Balancing Affordable Consulting with Long-Term Financial Services: A Guide for Entrepreneurs

Are you struggling to find affordable consulting for entrepreneurs while planning for future financial stability in your business?

As a life coach, I’ve guided many side hustlers through this exact challenge. In my experience, early-stage affordable business advisory services are crucial for laying a strong foundation for long-term financial strategies for startups.

In this article, you’ll learn actionable strategies to balance affordable consulting with entrepreneurial budget management. We’ll explore tiered packages, free workshops, and partnerships with CDFIs to provide cost-effective business consulting and strategic financial guidance for new businesses.

Let’s dive in to discover sustainable financial models for entrepreneurs.

Why Affordable Consulting is Crucial for Entrepreneurs

Finding affordable consulting for entrepreneurs while planning for future wealth management and retirement is a significant challenge. Many entrepreneurs struggle to lay a strong foundation without breaking the bank, especially when it comes to financial planning for small businesses.

This often leads to missing out on crucial early-stage advice and cost-effective business consulting.

In my experience, people often find themselves stuck between paying high consulting fees and neglecting their long-term financial strategies for startups. This dilemma can lead to poor business decisions and financial instability down the road, impacting entrepreneurial budget management.

Several clients report initial difficulties in accessing affordable business advisory services, which directly impacts their long-term planning. The lack of early support can cause serious setbacks in their entrepreneurial journey, affecting their ability to balance startup costs and future growth.

It’s a painful problem that requires immediate attention. You need solutions that offer both affordability and quality to ensure your business thrives over the long term, including sustainable financial models for entrepreneurs.

Strategic Solutions for Balancing Affordable Consulting and Long-Term Financial Services

To tackle this challenge in affordable consulting for entrepreneurs, follow these essential steps:

- Offer Tiered Consulting Packages with Upsells: Develop a range of cost-effective business consulting packages to fit various budgets and needs, focusing on sustainable financial models for entrepreneurs.

- Provide Free Workshops to Attract Clients: Host educational workshops on critical business topics, including financial planning for small businesses and entrepreneurial budget management, to draw in potential clients.

- Partner with CDFIs for Affordable Financing: Collaborate with Community Development Financial Institutions for budget-friendly business mentoring and financing options, balancing startup costs and future growth.

Let’s dive into these strategic financial guidance strategies for new businesses!

1: Offer tiered consulting packages with upsells

Offering tiered consulting packages with upsells helps you provide affordable consulting for entrepreneurs, catering to various budgets and needs, ensuring affordability without compromising quality.

Actionable Steps:

- Create entry-level packages: Develop basic consulting packages covering essential business planning topics at an affordable rate for entrepreneurs. Include services like business assessment and value proposition development, focusing on cost-effective business consulting.

- Introduce intermediate packages: Offer more comprehensive packages that build on the basics, including scaling readiness and customer acquisition strategies. Ensure these packages provide measurable results like a detailed business plan, incorporating financial planning for small businesses.

- Upsell to advanced packages: Present high-end packages that include in-depth financial planning and family office management. Provide additional services like personalized coaching and hands-on consulting, focusing on long-term financial strategies for startups.

Explanation: By offering tiered packages, you can meet immediate consulting needs while paving the way for long-term financial planning. This approach ensures that entrepreneurs have access to crucial advice at every stage, enhancing their business growth and financial stability through affordable business advisory services.

For instance, BizTech Connect offers similar tiered consulting services that have proven effective in supporting entrepreneurs.

Key benefits of tiered consulting packages:

- Tailored solutions for diverse client needs, including entrepreneurial budget management

- Scalable support as businesses grow, balancing startup costs and future growth

- Clear progression path for long-term client relationships, offering strategic financial guidance for new businesses

This method not only helps you attract a broad range of clients but also ensures their continued growth and success through affordable consulting for entrepreneurs and sustainable financial models.

2: Provide free workshops to attract clients

Offering free workshops is an excellent strategy to attract and engage potential clients seeking affordable consulting for entrepreneurs without upfront costs.

Actionable Steps:

- Host targeted educational workshops: Organize workshops on essential topics like financial planning for small businesses, entrepreneurial budget management, and cost-effective business consulting. Ensure the content is practical and immediately actionable.

- Distribute valuable follow-up resources: Provide attendees with free e-books, templates, and access to an online community focused on sustainable financial models for entrepreneurs. Track engagement and gather feedback to improve future sessions.

- Implement a robust lead nurturing system: Follow up with workshop participants, offering personalized affordable consulting for entrepreneurs packages based on their specific needs. Use AI tools to segment leads and tailor follow-up communications effectively, focusing on long-term financial strategies for startups.

Explanation: By hosting free workshops, you provide immediate value and establish trust with potential clients seeking budget-friendly business mentoring. This approach drives engagement and encourages attendees to consider your paid strategic financial guidance for new businesses.

For example, Stockton University successfully uses educational workshops to prepare students for entrepreneurial success. Providing follow-up resources and a nurturing system ensures continuous engagement and conversion to long-term clients interested in affordable business advisory services.

This strategy not only builds your brand’s credibility but also creates a pipeline of potential clients eager to invest in more comprehensive affordable consulting for entrepreneurs, balancing startup costs and future growth.

3: Partner with CDFIs for affordable financing

Partnering with Community Development Financial Institutions (CDFIs) can provide affordable financing options for entrepreneurs, ensuring access to necessary funds without high costs. This approach aligns with the goal of offering affordable consulting for entrepreneurs and supports financial planning for small businesses.

Actionable Steps:

- Identify potential CDFI partners: Research and establish partnerships with CDFIs that align with your mission. Ensure these partners offer affordable financing options for your clients, supporting cost-effective business consulting.

- Develop joint programs: Create programs that combine consulting services with CDFI financing, offering comprehensive support for entrepreneurs. Measure success through client testimonials and financial outcomes, focusing on long-term financial strategies for startups.

Explanation: Partnering with CDFIs can significantly enhance financial accessibility for entrepreneurs. These institutions provide valuable resources like grants, low-interest loans, and financial education, contributing to entrepreneurial budget management and sustainable financial models for entrepreneurs.

For example, the CDFI Fund supports economic growth in distressed communities by investing federal dollars alongside private sector capital. By leveraging these resources, you can offer affordable business advisory services that contribute to long-term business growth.

Advantages of CDFI partnerships for entrepreneurs:

- Access to low-interest loans and grants

- Tailored financial products for underserved communities

- Comprehensive support beyond just funding, including strategic financial guidance for new businesses

This approach ensures that entrepreneurs receive the financial support they need without overwhelming costs, balancing startup costs and future growth through budget-friendly business mentoring.

Partner with Alleo to Balance Affordable Consulting and Financial Services

We’ve explored how to balance affordable consulting for entrepreneurs with long-term financial planning. But did you know Alleo can make this journey easier for small businesses seeking cost-effective business consulting?

Set up your account and create a personalized plan with Alleo, the AI life coach. Alleo offers affordable business advisory services and tailored coaching to overcome specific challenges in entrepreneurial budget management.

She’ll follow up on your progress, handle changes, and keep you accountable via text and push notifications, providing strategic financial guidance for new businesses.

Ready to get started for free? Let me show you how to access budget-friendly business mentoring!

Step 1: Access Your Alleo Account

To begin balancing affordable consulting with long-term financial planning, Log in to your existing Alleo account or create a new one to access personalized AI coaching tailored to your business needs.

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” to align your business objectives with affordable consulting strategies, helping you balance immediate needs with long-term financial planning.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to tackle the challenge of balancing affordable consulting with long-term financial planning, ensuring you receive tailored guidance for your business’s financial stability and growth.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an initial intake session, where you’ll discuss your goals and create a personalized plan to balance affordable consulting with long-term financial planning.

Step 5: Viewing and Managing Goals After the Session

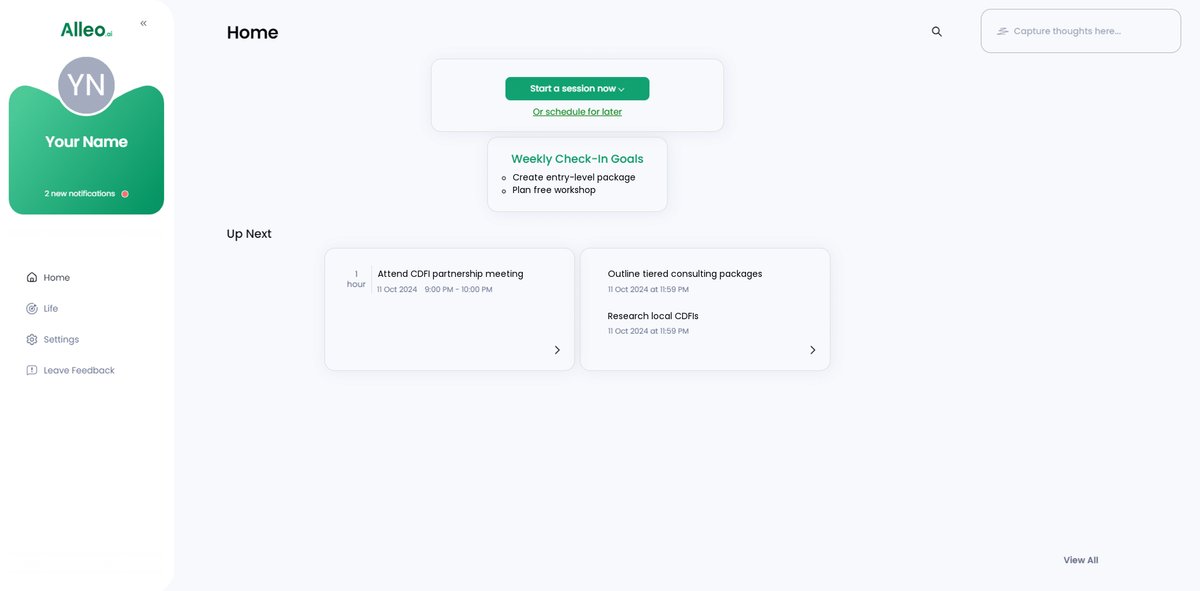

After your coaching session, open the Alleo app to find your discussed goals conveniently displayed on the home page, where you can easily view and manage them to stay on track with your financial planning and business growth objectives.

Step 6: Adding events to your calendar or app

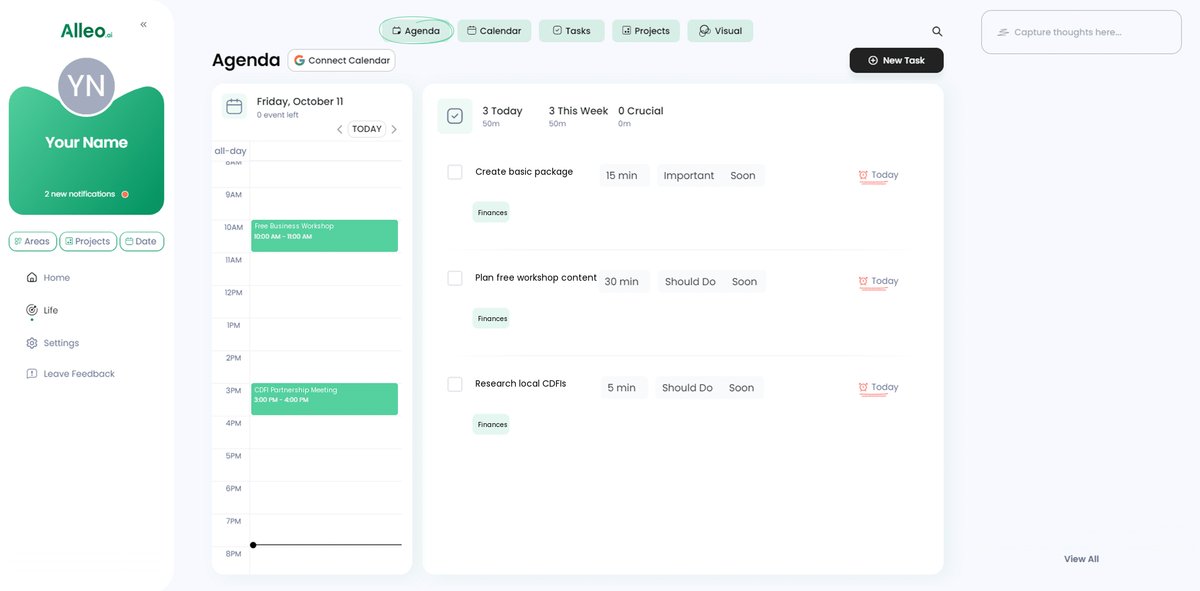

To keep track of your progress in balancing affordable consulting and long-term financial planning, use Alleo’s calendar and task features to add important events, deadlines, and milestones related to your business strategies and financial goals.

Taking the First Step Toward Achieving Your Financial Goals

Balancing affordable consulting for entrepreneurs with long-term financial strategies for startups is essential for your business success. It’s a challenge, but it’s achievable with strategic financial guidance for new businesses.

Remember, tiered consulting packages, free workshops, and CDFI partnerships are effective strategies for entrepreneurial budget management. They ensure you get the cost-effective business consulting you need without overwhelming costs.

Don’t forget, Alleo can simplify this process. She offers personalized coaching to help you stay on track with your financial planning for small businesses.

You can start solving this problem today. Set up your account with Alleo and create a personalized plan for sustainable financial models for entrepreneurs.

Your financial stability and business success are within reach with affordable business advisory services. Take the first step now and see the difference in balancing startup costs and future growth.