4 Essential Techniques to Simplify Finances with the Best Accounting Software for Small Business Owners

Are you tired of wrestling with clunky accounting software that complicates your cash flow management? It’s time to explore the best small business accounting software options available.

As a life coach, I’ve helped many freelancers navigate these challenges. In my experience, finding the right small business accounting tools can transform your financial management.

In this article, we’ll explore strategies to simplify your finances. We’ll delve into user-friendly cloud-based bookkeeping solutions, automatic transaction syncing, mobile apps, and AI-powered expense tracking for small businesses.

Let’s dive into the world of easy-to-use financial management software for entrepreneurs.

Why Clunky Accounting Software is a Major Obstacle

Many small business owners find existing accounting software cumbersome and difficult to use. This leads to inefficiencies in managing day-to-day finances and cash flow. The best small business accounting software should address these challenges.

The stress is real. Imagine missing invoice deadlines or struggling with tracking expenses due to poor software usability. Cloud-based bookkeeping solutions can help alleviate these issues.

In my experience, people often find these outdated systems overwhelming. They spend hours on manual data entry, which could have been automated with easy-to-use financial management software.

This inefficiency can cause significant financial mismanagement. As a result, business growth slows down, and you might even lose money. Affordable accounting programs for entrepreneurs can prevent such problems.

It’s clear. You need a more user-friendly solution, like automated expense tracking for small businesses.

Let’s explore how we can overcome these challenges with the best small business accounting software.

A Roadmap to Simplifying Your Finances

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress with the best small business accounting software:

- Choose user-friendly cloud-based accounting software: Look for small business accounting tools that offer ease of use and essential features.

- Set up automatic transaction syncing: Link your accounts to reduce manual data entry and ensure accuracy with cloud-based bookkeeping solutions.

- Use mobile apps for on-the-go financial management: Access your finances anytime, anywhere with easy-to-use financial management software apps.

- Implement AI-powered expense tracking and sorting: Automate categorization and gain insights with automated expense tracking for small businesses.

Let’s dive into selecting the best small business accounting software!

1: Choose user-friendly cloud-based accounting software

Choosing user-friendly cloud-based accounting software is essential for simplifying your financial management. Finding the best small business accounting software can streamline your operations.

Actionable Steps:

- Research and compare different cloud-based bookkeeping solutions. Create a checklist of essential features like invoicing, expense tracking, and reporting.

- Sign up for free trials to test usability and functionality. Allocate one week to trial each small business accounting tool, noting ease of use and integration capabilities.

- Select the easy-to-use financial management software that best fits your needs and budget. Ensure the chosen affordable accounting program for entrepreneurs offers customer support and regular updates.

Key benefits of cloud-based accounting software:

- Accessible from anywhere with internet connection

- Automatic backups and updates

- Scalable to grow with your business

Explanation: These steps matter because they help you find a solution that fits your business needs, saving time and reducing errors.

According to PCMag, user-friendly software simplifies financial management, meeting the needs of small businesses and freelancers.

By following these steps, you’ll be on your way to streamlined financial management with the best small business accounting software.

Let’s now explore the next step.

2: Set up automatic transaction syncing

Setting up automatic transaction syncing is crucial for reducing manual data entry and ensuring accurate financial records when using the best small business accounting software.

Actionable Steps:

- Link your bank accounts and payment gateways to your chosen cloud-based bookkeeping solution. This will streamline your financial management.

- Enable automatic transaction import to save time and reduce errors. This helps keep your records up to date using automated expense tracking for small businesses.

- Customize transaction categories to fit your business needs. Use software settings to create custom categories for better organization in your small business accounting tools.

Explanation: These steps matter because they help you manage finances more efficiently with easy-to-use financial management software, reducing the risk of errors and saving you valuable time.

According to Finanshels, automatic syncing enhances accuracy and simplifies financial management in the best small business accounting software.

Let’s now move on to the next step.

3: Use mobile apps for on-the-go financial management

Using mobile apps for on-the-go financial management is crucial for maintaining real-time control over your finances, especially when using the best small business accounting software.

Actionable Steps:

- Download the mobile app version of your chosen small business accounting tools. Enable notifications for real-time financial updates to stay informed.

- Utilize mobile invoicing to send invoices from anywhere. Sync your contacts and templates for quicker invoicing processes using cloud-based bookkeeping solutions.

- Track expenses and capture receipts on the go. Use the app’s photo capture feature for automated expense tracking for small businesses.

Key features to look for in mobile accounting apps:

- Real-time dashboard with financial overview

- Receipt scanning and expense categorization

- Offline mode for data entry without internet

Explanation: These steps matter because they offer flexibility and convenience, helping you manage finances efficiently even when you’re away from your desk, which is essential for easy-to-use financial management software.

According to PCMag, mobile access to accounting data is increasingly important for small business owners, allowing for real-time financial oversight and decision-making when using the best small business accounting software.

Implementing these steps will significantly streamline your financial management process using affordable accounting programs for entrepreneurs.

4: Implement AI-powered expense tracking and sorting

Implementing AI-powered expense tracking and sorting is essential for efficient financial management and cash flow visibility, especially when using the best small business accounting software.

Actionable Steps:

- Integrate AI tools with your accounting software to enhance expense tracking. Use cloud-based bookkeeping solutions like SaasAnt for smarter automation and automated expense tracking for small businesses.

- Utilize AI to generate financial reports and insights. Review AI-generated reports regularly to spot spending patterns and areas for improvement using financial reporting tools for small companies.

- Set up AI-driven alerts for unusual transactions or budget thresholds. Customize alert settings to stay informed about your financial health using budget planning software for small business owners.

Benefits of AI in financial management:

- Reduced manual data entry and human error

- Predictive analysis for better financial planning

- Automated reconciliation of transactions

Explanation: These steps matter because they automate tedious tasks, reducing errors and saving time, which is crucial when using small business accounting tools.

According to SaasAnt, AI integration enhances accounting efficiency, providing valuable insights for better decision-making when using the best small business accounting software.

Implementing these strategies will significantly streamline your expense management process, making the most of easy-to-use financial management software.

Partner with Alleo for Effortless Financial Management

We’ve explored how to simplify your finances with better tools and strategies, including the best small business accounting software. But did you know you can work directly with Alleo to make this journey easier and faster?

Alleo offers affordable, tailored coaching for financial management, acting as your cloud-based bookkeeping solution. Setting up is simple.

Sign up for a free 14-day trial—no credit card required. Create a personalized plan with Alleo’s AI coach, who will guide you through each step, much like easy-to-use financial management software.

The coach follows up on your progress, handles changes, and keeps you accountable with text and push notifications, similar to automated expense tracking for small businesses.

Alleo’s goal-setting and decision-making support ensure you stay on track, making it one of the best small business accounting software options available.

Ready to get started for free? Let me show you how Alleo can be your affordable accounting program for entrepreneurs!

Step 1: Log in or Create Your Account

Log in to your existing Alleo account or create a new one to begin simplifying your financial management with our AI coach.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to establish a consistent financial management system that aligns with the strategies discussed in the article, helping you overcome the challenges of clunky accounting software and streamline your cash flow management.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to directly address the challenges of managing cash flow and simplifying your accounting processes, aligning perfectly with the tools and strategies discussed in the article.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session, where you’ll work with your AI coach to create a personalized financial management plan tailored to your needs and goals.

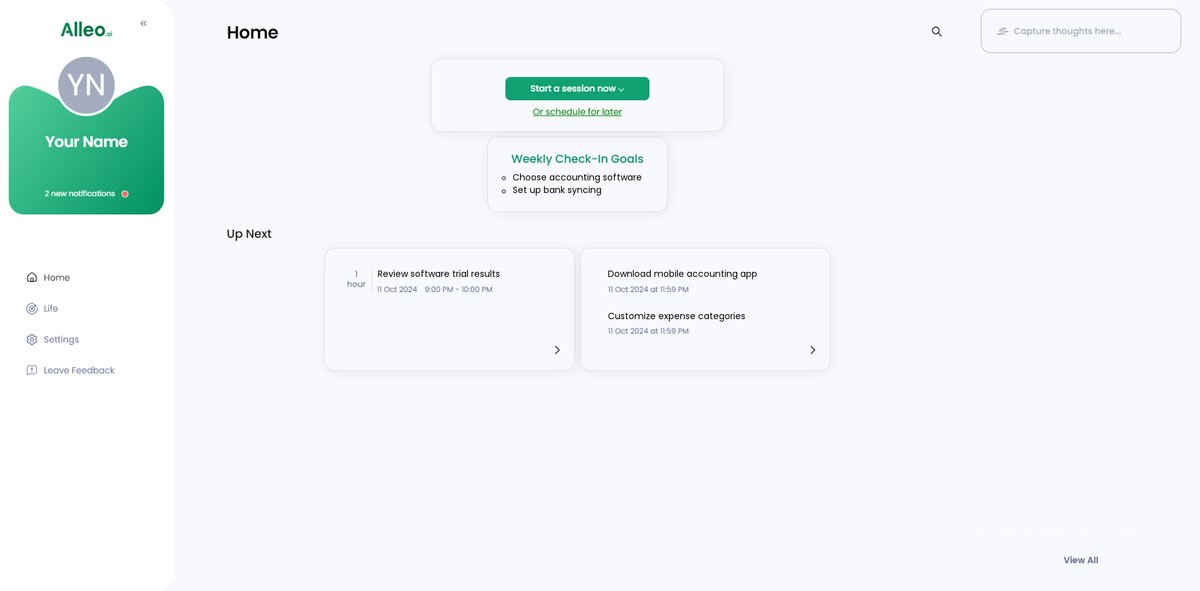

Step 5: Viewing and managing goals after the session

After your coaching session, easily access and manage the financial goals you discussed by checking the home page of the Alleo app, where they’ll be prominently displayed for your ongoing reference and tracking.

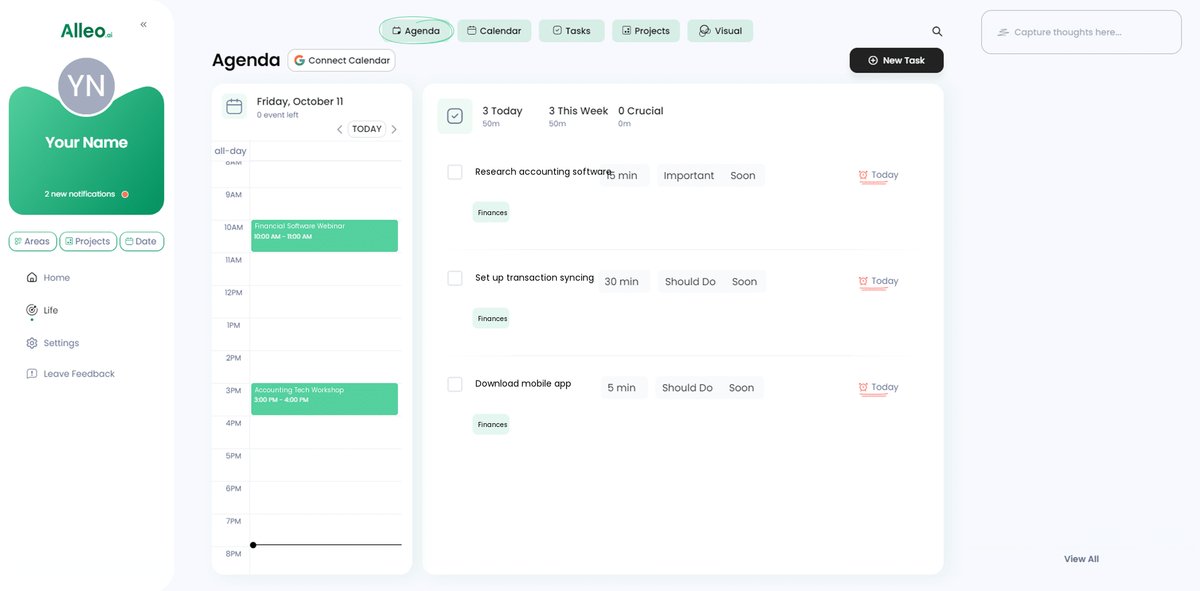

Step 6: Adding events to your calendar or app

Use the AI coach’s calendar and task features to add important financial deadlines, review dates, and milestones, helping you track your progress and stay on top of your simplified financial management journey.

Wrapping Up Your Financial Transformation

It’s clear that managing finances doesn’t have to be a nightmare. By choosing user-friendly cloud-based bookkeeping solutions and the best small business accounting software, setting up automatic transaction syncing, using mobile apps, and implementing AI-powered tools, you can simplify your financial management.

Imagine the ease of tracking expenses in real time with automated expense tracking for small businesses and never missing an invoice deadline again. These small steps lead to big improvements in cash flow management.

I understand the frustration of dealing with clunky software. But now, you have a roadmap to overcome those obstacles with easy-to-use financial management software.

Don’t let outdated systems hold you back any longer. Take control of your financial health today with affordable accounting programs for entrepreneurs.

Remember, Alleo is here to support you every step of the way. Sign up for a free trial of our best small business accounting software and start transforming your finances now.

You’ve got this!