Master Accurate Cash Flow Projections: The Ultimate Guide for Property Managers

Imagine managing multiple properties without knowing when your next large expense will hit. A nightmare, right? Property manager cash flow projections are crucial for avoiding such scenarios.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, understanding cash flow management and implementing accurate rental property cash flow analysis is crucial for property managers.

In this blog, we’ll explore how property manager cash flow projections can transform your property management business from chaotic to controlled. You’ll learn specific strategies, such as gathering historical data for cash flow forecasting for property management, including all costs and reserves in your expense tracking for property managers, and implementing regular monitoring using property management accounting software.

Let’s dive into rental income projection techniques and property management financial planning.

The Challenges of Unaccounted Expenses in Property Management

Managing properties without accurate property manager cash flow projections can be a nightmare. Many clients initially struggle with unexpected expenses, which can lead to financial crises.

For example, maintenance costs often spike without warning. Vacancy rates also fluctuate, catching you off guard. Expense tracking for property managers is crucial in these situations.

These issues create significant stress and disrupt financial stability, highlighting the importance of property management financial planning.

Without proper planning, freelancers managing properties might face constant cash flow crises. This uncertainty can make it hard to sustain your business. Implementing rental income projection techniques can help mitigate these risks.

Accurate property manager cash flow projections are essential for avoiding these pitfalls. They transform chaos into control, allowing you to handle expenses confidently and improve your real estate investment cash flow modeling.

A Roadmap to Accurate Cash Flow Projections

Overcoming this challenge requires a few key steps for property manager cash flow projections. Here are the main areas to focus on to make progress in cash flow forecasting for property management.

- Gather Historical Data for Accurate Forecasting: Collect past financial records to identify income and expense trends, essential for rental income projection techniques.

- Include All Operational Costs and Reserves: Make sure to list all known expenses and establish reserve funds, crucial for expense tracking for property managers.

- Implement Regular Monitoring and Adjustments: Schedule regular financial reviews and adjust projections based on real-time data, using property management accounting software for accurate rental property cash flow analysis.

Let’s dive into these property manager cash flow projections techniques!

1: Gather historical data for accurate forecasting

Having a solid understanding of past financial trends is essential for making accurate property manager cash flow projections.

Actionable Steps:

- Collect past financial records: Gather all income statements and balance sheets from the past three years for effective cash flow forecasting for property management.

- Analyze historical trends: Identify patterns in rental income projection techniques and expenses, noting any seasonal cash flow variations in property management or consistent spikes in costs.

- Utilize technology: Input historical data into property management accounting software to ensure it is accurately categorized for expense tracking for property managers.

Explanation: These steps are crucial as they provide a foundation for reliable forecasting. By examining historical trends, you can better predict future financial needs and avoid surprises in your property manager cash flow projections.

Utilizing budgeting tools for real estate cash flow streamlines this process and ensures data accuracy. For more on effective financial modeling, check out this resource.

This approach sets the stage for more precise property management financial planning, leading to better decision-making and stability.

Key benefits of accurate rental property cash flow analysis include:

- Improved financial stability

- Better-informed business decisions

- Enhanced ability to plan for growth in real estate investment cash flow modeling

2: Include all operational costs and reserves

Incorporating all operational costs and reserves is essential for accurate property manager cash flow projections.

Actionable Steps:

- List all known expenses: Identify and document every operational cost, including maintenance, capital expenses, and vacancy rates. Cross-verify with historical data for completeness in your property management financial planning.

- Establish reserve funds: Allocate funds for unexpected costs based on past trends. Aim to cover at least three months of operating expenses for effective expense tracking for property managers.

- Forecast future expenses: Use historical data and market trends to predict future costs. Update forecasts quarterly to reflect market changes, enhancing your cash flow forecasting for property management.

Explanation: Including all operational costs and reserves ensures you have a comprehensive financial overview for accurate rental property cash flow analysis.

This approach helps prevent surprises and improves financial stability in real estate investment cash flow modeling.

By forecasting expenses, you can plan better and avoid potential cash flow issues. For more on accurate financial forecasting, check out this resource.

This comprehensive strategy lays the groundwork for effective financial management and sustainability in property manager cash flow projections.

3: Implement regular monitoring and adjustments

Consistently monitoring and adjusting your property manager cash flow projections is crucial for maintaining financial stability in property management.

Actionable Steps:

- Schedule regular reviews: Set a monthly or quarterly schedule for financial reviews. Document these reviews and make necessary adjustments promptly to ensure accurate rental property cash flow analysis.

- Adjust projections based on real-time data: Incorporate real-time financial data into your projections. Compare these projections with actual performance and adjust accordingly, using property management accounting software for efficiency.

- Seek professional advice: Consult with financial advisors or mentors to refine your cash flow forecasting for property management. Implement at least one new strategy from each consultation.

Explanation: Regular monitoring and adjustments help you stay on top of your financial health in property management.

By incorporating real-time data and professional advice, you can make informed decisions and adapt to changes quickly, improving your property management financial planning. For more insights on accurate cash flow forecasting, check out this resource.

Signs that indicate the need for projection adjustments in property manager cash flow projections:

- Consistent discrepancies between projections and actual results in rental income projection techniques

- Significant changes in market conditions affecting real estate investment cash flow modeling

- Unexpected financial events or emergencies impacting expense tracking for property managers

This proactive approach ensures your cash flow projections remain accurate and reliable, accounting for seasonal cash flow variations in property management and supporting long-term cash flow projections for property portfolios.

Partner with Alleo for Accurate Cash Flow Projections

We’ve discussed the importance of accurate property manager cash flow projections. Now, let’s see how Alleo can help you master this skill for effective property management financial planning.

Setting up Alleo is simple. Start with a free 14-day trial—no credit card needed. It’s an ideal budgeting tool for real estate cash flow management.

Create a personalized plan tailored to your cash flow management needs, including rental income projection techniques. Alleo’s AI coach will guide you through every step of cash flow forecasting for property management.

It provides reminders and follow-ups to keep you on track with expense tracking for property managers. Alleo also offers actionable advice and adjusts strategies based on real-time data, ensuring accurate rental property cash flow analysis.

Ready to get started for free? Let me show you how Alleo can enhance your property management accounting and cash flow modeling!

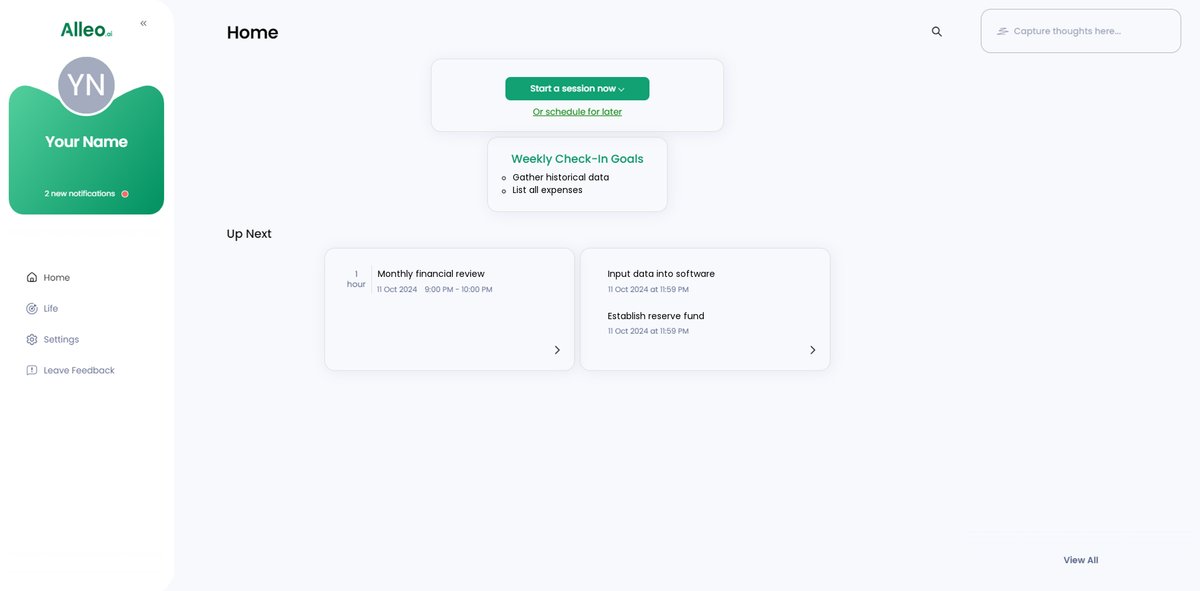

Step 1: Log In or Create Your Account

To begin your journey towards better cash flow management, log in to your Alleo account or create a new one to access our AI coach and start your 14-day free trial.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to establish consistent practices for managing cash flow projections, helping you transform financial chaos into control and avoid unexpected expenses in your property management business.

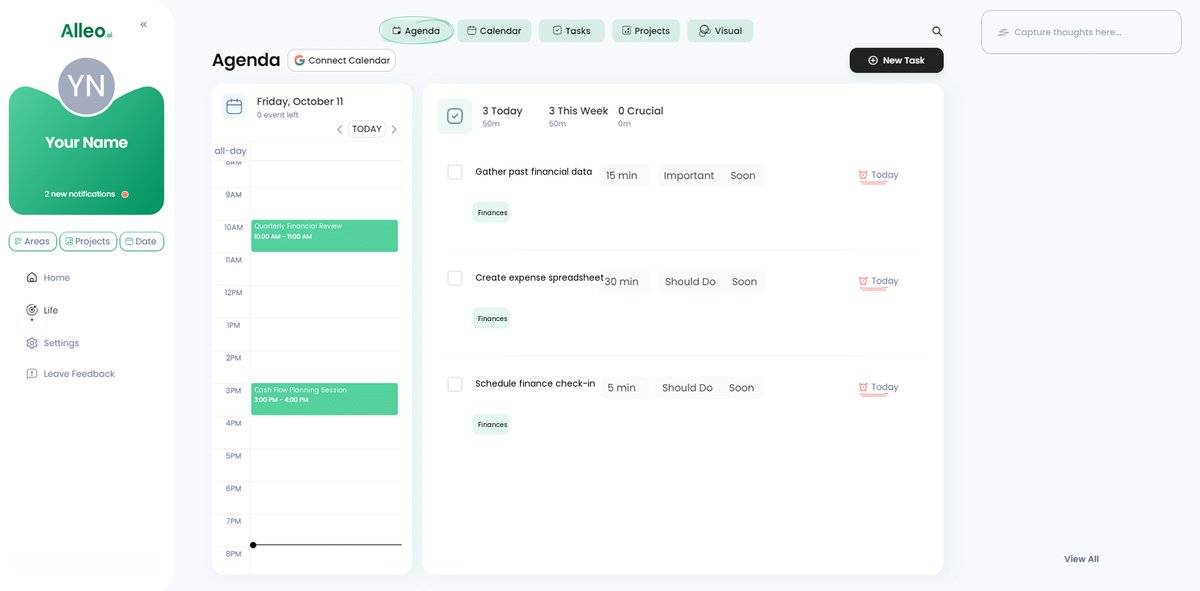

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to get tailored guidance on cash flow management for your property business, helping you transform financial chaos into control through accurate projections and strategic planning.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where our AI coach will help you set up a personalized cash flow management plan tailored to your property management needs.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check your app’s home page to review and manage the cash flow projection goals you discussed, allowing you to track your progress and make adjustments as needed.

Step 6: Adding Events to Your Calendar or App

Use Alleo’s calendar and task features to add and track important events related to your cash flow projections, such as monthly reviews or expense due dates, ensuring you stay on top of your financial management goals.

Bringing Everything Together for Financial Success

We’ve explored the steps to accurate property manager cash flow projections. Now, it’s time to take action.

Understanding your past financial trends is the foundation for cash flow forecasting for property management. Including all operational costs and reserves ensures no surprises in your rental income projection techniques.

Regular monitoring will keep you on track with expense tracking for property managers.

As a coach, I’ve seen the difference these property management financial planning strategies make. You can transform chaos into control using budgeting tools for real estate cash flow.

Remember, Alleo is here to help with accurate rental property cash flow analysis. Our AI coach offers guidance, reminders, and real-time adjustments using property management accounting software.

Take the first step in real estate investment cash flow modeling. Start your free trial today and see the impact on your seasonal cash flow variations in property management.

Your financial stability and long-term cash flow projections for property portfolios are within reach. Let’s achieve it together!