How Small Business Owners Can Master Cash Flow Forecasting: 3 Fundamental Principles

Imagine consistently knowing exactly how much cash your business has at any given moment. This is key to improve small business cash flow and maintain financial stability.

Many freelancers struggle with managing their cash flow due to a lack of accounting experience. As a life coach, I’ve helped many small business owners navigate these challenges, focusing on cash flow management techniques and small business financial planning.

In my experience, understanding cash flow is crucial for financial stability and working capital optimization.

In this article, you’ll discover actionable strategies to improve your cash flow forecasting. We’ll explore forecasting tools for entrepreneurs, cash flow projection strategies, and accounting software for cash forecasting to help with improving business liquidity.

Let’s dive into revenue prediction methods, expense tracking for small businesses, and cash flow analysis best practices.

Why Poor Cash Flow Management Hurts Your Business

Freelancers often find cash flow management overwhelming. You might miss opportunities because you’re unsure of your financial standing, making it crucial to improve small business cash flow.

Poor cash flow forecasting can lead to unexpected financial instability, highlighting the importance of effective cash flow management techniques.

Several clients initially struggle with predicting their cash inflows and outflows. This can result in delays in paying vendors or missing out on investments, underscoring the need for small business financial planning.

Imagine losing a great opportunity because your finances are unclear, emphasizing the importance of working capital optimization.

Understanding these challenges is crucial. In my experience, accurate cash flow management is vital for business stability and improving business liquidity.

By addressing these issues head-on, you can prevent many financial headaches and implement effective cash flow projection strategies.

Steps to Improve Cash Flow Forecasting for Small Business Owners

Overcoming cash flow management challenges requires a few key steps to improve small business cash flow. Here are the main areas to focus on to make progress with your cash flow projection strategies.

- Use Accounting Software for Automated Tracking: Choose cash forecasting software like QuickBooks or Xero for efficient tracking and expense tracking for small businesses.

- Create a Rolling 12-Month Cash Flow Forecast: Project future cash inflows and outflows to stay prepared, utilizing revenue prediction methods for small business financial planning.

- Set Up Clear Payment Terms and Invoice Promptly: Establish and communicate payment terms to ensure timely billing, improving business liquidity and working capital optimization.

Let’s dive in to these cash flow management techniques!

1: Use accounting software for automated tracking

Utilizing accounting software can significantly simplify cash flow management for small business owners and improve small business cash flow.

Actionable Steps:

- Research and select accounting software for cash forecasting that fits your business needs, such as QuickBooks or Xero.

- Automate invoicing and payment reminders to ensure timely billing and reduce late payments, enhancing working capital optimization.

- Regularly review financial reports generated by the software to stay informed about your financial health and implement cash flow analysis best practices.

Key benefits of using accounting software:

- Saves time and reduces manual errors in expense tracking for small businesses

- Provides real-time financial insights for small business financial planning

- Facilitates easier tax preparation and supports revenue prediction methods

Explanation:

These steps are crucial because they help streamline financial processes, making it easier to track cash flow and avoid financial surprises. By automating tasks, you save time and reduce errors, which is vital for maintaining financial stability and improving business liquidity.

According to U.S. Bank, using dedicated accounting software can greatly improve cash flow management techniques.

This approach sets a strong foundation for managing your finances more effectively and implementing cash flow projection strategies.

2: Create a rolling 12-month cash flow forecast

Creating a rolling 12-month cash flow forecast is essential for improving small business cash flow and maintaining financial stability.

Actionable Steps:

- Gather historical financial data: Collect past financial records to create an initial cash flow statement. Identify trends and recurring expenses for effective cash flow management techniques.

- Project future cash flows: Use the cash flow statement to estimate future cash inflows and outflows for the next 12 months. Update this forecast monthly as part of your small business financial planning.

- Plan for different scenarios: Model best-case, worst-case, and most-likely financial scenarios. Prepare contingency plans to handle potential fluctuations and improve business liquidity.

Explanation:

These steps are crucial because they help anticipate financial needs and avoid surprises. According to Nav, short-term forecasts are often most accurate, but regularly updating your 12-month forecast ensures you stay agile and ready for changes.

This approach can lead to better financial decision-making and improved business stability through effective cash flow projection strategies.

Factors to consider in your cash flow forecast:

- Seasonal fluctuations in revenue

- Upcoming large expenses or investments

- Changes in market conditions or competition

By maintaining a rolling forecast, you can confidently navigate your business finances and adapt to any challenges that come your way, ultimately improving small business cash flow.

3: Set up clear payment terms and invoice promptly

Effective cash flow management begins with establishing clear payment terms and invoicing promptly to improve small business cash flow.

Actionable Steps:

- Define clear payment terms: Establish and communicate payment terms with clients. Ensure all contracts and invoices include these terms to improve business liquidity.

- Send invoices immediately upon completion of work: Prompt invoicing helps maintain a steady cash flow and is crucial for small business financial planning.

- Follow up on payments: Implement a system for following up on overdue invoices. Monitor the percentage of invoices paid on time and reduce overdue accounts to optimize working capital.

Explanation:

These steps matter because they help ensure timely payments, which is essential for maintaining financial stability and improving small business cash flow. According to Cheektowaga.org, implementing better invoicing practices can speed up payments and ensure consistent cash flow.

By setting clear terms and following up on payments, you can reduce the risk of cash flow disruptions and enhance your cash flow management techniques.

Best practices for effective invoicing:

- Use professional, clearly formatted invoice templates

- Offer multiple payment options for client convenience

- Consider early payment discounts to incentivize prompt payments and improve small business cash flow

Mastering these practices will help you achieve a more predictable and stable financial situation for your business, supporting your cash flow projection strategies.

Partner with Alleo on Your Financial Journey

We’ve explored the challenges of cash flow management and how solving them can improve small business cash flow and ensure financial stability. But did you know you can work directly with Alleo to make this journey easier and faster?

Start by setting up an account with Alleo. Create a personalized plan that addresses your specific cash flow management techniques and small business financial planning needs.

Alleo’s AI coach will offer tailored advice and support, just like a human coach, helping you with cash flow projection strategies and working capital optimization.

The coach will follow up on your progress and keep you accountable. Text and push notifications will remind you to stay on track with your expense tracking for small businesses.

Alleo ensures you adapt your plan as needed, handling changes with ease and improving business liquidity.

Ready to get started for free? Let me show you how to improve small business cash flow!

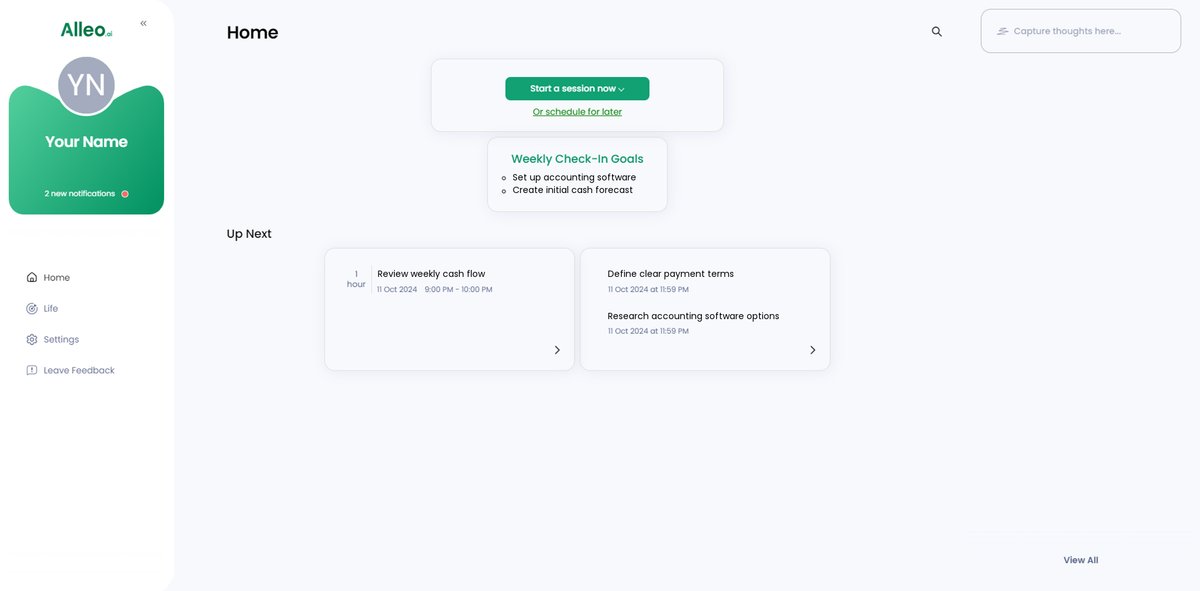

Step 1: Log In or Create Your Alleo Account

To start improving your cash flow management, log in to your Alleo account or create a new one to access personalized financial guidance and support.

Step 2: Choose “Building Better Habits and Routines”

Click on “Building Better Habits and Routines” to start improving your cash flow management practices, as consistent habits are key to maintaining financial stability and forecasting accuracy for your business.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to directly address your cash flow management challenges and receive tailored guidance for improving your business’s financial stability.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an initial intake session to discuss your cash flow challenges and create a personalized financial plan that aligns with your business goals.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the Alleo app’s home page to review and manage the cash flow goals you discussed, helping you stay on track with your financial management strategies.

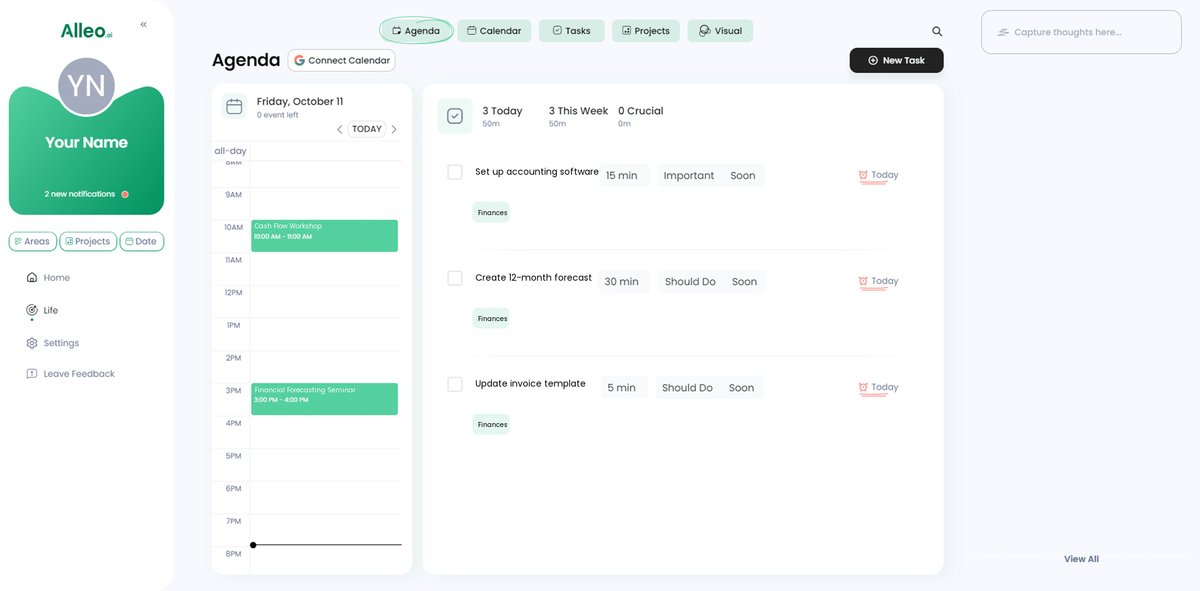

Step 6: Adding Events to Your Calendar or App

Track your progress in solving cash flow challenges by adding key financial tasks and milestones to the calendar and task features within the Alleo app, ensuring you stay on top of your cash flow management goals.

Master Your Cash Flow for Business Success

As we’ve explored, managing cash flow is crucial for your business’s financial stability. Utilizing accounting software for cash forecasting, creating a 12-month forecast, and setting clear payment terms can make a significant difference in improving small business cash flow.

I understand the challenges you face in cash flow management. You don’t have to navigate them alone.

By implementing these cash flow projection strategies, you can take control of your finances. You’ll avoid surprises and seize opportunities, effectively improving business liquidity.

Remember, Alleo is here to support you every step of the way in your small business financial planning. With personalized advice and reminders, Alleo makes managing your cash flow easier through working capital optimization.

Take action today to improve small business cash flow. Try Alleo for free and transform your financial management with our expense tracking and cash flow analysis best practices.