How to Balance High Debt and Retirement Goals: 7 Essential Tips for Young Professionals

How can you balance a $408k mortgage and $123k in student loans while planning for a comfortable retirement? Balancing debt and retirement planning is a common challenge for many young professionals.

As a life coach, I’ve helped many professionals navigate these challenges. I often encounter clients who feel overwhelmed by their financial burdens, especially when it comes to student loan debt management and planning for their future.

In this blog, you’ll find actionable steps to balance high debt and retirement goals without compromising your lifestyle. You’ll learn about budgeting for debt repayment and savings, debt prioritization, and maximizing your savings through strategies like 401(k) contributions while in debt.

Let’s dive in to explore financial planning for young adults and discover how to achieve a balance between debt repayment and securing your financial future.

The Financial Struggle of Balancing Debt and Retirement

Young professionals today face immense financial pressure when balancing debt and retirement planning. Many juggle substantial mortgage and student loan debts while trying to save for retirement.

It’s a challenging scenario that can feel overwhelming for those focused on financial planning for young adults.

Several clients I’ve worked with express feeling trapped under the weight of their financial obligations. High debt levels make it difficult to prioritize long-term financial goals, including 401(k) contributions while in debt.

This situation often leads to stress and anxiety, affecting overall well-being.

The increasing student loan debt and rising cost of living compound the issue. Without a clear financial plan for balancing debt and retirement planning, it’s easy to fall into a cycle of debt.

This cycle can impede your ability to save for emergencies or invest in your future, making emergency fund strategies for indebted professionals crucial.

Understanding these pressures is the first step towards finding balance. By recognizing the problem, you can begin to take actionable steps to regain control of your finances and effectively manage student loan debt.

Effective Strategies to Balance Debt and Retirement Goals

Overcoming the challenge of balancing debt and retirement planning requires a few key steps. Here are the main areas to focus on to make progress:

- Create a budget and track expenses rigorously: Use a budgeting app to monitor and categorize monthly expenses for effective debt repayment and savings.

- Prioritize high-interest debt with avalanche method: Allocate extra payments to the highest interest rate debt first, a key strategy in debt management for young adults.

- Automate savings for both debt and retirement: Set up automatic transfers to dedicated accounts, crucial for balancing debt and retirement planning.

- Explore income-driven student loan repayment plans: Enroll in a suitable plan and consider consolidation to manage student loan debt effectively.

- Maximize employer 401(k) match for retirement: Contribute at least enough to get the full employer match, even while focusing on debt repayment.

- Build an emergency fund to avoid new debt: Start with $1,000 and aim for three to six months of expenses, an essential strategy for indebted professionals.

- Pursue side hustles for extra debt repayment: Monetize skills and use earnings to pay off debt, a practical approach to balancing debt and retirement planning.

Let’s dive in!

1: Create a budget and track expenses rigorously

Creating a budget and tracking expenses is essential for balancing debt and retirement planning. This approach is crucial for financial planning for young adults.

Actionable Steps:

- Use a budgeting app: Download an app to monitor, categorize, and track all monthly expenses, aiding in budgeting for debt repayment and savings.

- Set monthly spending limits: Allocate specific limits for discretionary categories such as dining out and entertainment, which can help with student loan debt management.

- Review and adjust the budget monthly: Regularly reassess your budget to identify and cut unnecessary expenses, supporting your 401(k) contributions while in debt.

Explanation: Keeping a detailed budget helps you understand where your money goes, allowing you to make informed financial decisions. This practice is crucial for managing debt and saving for retirement.

According to a Bankrate report, 36% of U.S. adults are prioritizing both debt repayment and building emergency savings. This trend highlights the importance of financial planning.

Key benefits of budgeting include:

- Improved financial awareness

- Better control over spending

- Increased ability to meet financial goals

Starting with a solid budget is the first step toward achieving your long-term financial goals, including balancing debt and retirement planning.

![]()

2: Prioritize high-interest debt with avalanche method

Prioritizing high-interest debt with the avalanche method can significantly reduce the amount of interest paid over time, which is crucial when balancing debt and retirement planning.

Actionable Steps:

- List all debts with their interest rates and minimum payments: Create a comprehensive list that includes every debt, interest rate, and the required minimum payment for each. This is essential for effective debt management and financial planning for young adults.

- Allocate extra payments to the debt with the highest interest rate: Focus any additional payments on the debt with the highest interest rate while making minimum payments on all other debts. This strategy, known as the debt avalanche method, can be more effective than the debt snowball method for some individuals.

- Track progress and recalculate pay-off timelines: Regularly monitor your progress and adjust your repayment strategy as needed to stay motivated and on track. This is crucial for budgeting for debt repayment and savings.

Explanation: By focusing on high-interest debts first, you minimize the total interest paid, thus accelerating your path to becoming debt-free. This approach can help with balancing debt and retirement planning effectively.

According to Equitable, using a structured approach like the avalanche method can help you manage and reduce debt more effectively while preparing for retirement.

By implementing this method, you can take control of your finances and move closer to your financial goals, including balancing debt and retirement planning.

3: Automate savings for both debt and retirement

Automating your savings is essential to balancing debt and retirement planning goals.

Actionable Steps:

- Set up automatic transfers: Arrange for automatic transfers from your checking account to a dedicated debt repayment account and retirement savings account, supporting your strategy for balancing debt and retirement planning.

- Automate retirement contributions: Increase your 401(k) contributions while in debt by 1% annually, using tools provided by your employer or financial institution.

- Utilize round-up apps: Use apps or banking tools that round up your purchases and save the difference into a high-yield savings account, aiding in budgeting for debt repayment and savings.

Explanation: Automating these processes ensures consistent progress towards your financial goals without needing constant attention. This method allows you to prioritize both debt repayment and retirement savings effortlessly, crucial for financial planning for young adults.

According to a DFPI report, automating savings can significantly enhance financial stability and promote long-term success.

Taking these steps will help you stay on track with your financial objectives, effectively balancing debt and retirement planning.

4: Explore income-driven student loan repayment plans

Exploring income-driven student loan repayment plans can offer significant relief when managing high debt and planning for retirement, helping you balance debt and retirement planning effectively.

Actionable Steps:

- Research and enroll in an income-driven repayment plan: Select a plan that suits your financial situation to lower monthly payments, a key aspect of student loan debt management.

- Regularly update your income information: Ensure your payments remain affordable by keeping your income details current, crucial for budgeting for debt repayment and savings.

- Consider consolidation or refinancing options: Manage multiple loans more effectively by consolidating or refinancing for better terms, exploring debt consolidation options as part of your financial planning strategy.

Explanation: These steps help make student loan payments more manageable and align with your income. By doing so, you can balance debt repayment with other financial goals, such as saving for retirement and maintaining 401(k) contributions while in debt.

According to a CFR report, many borrowers benefit from income-driven plans, which offer more flexibility in repayment.

Taking these steps can significantly ease your financial burden while you work towards long-term stability, an essential aspect of balancing debt and retirement planning for young professionals.

5: Maximize employer 401(k) match for retirement

Maximizing your employer 401(k) match is crucial for enhancing your retirement savings and balancing debt and retirement planning.

Actionable Steps:

- Contribute at least enough to get the full employer match: Ensure you contribute the minimum required to receive the full match from your employer, even while managing student loan debt.

- Review and adjust contributions: Regularly review your employer’s retirement plan options and adjust your 401(k) contributions while in debt to maximize benefits.

- Attend financial planning seminars: Take advantage of company-offered seminars to learn how to optimize your retirement contributions and balance debt repayment.

Explanation: Contributing enough to get your employer’s 401(k) match is essentially earning free money, significantly boosting your retirement savings while budgeting for debt repayment and savings.

This approach aligns with industry trends, as seen in a NAPA report highlighting the importance of maximizing retirement benefits for young adults.

By taking these steps, you can ensure you’re not leaving money on the table and are on track for a secure retirement while managing your debt.

The benefits of maximizing your 401(k) match include:

- Increased retirement savings

- Tax advantages

- Compound growth potential

Taking full advantage of your employer’s 401(k) match is a smart way to enhance your financial future while balancing debt and retirement planning.

6: Build emergency fund to avoid new debt

Building an emergency fund is crucial to avoid new debt and maintain financial stability, especially when balancing debt and retirement planning.

Actionable Steps:

- Set a realistic target: Start with $1,000 and gradually build up to three to six months of essential expenses, considering your debt repayment and savings goals.

- Automatically transfer a fixed amount: Direct a portion of each paycheck to a high-yield savings account to grow your emergency fund steadily, while managing student loan debt.

- Use windfalls to boost savings: Allocate tax refunds or bonuses directly to your emergency fund for faster growth, enhancing your financial planning for young adults.

Explanation: These steps provide a financial cushion for unexpected expenses, preventing the need to incur new debt. Automating savings helps maintain consistency without requiring constant attention, supporting budgeting for debt repayment and savings.

According to a Bankrate report, 36% of U.S. adults prioritize both debt repayment and emergency savings, highlighting the importance of this financial strategy when balancing debt and retirement planning.

Building an emergency fund is a pivotal step in achieving long-term financial security and is crucial for emergency fund strategies for indebted professionals.

7: Pursue side hustles for extra debt repayment

Pursuing side hustles can be a great way to accelerate debt repayment while maintaining your lifestyle and balancing debt and retirement planning.

Actionable Steps:

- Identify monetizable skills and hobbies: Explore activities you enjoy, such as freelance writing, tutoring, or selling handcrafted items, and find ways to earn from them. These side hustle ideas for debt reduction can be particularly effective for financial planning for young adults.

- Dedicate side hustle income to debt repayment: Commit to using all earnings from your side hustles exclusively for paying off debt. This ensures focused financial progress and aids in student loan debt management.

- Join online communities for opportunities: Network in relevant online groups to find side hustle opportunities and gain support from others in similar situations, which can help with budgeting for debt repayment and savings.

Explanation: These steps help you generate additional income dedicated to debt repayment, speeding up the process. Engaging in side hustles also diversifies your income streams and adds financial stability, supporting your efforts in balancing debt and retirement planning.

According to a MagellanLV report, supplementing income through freelance or consulting work can effectively offset high costs and ease financial strain.

Popular side hustle options include:

- Freelance writing or graphic design

- Online tutoring or teaching

- Selling handmade items or vintage finds

Taking these actions can significantly boost your debt repayment journey and enhance financial security, contributing to your overall strategy for balancing debt and retirement planning.

Partner with Alleo on Your Financial Journey

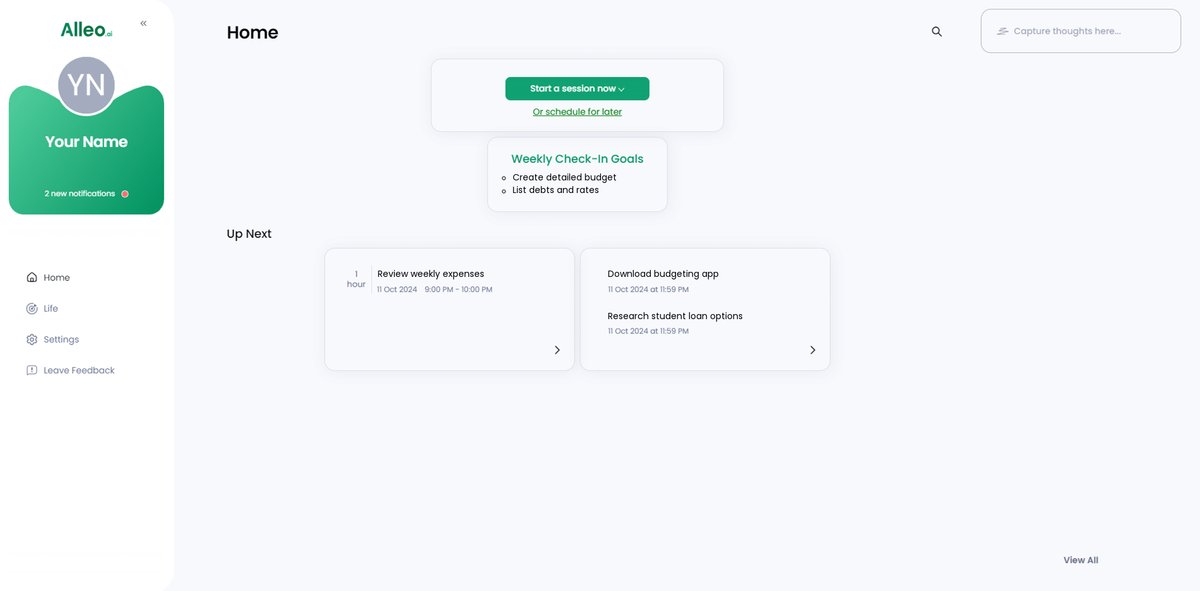

We’ve explored the challenges of balancing debt and retirement planning. But did you know you can work with Alleo to make this journey easier and faster? Our AI coach specializes in financial planning for young adults, helping you navigate student loan debt management and budgeting for debt repayment and savings.

Setting up an account with Alleo is simple. Create a personalized plan to tackle your financial challenges, including strategies for 401(k) contributions while in debt and exploring debt consolidation options.

Alleo’s AI coach offers tailored coaching support, just like a human coach. The coach will keep you on track with text and push notifications, guiding you through debt snowball vs. debt avalanche methods and emergency fund strategies for indebted professionals.

Are you ready to get started for free? Let me show you how to begin balancing debt and retirement planning today!

Step 1: Log in or Create Your Account

To start balancing your debt and retirement goals with personalized AI coaching, log in to your existing Alleo account or create a new one in just a few clicks.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to establish a solid financial foundation that will help you balance debt repayment and retirement savings more effectively, aligning with the strategies discussed in the article for improved money management and long-term financial success.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area to address the challenges of balancing high debt and retirement goals, allowing Alleo’s AI coach to provide tailored strategies for budgeting, debt management, and long-term financial planning.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your financial goals and create a personalized plan to balance your mortgage, student loans, and retirement savings.

Step 5: Viewing and managing goals after the session

After your coaching session, check the app’s home page to review and manage the financial goals you discussed, such as debt repayment strategies and retirement savings targets.

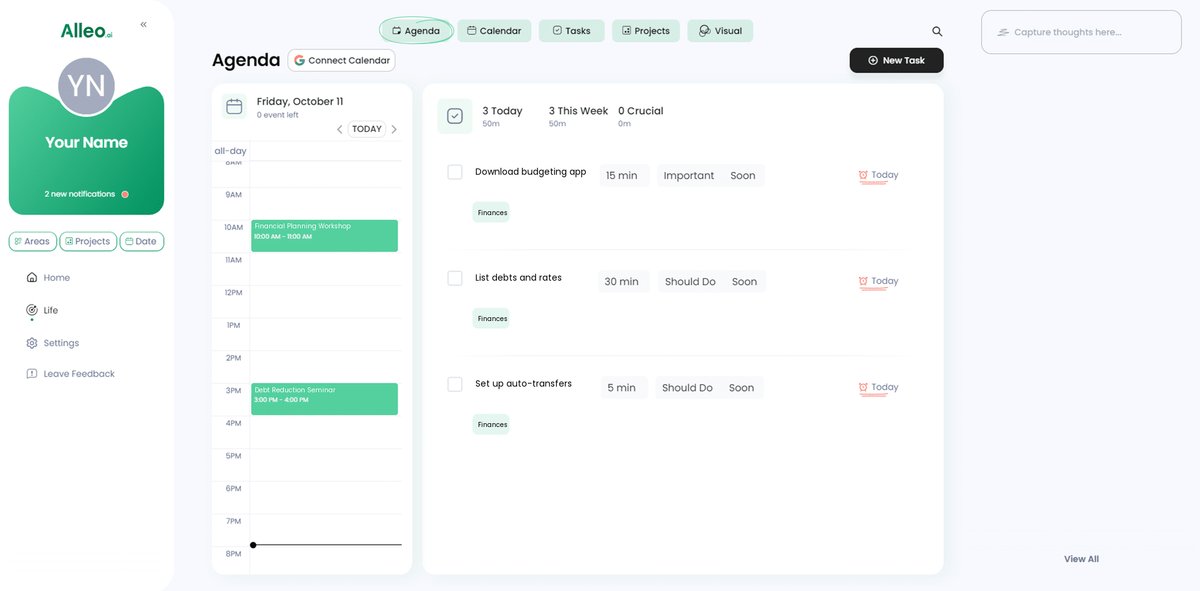

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track your debt repayment milestones, budgeting check-ins, and retirement savings goals, helping you stay accountable and visualize your progress towards financial freedom.

Taking Action Towards Financial Freedom

Balancing debt and retirement planning is tough. However, with the right steps, it’s achievable for young adults seeking financial planning guidance.

Remember, it’s about creating a budget for debt repayment and savings, prioritizing high-interest debt using methods like debt snowball or avalanche, and automating savings. Don’t forget to explore income-driven repayment plans for student loan debt management and maximize your 401(k) contributions while in debt.

Building an emergency fund and pursuing side hustle ideas for debt reduction can also make a big difference in balancing debt and retirement planning.

You’ve got this!

Take control of your finances today. Try Alleo for personalized financial planning support. It’s free and designed to help you succeed in balancing debt and retirement planning.

Start your journey to financial freedom now.