6 Essential Strategies for Recent Graduates to Manage Student Loan Payments on a Tight Budget

Are you struggling to balance your entry-level salary with mounting student loan payments? Managing student loans after graduation can be a daunting task.

As a life coach, I’ve guided many recent graduates through these exact challenges. Navigating student loan repayments on a limited income can feel overwhelming, but there are effective student loan repayment strategies available.

In this article, you’ll discover actionable steps to manage your student loan repayments effectively. We’ll cover budgeting tools for new professionals, income-driven repayment plans, automatic payments, student loan forgiveness programs, and more.

Ready to take control of your financial planning as a recent graduate? Let’s dive into budget-friendly debt management techniques.

The Financial Struggles of Recent Graduates

Many recent graduates face a daunting reality: balancing entry-level salaries with significant student loan payments. This challenge often leads to financial strain and stress as they navigate their new financial responsibilities and learn about managing student loans after graduation.

Several clients report struggling to make ends meet while managing their monthly loan payments. They often face difficult choices between paying off debt and covering essential living expenses, highlighting the need for effective student loan repayment strategies.

In my experience, the pain of mismanaging student loans can be severe, leading to default and long-term financial instability. This can have serious consequences, including damaged credit scores and legal actions, emphasizing the importance of budget-friendly debt management.

Graduates frequently find themselves overwhelmed by the sheer volume of their debt. They need to understand the importance of effective loan management to avoid falling into financial pitfalls, such as exploring income-driven repayment plans or loan consolidation for new grads.

Through proper planning and resource utilization, it’s possible to manage these financial challenges effectively. Let’s explore practical steps to make this journey smoother, including financial planning for recent graduates and minimizing expenses while repaying loans.

Key Steps to Managing Student Loan Payments on a Tight Budget

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in managing student loans after graduation:

- Create a detailed budget and track expenses: List and categorize all income and expenses for budget-friendly debt management.

- Enroll in income-driven repayment plans: Research and apply for suitable IDR plans to align with your entry-level salary and loan payments.

- Set up automatic payments for interest reduction: Contact your loan servicer to set up autopay as part of your student loan repayment strategies.

- Explore loan forgiveness or assistance programs: Check eligibility and apply for student loan forgiveness programs.

- Build an emergency fund for financial stability: Set savings goals and automate transfers as part of your financial planning for recent graduates.

- Consider temporary frugal living arrangements: Live with family or cut non-essential expenses, minimizing expenses while repaying loans.

Let’s dive in!

1: Create a detailed budget and track expenses

Creating a detailed budget and tracking expenses is crucial for managing student loans after graduation, especially when on a tight budget.

Actionable Steps:

- List all monthly income and expenses: Use a budgeting tool for new professionals to record every income source and expense. Review monthly bank statements to ensure all expenses are accounted for when managing student loans after graduation.

- Categorize and prioritize your spending: Identify essential expenses (e.g., rent, utilities, groceries) versus non-essential (e.g., dining out, subscriptions). Allocate a specific amount to each category based on priority, focusing on budget-friendly debt management.

- Adjust your budget regularly: Set a weekly or bi-weekly reminder to review and adjust the budget. Use insights from previous months to make informed adjustments in your student loan repayment strategies.

Explanation: Establishing a clear budget helps you understand where your money goes and allows you to make necessary adjustments. By categorizing and prioritizing spending, you can ensure that essential expenses are covered while minimizing expenses while repaying loans.

Regularly adjusting your budget ensures that it remains relevant and effective. According to Investopedia, tracking expenses is fundamental to financial stability and effective debt management, especially when managing student loans after graduation.

Key benefits of budgeting include:

- Improved financial awareness

- Better control over spending habits

- Increased ability to meet financial goals, including managing student loans after graduation

By sticking to a well-organized budget, you can create a solid foundation for managing your student loans. Next, we’ll explore how to enroll in income-driven repayment plans to further ease your financial burden.

2: Enroll in income-driven repayment plans

Enrolling in income-driven repayment plans can significantly reduce your monthly student loan payments based on your income and family size, making managing student loans after graduation more achievable.

Actionable Steps:

- Research available IDR plans: Compare plans like REPAYE, PAYE, and IBR to find the best fit for your situation. Use online calculators to estimate potential monthly payments, which is crucial for budget-friendly debt management.

- Apply for an IDR plan: Gather necessary documents such as proof of income and tax returns. Submit your application through the Federal Student Aid website or your loan servicer. This is an essential student loan repayment strategy for recent graduates.

- Monitor your plan annually: Re-certify your income each year to ensure your payments remain accurate. Stay informed about any changes or updates to income-driven repayment plans, especially as your entry-level salary may change.

Explanation: Enrolling in an income-driven repayment plan can make your student loan payments more manageable by aligning them with your current financial situation. This approach can help prevent default and financial instability while managing student loans after graduation.

According to Mass.gov, many borrowers find significant relief through these plans, with some even qualifying for $0 monthly payments. Consistently monitoring and adjusting your plan ensures it continues to meet your needs as part of your overall financial planning for recent graduates.

Transitioning to the next step, let’s explore how setting up automatic payments can help reduce your interest rates and streamline the repayment process, further aiding in managing student loans after graduation.

3: Set up automatic payments for interest reduction

Setting up automatic payments can significantly reduce your interest rates and streamline your student loan repayment process, which is crucial when managing student loans after graduation.

Actionable Steps:

- Contact your loan servicer: Inquire about setting up automatic payments and confirm any available interest rate discounts for your student loan repayment strategy.

- Set up autopay: Link your bank account to your loan account for seamless transactions. Ensure there are sufficient funds to avoid overdraft fees, which is essential for budget-friendly debt management.

- Monitor your account: Regularly check your account to confirm payments are processed correctly and adjust your budget if necessary, especially when balancing entry-level salary and loan payments.

Explanation: Enrolling in automatic payments can help you stay on top of your student loan repayments by reducing your interest rates and ensuring timely payments, which is a key aspect of managing student loans after graduation.

According to Investopedia, federal student loan borrowers may receive a 0.25% interest rate reduction for setting up automatic payments. This small reduction can add up over time, making a noticeable difference in your overall repayment strategy and financial planning for recent graduates.

Taking these steps can help you manage your loans more effectively and reduce financial stress. Now, let’s explore loan forgiveness or assistance programs that can further ease your financial burden while managing student loans after graduation.

4: Explore loan forgiveness or assistance programs

Exploring loan forgiveness or assistance programs can significantly reduce your student loan burden and provide financial relief when managing student loans after graduation.

Actionable Steps:

- Research eligibility for forgiveness programs: Investigate programs like Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness. Check requirements such as employment in qualifying public service jobs as part of your student loan repayment strategies.

- Apply for assistance programs: Gather necessary documentation and complete the application process. Follow up with your loan servicer to ensure all paperwork is submitted correctly, which is crucial for budget-friendly debt management.

- Attend informational workshops or webinars: Participate in sessions hosted by organizations or your alma mater for detailed guidance on managing student loans after graduation. Network with others in similar situations to share tips and resources on financial planning for recent graduates.

Explanation: Taking advantage of loan forgiveness or assistance programs can alleviate a significant portion of your student loan debt. These programs often require specific employment or service commitments but can lead to substantial financial benefits, especially when dealing with entry-level salary and loan payments.

According to NFCC, understanding and utilizing these programs can help you achieve long-term financial stability.

Common types of loan forgiveness programs:

- Public Service Loan Forgiveness (PSLF)

- Teacher Loan Forgiveness

- Income-Driven Repayment Forgiveness

Exploring these options can provide valuable support in your journey to manage student loan payments effectively while minimizing expenses while repaying loans.

Now, let’s consider building an emergency fund for added financial security.

5: Build an emergency fund for financial stability

Building an emergency fund is essential for maintaining financial stability while managing student loans after graduation.

Actionable Steps:

- Set a savings goal: Aim to save at least three to six months’ worth of living expenses. Break this goal down into smaller, manageable monthly savings targets, which is crucial for budget-friendly debt management.

- Automate your savings: Set up automatic transfers from your checking to your savings account. Start with a small amount and gradually increase as your budget allows, especially important when balancing an entry-level salary and loan payments.

- Open a separate savings account: Keep your emergency fund separate from your regular checking account to avoid temptation. Consider a high-yield savings account to earn more interest on your savings, aiding in your student loan repayment strategies.

Explanation: Establishing an emergency fund ensures you have a financial cushion for unexpected expenses, reducing reliance on credit.

This approach aligns with long-term financial stability and effective debt management. According to Investopedia, having an emergency fund is a crucial step toward financial independence.

Taking these steps will provide you with a safety net, making it easier to manage your student loans and avoid financial pitfalls.

Next, let’s consider temporary frugal living arrangements.

6: Consider temporary frugal living arrangements

For recent graduates, temporary frugal living arrangements can significantly ease the burden of student loan payments and contribute to managing student loans after graduation effectively.

Actionable Steps:

- Live with family or roommates: Reduce housing costs by moving in with family or sharing rent with roommates. Use the savings from reduced rent to pay off student loans or build your emergency fund. This approach aligns with budget-friendly debt management strategies.

- Cut down on non-essential expenses: Identify and eliminate subscriptions or memberships you can live without. Opt for budget-friendly alternatives for entertainment and dining, which is crucial for minimizing expenses while repaying loans.

Explanation: Temporary frugal living arrangements can free up funds to manage student loans after graduation more effectively. This approach helps reduce financial strain and allows you to focus on debt repayment, especially when dealing with an entry-level salary and loan payments.

According to Bankrate, cutting non-essential expenses is a practical way to optimize money management.

Smart ways to save money while living frugally:

- Cook meals at home instead of eating out

- Use public transportation or carpool

- Take advantage of free local events and activities

Taking these steps can create a more manageable financial environment, allowing you to focus on long-term stability and effective student loan repayment strategies.

Partner with Alleo on Your Financial Journey

We’ve explored the challenges of managing student loans after graduation on a tight budget. Imagine having tailored support to make this journey smoother.

With Alleo, you get just that.

Alleo offers personalized coaching sessions for student loan repayment strategies, just like a human coach. You’ll start with a free 14-day trial, no credit card required.

Create your account and set up a personalized plan for budget-friendly debt management. The Alleo AI coach will help you create and stick to a budget, enroll in income-driven repayment plans, and more.

Your coach will follow up on your progress and handle changes, assisting with financial planning for recent graduates. You’ll stay accountable through text and push notifications.

Ready to get started for free and explore student loan forgiveness programs?

Let me show you how!

Step 1: Log In or Create Your Account

To begin your journey towards managing student loan payments effectively, log in to your existing Alleo account or create a new one to access personalized AI coaching tailored to your financial situation.

Step 2: Choose Your Focus – Building Better Habits and Routines

Click on “Building better habits and routines” to start tackling your student loan management challenges head-on. By focusing on this goal, you’ll develop consistent practices for budgeting, tracking expenses, and making timely loan payments, setting a strong foundation for your financial future.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to receive tailored guidance on managing your student loans, creating a budget, and improving your overall financial health, directly addressing the challenges discussed in the article.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your student loan challenges and create a personalized plan to manage your repayments effectively.

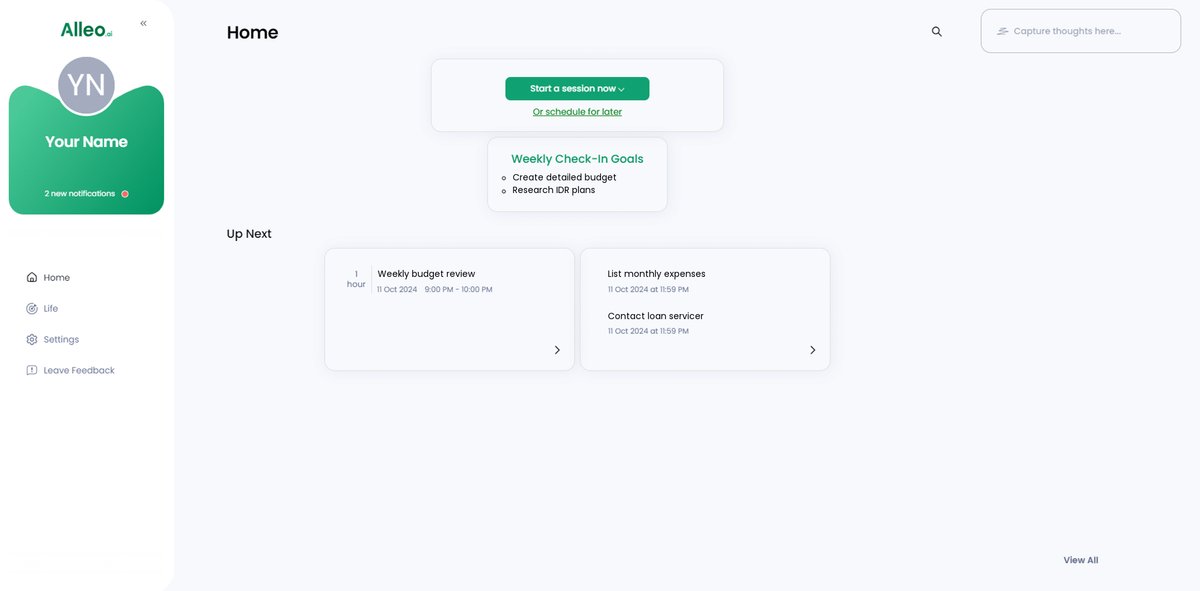

Step 5: Viewing and managing goals after the session

After your coaching session on managing student loans, check the Alleo app’s home page to view and track the financial goals you discussed, such as creating a budget or exploring loan forgiveness programs.

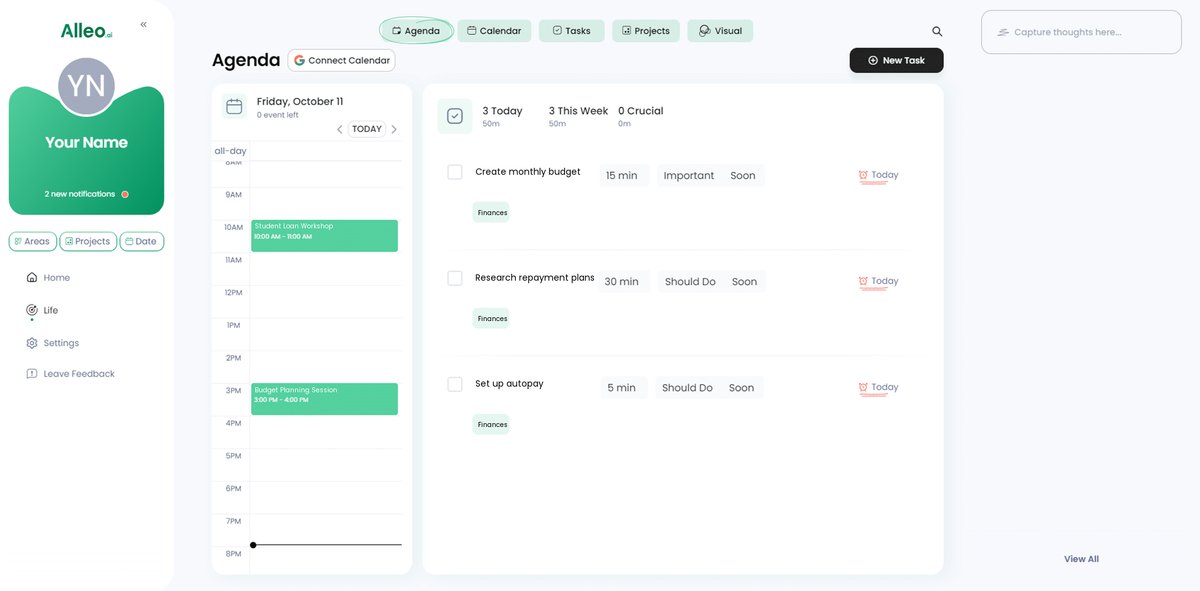

Step 6: Adding events to your calendar or app

Use the Alleo app’s calendar and task features to schedule reminders for loan payments, budget reviews, and savings goals, helping you track your progress in managing student loans and improving your financial stability.

Wrapping Up: Your Path to Financial Freedom

Managing student loans after graduation on a tight budget can be challenging, but it’s not impossible. By creating a detailed budget, enrolling in income-driven repayment plans, and setting up automatic payments, you can regain control over your finances and implement effective student loan repayment strategies.

Remember, building an emergency fund and exploring student loan forgiveness programs can provide the safety net you need. Temporary frugal living arrangements can also ease your financial burden and help with budget-friendly debt management.

I understand the difficulties you face as a recent graduate. Taking these steps will put you on the path to financial stability and aid in minimizing expenses while repaying loans.

Don’t forget, Alleo is here to support you every step of the way in managing student loans after graduation. Sign up for a free trial and see how personalized coaching can make a difference in your financial planning as a recent graduate.

Let’s tackle this journey together and explore effective strategies for loan repayment on an entry-level salary.