How to Find Reliable Housing Market Data: A Comprehensive Guide for First-Time Home Buyers

Are you struggling to find reliable housing market data sources for your first-time home buyers?

As a life coach, I’ve helped many professionals navigate these challenges. In my experience helping clients in the real estate industry, I often encounter the same frustrations with accessing accurate housing market reports and real estate data sources.

In this article, you’ll discover proven strategies to access accurate market data. We’ll explore trusted sources and tools to help you make informed decisions, including neighborhood price comparisons and property value assessment tools. You’ll learn about housing affordability indexes, mortgage rate forecasts, and real estate market trends essential for first-time home buyer statistics.

Let’s dive into reliable housing market data sources and the home buying process guide.

The Struggle for Reliable Housing Market Data

Finding unbiased and reliable housing market data sources is a major hurdle for real estate agents and first-time home buyers. Aggressive marketing tactics often distort the true picture, making it hard to discern fact from fiction in real estate market trends.

Many clients initially struggle with the sheer volume of conflicting data. They find themselves bombarded with deceptive advertisements and skewed reports, including inaccurate first-time home buyer statistics and unreliable housing affordability index figures.

These tactics can lead to poor decision-making and misunderstanding of market trends, especially when it comes to interpreting mortgage rate forecasts and neighborhood price comparisons.

In my experience, people often fall into common pitfalls. They rely on unreliable sources instead of trustworthy property value assessment tools, leading to costly mistakes in their home-buying journey.

The frustration is real. And it’s time we tackle it head-on by promoting access to reliable housing market data sources and comprehensive local housing market reports.

Strategic Steps to Reliable Housing Market Data

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in obtaining reliable housing market data sources.

- Consult NAR’s Research and Statistics Reports: Access detailed reports on real estate market trends and first-time home buyer statistics.

- Use FHFA’s Uniform Appraisal Dataset: Analyze standardized appraisal data for accurate neighborhood price comparisons and property value assessments.

- Subscribe to Fannie Mae’s National Housing Survey: Stay updated with consumer confidence, housing affordability index, and mortgage rate forecasts.

- Analyze Local MLS Data Through a Trusted Realtor: Partner with a reliable realtor for the most current local housing market reports and real estate data sources.

Let’s dive into these reliable housing market data sources and explore the home buying process guide!

1: Consult NAR’s research and statistics reports

Accessing the National Association of REALTORS® (NAR) reports can provide invaluable insights into the housing market, serving as one of the most reliable housing market data sources.

Actionable Steps:

- Download the latest “Profile of Home Buyers and Sellers” report: This report offers detailed information on buyer demographics and real estate market trends, including first-time home buyer statistics.

- Attend NAR webinars on market research: Engaging with industry experts during these sessions can deepen your understanding of current trends and housing market prediction models.

- Utilize NAR’s online databases: Access historical and current market data through NAR’s comprehensive databases, including the housing affordability index and local housing market reports.

Key benefits of using NAR’s research:

- Access to comprehensive market data and real estate data sources

- Insights into buyer behavior and preferences

- Reliable forecasts for market trends and mortgage rate forecasts

Explanation: Consulting NAR’s research reports can help you stay informed about market trends and buyer behaviors. These steps ensure you use reputable sources to guide your decisions.

For instance, the Profile of Home Buyers and Sellers report provides critical insights that can shape your strategy, including neighborhood price comparisons and property value assessment tools.

These steps will equip you with reliable housing market data, helping you navigate the housing market confidently and understand the home buying process guide.

2: Use FHFA’s Uniform Appraisal Dataset

The FHFA’s Uniform Appraisal Dataset (UAD) is a valuable tool for accessing standardized appraisal data, crucial for understanding neighborhood trends and serves as one of the reliable housing market data sources.

Actionable Steps:

- Register for the UAD portal: Visit the FHFA website and complete the registration to access the dataset, which provides real estate market trends and property value assessment tools.

- Analyze neighborhood-level data: Examine metrics like property characteristics and price trends to identify market patterns and conduct neighborhood price comparisons.

- Cross-reference with local trends: Compare UAD data with insights from local housing market reports to validate and enhance your understanding of the real estate data sources.

Explanation: Utilizing the UAD allows you to access consistent and detailed appraisal data, which is essential for making informed decisions about the housing market.

This resource provides comprehensive insights into property values and market conditions, helping you stay ahead of trends and access reliable housing market data sources.

For more information, explore the FHFA’s UAD data.

Leveraging the UAD ensures you have a reliable foundation for your real estate analysis and understanding of housing market prediction models.

3: Subscribe to Fannie Mae’s National Housing Survey

Staying updated with consumer confidence and market trends is crucial for real estate professionals and first-time home buyers seeking reliable housing market data sources.

Actionable Steps:

- Subscribe to Fannie Mae’s monthly updates: Visit the Fannie Mae website and sign up for their National Housing Survey updates, a valuable real estate data source.

- Monitor the Home Purchase Sentiment Index (HPSI): Use the HPSI to gauge consumer attitudes towards buying and selling homes, providing insights into real estate market trends.

- Participate in webinars: Attend Fannie Mae’s webinars to engage in discussions on housing market conditions and trends, including mortgage rate forecasts.

Key insights from the National Housing Survey:

- Consumer sentiment on home buying

- Expectations for mortgage rates

- Perceptions of housing affordability

Explanation: Utilizing Fannie Mae’s National Housing Survey provides valuable insights into consumer sentiment, which can influence market trends and serve as one of the reliable housing market data sources.

Regular updates and participation in webinars allow you to stay informed and network with industry peers, enhancing your understanding of housing market prediction models.

For more details, check out the National Housing Survey.

This approach ensures you have a comprehensive understanding of market conditions and consumer confidence, essential for analyzing first-time home buyer statistics and local housing market reports.

4: Analyze local MLS data through a trusted realtor

Accessing local MLS data through a trusted realtor is crucial for staying updated on market changes and making informed decisions. This is one of the most reliable housing market data sources available to buyers.

Actionable Steps:

- Partner with a reputable local realtor: Choose a realtor with a strong track record and positive client reviews who can provide access to real estate market trends.

- Regularly review MLS updates: Monitor key metrics such as days on market, list-to-sale price ratios, and new listings to understand current real estate data sources.

- Attend local real estate forums: Engage in roundtables and discussions hosted by realtors to gain community insights and learn about local housing market reports.

Essential MLS data points to track:

- Average sales price in your target area, which contributes to the housing affordability index

- Inventory levels and turnover rates, crucial for first-time home buyer statistics

- Seasonal market fluctuations, which can impact neighborhood price comparisons

Explanation: Partnering with a trusted realtor ensures access to the most accurate and current market data, including mortgage rate forecasts.

Regularly reviewing MLS updates helps you stay informed about local trends. Engaging in real estate forums offers valuable community insights and can provide information on property value assessment tools.

For more insights on effective market data analysis, refer to the How to Buy a Home podcast.

These steps provide a comprehensive approach to understanding the housing market better, aiding in the home buying process guide.

Partner with Alleo for Reliable Market Data

We’ve explored the challenges of finding reliable housing market data sources. But did you know you can work directly with Alleo to make this journey easier for first-time home buyers?

Alleo offers affordable, tailored coaching support to overcome these specific challenges in navigating real estate market trends. Set up an account and create a personalized plan to access local housing market reports.

Work with Alleo’s coach to access accurate market data and property value assessment tools. The coach will follow up on your progress and handle changes in housing affordability index and mortgage rate forecasts.

Stay accountable with text and push notifications as you explore neighborhood price comparisons and real estate data sources.

Ready to get started for free? Let me show you how to use our home buying process guide and housing market prediction models!

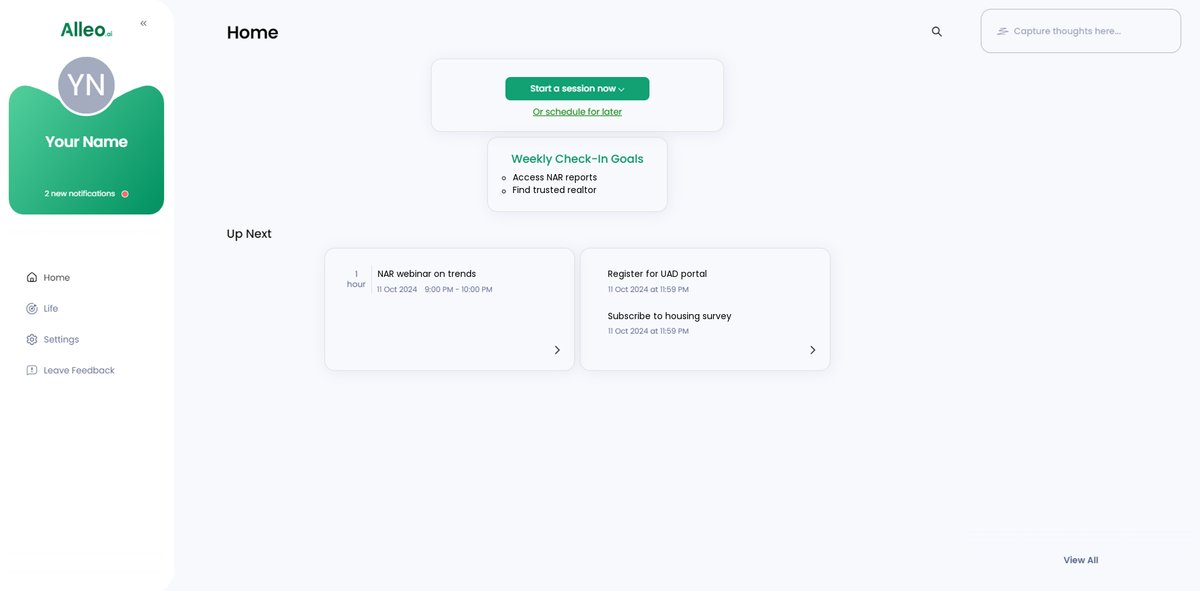

Step 1: Log In or Create Your Alleo Account

To start accessing reliable housing market data with personalized coaching support, log in to your Alleo account or create a new one if you haven’t already.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to establish consistent practices for accessing and analyzing reliable housing market data, helping you make informed decisions and stay ahead in the real estate industry.

Step 3: Select “Finances” as Your Focus Area

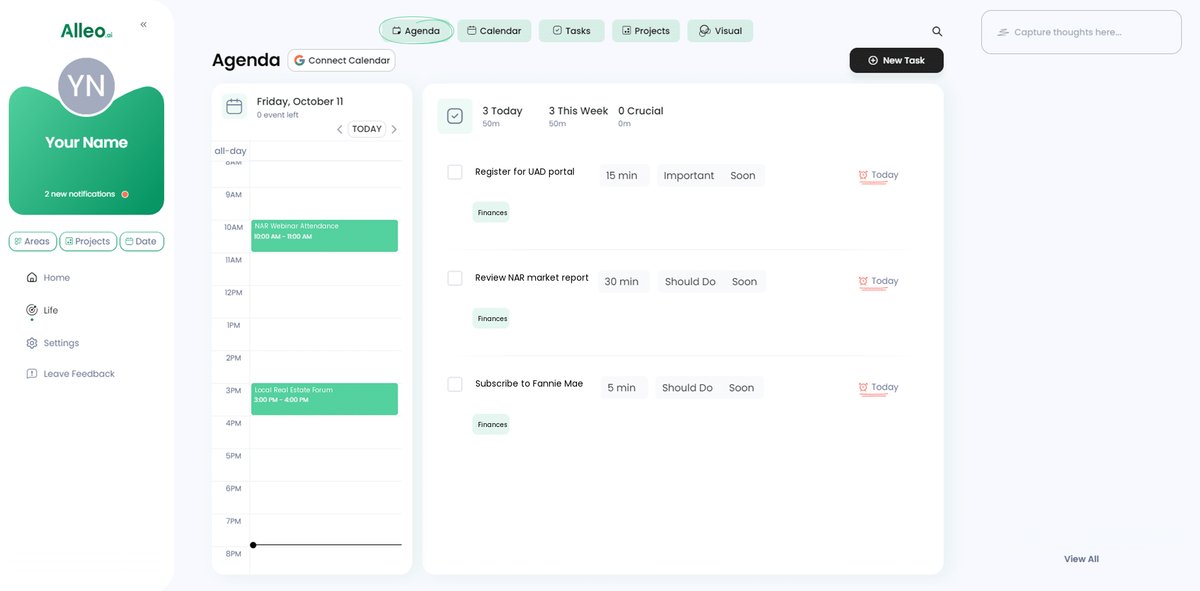

Choose “Finances” as your focus area to gain expert guidance on navigating the housing market, accessing reliable data sources, and making informed financial decisions for your real estate investments or home purchase.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session to create a personalized plan for accessing reliable housing market data and making informed real estate decisions.

Step 5: Viewing and Managing Goals After the Session

After your coaching session on finding reliable housing market data, check the Alleo app’s home page to view and manage the goals you discussed, allowing you to track your progress in accessing accurate real estate information.

Step 6: Adding events to your calendar or app

To track your progress in finding reliable housing market data, use the calendar and task features in the Alleo app to schedule key activities like reviewing NAR reports, analyzing FHFA data, and meeting with your trusted realtor.

Wrapping Up: Your Path to Reliable Market Data

To sum up, finding reliable housing market data sources is challenging but essential. You’ve seen how to navigate this maze with trusted real estate data sources.

Empathizing with your frustrations, I encourage you to take proactive steps. You can overcome deceptive marketing tactics and make informed decisions using housing market prediction models.

Remember, consulting NAR reports, FHFA’s UAD, Fannie Mae’s surveys, and local housing market reports are key strategies for accessing reliable housing market data sources.

But you don’t have to do it alone.

With Alleo, you’ll have a partner to guide you through this process. Set up your free account today and take the first step toward accurate market insights and neighborhood price comparisons.