4 Powerful Strategies for Small Business Owners to Improve Cash Flow Forecasting on a Budget

Are you struggling to manage cash flow and plan for your business’s future? You’re not alone. Many freelancers face challenges with cash flow forecasting for their small businesses.

As a life coach, I’ve helped many freelancers navigate these challenges. In my experience working with clients, I often encounter the same issues with cash flow forecasting and budget-friendly financial planning tools.

In this article, you’ll discover actionable strategies and tools to improve your cash flow forecasting on a budget. We’ll cover everything from using free cash flow projection tools to setting up alerts for expenses, helping you optimize working capital for your small business.

Let’s dive into some affordable cash flow prediction methods and small business budgeting tips.

The Challenges Freelancers Face with Cash Flow Management

Freelancers often encounter significant hurdles when it comes to cash flow forecasting for freelancers and managing cash flow. Many clients initially struggle with unpredictable income streams and varying payment terms, making cash flow management techniques essential.

In my experience, people often find themselves juggling multiple invoices with different due dates, which complicates their financial planning. This lack of consistency can be stressful, making it difficult to anticipate future cash shortages or surpluses and emphasizing the need for small business budgeting tips.

Additionally, the absence of budget-friendly financial planning tools that integrate customer order data and expected ship dates adds to the complexity. This results in unreliable projections, leaving you unprepared for unexpected financial challenges and highlighting the importance of improving cash flow accuracy.

It doesn’t have to be this way. Let’s explore actionable solutions to ease this burden and optimize working capital for small businesses.

Roadmap to Effective Cash Flow Forecasting for Freelancers

Overcoming cash flow challenges requires a few key steps. Here are the main areas to focus on to make progress in cash flow forecasting for freelancers:

- Use free spreadsheet templates for cash flow tracking: Download, customize, and regularly update a cash flow template to improve cash flow accuracy.

- Implement a basic accounting software solution: Choose and set up budget-friendly financial planning tools for small business financial forecasting.

- Create a simple monthly cash flow statement: Input financial data into a monthly cash flow statement template, utilizing low-cost cash flow forecasting strategies.

- Set up alerts for upcoming expenses and payments: Use tools to set alerts for due dates and recurring expenses, optimizing working capital for small businesses.

Let’s dive into these cash flow management techniques!

1: Use free spreadsheet templates for cash flow tracking

One effective way to manage cash flow on a budget is by using free spreadsheet templates, which are essential for cash flow forecasting for freelancers and small businesses.

Actionable Steps:

- Download and customize a free cash flow spreadsheet template from reputable sources like SCORE or Google Sheets, providing budget-friendly financial planning tools.

- Regularly update the spreadsheet with real-time data to maintain accuracy. Set a weekly reminder to input new data and review existing entries, improving cash flow accuracy.

- Analyze the data to identify patterns and potential cash flow issues. Use color-coding to easily spot trends and anomalies in your cash flow, employing DIY cash flow analysis for entrepreneurs.

Explanation:

Using free spreadsheet templates allows you to track your financial health without spending money on software. These templates help you organize customer order data, expected ship dates, and payment terms, providing reliable projections and serving as affordable cash flow prediction methods.

Regular updates ensure that you stay on top of your finances, and analyzing the data helps you anticipate and address cash flow issues. For more tips on managing cash flow, check out this guide.

Key benefits of using spreadsheet templates:

- Cost-effective solution for tight budgets, ideal for cash flow forecasting for freelancers

- Customizable to fit specific business needs, supporting small business financial forecasting

- Easy to share and collaborate with team members, facilitating cash flow management techniques

By implementing these steps, you’ll gain better control over your finances, making it easier to plan and grow your business while optimizing working capital for small businesses.

![]()

2: Implement a basic accounting software solution

Incorporating a basic accounting software solution can significantly streamline your cash flow management and improve cash flow forecasting for freelancers.

Actionable Steps:

- Research and select a budget-friendly financial planning tool that suits your needs (e.g., QuickBooks Self-Employed, Wave).

- Take advantage of free trials to test different small business financial forecasting software and find the best fit.

- Set up your accounting software to categorize income and expenses accurately.

- Create custom categories that reflect your specific freelancing business expenses and optimize working capital for small businesses.

- Use the software’s reporting features to generate monthly cash flow statements.

- Schedule monthly review sessions to go over these reports and make informed financial decisions using DIY cash flow analysis for entrepreneurs.

Explanation:

Implementing accounting software is crucial for maintaining accurate financial records and generating detailed cash flow statements. These affordable cash flow prediction methods help categorize income and expenses, making it easier to analyze financial health and improve cash flow accuracy.

This is particularly beneficial for freelancers managing multiple invoices and payment terms. For more insights on managing cash flow, visit this guide.

This approach ensures you stay on top of your finances, enabling better planning and decision-making through effective cash flow forecasting for freelancers.

3: Create a simple monthly cash flow statement

Creating a simple monthly cash flow statement is crucial for understanding your business’s financial health and is a key component of cash flow forecasting for freelancers.

Actionable Steps:

- Gather all necessary financial documents, including invoices, receipts, and bank statements.

- Use a digital filing system to keep these documents organized and easily accessible, which aids in cash flow management techniques.

- Input your financial data into a monthly cash flow statement template.

- Break down your income and expenses into categories to get a clear picture of your financial health, utilizing budget-friendly financial planning tools.

- Review the statement to identify cash flow gaps and opportunities for improvement.

- Look for patterns in your income and expenses to forecast future cash flow more accurately, improving cash flow accuracy.

Important components of a cash flow statement:

- Operating activities (income from sales, payments to suppliers)

- Investing activities (purchase or sale of assets)

- Financing activities (loans, dividends, stock issuance)

Explanation:

These steps help you maintain an organized record of your finances, making it easier to spot trends and address issues promptly, which is essential for cash flow forecasting for freelancers.

By regularly reviewing your cash flow statement, you can stay ahead of potential financial challenges. For additional insights on managing cash flow, check out this guide from SCORE.

This method ensures you have a clear understanding of your financial status, which is essential for effective business planning and optimizing working capital for small businesses.

4: Set up alerts for upcoming expenses and payments

Setting up alerts for upcoming expenses and payments is crucial for maintaining control over your financial commitments and is a key aspect of cash flow forecasting for freelancers.

Actionable Steps:

- Use your accounting software or a calendar app to set up alerts for due dates on invoices and bills.

- Schedule alerts a few days before the actual due date to ensure timely payments and improve cash flow accuracy.

- Create a list of recurring expenses and set up automatic reminders.

- Include varying payment terms and expected dates to avoid any financial surprises and optimize working capital for small businesses.

- Monitor your cash flow regularly to adjust alerts and stay on top of your financial commitments.

- Allocate a specific time each week to review your alerts and make necessary adjustments, utilizing DIY cash flow analysis for entrepreneurs.

Explanation:

These steps help you stay proactive about your financial obligations, reducing the risk of late payments and associated fees, which is essential for effective cash flow management techniques.

Setting up alerts ensures you never miss a payment, thereby maintaining good relationships with vendors and clients and supporting small business financial forecasting.

Regular monitoring also allows you to adjust your financial plans as needed. For more insights, check out this guide on small business budgeting.

Types of alerts to consider:

- Invoice due date reminders

- Recurring bill payment alerts

- Low balance notifications

This approach reinforces the importance of staying organized and prepared, ensuring smoother financial management and supporting budget-friendly financial planning tools for cash flow forecasting for freelancers.

Partner with Alleo on Your Cash Flow Journey

We’ve explored the challenges of cash flow forecasting for freelancers and how to overcome them. But did you know you can work directly with Alleo to make this journey easier and faster?

Setting up an account with Alleo is simple. Create a personalized plan with Alleo’s AI coach to tackle cash flow issues and improve your cash flow accuracy.

Alleo provides affordable cash flow prediction methods and tailored coaching support with full sessions like any human coach. Enjoy a free 14-day trial with no credit card required, making it a budget-friendly financial planning tool for freelancers.

The coach will follow up on your progress and handle changes, helping you optimize working capital for your small business. Stay accountable with text and push notifications.

Ready to get started for free with cash flow forecasting for freelancers?

Let me show you how!

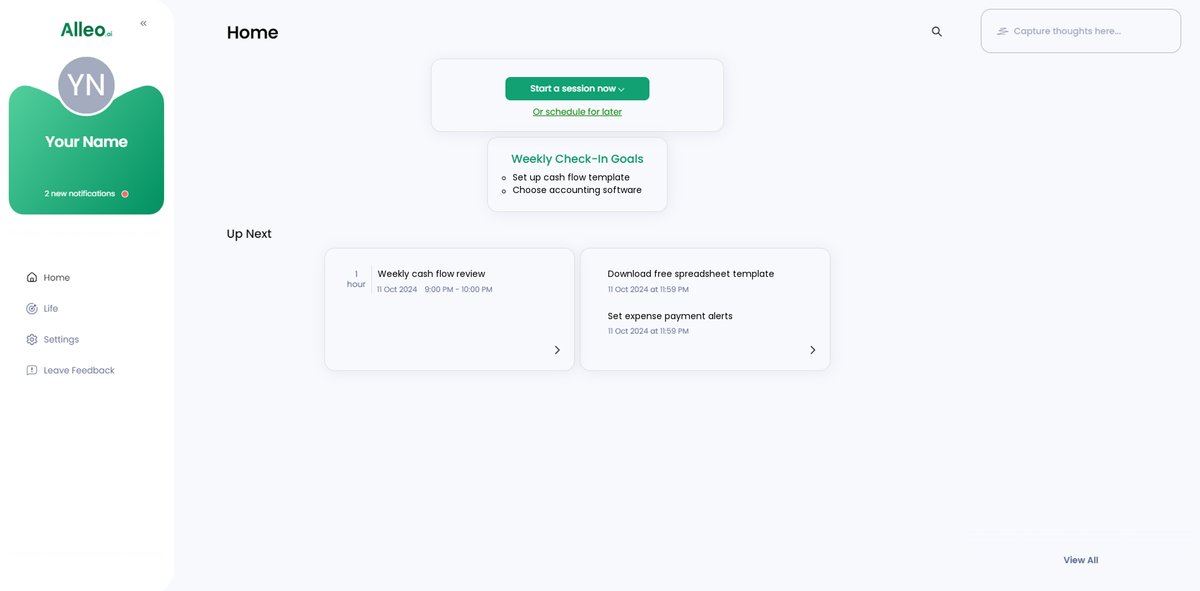

Step 1: Log In or Create Your Account

To start improving your cash flow management, simply log in to your account or create a new one to access Alleo’s AI coach and personalized financial planning tools.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start improving your cash flow management skills, as developing consistent financial practices is key to overcoming the challenges of unpredictable income and varying payment terms discussed in the article.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to address your cash flow forecasting challenges head-on. This selection will tailor the AI coach’s guidance to help you implement the cash flow management strategies discussed in this article, ensuring you receive personalized support for improving your financial planning and business stability.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an initial intake session, where you’ll work with your AI coach to create a personalized plan for improving your cash flow management and forecasting.

Step 5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to view and manage the cash flow goals you discussed, allowing you to track your progress and stay accountable to your financial planning objectives.

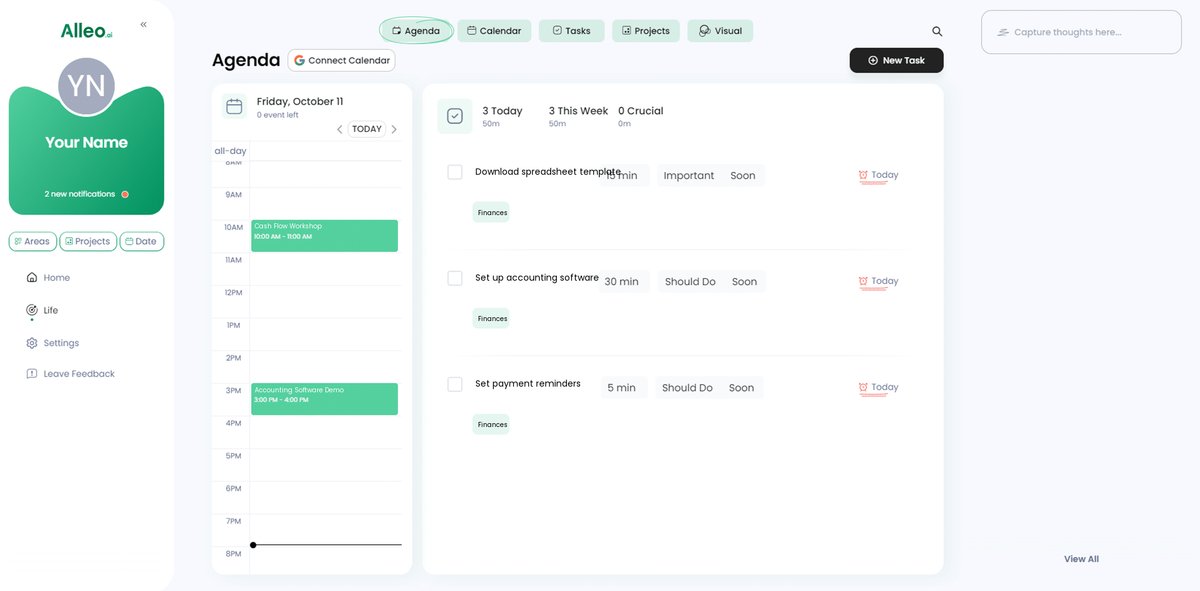

Step 6: Adding events to your calendar or app

Use the calendar and task features in the Alleo app to add important financial events, such as invoice due dates and expense reminders, allowing you to easily track your progress in solving cash flow management challenges.

Wrapping Up Your Cash Flow Journey

We’ve covered a lot, haven’t we? Improving cash flow forecasting for freelancers can feel overwhelming, but you now have practical steps to take.

Remember, mastering cash flow management techniques is a journey. Start small with free cash flow projection tools and work your way up to more advanced small business financial forecasting software.

Empathizing with your struggles, I know these budget-friendly financial planning tools can make a big difference.

You have the power to transform your financial planning. By implementing these cash flow management techniques, you’ll gain control over your business finances and optimize working capital for your small business.

Don’t forget, Alleo is here to support you. Try Alleo for free and see how it can simplify your cash flow forecasting for freelancers.

Stay proactive with your DIY cash flow analysis, and you’ll see positive changes in your small business budgeting.