4 Essential Ways to Save for Your Dream Wedding While Tackling Debt

Are you struggling with saving for wedding with debt while juggling student loan payments? Many couples face the challenge of balancing debt and wedding expenses.

As a life coach, I’ve guided many recent graduates through similar financial planning for couples. I understand the stress of managing debt while planning for significant milestones like a budget-friendly wedding.

In this article, you’ll discover actionable debt repayment strategies and wedding savings tips to balance loan payments and wedding costs. We’ll cover budgeting, the debt avalanche method, high-yield savings accounts, and picking up a side job for saving for wedding with debt.

Let’s dive into these frugal wedding ideas.

The Dual Challenge of Debt and Wedding Planning

Balancing debt repayment while saving for a wedding is a significant challenge for many recent graduates. Many clients initially struggle with the overwhelming pressure of managing student loans while also planning for a major life event. Saving for wedding with debt requires careful financial planning for couples.

Financial stress can strain relationships and create anxiety about the future. This stress is common among many clients, who often find balancing these financial goals difficult and stressful. Implementing effective debt repayment strategies while exploring budget-friendly wedding planning options can help alleviate some of this pressure.

In my experience, people often feel torn between paying off their debt and saving for their wedding. Without the right strategies, it can seem impossible to achieve both goals. However, with frugal wedding ideas and wedding savings tips, couples can work towards balancing debt and wedding expenses more effectively.

Overcoming the challenge of saving for a wedding with debt requires a few key steps. Here are the main areas to focus on to make progress while balancing debt and wedding expenses.

- Create a detailed budget for debt and wedding: Track income and expenses to allocate funds effectively for both debt repayment strategies and wedding savings tips.

- Use the debt avalanche method for repayment: Prioritize high-interest debts to save on interest payments, an essential part of financial planning for couples.

- Open high-yield savings accounts for wedding expenses: Maximize savings with high-interest accounts to support budget-friendly wedding planning.

- Pick up a side job for extra debt/wedding funds: Boost income by finding additional work to help with saving for a wedding with debt.

Let’s dive in to explore these frugal wedding ideas!

1: Create a detailed budget for debt and wedding

Creating a detailed budget is crucial for saving for a wedding with debt and managing both debt repayment and wedding savings effectively.

Actionable Steps:

- List all sources of income and monthly expenses.

- Utilize a budgeting tool or wedding budget calculator to track every dollar.

- Categorize expenses into essentials and non-essentials.

- Identify areas where you can cut back, like dining out or subscription services, to support wedding savings tips.

- Allocate a specific amount each month for debt repayment strategies and wedding savings.

- Set realistic targets for both goals, ensuring you don’t neglect either when balancing debt and wedding expenses.

Explanation:

Establishing a detailed budget helps you visualize your financial situation and make informed decisions about budget-friendly wedding planning. By tracking income and expenses, you can identify wasteful spending and allocate funds more efficiently for saving for a wedding with debt.

This approach supports both debt repayment and wedding savings goals. For more frugal wedding ideas, check out The Knot’s guide on how to pay for a wedding.

Key benefits of creating a detailed budget include:

- Improved financial awareness for couples

- Better control over spending habits

- Increased likelihood of achieving financial planning for couples goals

These steps ensure that you stay on track with both debt and wedding savings, leading to financial stability and peace of mind while exploring low-cost wedding alternatives.

2: Use the debt avalanche method for repayment

Using the debt avalanche method is crucial to efficiently pay off your high-interest debts and free up money for saving for your wedding with debt.

Actionable Steps:

- List all debts from highest to lowest interest rates.

- Focus on paying off high-interest debts first to save on interest payments and accelerate your wedding savings.

- Make minimum payments on all debts except the highest interest one.

- Direct any extra funds towards the highest interest debt as part of your debt repayment strategies.

- Once the highest interest debt is paid off, move to the next one.

- Continue this process until all debts are cleared, allowing you to focus on frugal wedding ideas.

Explanation:

This method saves you money on interest payments, accelerating your debt repayment. By focusing on high-interest debts, you’ll reduce the total interest paid over time, which is essential when balancing debt and wedding expenses.

For more detailed advice, check out Budget’s Made Easy for strategies on conquering student loan debt.

Implementing the debt avalanche method helps you become debt-free faster, allowing you to focus on saving for your wedding with debt and future financial planning for couples.

3: Open high-yield savings for wedding expenses

Opening high-yield savings accounts can help maximize your wedding savings with minimal effort, even when saving for a wedding with debt.

Actionable Steps:

- Research and compare high-yield savings accounts for budget-friendly wedding planning.

- Choose accounts with no fees and the highest interest rates.

- Open separate savings accounts for different wedding expenses.

- Allocate funds for categories like venue, attire, and catering to aid in financial planning for couples.

- Set up automatic transfers from your checking account to your savings accounts.

- Ensure consistent contributions to your wedding fund while balancing debt and wedding expenses.

Explanation:

These steps ensure your money works harder for you, growing faster with higher interest rates. By segregating funds, you’ll stay organized and on track with your wedding budget calculator.

For more guidance, check out FinanceBuzz’s tips on saving for a wedding.

Advantages of high-yield savings accounts for wedding expenses:

- Higher interest rates than traditional savings accounts

- Easy tracking of savings progress for frugal wedding ideas

- Reduced temptation to spend savings on non-wedding expenses, supporting debt repayment strategies

This approach helps you achieve financial stability and peace of mind for your big day, whether you’re considering affordable wedding venues or low-cost wedding alternatives.

4: Pick up a side job for extra debt/wedding funds

Taking on a side job can provide the additional income needed to balance debt repayment and wedding savings when saving for a wedding with debt.

Actionable Steps:

- Explore gig economy jobs that fit your schedule and skills.

- Consider freelancing, ride-sharing, or online tasks that you can do in your spare time to boost your wedding savings.

- Allocate earnings from the side job specifically for debt repayment or wedding savings.

- Keep this income separate from your primary funds to stay focused on your financial planning for couples goals.

- Utilize your network to find side gigs.

- Ask friends, family, and colleagues if they know about any opportunities for balancing debt and wedding expenses.

Explanation:

These steps are essential to boost your income and allocate funds efficiently towards your financial goals. By taking on a side job, you can accelerate debt repayment strategies and save more for your budget-friendly wedding planning.

This approach not only helps achieve financial stability but also reduces stress related to financial planning. For more tips on managing finances, visit FinanceBuzz’s guide.

Popular side jobs to consider for extra income when saving for a wedding with debt:

- Freelance writing or graphic design

- Virtual assistance or tutoring

- Food delivery or ride-sharing services

This method will help you achieve your financial goals faster, allowing you to enjoy your wedding without the burden of debt while implementing frugal wedding ideas.

Partner with Alleo on Your Financial Journey

We’ve explored balancing debt and wedding savings, and the steps to achieve it. But did you know you can work directly with Alleo to make this journey easier and faster when saving for a wedding with debt?

Setting up an Alleo account is simple. Start with a free 14-day trial, no credit card needed. It’s a great way to kickstart your budget-friendly wedding planning.

Alleo provides personalized coaching sessions tailored to your financial goals. The AI coach helps create a budget, track expenses, and prioritize debt repayment strategies while offering wedding savings tips.

Alleo follows up on your progress and keeps you accountable with notifications, ensuring you stay on track with balancing debt and wedding expenses.

Ready to get started for free? Let’s dive in and explore frugal wedding ideas together!

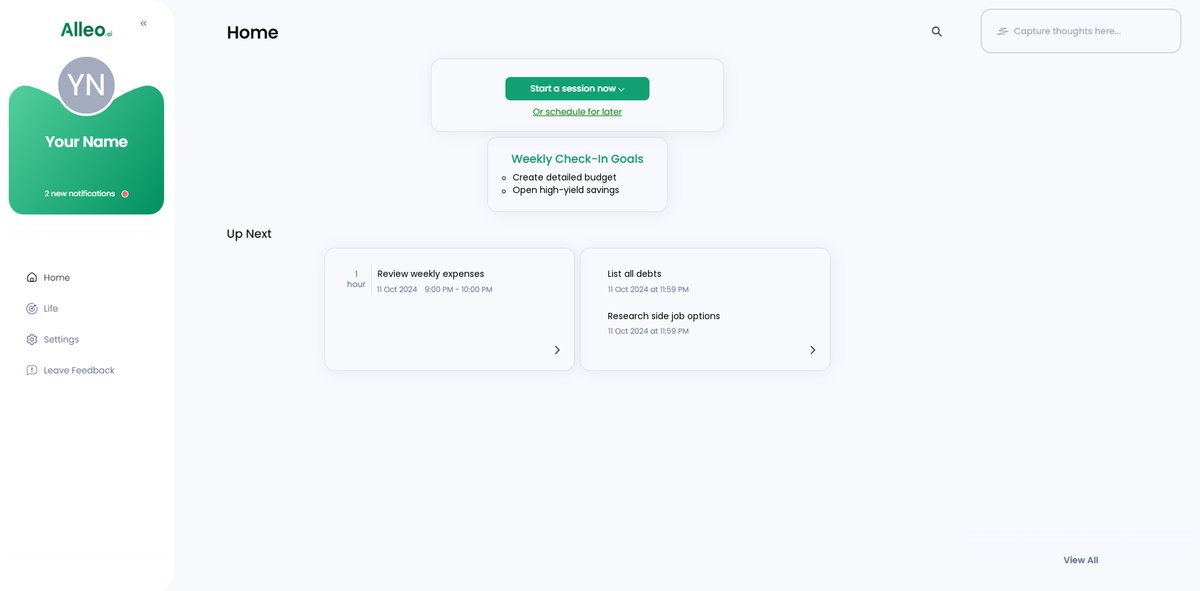

Step 1: Logging in or Creating an Account

To start your journey towards balancing debt repayment and wedding savings, Log in to your existing Alleo account or create a new one to access personalized financial coaching and budgeting tools.

Step 2: Choose Your Financial Focus

Select “Setting and achieving personal or professional goals” to start tackling your debt repayment and wedding savings challenges, allowing Alleo to provide tailored strategies for balancing these important financial objectives.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to receive tailored guidance on balancing debt repayment and wedding savings, helping you achieve your financial goals more effectively.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your debt repayment and wedding savings goals to create a personalized financial plan tailored to your needs.

Step 5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to view and manage the financial goals you discussed, helping you stay on track with balancing debt repayment and wedding savings.

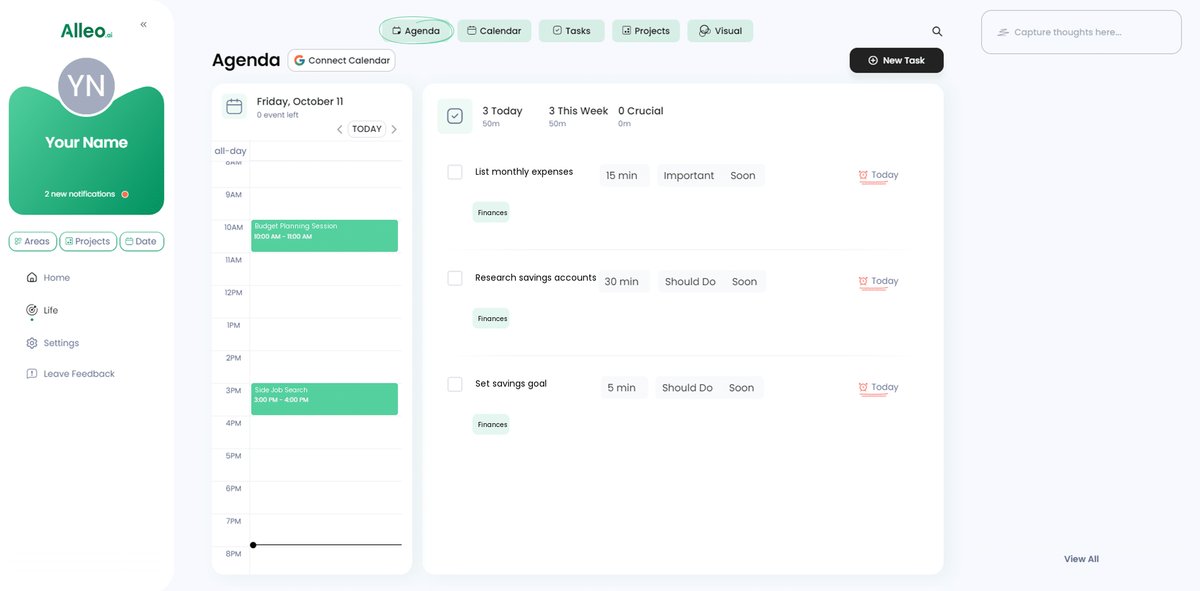

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to track your progress on debt repayment and wedding savings goals, allowing you to easily add important dates like bill due dates, savings milestones, and wedding planning deadlines to stay organized and motivated throughout your financial journey.

Achieving Your Dream Wedding While Managing Debt

Balancing debt repayment and wedding savings is challenging, but you can do it while saving for a wedding with debt.

By creating a detailed budget, using the debt avalanche method, opening high-yield savings accounts, and picking up a side job, you can make significant progress in your financial planning for couples.

Remember, small steps lead to big changes in budget-friendly wedding planning.

I’ve seen many clients succeed with these debt repayment strategies.

You can too, even when balancing debt and wedding expenses.

Managing finances doesn’t have to be overwhelming when saving for a wedding with debt.

With determination and the right tools, achieving your financial goals is possible, including frugal wedding ideas.

Don’t forget, Alleo is here to help with wedding savings tips.

Take control of your financial journey today.

Sign up for a free trial with Alleo and start planning your debt-free dream wedding using our wedding budget calculator.