustles for stay-at-home parents and passive income ideas.

Explanation:

These steps matter because they help build a community that provides ongoing support and motivation for financial independence for stay-at-home parents. Regular meetups create opportunities for sharing experiences and learning from others about frugal living tips and building emergency funds as a stay-at-home parent.

For instance, ChooseFI highlights the benefits of community support in achieving financial independence. Connecting with like-minded individuals can significantly boost your progress and maintain your drive towards financial planning for stay-at-home parents.

Starting a local meetup sets the stage for a stronger support network, helping you stay motivated and focused on your financial goals, including exploring remote work opportunities for stay-at-home parents and discussing tax strategies for stay-at-home parents.

3: Create a savings goal tracker with rewards

Creating a savings goal tracker with rewards can make your financial journey more engaging and motivating, especially for stay-at-home parents pursuing financial independence.

Actionable Steps:

- Design a Custom Savings Tracker: Use tools like Excel or a dedicated app to create a visual savings goal tracker for financial independence as a stay-at-home parent. Set measurable milestones and deadlines for each goal.

- Implement a Reward System: Assign small rewards for reaching each milestone, such as a special treat or activity. Celebrate achievements with your community to maintain motivation in your journey towards financial independence.

- Share Progress Publicly: Post updates about your progress on social media or in your FI/RE community. Encourage other stay-at-home parents to share their progress and celebrate together.

Effective rewards for achieving savings milestones:

- A guilt-free purchase from your wishlist, aligned with frugal living tips for financial independence

- A day trip or experience you’ve been wanting, balancing childcare and financial goals

- Extra time for a favorite hobby or self-care activity, important for stay-at-home parents pursuing financial independence

Explanation:

These steps are essential because they help you stay motivated and track your progress effectively. Visual tools and rewards can make your savings journey more enjoyable, especially when implementing budgeting tips for single-income households.

For instance, the Financial Samurai emphasizes the importance of setting and celebrating small milestones. Sharing your progress publicly also provides accountability and encouragement from your community, which can be crucial for stay-at-home parents working towards financial independence.

Celebrating each milestone can keep you motivated and focused on your financial goals, making the journey less daunting for stay-at-home parents aiming for financial independence.

4: Find flexible side hustles that fit your schedule

Finding flexible side hustles is crucial for stay-at-home parents to achieve financial independence without compromising family time. These opportunities can significantly contribute to financial planning for stay-at-home parents.

Actionable Steps:

- Explore remote work options: Search for part-time remote jobs or freelance gigs on platforms like Upwork or Fiverr. Dedicate a set number of hours per week that fits your schedule, enhancing your journey towards financial independence for stay-at-home parents.

- Monetize your skills: Identify skills you can offer, such as tutoring or crafting. Set up an online store or advertise your services through local community boards. This approach can create passive income ideas for stay-at-home parents.

- Join side hustle communities: Participate in forums or groups dedicated to side hustles for additional support and ideas. Share your experiences and learn from others who have succeeded in similar ventures, focusing on side hustles for stay-at-home parents.

Explanation:

These steps matter because they help you earn additional income while keeping your schedule flexible. For instance, The Everymom emphasizes the importance of utilizing your skills for side income, which aligns with financial independence for stay-at-home parents.

Engaging with side hustle communities can provide valuable insights and support, boosting your chances of success in remote work opportunities for stay-at-home parents.

Starting a flexible side hustle can significantly enhance your financial independence journey while maintaining a balanced family life, contributing to effective budgeting tips for single-income households.

5: Participate in financial independence challenges

Participating in financial independence challenges can significantly boost your motivation and progress towards financial independence for stay-at-home parents.

Actionable Steps:

- Join a savings challenge: Participate in a 30-day savings challenge with your community. Track your progress and share budgeting tips for single-income households with other participants.

- Engage in a no-spend month: Commit to a no-spend month, focusing only on essential expenses. Discuss frugal living tips for financial independence and progress with your support network.

- Plan a budgeting workshop: Organize or join a budgeting workshop to refine your financial planning for stay-at-home parents. Implement at least three new budgeting techniques learned from the workshop.

Popular financial independence challenges for stay-at-home parents to consider:

- 52-week money saving challenge

- Declutter and sell challenge as a side hustle for stay-at-home parents

- Frugal meal planning challenge for building emergency funds as a stay-at-home parent

Explanation:

These steps matter because they create a structured approach to saving and spending. Challenges like a no-spend month help you recognize unnecessary expenses and build better habits for achieving financial independence as a stay-at-home parent.

For instance, the Financial Samurai emphasizes the importance of disciplined financial planning. Engaging in these activities with a community offers support and accountability for stay-at-home parents pursuing financial independence.

Participating in these challenges will help you stay focused and motivated on your financial journey, balancing childcare and financial goals effectively.

Partner with Alleo on Your Financial Independence Journey

We’ve explored strategies to help stay-at-home parents achieve financial independence. But did you know you can work directly with Alleo to make this journey towards financial independence for stay-at-home parents easier and faster?

Set up an account with Alleo to create a personalized plan for financial planning for stay-at-home parents. Alleo’s AI life coach tailors guidance to your unique situation, including budgeting tips for single-income households and investing strategies for families with one income.

Get full coaching sessions like any human coach, with a free 14-day trial and no credit card required. Explore side hustles for stay-at-home parents and passive income ideas during your trial.

Alleo will follow up on your progress, handle changes, and keep you accountable. You’ll receive text and push notifications to stay on track with your financial goals, including building emergency funds as a stay-at-home parent.

Ready to get started for free and explore remote work opportunities for stay-at-home parents?

Let me show you how!

Step 1: Log In or Create Your Alleo Account

To begin your financial independence journey with Alleo, simply log in to your existing account or create a new one to access personalized guidance tailored for stay-at-home parents.

Step 2: Choose Your Financial Independence Goal

Select “Setting and achieving personal or professional goals” to focus on your financial independence journey. This option will help you create a tailored plan to overcome the unique challenges of achieving financial freedom as a stay-at-home parent, aligning with the strategies discussed in the article.

Step 3: Choose “Finances” as Your Focus Area

Select “Finances” as your primary focus area in Alleo to receive tailored guidance on achieving financial independence as a stay-at-home parent, aligning perfectly with your goal of building a strong financial future while managing family responsibilities.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll work with the AI coach to create a personalized financial independence plan tailored to your needs as a stay-at-home parent.

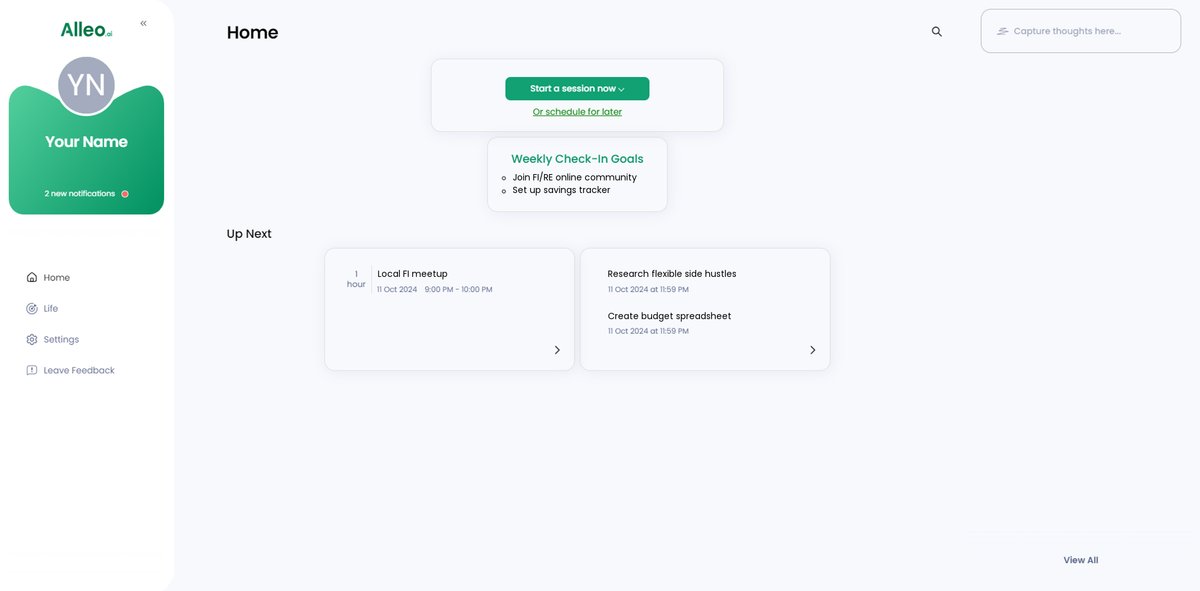

Step 5: Viewing and Managing Goals After the Session

After your coaching session, easily access and track your financial independence goals on the Alleo app’s home page, allowing you to stay focused on your journey as a stay-at-home parent.

Step 6: Adding events to your calendar or app

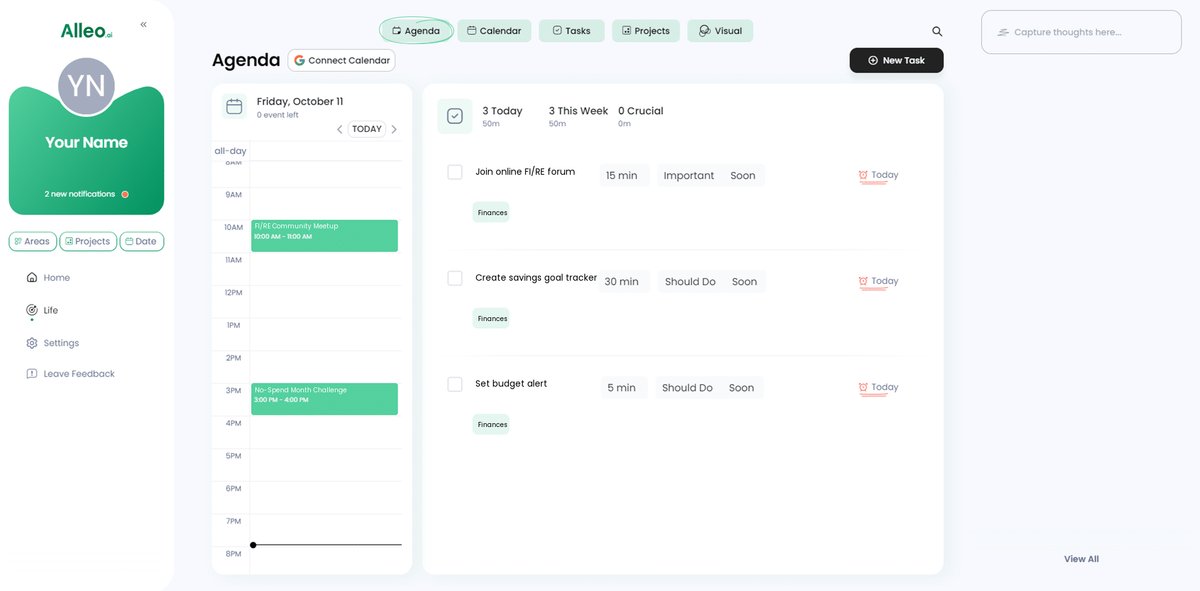

Use Alleo’s calendar and task features to schedule and track your financial milestones, savings goals, and side hustle activities, helping you stay organized and motivated on your path to financial independence.

Wrapping Up Your Financial Independence Journey

All right, we’ve covered a lot! Achieving financial independence for stay-at-home parents is a challenging but rewarding journey.

Remember, you’re not alone in this. Building a support network and finding flexible side hustles for stay-at-home parents can make a huge difference.

Celebrate your progress, no matter how small. Each step brings you closer to your financial independence goals.

And don’t forget, Alleo is here to help. Our AI life coach can guide you every step of the way, from budgeting tips for single-income households to investing strategies for families with one income.

Try Alleo for free today and take control of your financial future as a stay-at-home parent. You’ve got this!