Revolutionize Your Freelance Cash Flow: Beyond Traditional Budgeting

Are you struggling to manage your cash flow as a freelancer? Freelancer cash flow management can be challenging for many self-employed professionals.

As a life coach, I’ve helped many freelancers navigate the challenges of irregular income. I’ve seen firsthand how traditional budgeting can fall short for those with variable income streams, especially when it comes to freelance income management.

In this article, you’ll discover strategies like flexible budgeting, using AI-powered tools, and building an emergency fund. These tools will help you achieve financial stability and clarity in your freelance business financial planning. We’ll explore effective freelancer cash flow management techniques and income smoothing for freelancers.

Let’s dive in to explore these self-employed budgeting techniques and irregular cash flow strategies.

Understanding the Challenges of Irregular Income

Freelancers often struggle with traditional budgeting. The irregular nature of freelance income management makes it difficult to predict how much money will come in each month.

This unpredictability can lead to stress and financial instability for those in the gig economy.

In my experience, many clients initially struggle with unexpected expenses. These surprises can derail even the best-laid freelancer cash flow management plans.

Without a steady paycheck, it’s tough to maintain a consistent budget for self-employed professionals.

Additionally, inconsistent income complicates financial planning and resource allocation. Freelancers must juggle bills, taxes, and savings without knowing their exact monthly earnings, making variable income planning essential.

This lack of financial stability can make it hard to stay on track with freelance business financial planning.

To add to the difficulty, traditional budgeting methods often fail to address these unique challenges. Fixed expense categories and rigid budgets don’t adapt well to a freelancer’s fluctuating income, necessitating irregular cash flow strategies.

As a result, many find themselves overwhelmed and unsure of how to manage their finances effectively.

Freelancers need a more flexible approach to budgeting. This could mean using AI-powered tools, setting aside a cash reserve for independent contractors, or implementing staged payments.

Adapting financial management to suit freelancing can provide much-needed stability and clarity in freelancer cash flow management.

Key Steps to Managing Cash Flow as a Freelancer

Overcoming this challenge requires a few key steps in freelancer cash flow management. Here are the main areas to focus on to make progress with your freelance income management:

- Implement flexible budgeting with income tiers: Adjust your budget monthly based on income tiers, a crucial self-employed budgeting technique.

- Use AI-powered tools for automated categorization: Automate transaction categorization to simplify tracking, essential for expense tracking for self-employed professionals.

- Create a 3-6 month emergency fund cushion: Save for unexpected expenses to ensure stability, building a cash reserve for independent contractors.

- Set up staged payments for stable cash flow: Break project fees into multiple payments for consistency, an effective irregular cash flow strategy.

- Separate personal and business finances clearly: Use separate accounts to manage finances efficiently, a key aspect of freelance business financial planning.

Let’s dive into these freelancer cash flow management strategies!

1: Implement flexible budgeting with income tiers

Implementing flexible budgeting with income tiers helps freelancers manage their variable earnings and improve freelancer cash flow management more effectively.

Actionable Steps:

- Identify income tiers: Use past income data to establish your highest, average, and lowest monthly earnings. Set spending limits and savings goals for each tier, focusing on freelance income management.

- Adjust your budget monthly: Review and revise your budget at the start of each month based on the income tier you fall into. Ensure essential expenses are covered first, a key aspect of variable income planning.

- Track your progress: Use a budgeting app to monitor your spending and make necessary changes to stay within your tier limits, enhancing your freelancer cash flow management.

Explanation:

These steps matter because they allow you to adapt your financial plans to your fluctuating income, reducing stress and ensuring essential expenses are always covered, which is crucial for freelancer financial stability.

By using a structured approach, you can achieve greater financial stability and clarity. For additional tips on managing your freelance finances, check out this resource on self-employed budget tips.

Benefits of flexible budgeting for freelancers:

- Adapts to income fluctuations, addressing irregular cash flow strategies

- Ensures essential expenses are covered, a key aspect of freelancer cash flow management

- Reduces financial stress, contributing to overall freelance business financial planning

Flexible budgeting with income tiers is just the beginning—let’s explore more strategies to help you succeed in freelancer cash flow management.

2: Use AI-powered tools for automated categorization

Automated categorization helps freelancers streamline their financial tracking, making budgeting simpler and more accurate for effective freelancer cash flow management.

Actionable Steps:

- Choose an AI-powered tool: Select a financial management tool with features like expense tracking, freelance income management, and financial reporting for self-employed budgeting techniques.

- Set up automated categorization: Link your bank accounts and credit cards to the tool to categorize transactions automatically, aiding in variable income planning.

- Review and update categories: Check the categorization weekly to correct any errors and adjust as needed, ensuring accurate irregular cash flow strategies.

Explanation:

These steps matter because they reduce manual errors and save time, allowing you to focus on your work. Automated tools also provide real-time financial insights for freelancer financial stability.

For more details on effective financial management, visit Novo’s guide for freelancers.

Using AI-powered tools is a smart way to manage your finances efficiently, supporting cash reserve management for independent contractors and income smoothing for freelancers.

3: Create a 3-6 month emergency fund cushion

Creating a 3-6 month emergency fund cushion is vital for freelancer cash flow management to handle unexpected expenses and maintain financial stability.

Actionable Steps:

- Calculate your average monthly expenses: Include essential expenses like rent, utilities, and groceries. Determine the total amount needed to cover 3-6 months for effective freelance income management.

- Set up a separate savings account: Automate monthly transfers to this account. Start with a manageable amount and increase it gradually, implementing self-employed budgeting techniques.

- Prioritize building your emergency fund: Cut back on non-essential expenses to accelerate savings. Reevaluate your progress quarterly and adjust your savings plan if necessary, focusing on variable income planning.

Explanation:

These steps matter because having an emergency fund provides a safety net during income fluctuations. It ensures that you can cover essential expenses without stress, which is crucial for freelancer financial stability.

For more insights on building a strong financial foundation, visit this resource.

Key benefits of an emergency fund:

- Financial security during lean periods, supporting irregular cash flow strategies

- Stress reduction in unexpected situations

- Ability to focus on work without financial worries, enhancing freelancer cash flow management

Building an emergency fund is crucial for achieving financial stability and effective cash flow management for freelancers.

4: Set up staged payments for stable cash flow

Setting up staged payments can provide freelancers with a consistent income stream, reducing financial stress and improving freelancer cash flow management.

Actionable Steps:

- Implement a staged payment system for projects: Break down your project fees into multiple payments, including an initial deposit, a mid-project payment, and a final payment upon completion. This approach supports effective freelance income management.

- Clearly communicate payment schedules: Include the payment terms in your contracts and send reminders to clients before each due date, which is crucial for variable income planning.

- Use invoicing software: Automate invoice generation and tracking to streamline the payment process and follow up promptly on overdue payments. This is essential for expense tracking for self-employed professionals.

Explanation:

These steps matter because they help ensure a steady cash flow, making it easier to manage expenses and plan for the future. For more insights on managing freelance finances, visit Novo’s guide for freelancers.

Implementing staged payments can provide much-needed financial stability for freelancers and is a key strategy in freelancer cash flow management.

By following these steps, you can maintain a stable cash flow and reduce financial uncertainties, which is crucial for budgeting for gig economy workers and achieving freelance business financial planning goals.

5: Separate personal and business finances clearly

Separating personal and business finances is crucial for effective freelancer cash flow management.

Actionable Steps:

- Open dedicated bank accounts: Use one account for personal expenses and another for freelance income management and business expenses.

- Maintain detailed records: Track all business transactions using accounting software. Keep receipts and invoices organized for tax purposes and expense tracking for self-employed professionals.

- Regularly reconcile accounts: Set aside time monthly to review and reconcile your accounts. Address discrepancies immediately to ensure freelancer financial stability.

Explanation:

These steps matter because they simplify tracking and ensure accuracy in your finances. Clear separation helps with self-employed budgeting techniques, tax preparation, and freelance business financial planning.

For more tips, check out this IRS resource on managing small business finances.

Advantages of separating finances:

- Simplified tax preparation

- Clearer view of business profitability

- Improved financial decision-making for variable income planning

Effectively separating finances can lead to better financial stability and clarity, essential for freelancer cash flow management and irregular cash flow strategies.

Partner with Alleo for Your Freelance Financial Success

We’ve explored the challenges of managing cash flow as a freelancer, the benefits of overcoming these challenges, and the steps to achieve financial stability. But did you know you can work directly with Alleo to make this freelancer cash flow management journey easier and faster?

Step 1: Utilize Alleo to set and achieve financial goals for freelance income management.

- Use Alleo’s goal-setting features to create and track your savings and budgeting goals, essential for self-employed budgeting techniques.

Step 2: Leverage Alleo’s decision-making tools for financial planning and variable income planning.

- Get personalized advice on managing cash flow and budgeting for gig economy workers.

Step 3: Plan your schedule to include time for financial reviews and adjustments, crucial for irregular cash flow strategies.

- Use Alleo to organize your financial tasks and reminders, supporting freelancer financial stability.

Step 4: Build healthy financial habits with Alleo’s habit-building features for effective freelancer cash flow management.

- Set up routines for regular expense tracking for self-employed professionals and savings contributions, aiding in income smoothing for freelancers.

Ready to get started for free with freelance business financial planning?

Let me show you how to build a cash reserve for independent contractors!

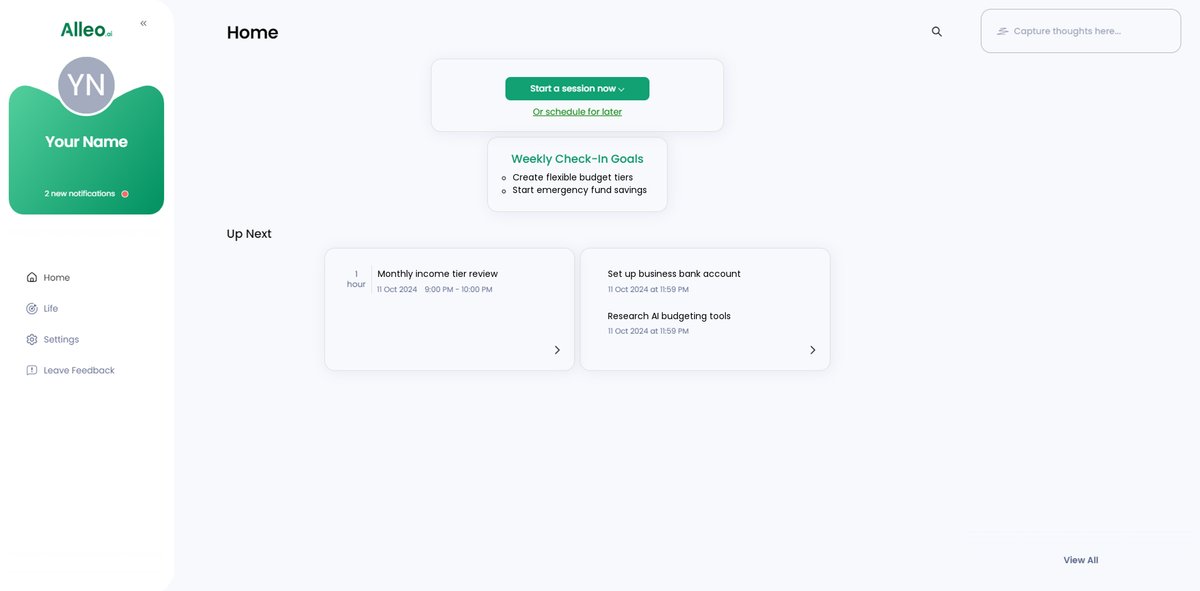

Step 1: Log In or Create Your Account

To start managing your freelance finances with Alleo, Log in to your account or create a new one if you’re a first-time user.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to develop consistent financial practices that will help you manage your irregular income and achieve greater financial stability as a freelancer.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to directly address your freelance cash flow challenges and receive tailored guidance on budgeting, income management, and financial stability strategies.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session to discuss your freelance financial goals and create a personalized plan for managing your cash flow effectively.

Step 5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to view and manage the financial goals you discussed, allowing you to track your progress and make adjustments to your freelance cash flow management strategy as needed.

Step 6: Adding events to your calendar or app

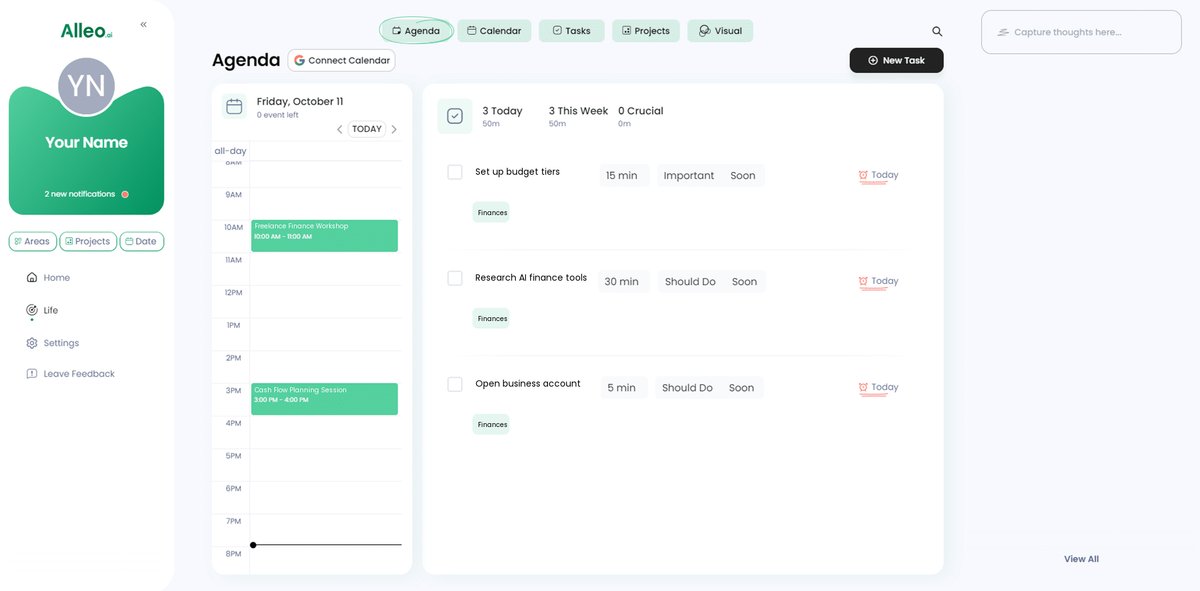

Use Alleo’s calendar and task features to schedule and track your financial review sessions, helping you stay on top of your freelance cash flow management and monitor your progress towards financial stability.

Wrapping Up: Taking Control of Your Freelance Finances

Managing cash flow as a freelancer can be challenging, but it’s not impossible. By implementing flexible budgeting, using AI-powered tools for freelancer cash flow management, and building an emergency fund, you can achieve financial stability for your freelance business.

Remember to separate your personal and business finances and set up staged payments to maintain a steady cash flow. These freelance income management steps will help you adapt to your fluctuating income and stay on track with variable income planning.

I understand the struggles you face with irregular cash flow strategies, and I want to help you succeed. Consider using Alleo to simplify your financial planning and build healthy financial habits for self-employed budgeting techniques.

Together, we can make your freelance journey smoother and improve your freelancer cash flow management. Ready to get started with income smoothing for freelancers?

Try Alleo for free today to enhance your expense tracking for self-employed professionals!