How to Decide Between Consolidating Accounts or Diversifying Financial Institutions: 5 Essential Techniques

Are you overwhelmed by managing multiple financial accounts from your various side hustles? Wondering whether to consolidate or diversify accounts?

As a life coach, I understand the challenges side hustlers face in financial planning. Many of my clients struggle with deciding whether to consolidate their accounts or diversify across multiple financial institutions. It’s a common dilemma when balancing convenience and financial diversity.

In this article, you’ll discover strategies to evaluate your options and make informed decisions about whether to consolidate or diversify accounts. We’ll cover assessing current accounts, comparing fees, evaluating risk, and more. You’ll learn about account consolidation benefits, managing multiple bank accounts effectively, and financial risk management strategies.

Let’s dive in to explore the pros and cons of consolidating or diversifying your accounts, including considerations for streamlining personal finances and maximizing interest rates across accounts.

Understanding the Dilemma: Consolidating vs. Diversifying Accounts

When juggling multiple income streams, managing various financial accounts can become a nightmare. Side hustlers often face the challenge of tracking numerous accounts, each with its own fees and benefits, leading many to question whether to consolidate or diversify accounts.

This complexity can lead to confusion and missed opportunities when managing multiple bank accounts.

Conflicting advice only adds to the stress. Some financial experts advocate for consolidation to simplify management, while others highlight the safety of diversifying financial institutions. These opposing views reflect different financial risk management strategies.

These mixed messages can be overwhelming for those trying to streamline personal finances.

Beyond the practical challenges, there’s an emotional toll. Seeing all your investments in one place during market downturns might lead to hasty decisions, which is a consideration when weighing whether to consolidate or diversify accounts.

This emotional strain can make financial planning even more daunting, affecting decisions about account consolidation benefits and bank account security considerations.

Steps to Solve the Dilemma of Consolidating vs. Diversifying Accounts

Overcoming this challenge of whether to consolidate or diversify accounts requires a few key steps. Here are the main areas to focus on to make progress in streamlining personal finances.

- Assess Current Financial Accounts and Goals: List all your accounts and establish clear financial goals, considering account consolidation benefits.

- Compare Fees and Benefits Across Institutions: Analyze fee structures and benefits to identify potential savings, while maximizing interest rates across accounts.

- Evaluate Risk Tolerance and Diversification Needs: Understand your risk tolerance and the importance of diversification, weighing the pros and cons of diversifying financial institutions.

- Consider Convenience of Account Management: Review account management tools and simplify financial tasks, balancing convenience and financial diversity.

- Consult with a Financial Advisor for Guidance: Seek personalized advice to develop a plan of action for managing multiple bank accounts and implementing financial risk management strategies.

Let’s dive in!

1: Assess current financial accounts and goals

Understanding your current financial situation is crucial for making informed decisions about whether to consolidate or diversify accounts.

Actionable Steps:

- List all your current financial accounts, including checking, savings, investment, and retirement accounts. Note the purpose and balance of each account to help with managing multiple bank accounts.

- Set clear financial goals. Determine your short-term and long-term financial goals, and prioritize them based on your side hustle income and personal expenses, considering financial risk management strategies.

Key benefits of assessing your financial accounts:

- Gain a clear overview of your financial health

- Identify areas for improvement or consolidation

- Align your accounts with your financial goals, which may involve streamlining personal finances

Explanation:

These steps matter because they provide a clear picture of your financial landscape. Knowing your starting point makes it easier to decide whether to consolidate or diversify accounts, considering factors like maximizing interest rates across accounts and bank account security considerations.

According to First Interstate Bank, balancing consolidation and diversification is essential in financial planning. Taking stock of your accounts and goals will set a solid foundation for your financial strategy, including simplifying financial record keeping and understanding FDIC insurance limits.

Next, we will explore how to compare fees and benefits across institutions, which is crucial when considering account consolidation benefits and the pros and cons of diversifying financial institutions.

2: Compare fees and benefits across institutions

Understanding the fees and benefits associated with different financial institutions is crucial for making informed decisions when considering whether to consolidate or diversify accounts.

Actionable Steps:

- Compare the fees: Review the fees for each financial account, focusing on maintenance, transaction, and transfer fees when managing multiple bank accounts.

- Analyze benefits: Evaluate the benefits offered, such as interest rates, rewards programs, and customer service, considering the pros and cons of diversifying financial institutions.

- Identify savings: Look for potential savings by consolidating accounts with institutions that offer better terms, streamlining personal finances.

Explanation:

These steps are essential because they highlight where you can save money and take advantage of better benefits. By comparing fees and benefits, you can ensure your financial strategy aligns with your goals and helps in maximizing interest rates across accounts.

For instance, consolidating accounts at an institution with lower fees and higher interest rates can simplify your financial management and enhance your savings. According to RBC Wealth Management, this approach can lead to significant cost savings and improved financial clarity. However, it’s important to consider FDIC insurance limits when deciding whether to consolidate or diversify accounts.

Next, we’ll evaluate your risk tolerance and diversification needs as part of your financial risk management strategies.

3: Evaluate risk tolerance and diversification needs

Understanding your risk tolerance and diversification needs is vital for making informed financial decisions, especially when considering whether to consolidate or diversify accounts.

Actionable Steps:

- Take a risk tolerance quiz: Complete a quiz to gauge your comfort level with risk. This will help you understand how much risk you can tolerate in your investments and guide your account consolidation or diversification strategy.

- Analyze diversification benefits: Evaluate the advantages of spreading assets across different institutions. This might reduce risk and provide a safety net, which is crucial when considering diversifying financial institutions pros and cons.

- Review asset allocation: Ensure your investments are allocated to match your risk tolerance. Adjust your portfolio to balance risk and reward, considering financial risk management strategies.

Factors influencing risk tolerance:

- Age and investment timeline

- Financial goals and obligations

- Personal comfort with market fluctuations

Explanation:

These steps matter because knowing your risk tolerance helps tailor your financial strategy. Diversifying assets can mitigate risks, especially during market downturns. Consider the benefits of managing multiple bank accounts as part of your approach to consolidate or diversify accounts.

For more insights, check out the benefits of non-bank FCMs for diversification. Evaluating these factors ensures your financial plan aligns with your goals and resilience needs.

Next, let’s consider the convenience of account management when deciding to consolidate or diversify accounts.

4: Consider convenience of account management

Considering the ease of managing your accounts can significantly impact your financial planning, especially when you decide to consolidate or diversify accounts.

Actionable Steps:

- Assess account management tools: Evaluate the tools offered by each institution, like mobile apps and online banking capabilities, to help with managing multiple bank accounts.

- Streamline financial tasks: Use features such as automatic bill payments and direct deposits to simplify your financial activities and aid in streamlining personal finances.

Explanation:

These steps matter because they help you save time and reduce stress when deciding whether to consolidate or diversify accounts.

Efficient tools and streamlined tasks can make managing finances easier, allowing you to focus on growing your side hustles while considering account consolidation benefits and financial risk management strategies.

For more insights, check out the importance of financial planning.

Next, let’s consider consulting with a financial advisor for personalized guidance.

5: Consult with a financial advisor for guidance

Consulting with a financial advisor can provide personalized advice tailored to your unique financial situation, especially when deciding whether to consolidate or diversify accounts.

Actionable Steps:

- Schedule a consultation: Book a meeting with a certified financial advisor to discuss your financial goals, concerns, and strategies for managing multiple bank accounts.

- Prepare your financial data: Gather all relevant financial documents, including account statements and a list of assets and liabilities, to help streamline personal finances.

- Discuss recommendations: Review the advisor’s suggestions on whether to consolidate or diversify your accounts, considering account consolidation benefits and financial risk management strategies.

Key questions to ask your financial advisor:

- How can I optimize my account structure while balancing convenience and financial diversity?

- What are the pros and cons of consolidation in my situation, considering FDIC insurance limits?

- How can I balance risk and diversification effectively across financial institutions?

Explanation:

These steps matter because a financial advisor can provide expert insights and help you navigate complex financial decisions, such as whether to consolidate or diversify accounts. Personalized advice ensures your strategy aligns with your goals, risk tolerance, and bank account security considerations.

According to RBC Wealth Management, consulting with an advisor can lead to better financial clarity and confidence.

Connecting with a financial advisor gives you the guidance needed to make informed decisions about consolidating or diversifying accounts, maximizing interest rates across accounts, and simplifying financial record keeping.

Partner with Alleo for Financial Clarity

We’ve explored the dilemma of whether to consolidate or diversify accounts and the steps to address it. Did you know you can work directly with Alleo to simplify this process of managing multiple bank accounts?

How Alleo Can Help

- Goal Setting: Use Alleo to set and track your financial goals, including strategies for consolidating or diversifying accounts.

- Decision Making: Leverage Alleo’s AI capabilities to compare fees, benefits, and risk factors when considering account consolidation benefits or diversifying financial institutions.

- Plan Management: Utilize Alleo’s organizational tools to manage accounts and simplify financial tasks, streamlining personal finances.

- Advisor Consultation: Find and connect with a financial advisor through Alleo’s network to discuss financial risk management strategies.

Get Started

Sign up for Alleo, create your personalized plan, and work with Alleo’s AI coach to overcome financial challenges, including whether to consolidate or diversify accounts.

The AI coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications, helping you balance convenience and financial diversity.

Ready to get started for free? Let me show you how to simplify financial record keeping and maximize your financial strategy!

Step 1: Log In or Create Your Account

To begin managing your side hustle finances with Alleo, log in to your existing account or create a new one if you’re joining us for the first time.

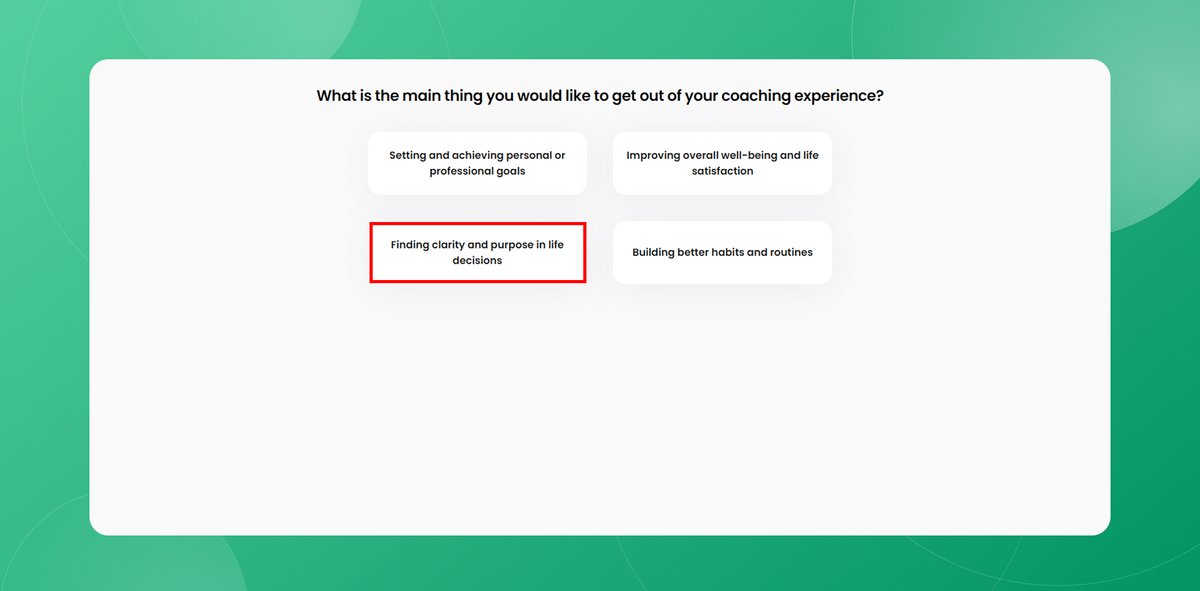

Step 2: Choose Your Financial Focus

Select “Finding clarity and purpose in life decisions” to address your account consolidation vs. diversification dilemma, helping you align your financial strategy with your side hustle goals and risk tolerance.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to address your account consolidation and diversification challenges, aligning with your side hustle income management goals and helping you streamline your financial planning process.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an initial intake session, where you’ll work with the AI coach to set up a personalized financial plan that addresses your account consolidation and diversification needs.

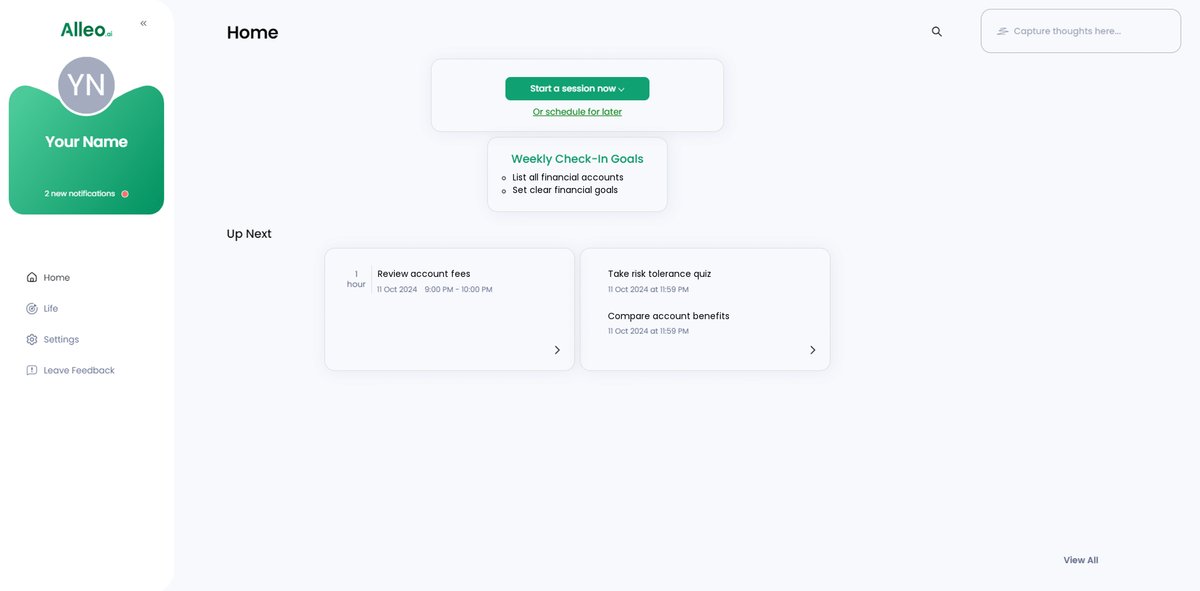

Step 5: Viewing and managing goals after the session

After your coaching session, open the Alleo app to find your discussed financial goals conveniently displayed on the home page, allowing you to easily track and manage your progress towards consolidating or diversifying your accounts.

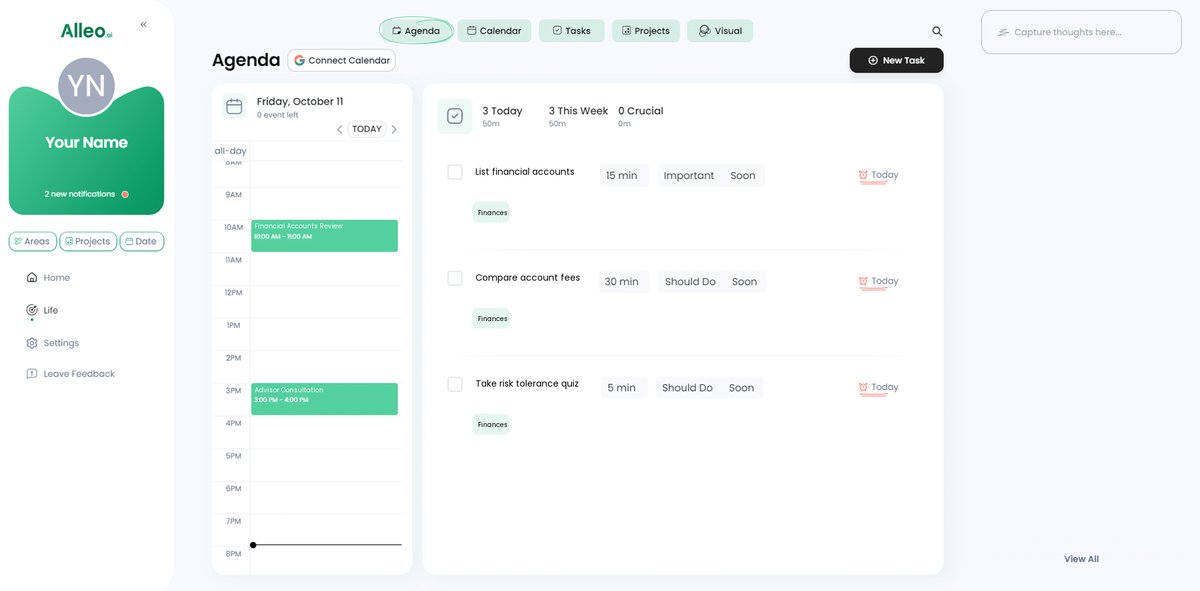

6: Add events to your calendar or app

Use Alleo’s calendar and task features to schedule and track important financial activities, such as account reviews, fee comparisons, and meetings with your financial advisor, helping you stay organized and accountable in your journey towards financial clarity.

Final Thoughts on Your Financial Planning Journey

Balancing whether to consolidate or diversify accounts is a significant decision in your financial planning journey. It can be overwhelming, but you’re not alone in considering account consolidation benefits and the pros and cons of diversifying financial institutions.

Take the first step by assessing your current accounts and setting clear goals. Compare fees and benefits, evaluate your risk tolerance, and consider the convenience of managing multiple bank accounts. Streamlining personal finances and maximizing interest rates across accounts are key factors to weigh.

Consulting with a financial advisor provides personalized guidance on financial risk management strategies. Remember, small steps lead to big changes in simplifying financial record keeping.

Alleo is here to help you through this process of deciding whether to consolidate or diversify accounts. With Alleo, you can set goals, make informed decisions, and manage your accounts effortlessly while considering bank account security considerations and FDIC insurance limits.

Sign up for Alleo today and start your journey towards financial clarity and confidence, whether you choose to consolidate or diversify accounts.