5 Essential Steps to Consolidate Retirement Accounts for Young Professionals

Have you ever felt overwhelmed managing multiple retirement accounts while juggling a side hustle and planning for your financial future? Consolidating retirement accounts efficiently can be a game-changer for your financial planning.

Meet Sarah, a dynamic young professional who found herself lost in the maze of her various retirement accounts. Like many millennials, she struggled with early career retirement planning and simplifying retirement savings.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, managing multiple accounts can complicate financial planning, making retirement account management a daunting task.

By following along, you’ll discover best practices for consolidating retirement accounts efficiently. These strategies will simplify your financial planning and enhance asset allocation. We’ll explore 401(k) consolidation strategies and IRA transfer tips to help you maximize retirement benefits.

Let’s dive in and learn how to combine multiple 401(k) accounts while considering the tax implications of account consolidation.

The Complexity of Managing Multiple Retirement Accounts

Managing multiple retirement and investment accounts can be a significant challenge. I often see clients struggle to keep track of various 401(k)s, IRAs, and other accounts, highlighting the need to consolidate retirement accounts efficiently.

This complexity can lead to disorganization and missed opportunities for retirement account rollovers and 401(k) consolidation strategies.

For many young professionals, balancing multiple income streams with a side hustle only adds to the chaos. It’s easy to overlook account consolidation, which could simplify your retirement savings and financial planning.

Many people miss out on potential benefits like lower fees and better asset allocation when combining multiple 401(k) accounts.

The impact is clear. Disjointed accounts can make it harder to achieve your financial goals and maximize retirement benefits.

Simplifying and consolidating your accounts can provide a clearer financial picture and more effective planning for early career retirement planning.

Roadmap to Simplify Your Retirement Accounts

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to consolidate retirement accounts efficiently:

- Inventory all existing retirement accounts: Gather and organize all account statements for effective retirement account management.

- Choose a single provider for consolidation: Research and select the best financial institution for 401(k) consolidation strategies.

- Execute direct transfers to minimize taxes: Initiate and monitor trustee-to-trustee transfers, considering tax implications of account consolidation.

- Set up automatic contributions post-consolidation: Automate regular contributions to your consolidated account, maximizing retirement benefits.

- Review and adjust asset allocation strategy: Regularly assess and rebalance your portfolio, a crucial step in simplifying retirement savings.

Let’s dive in to consolidate retirement accounts efficiently!

1: Inventory all existing retirement accounts

The first crucial step in consolidating your retirement accounts efficiently is to take inventory of all your existing accounts. This sets the foundation for effective retirement account management.

Actionable Steps:

- Gather account statements: Collect recent statements from all your 401(k)s, IRAs, and other retirement accounts to begin the process of combining multiple 401(k) accounts.

- Create a detailed list: Document account balances, fees, and investment options for each account, which is essential for simplifying retirement savings.

- Use digital tools: Utilize online financial management tools to aggregate and organize your account data, supporting early career retirement planning.

Explanation:

Understanding what you have is essential for effective consolidation. By meticulously documenting your accounts, you can identify overlaps and potential areas for improvement, which is crucial when considering retirement account rollovers.

This inventory step is critical for streamlining your financial planning and ensuring that no account is overlooked when you consolidate retirement accounts efficiently. For more detailed guidance on 401(k) consolidation strategies, you can read this guide on account consolidation.

This foundational step sets the stage for choosing the right provider and maximizing retirement benefits, which we’ll discuss next.

2: Choose a single provider for consolidation

Choosing a single provider to consolidate retirement accounts efficiently is crucial to streamline your retirement savings and improve financial planning for millennials.

Actionable Steps:

- Research providers: Compare different financial institutions based on fees, services, and investment options for 401(k) consolidation strategies. Evaluate both traditional firms and robo-advisors for retirement account management.

- Evaluate customer service: Read reviews and seek testimonials from other young professionals. Prioritize providers with strong support and user-friendly interfaces for simplifying retirement savings.

Key factors to consider when selecting a provider for retirement account rollovers:

- Low fees and expense ratios

- Wide range of investment options for maximizing retirement benefits

- User-friendly online platform and mobile app for combining multiple 401(k) accounts

- Excellent customer support and educational resources for early career retirement planning

Explanation:

By carefully selecting a provider, you ensure that your consolidated account benefits from lower fees, better services, and a seamless user experience. This step is vital for simplifying your financial planning and maximizing the benefits of account consolidation.

For more insights, review this guide on choosing the right provider.

This sets the stage for executing direct transfers to minimize taxes, which we’ll cover next.

3: Execute direct transfers to minimize taxes

Executing direct transfers is crucial for minimizing taxes and streamlining your retirement accounts. This step is essential when you consolidate retirement accounts efficiently.

Actionable Steps:

- Initiate direct transfers: Contact your chosen provider to facilitate trustee-to-trustee transfers for 401(k) consolidation strategies. Ensure all paperwork is completed accurately to avoid tax implications of account consolidation.

- Monitor the transfer process: Keep track of each retirement account rollover and confirm receipt with the new provider. Follow up regularly until all accounts are successfully consolidated, simplifying retirement savings.

Explanation:

Direct transfers help you avoid unnecessary taxes and penalties when combining multiple 401(k) accounts. By following up on the process, you ensure a smooth transition in retirement account management.

This can significantly impact your financial planning for millennials. For more detailed guidance on IRA transfer tips, check out this resource on annuity rollovers.

These steps prepare you for setting up automatic contributions, which we’ll discuss next as part of maximizing retirement benefits.

4: Set up automatic contributions post-consolidation

Setting up automatic contributions post-consolidation is crucial for maintaining consistent savings and reaching your financial goals when you consolidate retirement accounts efficiently.

Actionable Steps:

- Automate contributions: Set up automatic transfers from your paycheck or bank account to the consolidated retirement account. Adjust contribution amounts based on your savings goals, focusing on simplifying retirement savings.

- Maximize employer benefits: Ensure you are taking full advantage of any employer matching contributions. Review and update your contribution settings annually to maximize retirement benefits.

Benefits of automating your retirement contributions:

- Consistent savings without the need for manual transfers, aiding in retirement account management

- Reduced temptation to spend money earmarked for retirement

- Potential for dollar-cost averaging in market investments, a key strategy in early career retirement planning

Explanation:

Automating contributions ensures consistent savings, helping you stay on track with your retirement goals. Taking full advantage of employer matches further boosts your savings, which is essential when combining multiple 401(k) accounts.

Consistent contributions can significantly impact your long-term financial security. For more details, visit this guide on workplace retirement plans.

By automating your contributions, you’re setting yourself up for a more secure financial future as you consolidate retirement accounts efficiently.

5: Review and adjust asset allocation strategy

Reviewing and adjusting your asset allocation strategy is essential to ensure your investments align with your financial goals and risk tolerance when you consolidate retirement accounts efficiently.

Actionable Steps:

- Assess your current allocation: Regularly evaluate your consolidated account’s asset allocation. Compare it to your risk tolerance and retirement goals, considering 401(k) consolidation strategies.

- Rebalance your portfolio: Make necessary adjustments to diversify and optimize your investment strategy. Schedule periodic reviews to maintain balance and simplify retirement savings.

- Consult a financial advisor: Seek professional advice to ensure your strategy meets your long-term objectives and maximizes retirement benefits. Utilize tools like the Vanguard retirement calculator for better insights on retirement account management.

Signs it’s time to review your asset allocation:

- Major life changes (marriage, children, job change) that may affect early career retirement planning

- Significant market fluctuations impacting your IRA transfer or 401(k) consolidation

- Approaching a new life stage (e.g., nearing retirement) requiring financial planning for millennials

Explanation:

These steps are crucial because a well-balanced portfolio can significantly impact your financial future. Regular reviews and adjustments help you stay on track and adapt to market changes when combining multiple 401(k) accounts.

For more detailed guidance on how to consolidate retirement accounts efficiently and understand tax implications of account consolidation, visit this investment education resource.

By following these steps, you can ensure your retirement savings are effectively managed and optimized through efficient retirement account rollovers.

Partner with Alleo for Seamless Retirement Account Consolidation

We’ve explored the challenges of managing multiple retirement accounts and how consolidating them can simplify your financial planning. But did you know you can work directly with Alleo to consolidate retirement accounts efficiently and make this process easier?

Step 1: Goal Setting with Alleo

Use Alleo to set clear financial goals and timelines for your retirement savings. Track your progress and receive personalized tips for retirement account rollovers and 401(k) consolidation strategies.

Our AI coach will help you create a tailored plan that fits your unique needs, including IRA transfer tips and strategies for combining multiple 401(k) accounts.

Step 2: Decision-Making Assistance

Alleo analyzes your preferences and needs to help you choose the best provider for consolidating retirement accounts efficiently. Receive curated recommendations and streamline the decision-making process for maximizing retirement benefits.

Our AI coach ensures you make informed choices to enhance your financial strategy, including understanding tax implications of account consolidation.

Step 3: Schedule Management

Let Alleo manage your consolidation timeline and remind you of important deadlines. Simplify your retirement account management with automated alerts and updates.

Our AI coach will keep you accountable, ensuring you stay on track with your goals for simplifying retirement savings and early career retirement planning.

Ready to get started for free?

Let me show you how to efficiently consolidate retirement accounts!

Step 1: Log In or Create Your Alleo Account

To begin simplifying your retirement account management, log in to your Alleo account or create a new one if you haven’t already, allowing you to access personalized financial guidance and streamline your consolidation process.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start organizing your financial life and simplify managing multiple retirement accounts – this goal will help you develop consistent practices for tracking and consolidating your investments.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to streamline your retirement account consolidation process and receive tailored guidance on simplifying your financial planning, aligning perfectly with the challenges discussed in managing multiple retirement accounts.

Step 4: Starting a Coaching Session

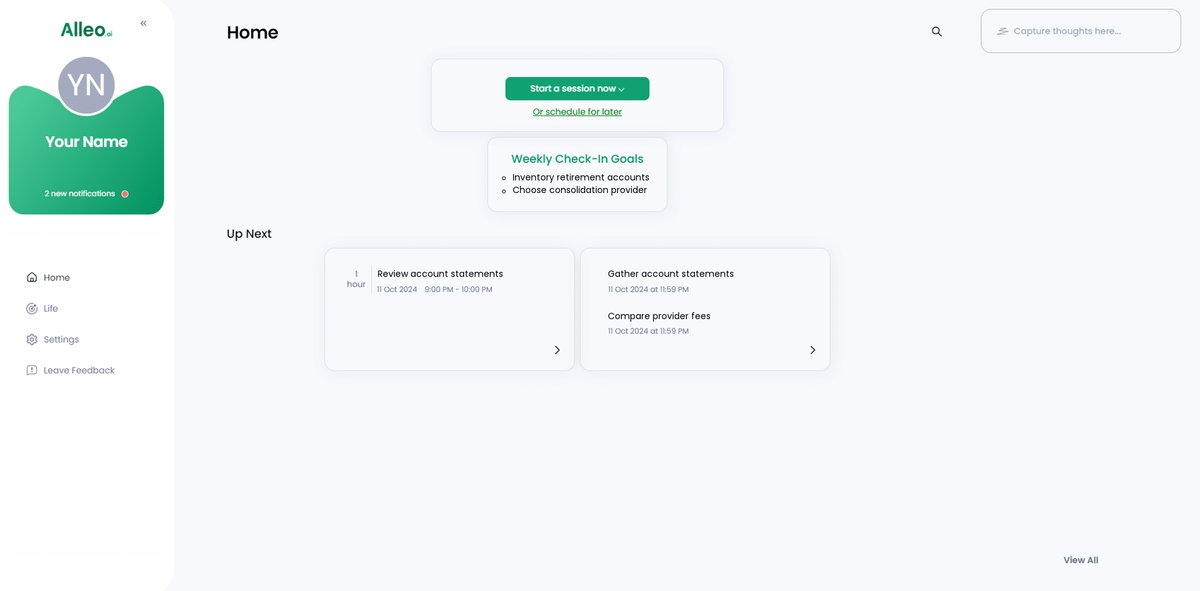

Begin your journey with Alleo by scheduling an initial intake session, where our AI coach will help you set up a personalized plan to consolidate your retirement accounts and optimize your financial strategy.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, open the Alleo app to find your retirement account consolidation goals displayed on the home page, allowing you to easily track and manage your progress towards simplifying your financial planning.

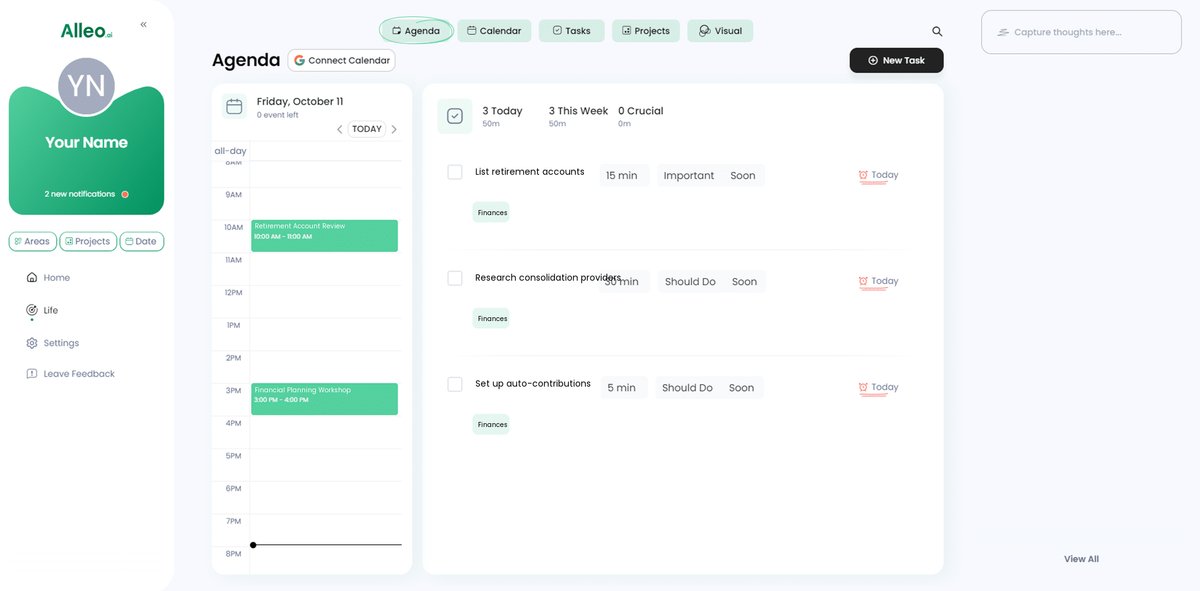

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to track your progress in consolidating your retirement accounts, adding important dates like account transfer deadlines and review sessions to stay on top of your financial planning goals.

Wrapping Up Your Financial Journey

Taking control of your retirement accounts can feel overwhelming, but it’s a game-changer for your financial future. By learning to consolidate retirement accounts efficiently, you simplify your planning and enhance your asset allocation strategy.

Remember, the steps we’ve discussed—inventorying accounts, choosing a provider, executing transfers, automating contributions, and adjusting asset allocation—are all about making your life easier and maximizing retirement benefits.

Imagine the peace of mind you’ll gain from a streamlined financial plan, especially when it comes to retirement account management.

At Alleo, we’re here to help you every step of the way with retirement account rollovers. Our tools and AI coach can make this process of combining multiple 401(k) accounts seamless.

So why wait? Take action now and start your journey towards a stress-free financial future through efficient 401(k) consolidation strategies.

Try Alleo for free today and simplify your retirement savings. You’ve got this!