5 Essential Cash Flow Forecasting Strategies for Small Business Success

Are you struggling with managing your freelance business’s cash flow and need help with cash flow forecasting for freelancers?

As a life coach, I’ve assisted numerous freelancers with these exact challenges. Many find it hard to predict cash inflows due to varying customer payment terms and the limitations of tools like Excel, making financial planning for small businesses difficult.

This article will cover best practices for cash flow forecasting for freelancers, including cloud-based cash flow analysis software, sales forecasts, and automated invoicing to improve your business financial health.

Let’s dive into effective cash flow management and working capital optimization techniques.

Understanding the Cash Flow Forecasting Struggles

Freelancers often face unpredictable cash inflows, making cash flow forecasting for freelancers a critical skill. Clients may have varying payment terms, making cash flow management challenging.

Tools like Excel or NetSuite often fall short for small business budgeting, providing clunky data management and limited forecasting techniques.

In my experience, cash flow forecasting inaccuracies can severely hinder financial planning for small businesses. This instability impacts business financial health, leading to high stress and potential financial jeopardy.

Moreover, many freelancers initially struggle with understanding how to forecast their finances accurately. This results in missed opportunities for working capital optimization and financial missteps.

To address these issues, it’s crucial to adopt more reliable and user-friendly cash flow analysis software and revenue projection tools.

A Roadmap to Effective Cash Flow Forecasting for Freelancers

Overcoming this challenge requires a few key steps. Here are the main areas to focus on for effective cash flow forecasting for freelancers and small business budgeting.

- Use cloud-based cash flow forecasting software: Automate and integrate your cash flow management for real-time updates and working capital optimization.

- Create a detailed sales forecast spreadsheet: Use historical data to predict future sales accurately with revenue projection tools.

- Implement automated invoicing and payment systems: Ensure timely payments with automation tools for improved financial planning for small businesses.

- Set up regular financial review meetings: Regularly review financial reports to stay on track with your cash flow analysis and short-term financial planning.

- Develop a cash reserve strategy for stability: Build reserves to cover unexpected expenses and maintain business financial health.

Let’s dive into these cash flow forecasting techniques for freelancers!

1: Use cloud-based cash flow forecasting software

Utilizing cloud-based cash flow forecasting software is crucial for managing financial stability effectively, especially for freelancers and small businesses.

Actionable Steps:

- Research and select a cloud-based cash flow forecasting tool that integrates with your existing systems for optimal cash flow management.

- Look for features like real-time data updates and easy integration with your accounting software for accurate financial planning.

- Set up automated cash flow reports to get regular updates on your financial status and improve small business budgeting.

- Schedule daily or weekly reports to monitor cash inflows and outflows, enhancing your working capital optimization.

- Utilize the software to simulate different financial scenarios and plan accordingly using advanced forecasting techniques.

- Create scenarios based on best-case and worst-case sales projections to prepare for various outcomes and improve short-term financial planning.

Explanation: Adopting cloud-based forecasting tools allows for real-time data updates, which improves accuracy and decision-making in cash flow forecasting for freelancers.

Tools like these can provide significant benefits, such as integration with accounting software and automated reporting, enhancing overall business financial health.

According to Shopify, cash flow forecasting can help businesses meet obligations, monitor expenses, and plan for growth.

Key benefits of cloud-based forecasting software:

- Real-time data updates for accurate decision-making in cash flow analysis

- Integration with existing accounting systems for comprehensive expense tracking

- Automated reporting for consistent monitoring of revenue projections

Transitioning to cloud-based solutions can significantly enhance your ability to manage cash flow effectively, providing valuable revenue projection tools for freelancers and small businesses.

2: Create a detailed sales forecast spreadsheet

Creating a detailed sales forecast spreadsheet is essential for cash flow forecasting for freelancers and predicting future revenue and planning accordingly.

Actionable Steps:

- Gather historical sales data to identify trends and patterns.

- Use past sales data to predict future sales for different periods (monthly, quarterly), enhancing your cash flow management.

- Break down sales forecasts by product/service and customer segment.

- Create separate forecasts for different product lines or types of clients, improving your financial planning for small businesses.

- Regularly update the sales forecast with actual sales data to refine predictions.

- Adjust your forecasts at the end of each month based on actual sales figures, a crucial aspect of small business budgeting.

Explanation: These steps are crucial because they help you predict future cash inflows more accurately, a key component of cash flow forecasting for freelancers.

By breaking down forecasts and updating them regularly, you can make informed decisions about inventory, staffing, and marketing, which are essential for working capital optimization.

According to SCORE, financial projections help businesses plan for future income and expenses, ensuring better financial management and overall business financial health.

This method allows you to stay proactive with your cash flow management and short-term financial planning.

3: Implement automated invoicing and payment systems

Implementing automated invoicing and payment systems is essential for ensuring timely payments and improving cash flow management for freelancers and small businesses.

Actionable Steps:

- Choose an invoicing tool that offers automation features, such as recurring invoices and payment reminders.

- Select a tool like QuickBooks or FreshBooks that integrates with your accounting software and supports cash flow forecasting for freelancers.

- Set up automated payment follow-ups to ensure timely payments from clients.

- Configure the system to send reminders for overdue invoices automatically, enhancing your working capital optimization.

- Offer multiple payment options to make it easier for clients to pay on time.

- Include options like credit card payments, bank transfers, and digital wallets to improve your business financial health.

Explanation: These steps are crucial because they streamline the invoicing process, reduce manual errors, and ensure more consistent cash inflows, which are vital for effective cash flow forecasting for freelancers.

By automating payment reminders and offering various payment options, you can significantly reduce the risk of late payments and improve your short-term financial planning.

According to U.S. Bank, using dedicated software to manage finances and streamline cash flow can greatly enhance financial stability and operational efficiency.

Consider these factors when choosing an invoicing system:

- Integration capabilities with existing cash flow analysis software

- Customizable invoice templates for efficient expense tracking methods

- Robust reporting features for revenue projection tools

Adopting these practices will help maintain a steady cash flow and improve overall business stability, which is crucial for effective cash flow forecasting for freelancers and small business budgeting.

4: Set up regular financial review meetings

Regular financial review meetings are crucial for maintaining a clear understanding of your business’s financial health, especially when it comes to cash flow forecasting for freelancers.

Actionable Steps:

- Schedule monthly financial review meetings with your accountant or financial advisor. Use these meetings to review cash flow statements, update forecasts, and discuss financial planning for small businesses.

- Prepare detailed financial reports ahead of each meeting to facilitate informed discussions. Include cash flow statements, sales forecasts, and expense tracking methods in your meeting agenda.

- Use insights from these meetings to adjust your financial plans and strategies. Make data-driven decisions about cost-cutting, investment opportunities, and other aspects of small business budgeting.

Explanation: These steps matter because they ensure you stay proactive and informed about your business’s financial status and improve working capital optimization.

Regular reviews help identify trends, spot issues early, and make necessary adjustments to your cash flow forecasting for freelancers.

According to Forbes, closely watching cash flow statements is essential, especially for small businesses with limited access to credit.

Regular financial review meetings can significantly improve your cash flow management and overall business financial health.

5: Develop a cash reserve strategy for stability

Building a cash reserve is vital for ensuring financial stability, especially during unpredictable periods. This is a crucial aspect of cash flow forecasting for freelancers and small businesses.

Actionable Steps:

- Calculate your monthly operating expenses to determine the ideal cash reserve amount.

- Aim to set aside enough cash to cover 3-6 months of expenses, a key part of financial planning for small businesses.

- Create a savings plan to gradually build up your cash reserves.

- Allocate a percentage of your monthly profits to a dedicated cash reserve account, utilizing expense tracking methods.

- Regularly review and adjust your cash reserve strategy to meet your business needs.

- Increase your cash reserves during high revenue periods and adjust during slower months, applying cash flow management techniques.

Explanation: These steps matter because a well-planned cash reserve can help you manage unexpected expenses and maintain business stability, which is essential for working capital optimization.

According to U.S. Bank, having a robust cash reserve strategy is crucial for long-term financial health. Regularly reviewing your reserves ensures they remain adequate to support your business needs, aligning with effective small business budgeting practices.

Key benefits of maintaining a cash reserve:

- Financial stability during lean periods

- Ability to seize unexpected opportunities

- Reduced reliance on external financing

Taking these steps will help you build a financial cushion, making your business more resilient. Implementing these cash flow forecasting techniques for freelancers can significantly improve your business financial health.

Partner with Alleo for Better Cash Flow Management

We’ve explored the challenges of cash flow forecasting for freelancers and how to tackle them effectively. But did you know you can work directly with Alleo to make this journey easier and faster?

Alleo is an AI life coach tailored to help freelancers manage their cash flow and improve their business financial health. Setting up an account is quick and easy.

Create a personalized plan to address your specific cash flow challenges and optimize working capital. Alleo will guide you through each step, providing actionable advice and reminders for effective financial planning for small businesses.

You’ll receive follow-ups on your progress and tips to handle changes in your revenue projections. Alleo keeps you accountable via text and push notifications, supporting your short-term financial planning efforts.

Ready to get started for free with our cash flow analysis software? Let me show you how!

Step 1: Log In or Create Your Account

To start improving your cash flow management with Alleo, Log in to your account or create a new one if you’re new to the platform.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start improving your cash flow management practices. This goal directly addresses the need for consistent financial habits, helping you implement the strategies outlined in the article and achieve greater stability in your freelance business.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to directly address your cash flow management challenges and receive tailored guidance on implementing the strategies discussed in this article.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session to discuss your cash flow challenges and create a personalized plan for improving your financial management.

Step 5: Viewing and Managing Goals After the Session

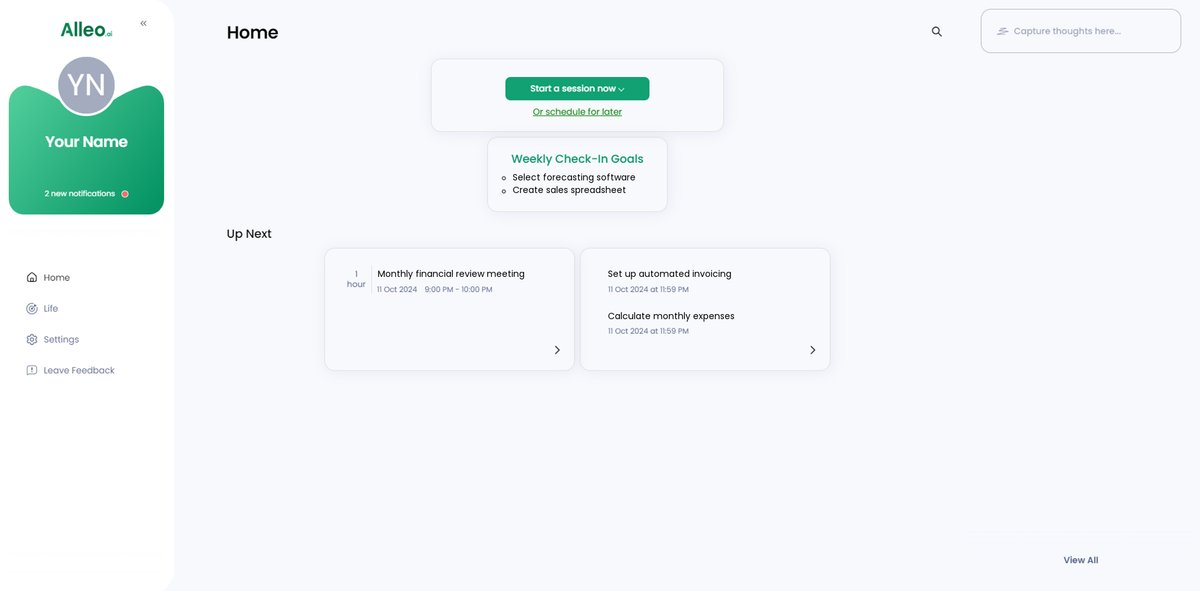

After your coaching session, open the Alleo app to find your discussed cash flow management goals displayed on the home page, allowing you to easily track and update your progress.

Step 6: Adding events to your calendar or app

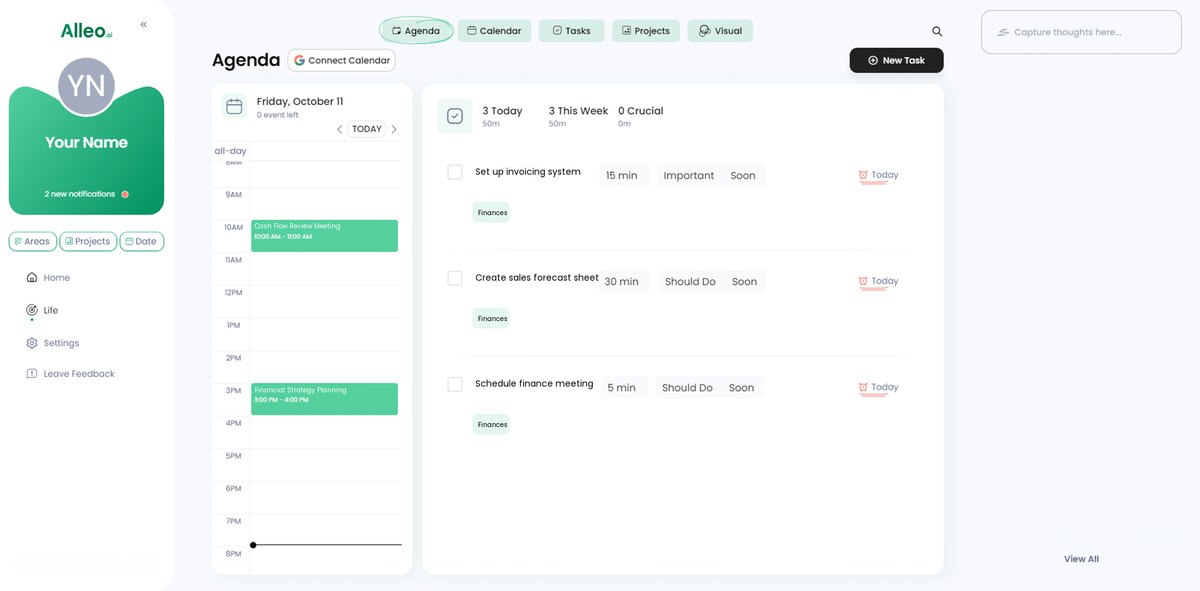

Use Alleo’s calendar and task features to schedule and track your financial review meetings, ensuring you stay on top of your cash flow management progress.

Wrapping Up Your Cash Flow Strategy

Before we conclude, let’s quickly recap how you can improve your cash flow management for freelancers.

Managing your freelance business’s cash flow is challenging, but it’s possible to overcome these hurdles. By using cloud-based cash flow analysis software, detailed sales forecasts, automated invoicing, regular financial reviews, and building cash reserves, you can achieve financial stability and optimize your working capital.

I know this process of cash flow forecasting for freelancers can seem overwhelming. But with each step, you’ll gain more control over your finances and improve your business’s financial health.

Remember, Alleo is here to support you through this journey of financial planning for small businesses. Our AI life coach can help you implement these cash flow forecasting techniques and expense tracking methods with ease.

Start today to take charge of your cash flow and secure your business’s future through effective short-term financial planning. Ready to transform your financial management and enhance your small business budgeting?

Try Alleo for free and see the difference it makes in your cash flow forecasting for freelancers!