Master Small Business Accounting: The Ultimate Guide for Non-Accountants

Are you struggling to keep your freelance business afloat because of accounting headaches? Mastering freelancer accounting basics is crucial for success.

As a life coach, I’ve helped many freelancers tackle these daunting challenges. In my experience, poor accounting knowledge can derail even the best business plans. Understanding bookkeeping fundamentals for entrepreneurs is essential.

In this guide, you’ll learn basic accounting terms, how to track income and expenses, and the benefits of using simple accounting software for beginners. You’ll also discover how regular financial reviews, including profit and loss statements and balance sheet essentials, can improve your business health.

Let’s dive into the world of freelancer accounting basics.

Understanding the Deep-Seated Challenges in Freelancer Accounting

It’s no secret that many freelancers find themselves overwhelmed by accounting tasks. In my experience, people often struggle to keep their finances organized, leading to stress and confusion when dealing with freelancer accounting basics.

The impact of poor accounting knowledge can be devastating. I’ve seen several clients make critical financial decisions based on inaccurate data, often due to a lack of understanding of bookkeeping fundamentals for entrepreneurs.

This can result in unexpected expenses, missed tax deductions, and even penalties, highlighting the importance of small business tax basics.

Without a solid grasp of accounting, planning for the future becomes nearly impossible. Many freelancers face cash flow issues simply because they don’t understand the basics of financial management and cash flow management tips.

These challenges aren’t just frustrating—they can be business-threatening. But, there’s hope for those looking to master freelancer accounting basics.

Let’s explore practical solutions to these common issues, including the use of accounting software for beginners and understanding financial statements for small businesses.

A Roadmap to Mastering Small Business Accounting for Freelancers

Overcoming accounting challenges requires a few key steps. Here are the main areas to focus on to make progress in freelancer accounting basics:

- Learn basic accounting terms and concepts: Start with bookkeeping fundamentals for entrepreneurs to build your knowledge base.

- Track income and expenses consistently: Keep detailed records to stay organized and informed, implementing expense tracking for small businesses.

- Use simple accounting software for beginners: Simplify tasks and reduce errors with technology, aiding in cash flow management.

- Review financial statements regularly: Analyze your finances, including profit and loss statements and balance sheet essentials, to make informed decisions.

Let’s dive into these freelancer accounting basics!

1: Learn basic accounting terms and concepts

Understanding basic accounting terms and concepts is crucial for freelancers to manage their cash flow effectively. Mastering freelancer accounting basics is essential for financial success.

Actionable Steps:

- Enroll in an online course or workshop on basic accounting for small businesses, covering bookkeeping fundamentals for entrepreneurs.

- Measurable: Complete the course within 4 weeks.

- Read beginner-friendly accounting books such as “Accounting Made Simple” by Mike Piper to learn about financial statements for small businesses.

- Measurable: Read one chapter per week.

- Join online forums or communities focused on small business tax basics and accounting software for beginners.

- Measurable: Participate in discussions and ask questions weekly.

Explanation:

By learning basic accounting terms and freelancer accounting basics, you’ll gain the confidence to make informed financial decisions. Understanding these concepts helps you avoid financial pitfalls and plan for the future.

Resources like “Accounting Made Simple” by Mike Piper can be particularly helpful for beginners. These steps will help you stay organized and reduce stress.

Key accounting concepts for freelancers:

- Cash flow management tips

- Income and expense tracking for small businesses

- Tax deductions

Taking these steps will set a solid foundation for mastering small business accounting, including profit and loss statements explained and balance sheet essentials.

2: Track income and expenses consistently

Tracking income and expenses consistently is critical for freelancers to maintain financial stability and clarity. This is a fundamental aspect of freelancer accounting basics.

Actionable Steps:

- Open a dedicated business bank account separate from personal finances.

- Measurable: Set up the account within the next week.

- Use a spreadsheet or accounting software for beginners to record all business transactions daily.

- Measurable: Update the records every evening.

- Organize all receipts and invoices in a digital or physical folder for effective expense tracking for small businesses.

- Measurable: Review and file receipts and invoices weekly.

Explanation:

Tracking income and expenses ensures you have an accurate picture of your financial health. By separating business and personal finances, you avoid confusion and make tax time easier, which is crucial for small business tax basics.

Using tools like spreadsheets or apps can simplify this process and help you stay organized. Consistent tracking helps avoid common mistakes freelancers make, such as missing deductions or overlooking expenses. This is essential for cash flow management tips and creating accurate profit and loss statements.

For more insights on bookkeeping mistakes, visit this SCORE article.

Taking these steps will make managing your finances less stressful and more efficient, which is crucial for mastering freelancer accounting basics.

3: Use simple accounting software for automation

Using simple accounting software for automation can significantly streamline your financial management processes, which is crucial for mastering freelancer accounting basics.

Actionable Steps:

- Choose and set up user-friendly accounting software for beginners like QuickBooks or Freshbooks within the first week.

- Automate invoicing and expense tracking for small businesses by setting up recurring transaction rules within two weeks.

- Regularly use the software’s reporting features to monitor your financial health, reviewing profit and loss statements and balance sheet essentials monthly.

Explanation:

Automation reduces the risk of human error and saves you time, allowing you to focus on growing your business. Tools like QuickBooks and Freshbooks offer features that automate repetitive tasks and provide real-time financial insights, essential for cash flow management tips and small business tax basics.

For more on the benefits of accounting software, visit this article from Business.com. Implementing these steps will help you maintain accurate records and make informed decisions based on financial ratios for business owners.

Benefits of accounting software for freelancers:

- Time-saving automation

- Accurate financial reporting

- Simplified tax preparation

Taking these steps will ensure that your financial management becomes more efficient and less stressful, helping you master bookkeeping fundamentals for entrepreneurs.

4: Review financial statements regularly

Regularly reviewing financial statements is crucial for freelancers to maintain a clear understanding of their business’s financial health. This practice is a key part of freelancer accounting basics.

Actionable Steps:

- Schedule monthly reviews of your balance sheet, income statement, and cash flow statement.

- Measurable: Block out one hour at the end of each month for review.

- Compare monthly financial statements to identify trends and areas for improvement.

- Measurable: Document findings and action steps in a financial journal.

- Consult with a professional accountant or financial advisor quarterly.

- Measurable: Set up and attend quarterly meetings.

Explanation:

Reviewing financial statements helps you make informed decisions and spot potential issues early. By comparing statements monthly, you can identify trends and opportunities for improvement. This is essential for mastering bookkeeping fundamentals for entrepreneurs.

Consulting with a professional ensures accuracy and offers expert insights. For more tips on financial statements for small businesses, visit this article from Business.com.

Key financial statements for freelancers:

- Income Statement (also known as Profit and Loss statements)

- Balance Sheet

- Cash Flow Statement

These steps will help you stay on top of your finances and make better business decisions, which are crucial aspects of freelancer accounting basics.

Work with Alleo to Master Small Business Accounting

We’ve explored the challenges of managing freelance finances and the steps to overcome them, including freelancer accounting basics. But did you know Alleo can make this journey easier for entrepreneurs learning bookkeeping fundamentals?

Set up an Alleo account for personalized coaching on financial statements for small businesses. Create a tailored plan and start working with Alleo’s AI coach to master cash flow management tips.

The coach will track your progress and keep you accountable, helping you understand small business tax basics.

Receive reminders to update your records and review financials, including profit and loss statements. Alleo’s coach will follow up via text and push notifications, assisting with balance sheet essentials.

Stay on top of your finances effortlessly, mastering invoicing best practices and expense tracking for small businesses.

Ready to get started for free and learn about financial ratios for business owners? Let me show you how!

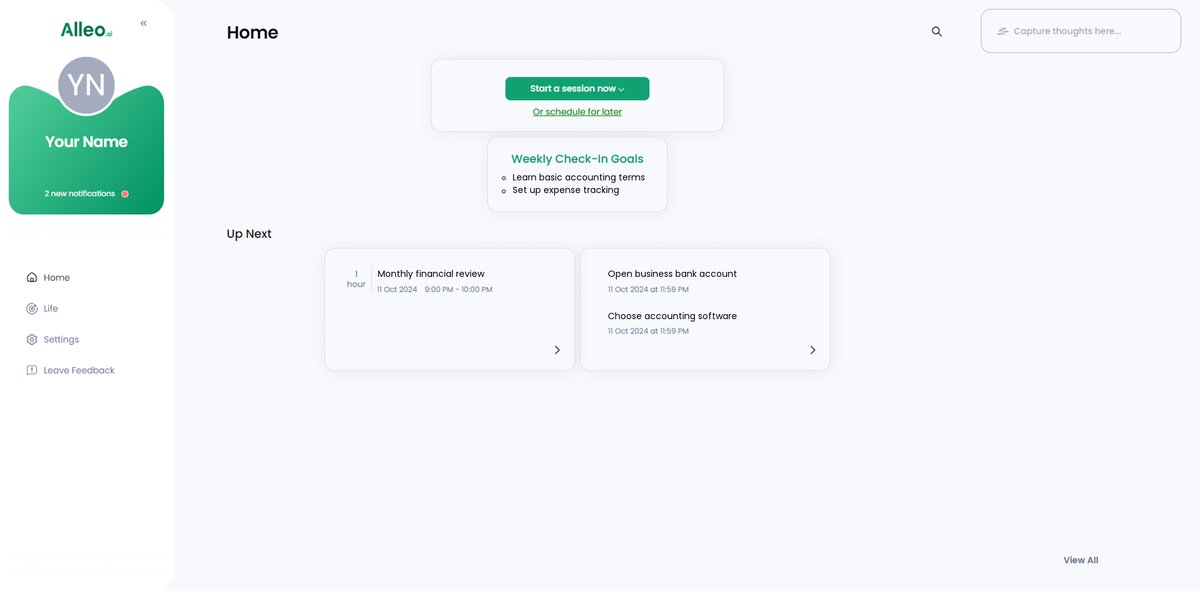

Step 1: Log In or Create Your Account

To begin mastering your freelance accounting with AI guidance, log in to your existing Alleo account or create a new one in just a few clicks.

Step 2: Choose Your Focus – Building Better Habits and Routines

Click on “Building better habits and routines” to start improving your accounting practices. This goal directly addresses the challenges outlined in the article, helping you develop consistent financial tracking habits that are crucial for freelance success.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to address your freelance accounting challenges head-on. By selecting this life area, you’ll receive tailored guidance and support to help you master small business accounting, track expenses more effectively, and make informed financial decisions for your freelance career.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an initial intake session, where you’ll discuss your freelance accounting challenges and set up a personalized plan to improve your financial management skills.

Step 5: Viewing and Managing Goals After the Session

After your coaching session on accounting strategies, check the Alleo app’s home page to view and manage the financial goals you discussed, allowing you to track your progress and stay accountable to your freelance business objectives.

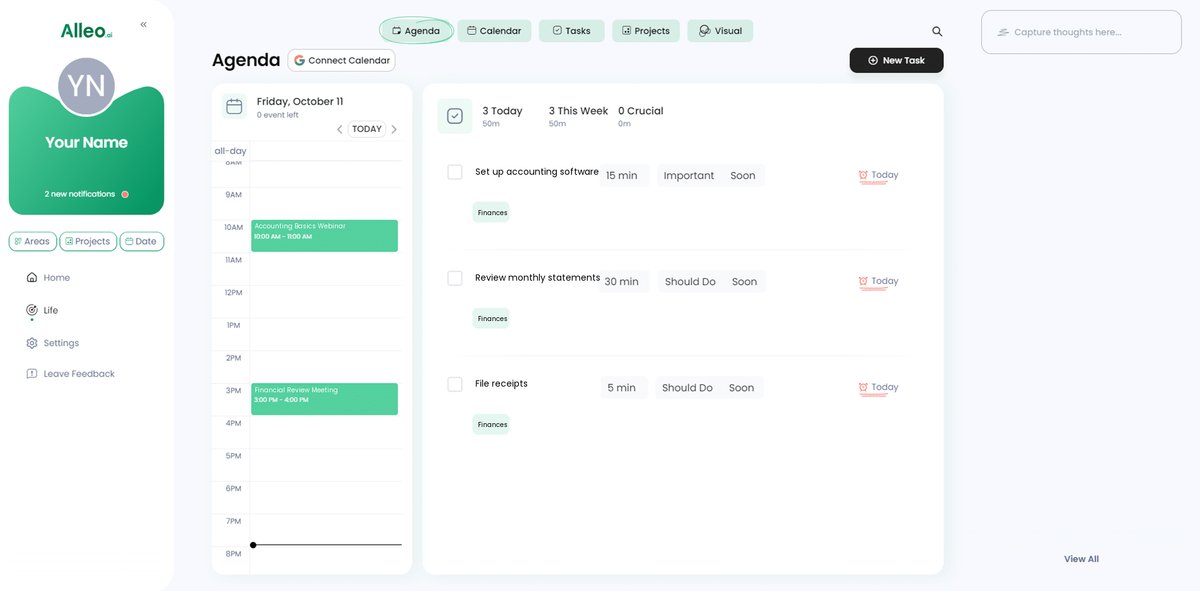

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule your monthly financial reviews and track your progress in mastering accounting skills, ensuring you stay on top of your freelance business finances.

Wrapping Up Your Accounting Journey

You’re almost there!

Mastering freelancer accounting basics as a small business owner is challenging, but it’s absolutely possible. By learning fundamental bookkeeping for entrepreneurs, tracking income and expenses, automating with accounting software for beginners, and reviewing financial statements for small businesses, you’ll gain control.

Remember, you’re not alone in this journey. Many freelancers have faced and conquered these challenges in cash flow management and small business tax basics.

Empower yourself to make informed financial decisions and plan for a successful future. Take the first step today in understanding profit and loss statements and balance sheet essentials.

Alleo is here to support you every step of the way. Sign up for free and see how Alleo can transform your business management, from invoicing best practices to expense tracking for small businesses.

You’ve got this!