5 Essential Investment Strategies for Young Professionals to Build Net Worth

Are you struggling to navigate the complexities of various investment accounts and strategies while working to increase your net worth and financial security? Smart investments for young professionals can be the key to building wealth in your 20s and 30s.

As a life coach, I’ve helped many young professionals like you achieve financial independence. In my experience, understanding and utilizing smart investment strategies can transform your financial future, especially when it comes to long-term financial planning for young adults.

In this article, you’ll learn about:

- Diversifying investment portfolio

- Maximizing employer benefits

- Tax-free growth accounts

- Emergency savings and high-yield savings accounts

- Effective budgeting

Let’s dive into these smart investments for young professionals.

Understanding the Challenges in Building Net Worth

Managing investments and building net worth can be daunting for single women. Many clients initially struggle with knowing where to start, especially when considering smart investments for young professionals.

Figuring out which accounts and strategies work best adds to the stress, particularly when exploring investment strategies for beginners.

Financial independence is crucial but often hard to achieve. The obstacles can feel overwhelming, especially when focusing on building wealth in your 20s and 30s.

In my experience, the emotional toll of financial insecurity can’t be ignored, making long-term financial planning for young adults essential.

It’s not just about numbers; it’s about peace of mind. The fear of making the wrong decision can be paralyzing, whether it’s about diversifying investment portfolios or considering retirement savings for millennials.

That’s why a clear, actionable plan is essential for smart investments for young professionals.

Key Steps to Building Net Worth for Young Professionals

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress with smart investments for young professionals:

- Start with low-cost index funds for diversification: Research and select reputable low-cost index funds and ETFs for new investors. Set up automatic contributions and periodically rebalance your investment portfolio.

- Maximize employer 401(k) match for free money: Enroll in your employer’s 401(k) plan for retirement savings for millennials. Contribute enough to get the full employer match.

- Open a Roth IRA for tax-free growth: Open a Roth IRA with a trusted financial institution for long-term financial planning for young adults. Contribute regularly and invest in a diversified portfolio.

- Build emergency fund in high-yield savings account: Calculate three to six months’ worth of living expenses. Open a high-yield savings account and set up automatic transfers as part of building wealth in your 20s and 30s.

- Use budgeting app to track expenses and savings: Choose a reliable budgeting app. Categorize your income and expenses, set financial goals, and track progress to support your investment strategies for beginners.

Let’s dive in to explore these smart investments for young professionals!

1: Start with low-cost index funds for diversification

Starting with low-cost index funds is essential for building a diversified investment portfolio, making it one of the smart investments for young professionals.

Actionable Steps:

- Research and select reputable low-cost index funds.

- Example: Vanguard Total Stock Market Index Fund.

- Action: Allocate a portion of your savings to buy shares in these funds, a key strategy for building wealth in your 20s and 30s.

- Set up automatic contributions to your chosen index funds.

- Action: Decide on a fixed percentage of your income or a specific dollar amount to invest each month, supporting long-term financial planning for young adults.

- Monitor and rebalance your portfolio periodically.

- Action: Review your investments quarterly and adjust as needed to maintain your desired asset allocation, crucial for diversifying investment portfolio.

Explanation: Implementing these steps can help you achieve steady growth while minimizing risk. Diversifying your investments through low-cost index funds ensures that your portfolio is resilient against market fluctuations, a key aspect of smart investments for young professionals.

According to Investopedia, diversification is a key strategy in personal finance for managing risk and maximizing returns. Starting with low-cost index funds is a smart move for young professionals aiming for long-term wealth accumulation.

Key benefits of low-cost index funds:

- Lower fees mean more of your money stays invested

- Broad market exposure reduces individual stock risk

- Passive management often outperforms active strategies

Taking these steps will set a solid foundation for your financial journey, including retirement savings for millennials. Next, we’ll explore maximizing employer 401(k) matches.

2: Maximize employer 401(k) match for free money

Maximizing your employer 401(k) match is a critical step in building your net worth and securing financial independence. This is one of the smart investments for young professionals looking to start their journey towards long-term financial planning.

Actionable Steps:

- Enroll in your employer’s 401(k) plan.

- Contact your HR department to set up your account and choose your contribution percentage, an essential retirement savings strategy for millennials.

- Contribute enough to get the full employer match.

- Calculate the required percentage to maximize the match and adjust your contributions accordingly, a key investment strategy for beginners.

- Review and adjust your 401(k) investments.

- Choose a mix of investments within your 401(k) that align with your risk tolerance and financial goals, focusing on diversifying investment portfolio.

Explanation: Taking full advantage of your employer’s 401(k) match is essentially free money added to your retirement savings.

This match can significantly boost your long-term investment returns, making it one of the smart investments for young professionals building wealth in their 20s and 30s.

According to Johnson Financial Group, maximizing employer benefits is a key strategy for young professionals aiming for financial stability and growth.

Next, we’ll explore the benefits of opening a Roth IRA for tax-free growth.

3: Open a Roth IRA for tax-free growth

Opening a Roth IRA is crucial for achieving tax-free growth and long-term financial stability, making it one of the smart investments for young professionals seeking to build wealth in their 20s and 30s.

Actionable Steps:

- Research and open a Roth IRA with a trusted financial institution.

- Complete the account setup process and fund your Roth IRA, an essential step in retirement savings for millennials.

- Contribute regularly to your Roth IRA.

- Set up automatic monthly contributions to ensure consistent funding, a key aspect of long-term financial planning for young adults.

- Invest in a diversified portfolio within your Roth IRA.

- Select a mix of stocks, bonds, and index funds to optimize growth potential while managing risk, an important investment strategy for beginners.

Explanation: These steps are essential for maximizing your retirement savings. With a Roth IRA, your contributions grow tax-free, providing significant benefits over time, making it one of the smart investments for young professionals.

According to The Minimalists, starting early with tax-advantaged accounts like Roth IRAs can lead to substantial long-term gains. Ensuring regular contributions and a diversified investment portfolio helps manage risk and enhance growth for young professionals.

Key advantages of a Roth IRA:

- Tax-free withdrawals in retirement

- No required minimum distributions

- Flexibility to withdraw contributions penalty-free

By taking these steps, you’ll be well on your way to building a robust financial future. Next, let’s discuss building an emergency fund in a high-yield savings account, another smart investment for young professionals.

4: Build emergency fund in high-yield savings account

Building an emergency fund in a high-yield savings account is vital for maintaining financial stability and security, making it one of the smart investments for young professionals.

Actionable Steps:

- Calculate your emergency fund goal.

- Determine the amount needed for three to six months’ worth of living expenses, a crucial step in long-term financial planning for young adults.

- Open a high-yield savings account.

- Choose a reputable bank like Ally Bank or Marcus by Goldman Sachs and transfer an initial amount to start your fund, an important investment strategy for beginners.

- Set up automatic transfers.

- Schedule regular transfers from your checking account to your high-yield savings account to build your fund consistently, supporting your goal of building wealth in your 20s and 30s.

Explanation: Having an emergency fund ensures you can cover unexpected expenses without derailing your financial progress, a key aspect of risk management in early career investments.

According to Johnson Financial Group, maintaining an emergency fund is crucial for financial stability and peace of mind.

Regular contributions to a high-yield account grow your savings faster, thanks to higher interest rates, making it an essential component of smart investments for young professionals.

Next, we’ll explore using a budgeting app to track expenses and savings.

5: Use budgeting app to track expenses and savings

Using a budgeting app is crucial for maintaining financial discipline and achieving your savings goals, especially for young professionals looking to make smart investments.

Actionable Steps:

- Choose a reliable budgeting app.

- Download and set up apps like Mint, YNAB (You Need A Budget), or Alleo on your smartphone to support your investment strategies for beginners.

- Categorize your income and expenses.

- Input all sources of income and regular expenses into the app, aiding in building wealth in your 20s and 30s.

- Set financial goals and track progress.

- Use the app to set monthly savings targets and monitor your spending habits, supporting long-term financial planning for young adults.

Explanation: These steps help you stay on top of your finances and make informed decisions for smart investments as a young professional.

Budgeting apps provide a clear view of your spending patterns, making it easier to identify areas for improvement and opportunities for diversifying your investment portfolio.

According to Bookmap, embracing technology in financial planning can significantly enhance your ability to manage money effectively, including retirement savings for millennials.

Top features to look for in a budgeting app:

- Automatic transaction categorization

- Bill payment reminders

- Goal tracking and visualization for high-yield savings accounts and stock market investing for young professionals

Next, we’ll explore how Alleo can assist in achieving these financial goals, including real estate investment for wealth building and using index funds and ETFs for new investors.

Achieve Financial Independence with Alleo

We’ve explored the challenges of building net worth through smart investments for young professionals. But did you know you can work directly with Alleo to make this journey easier and faster?

Setting up an account with Alleo is simple. Create a personalized plan tailored to your financial goals, including investment strategies for beginners and long-term financial planning for young adults.

Alleo’s AI coach offers affordable, tailored support for building wealth in your 20s and 30s. The coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications, helping you with diversifying investment portfolio and retirement savings for millennials.

Ready to get started for free? Let me show you how!

Step 1: Log In or Create Your Account

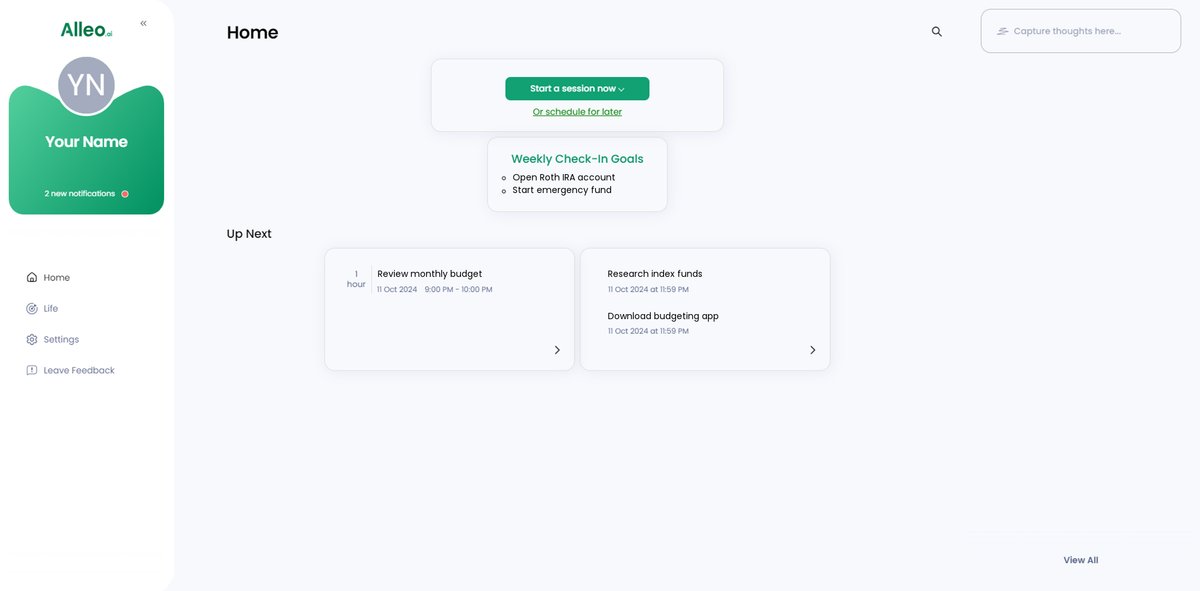

To start your journey towards financial independence, log in to your existing Alleo account or create a new one to access personalized investment strategies and AI-powered coaching.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start developing consistent financial practices that will support your journey to financial independence. Establishing strong money habits is crucial for successfully implementing the investment strategies and budgeting techniques discussed in this article.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area in Alleo to align with your goal of building net worth through smart investments. This selection will tailor Alleo’s AI coach to provide personalized guidance on budgeting, investment strategies, and financial planning, helping you achieve the financial independence you’re aiming for.

Step 4: Starting a coaching session

Begin your financial journey with Alleo by scheduling an initial intake session, where you’ll work with our AI coach to create a personalized plan aligned with the investment strategies and goals outlined in this article.

Step 5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to review and manage the financial goals you discussed, allowing you to track your progress and stay accountable to your wealth-building plan.

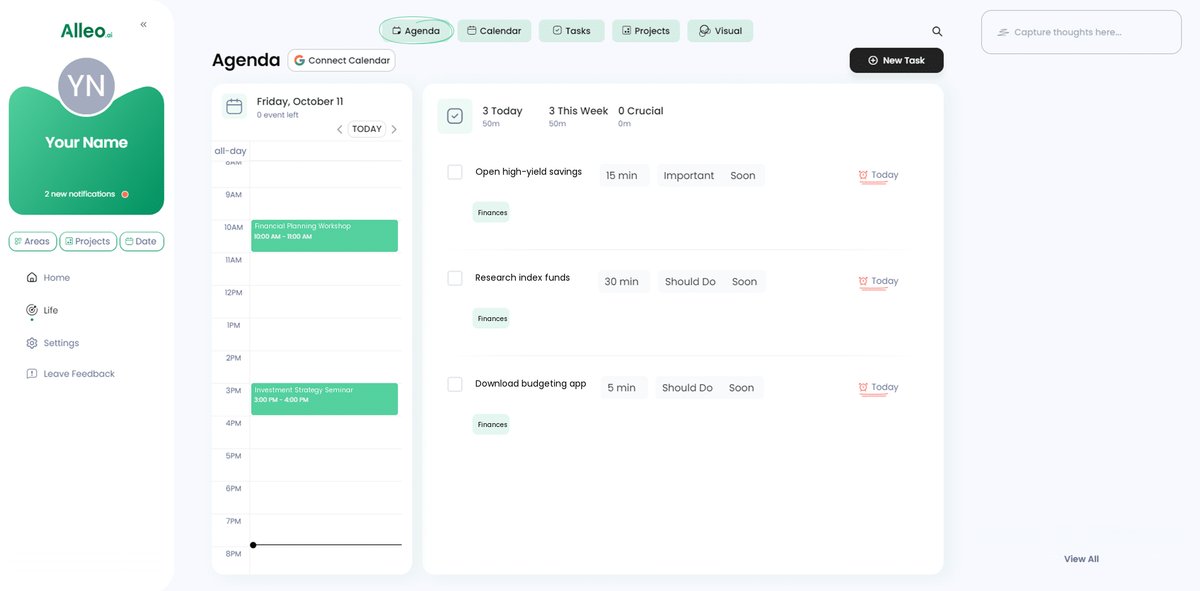

6: Add events to your calendar or app

Use Alleo’s calendar and task features to schedule and track your financial activities, such as regular investment contributions, budget reviews, and savings goals, ensuring you stay on top of your wealth-building journey and can easily monitor your progress towards financial independence.

Final Thoughts on Building Your Net Worth

You’ve learned how to take control of your financial future through smart investments for young professionals. Now, it’s time to put these strategies into action.

Building net worth through smart investments may seem overwhelming, but you can do it. Start with small, manageable steps, like exploring high-yield savings accounts or considering index funds and ETFs for new investors.

Remember, financial independence is within your reach. Stay focused and consistent with your investment strategies for beginners.

Alleo is here to help. Our tools and support make the journey easier, especially when it comes to building wealth in your 20s and 30s.

Don’t wait. Begin your financial transformation today with Alleo and start your path to long-term financial planning for young adults.

Together, we can achieve your financial goals and develop smart investments for young professionals.