7 Best Practices for Financial Advisors Using VR in Client Meetings: A Comprehensive Guide

Imagine a world where financial advisors can walk their clients through a 3D visualization of their portfolio using VR in financial advising meetings, making complex financial concepts easy to grasp. This immersive financial planning experience transforms client engagement.

As a life coach, I’ve helped many professionals navigate technology adoption. In my experience, integrating virtual reality in financial advising and AR can revolutionize client meetings, offering interactive wealth management tools and virtual financial consultations.

In this article, we’ll explore best practices for using VR technology for client engagement. You’ll learn actionable strategies to enhance remote client meetings using VR and improve portfolio reviews through virtual reality risk assessment.

Let’s dive into the world of VR investment scenarios and augmented reality financial education.

Challenges in Adopting VR and AR for Financial Advising

Transitioning from traditional practices to incorporate VR in financial advising meetings is no small feat. Many clients initially struggle with understanding how these technologies can enhance their immersive financial planning experiences.

This gap between current methods and the potential of virtual reality in financial advising can be daunting.

In my experience, people often find the learning curve steep. They worry about the costs and time needed for effective implementation of VR technology for client engagement.

However, staying ahead in a competitive market requires embracing these innovations in virtual financial consultations.

Imagine the frustration of trying to explain complex financial data without visual aids. It’s clear that integrating VR and AR can significantly enhance client engagement and communication through interactive wealth management tools and 3D portfolio visualization.

Strategic Steps for Integrating VR in Financial Advising

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in implementing VR in financial advising meetings:

- Implement 3D Financial Data Visualization: Use 3D tools for clearer financial presentations, enhancing immersive financial planning experiences.

- Create Personalized VR Meeting Environments: Tailor virtual spaces to client preferences, improving virtual reality in financial advising.

- Train Advisors on VR Communication Techniques: Enhance communication skills in VR settings for effective virtual financial consultations.

- Develop Interactive Portfolio Review Tools: Use interactive wealth management tools for effective reviews in VR investment scenarios.

- Integrate Real-Time Market Data in VR Space: Present up-to-date market data in VR, enhancing virtual reality risk assessment.

- Establish VR Etiquette for Client Meetings: Set guidelines for smooth VR interactions during remote client meetings using VR.

- Use AR to Enhance Physical Document Reviews: Overlay digital information on documents, combining augmented reality financial education with traditional methods.

Let’s dive in to explore how VR technology for client engagement can transform financial advising meetings!

1: Implement 3D financial data visualization

Implementing 3D financial data visualization and VR in financial advising meetings can make complex financial concepts more understandable for your clients.

Actionable Steps:

- Attend a webinar on the latest 3D data visualization tools and virtual reality in financial advising to stay updated on new technologies.

- Collaborate with a tech-savvy team member to integrate 3D models and VR technology for client engagement into your client presentations.

- Use client feedback to refine and improve the 3D visualization experience and immersive financial planning experiences, ensuring they meet client needs.

Explanation: 3D visualization tools and VR in financial advising meetings can significantly enhance client presentations by making data more engaging and easier to understand.

By staying updated on the latest tools, collaborating with knowledgeable team members, and incorporating client feedback, you can create a more effective and interactive experience, including virtual financial consultations and 3D portfolio visualization.

For example, attending webinars like those offered on this platform can keep you informed on the latest advancements in 3D visualization and VR investment scenarios.

This approach not only improves client understanding but also strengthens your advisory services by leveraging cutting-edge technology, such as interactive wealth management tools and virtual reality risk assessment.

2: Create personalized VR meeting environments

Creating personalized VR meeting environments for financial advising can significantly enhance client engagement and satisfaction in virtual reality financial advising sessions.

Actionable Steps:

- Conduct a survey to understand your clients’ preferences for virtual meeting environments in VR financial advising. Gather insights into their interests and needs for immersive financial planning experiences.

- Use VR design software to craft customized meeting spaces tailored to individual client preferences for VR in financial advising meetings. Ensure the spaces reflect their financial goals and enable 3D portfolio visualization.

- Schedule trial runs with select clients to gather feedback on virtual financial consultations and refine the virtual environments based on their suggestions for interactive wealth management tools.

Explanation: These steps are crucial for ensuring that the VR meeting environments meet your clients’ needs and preferences for remote client meetings using VR. Personalized virtual spaces can make clients feel more comfortable and engaged during virtual reality financial advising sessions.

According to a recent report, tailored environments can also enhance understanding and retention of complex financial information. This approach to VR in financial advising meetings can set you apart in a competitive market by offering a unique, client-centric experience with immersive financial planning experiences.

Remember, personalizing your VR meeting environments for financial advising can create a more engaging and effective client interaction, paving the way for better financial advising outcomes through virtual reality risk assessment and VR investment scenarios.

3: Train advisors on VR communication techniques

Training advisors on VR communication techniques is crucial for effective client interactions in a virtual environment, especially when implementing VR in financial advising meetings.

Actionable Steps:

- Enroll in a VR communication skills workshop: Find a workshop that focuses on developing VR-specific communication skills for virtual reality in financial advising and enroll your advisors.

- Pair up advisors for peer-to-peer VR role-playing sessions: Create role-playing scenarios where advisors can practice VR communication and explore immersive financial planning experiences with each other.

- Implement a feedback loop: Establish a system where advisors can share their experiences and tips on VR technology for client engagement, ensuring continuous improvement.

Explanation: These steps ensure advisors are well-prepared for VR interactions, enhancing their ability to communicate effectively in virtual financial consultations.

According to a recent report, proper training in VR communication can significantly improve client engagement and understanding in VR financial advising meetings.

By investing in workshops, encouraging peer practice with interactive wealth management tools, and fostering a feedback culture, you can ensure your team excels in this new medium of VR in financial advising meetings.

Key benefits of VR communication training include:

- Enhanced client engagement and rapport building in virtual reality risk assessments

- Improved ability to explain complex financial concepts using 3D portfolio visualization

- Increased confidence in virtual environments for remote client meetings using VR

This foundation in VR communication will elevate your client meetings, making them more engaging and effective, while leveraging augmented reality financial education techniques.

4: Develop interactive portfolio review tools

Developing interactive portfolio review tools, including VR in financial advising meetings, is essential for making financial data more engaging and understandable for clients.

Actionable Steps:

- Partner with a software developer: Collaborate with a developer to create custom interactive tools tailored to your clients’ needs, such as 3D portfolio visualization and virtual reality risk assessment.

- Beta test these tools with a small group of clients: Identify usability issues by gathering feedback from a select group of clients on immersive financial planning experiences.

- Incorporate client suggestions: Enhance the tool’s functionality based on client feedback to ensure it meets their expectations for virtual financial consultations.

Explanation: Interactive tools, including virtual reality in financial advising, can transform portfolio reviews by making data more engaging and easier to understand.

By partnering with developers, beta testing, and incorporating client feedback, you can create a user-friendly experience for remote client meetings using VR.

According to a recent report, such tools can significantly improve client engagement and satisfaction.

This approach ensures that your tools are effective and tailored to client needs, enhancing your advisory services through VR technology for client engagement.

5: Integrate real-time market data in VR space

Integrating real-time market data in VR space is crucial for providing timely and accurate financial insights to clients during VR in financial advising meetings.

Actionable Steps:

- Subscribe to a real-time market data service: Choose a reputable provider that offers VR integration to ensure seamless data updates for virtual reality in financial advising.

- Train advisors on data interpretation in VR: Conduct training sessions to help advisors understand and present market data effectively in a VR environment, enhancing immersive financial planning experiences.

- Regularly update the VR space: Ensure the VR space reflects the latest market trends and data points to keep clients informed, utilizing interactive wealth management tools.

Explanation: These steps are vital for making real-time market data accessible and understandable in a VR environment. By subscribing to a reliable data service, training advisors, and keeping the VR space updated, you enhance client engagement and decision-making through VR technology for client engagement.

According to a recent report, integrating real-time data in VR can significantly improve client interactions and satisfaction during virtual financial consultations.

Staying current with market trends in a VR setting helps you provide superior advisory services, including 3D portfolio visualization and virtual reality risk assessment.

6: Establish VR etiquette for client meetings

Establishing VR etiquette for client meetings is crucial for ensuring smooth and professional interactions in a virtual environment, especially when using VR in financial advising meetings.

Actionable Steps:

- Develop a VR meeting code of conduct: Collaborate with advisors and clients to create guidelines for behavior and communication in VR meetings, focusing on virtual reality in financial advising.

- Conduct training sessions on VR etiquette: Organize workshops to educate all staff on the established VR meeting code of conduct, emphasizing VR technology for client engagement.

- Create a quick-reference guide for clients: Provide clients with a concise guide outlining VR meeting etiquette to ensure they are comfortable and well-prepared for immersive financial planning experiences.

Explanation: These steps help set clear expectations for both advisors and clients, ensuring a professional and respectful virtual meeting environment for financial consultations.

According to a recent blog, proper training and guidelines can significantly enhance the effectiveness of virtual meetings. Clear etiquette improves client engagement and satisfaction, making the virtual experience more seamless and pleasant, particularly in VR investment scenarios.

Essential VR meeting etiquette guidelines:

- Maintain eye contact with avatars

- Use clear and concise language

- Respect personal space in virtual environments

By establishing and adhering to VR etiquette, you can enhance the professionalism and efficiency of your client interactions, setting the stage for productive and engaging meetings using VR in financial advising meetings.

7: Use AR to enhance physical document reviews

Using AR to enhance physical document reviews can make complex financial information more accessible and engaging for clients, similar to how VR in financial advising meetings can create immersive financial planning experiences.

Actionable Steps:

- Invest in AR glasses or devices: Purchase AR devices that can overlay digital information on physical documents to enhance your presentations, complementing virtual reality in financial advising.

- Train advisors on AR tools: Conduct training sessions to help advisors effectively use AR tools during client meetings, similar to training for VR technology for client engagement.

- Collect client feedback: Gather feedback from clients on the AR-enhanced document review process to make continuous improvements, as you would with virtual financial consultations.

Explanation: These steps ensure that AR technology is effectively integrated into your advisory services, making financial information easier to understand, much like 3D portfolio visualization in VR.

According to a recent report, using AR can significantly improve client engagement and satisfaction, similar to the benefits of VR in financial advising meetings.

By investing in the right tools, training your team, and continuously refining your approach based on client feedback, you can stay ahead in a competitive market, leveraging both AR and VR investment scenarios.

Benefits of AR-enhanced document reviews:

- Improved information retention, similar to virtual reality risk assessment

- Enhanced visual understanding of complex data, akin to interactive wealth management tools

- Increased client engagement during presentations, comparable to remote client meetings using VR

Implementing AR can create a more interactive and effective client experience, enhancing your advisory services, much like augmented reality financial education.

Partner with Alleo on Your VR Integration Journey

We’ve explored the challenges of adopting VR in financial advising meetings, the benefits, and the steps to achieve it. But did you know you can work directly with Alleo to make this journey into virtual reality in financial advising easier and faster?

Alleo, your AI coach and organizer, provides affordable, tailored coaching support for implementing VR technology for client engagement. It offers full coaching sessions like any human coach and a free 14-day trial, requiring no credit card, to help you create immersive financial planning experiences.

Setting up an account with Alleo is simple. Create a personalized plan and start working with Alleo’s coach to overcome specific challenges in integrating 3D portfolio visualization and interactive wealth management tools.

The coach will follow up on your progress with virtual reality risk assessment, handle changes, and keep you accountable via text and push notifications as you explore remote client meetings using VR.

Ready to get started for free with VR in financial advising meetings?

Let me show you how!

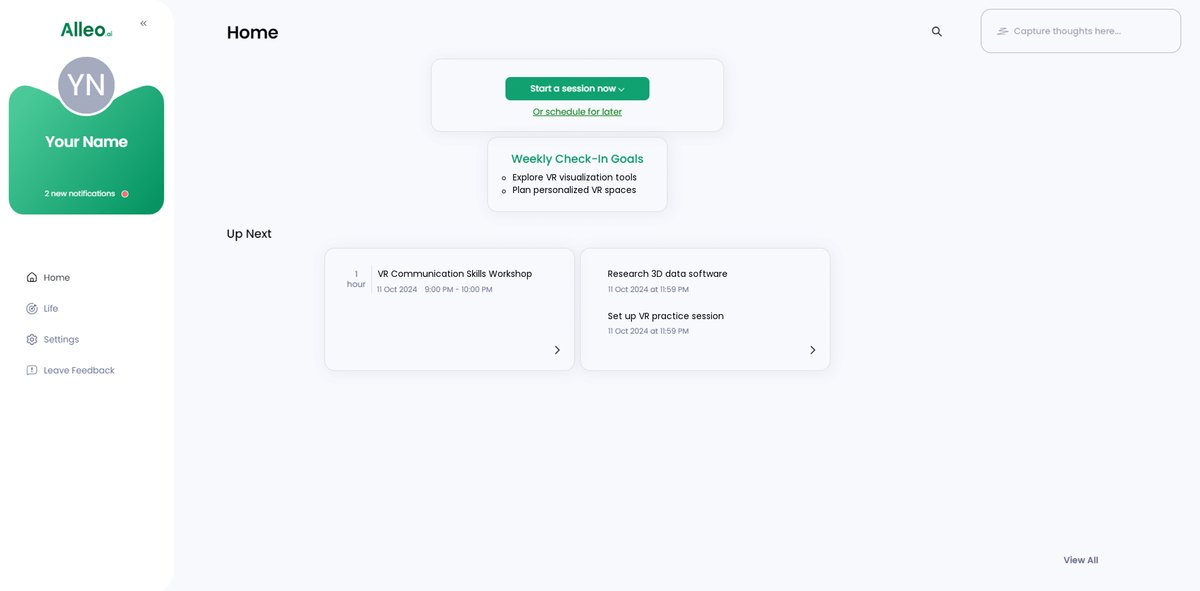

Step 1: Log in or Create Your Alleo Account

To begin your VR integration journey with Alleo, Log in to your account or create a new one to access personalized AI coaching support for implementing VR in your financial advising practice.

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” to align Alleo’s coaching with your VR integration journey, helping you overcome challenges and stay accountable as you implement new technologies in your financial advising practice.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area to align Alleo’s coaching with your goal of integrating VR into financial advising, ensuring personalized guidance to enhance your client interactions and portfolio management skills.

Step 4: Starting a Coaching Session

Begin your VR integration journey by scheduling an intake session with Alleo’s AI coach to create a personalized plan for implementing VR tools in your financial advising practice.

Step 5: Viewing and managing goals after the session

After your coaching session on integrating VR in financial advising, check the Alleo app’s home page to review and manage the goals you discussed, ensuring you stay on track with implementing new VR techniques in your practice.

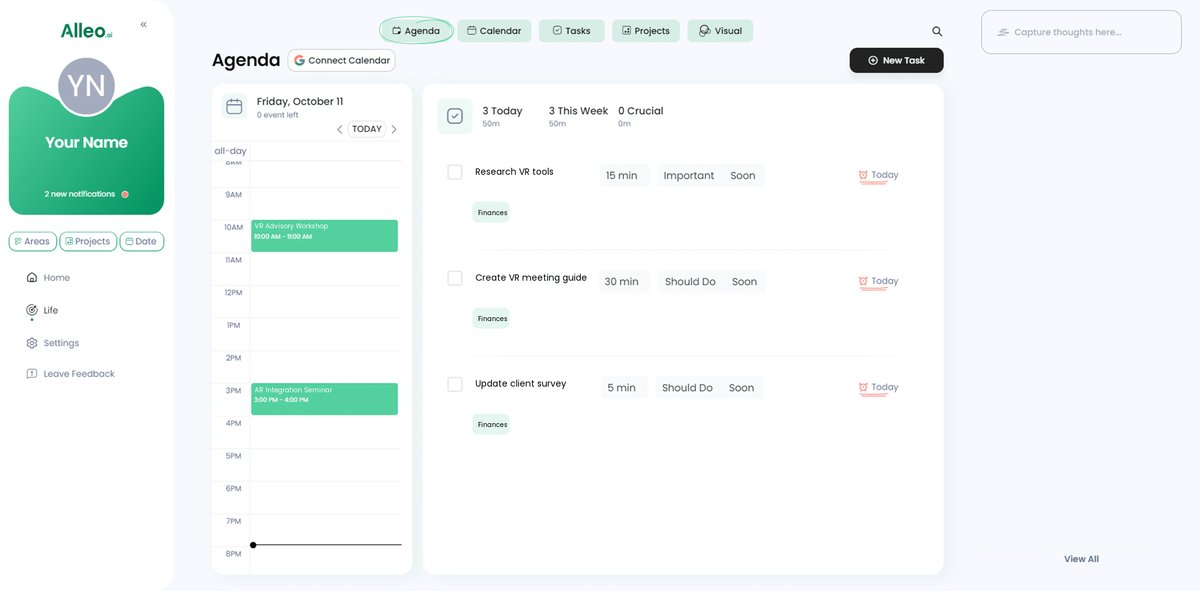

Step 6: Adding events to your calendar or app

Track your progress in implementing VR and AR solutions by adding key milestones and tasks to your calendar or app, allowing you to monitor your advancement and stay accountable as you enhance your financial advising practice with immersive technologies.

Take the Leap with VR in Financial Advising

Bringing it all together, incorporating VR in financial advising meetings can transform client interactions.

I understand the hesitation and challenges of implementing virtual reality in financial advising.

Remember, starting small is key. Implementing even one VR technology for client engagement can make a big difference.

Don’t let the fear of technology hold you back from exploring immersive financial planning experiences.

By following these actionable steps, you can enhance client engagement and portfolio reviews through interactive wealth management tools.

And Alleo is here to support you every step of the way in adopting VR for financial advising meetings.

Start your free trial of Alleo today. Take the leap and elevate your financial advising practice with virtual reality.