5 Proven Strategies to Increase Tech Adoption Rates for Managers

Imagine a world where every new technology instantly boosts productivity without a hitch. Sounds ideal, right? But for financial advisors, the reality of increasing tech adoption is often a bit more complicated.

As a life coach, I’ve helped many professionals navigate these challenges in technology adoption strategies. In my experience, understanding the root causes of resistance is key to overcoming resistance to tech change.

In this blog, we’ll explore actionable strategies to increase financial advisor tech adoption rates. You’ll learn about clear communication, comprehensive training for managers implementing new technologies, empowered champions for digital transformation leadership, phased rollouts, and analytics for measuring tech adoption success.

Let’s dive into these tech adoption best practices for managers.

![]()

Diving Deeper Into the Challenges of Tech Adoption

Many financial advisors initially struggle with the perceived complexity of new technologies when increasing financial advisor tech adoption. This fear often stems from a lack of understanding and inadequate manager training for new technologies.

In my experience, established workflows are another major hurdle in technology adoption strategies. Advisors worry that new systems will disrupt their daily routines, leading to inefficiencies, which is a key concern in change management for tech implementation.

Additionally, the high initial costs of new technology can be daunting. Many hesitate to invest in tools that might not bring immediate returns, highlighting the importance of understanding the ROI of technology adoption.

These challenges make it clear that overcoming resistance to tech change isn’t just about introducing new tech. It requires a comprehensive strategy that addresses these underlying concerns, emphasizing the need for digital transformation leadership.

A Roadmap to Overcome Tech Adoption Challenges

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in increasing financial advisor tech adoption:

- Communicate clear benefits of new technology – Highlight specific benefits relevant to different roles within the organization, emphasizing ROI of technology adoption.

- Provide comprehensive, role-specific training – Ensure users understand how to use the technology effectively with ongoing support, implementing manager training for new technologies.

- Identify and empower tech adoption champions – Select enthusiastic early adopters to lead by example and advocate for the technology, fostering digital transformation leadership.

- Implement a phased rollout with user feedback – Start with pilot programs, gather feedback, and make necessary adjustments, following tech adoption best practices for managers.

- Use analytics to measure and improve adoption – Define clear metrics, analyze data regularly, and adjust strategies based on insights, measuring tech adoption success.

Let’s dive into these technology adoption strategies!

1: Communicate clear benefits of new technology

Communicating the clear benefits of new technology is crucial for increasing financial advisor tech adoption and overcoming resistance to tech change. This approach fosters adoption among financial advisors and supports digital transformation leadership.

Actionable Steps:

- Develop a compelling narrative: Craft a story showing how the technology improves daily tasks and productivity. Use real-life success stories to illustrate the benefits and ROI of technology adoption.

- Regular updates and transparency: Keep communication lines open with frequent updates on progress, benefits, and addressing concerns, which are key tech adoption best practices for managers.

- Tailored benefits presentation: Highlight specific benefits relevant to different roles within the organization, making the technology’s value clear to each user and enhancing employee engagement in tech adoption.

Key benefits of clear communication include:

- Reduced resistance to change

- Increased trust in the technology

- Higher motivation for adoption

Explanation: These steps matter because clear communication helps in reducing resistance and building trust. By tailoring the benefits to specific roles, you ensure that every team member sees the value in the new technology, which is essential for measuring tech adoption success.

For more insights on effective communication strategies, check out this guide on software adoption.

Transitioning to the next step, let’s discuss how to provide comprehensive, role-specific training as part of change management for tech implementation.

2: Provide comprehensive, role-specific training

Providing comprehensive, role-specific training is essential to ensure financial advisors can confidently use new technology, a key factor in increasing financial advisor tech adoption.

Actionable Steps:

- Organize interactive workshops and webinars: Schedule hands-on training sessions tailored to specific roles within the finance team. Ensure participants understand how to use the new technology effectively, implementing change management for tech implementation.

- Offer ongoing support and resources: Set up a knowledge base or help desk. Provide users with access to answers and assistance anytime they need it, supporting digital transformation leadership.

- Establish peer mentoring programs: Implement a system where tech-savvy advisors can support their colleagues. Encourage collaboration and shared learning, enhancing employee engagement in tech adoption.

Explanation: These steps matter because they address the need for continuous learning and support, which is crucial for successful tech adoption and overcoming resistance to tech change.

By tailoring training to specific roles and providing ongoing resources, you help ensure that every team member can use the technology effectively, following tech adoption best practices for managers.

For more insights on effective training strategies, you can refer to this guide on software adoption.

Next, we’ll discuss how to identify and empower tech adoption champions, further increasing financial advisor tech adoption.

3: Identify and empower tech adoption champions

Identifying and empowering tech adoption champions can significantly boost technology adoption rates among financial advisors, playing a crucial role in increasing financial advisor tech adoption.

Actionable Steps:

- Select enthusiastic early adopters: Identify and empower individuals who are enthusiastic about the new technology to lead by example, fostering employee engagement in tech adoption.

- Provide leadership training: Equip these champions with leadership and communication skills to effectively advocate for the technology, supporting digital transformation leadership.

- Recognize and reward champions: Acknowledge the efforts of these champions through rewards or public recognition, incentivizing tech adoption in organizations.

Qualities to look for in tech adoption champions:

- Enthusiasm for new technology

- Strong communication skills

- Influence among peers

Explanation: These steps matter because champions can influence their peers and drive adoption through positive reinforcement, which is key to overcoming resistance to tech change.

By providing leadership training and recognizing their efforts, you ensure these champions are effective and motivated, aligning with tech adoption best practices for managers.

For more insights on empowering champions, visit this guide.

Next, we’ll discuss how to implement a phased rollout with user feedback, an essential technology adoption strategy.

4: Implement a phased rollout with user feedback

Implementing a phased rollout with user feedback is vital for increasing financial advisor tech adoption and ensuring smooth technology adoption.

Actionable Steps:

- Start with pilot programs: Select a small group of users to test the technology. Gather their feedback and make necessary adjustments before expanding, following tech adoption best practices for managers.

- Incremental implementation: Roll out the technology in stages. This allows users to adapt gradually and receive ample support at each phase, which is crucial for change management for tech implementation.

- Continuous feedback loops: Regularly collect and act on user feedback. This helps address any issues and improve the implementation process, enhancing employee engagement in tech adoption.

Explanation: These steps matter because they enable a controlled, manageable transition to new technology, which is essential for digital transformation leadership.

Pilot programs and phased rollouts minimize disruption while continuous feedback ensures the process stays user-focused, helping in overcoming resistance to tech change.

For more insights on effective phased rollouts, check out this guide on software adoption.

Next, we’ll discuss how to use analytics to measure and improve adoption, which is crucial for measuring tech adoption success.

5: Use analytics to measure and improve adoption

Using analytics to measure and improve adoption is crucial for tracking progress and making informed decisions when increasing financial advisor tech adoption.

Actionable Steps:

- Establish key metrics: Define metrics such as usage rates and user satisfaction to monitor adoption progress and measure tech adoption success.

- Regular analysis and reporting: Analyze data regularly to identify trends, improvement areas, and success stories in technology adoption strategies.

- Adjust strategies based on data: Use insights from the data to tweak your approach, ensuring continuous improvement in adoption rates and ROI of technology adoption.

Key metrics to track for technology adoption:

- User engagement rates

- Task completion times

- Support ticket volume

Explanation: These steps matter because they provide a clear picture of how well the technology is being adopted and highlight areas needing attention in digital transformation leadership.

By regularly analyzing and adjusting strategies, you ensure ongoing success in overcoming resistance to tech change.

For more insights, refer to this guide on software adoption.

Next, let’s discuss how Alleo can assist with these strategies for increasing financial advisor tech adoption.

Partner with Alleo to Boost Tech Adoption

We’ve explored the challenges of increasing financial advisor tech adoption and the steps to overcome them. Did you know you can work directly with Alleo to make this journey easier and faster?

Setting up an account with Alleo is simple. Create a personalized plan tailored to your needs with just a few clicks, incorporating technology adoption strategies for your organization.

Alleo’s AI coach will guide you through overcoming specific challenges, like user resistance and training gaps in tech adoption. The coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications, supporting your digital transformation leadership.

Ready to get started for free and boost your tech adoption success?

Let me show you how to implement tech adoption best practices for managers!

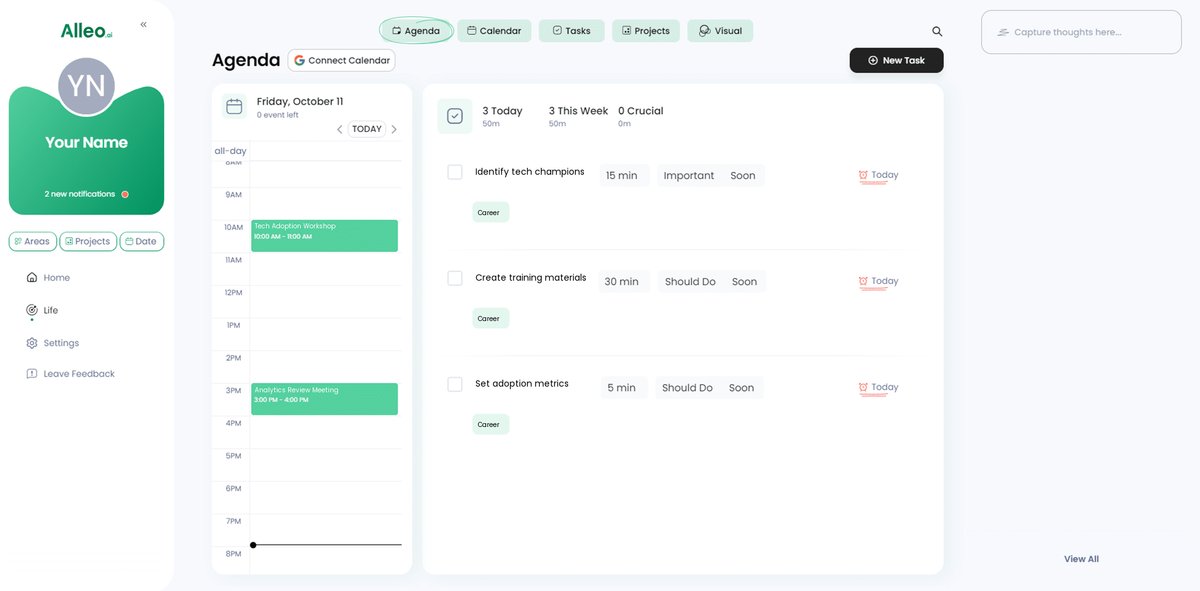

Step 1: Log In or Create Your Account

To begin your journey towards improved tech adoption, log in to your existing Alleo account or create a new one in just a few clicks.

Step 2: Choose Your Focus Area

Click on “Setting and achieving personal or professional goals” to align the AI coach with your tech adoption challenges, helping you overcome resistance and boost implementation success in your financial advisory practice.

Step 3: Select “Career” as Your Focus Area

Choose “Career” as your focus area to address tech adoption challenges in your financial advisory role, aligning with the strategies discussed for improving productivity and efficiency in your professional life.

Step 4: Starting a coaching session

Begin your tech adoption journey with an intake session through Alleo’s AI coach, where you’ll collaboratively set up a personalized plan to address your specific challenges and goals.

Step 5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to view and manage the goals you discussed, making it easy to track your progress in boosting tech adoption rates among your financial advisors.

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to easily add and track events related to your tech adoption journey, allowing you to monitor your progress and stay accountable as you implement the strategies discussed in this article.

Wrapping It All Up: Your Journey to Tech Adoption Success

We’ve covered a lot, haven’t we? Remember, understanding and addressing resistance is key to increasing financial advisor tech adoption.

By communicating clear benefits, providing role-specific training, and empowering champions, you can make a big difference in overcoming resistance to tech change.

Implementing phased rollouts and using analytics will help you track progress and measure tech adoption success.

I know it can be challenging, but with these technology adoption strategies, you’re on the right path to digital transformation leadership.

And don’t forget, Alleo is here to support you every step of the way in your journey to increasing financial advisor tech adoption.

Start implementing these tech adoption best practices for managers and watch your team flourish.

Why wait? Try Alleo for free today and boost your tech adoption rates effortlessly, improving your ROI of technology adoption.