Financial Advisors: The Ultimate Guide to Mastering Fintech Tools for Enhanced Client Management

Are you struggling to keep up with the latest fintech tools for financial advisors in client management?

As a life coach, I’ve helped many financial advisors navigate these challenges. In my experience, adapting to new software and apps, including client relationship management software and digital portfolio management tools, can significantly enhance your practice.

In this article, we’ll explore actionable strategies to master these financial technology tools for wealth management, from conducting a needs assessment to integrating AI-powered financial forecasting solutions. You’ll also discover the benefits of targeted training and practice with automated financial planning platforms and data analytics for financial advisors.

Let’s dive in.

Navigating the Technical Skills Gap

Many financial advisors face a significant challenge: the technical skills gap. Adapting to new fintech tools for financial advisors, including software and apps for digital portfolio management tools, client communication, and regulatory compliance is essential yet daunting.

In my experience, people often find that outdated tools hinder efficiency and client satisfaction. Imagine struggling to keep track of client interactions because your client relationship management software is clunky and outdated.

This is more common than you might think. Advisors frequently report frustration with financial technology for wealth management that doesn’t integrate seamlessly, leading to wasted time and effort.

This gap not only impacts productivity but also client trust.

You don’t have to face these challenges alone. By embracing new fintech tools for financial advisors and continuous learning, you can turn this struggle into an opportunity for growth.

Key Steps to Master New Fintech Tools for Financial Advisors

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress with fintech tools for financial advisors.

- Assess and prioritize key fintech tools: Identify gaps in your technology stack and select the best financial technology for wealth management.

- Enroll in targeted online training courses: Gain skills by signing up for relevant courses and webinars on digital portfolio management tools.

- Practice with demo versions of chosen tools: Test fintech tools for financial advisors in a sandbox environment to refine your usage.

- Integrate AI-powered meeting support tools: Use AI-powered financial forecasting to enhance meeting preparation and follow-up.

- Implement a cloud-based CRM system: Migrate data and train your team on a new client relationship management software.

- Use risk assessment software for portfolios: Enhance decision-making with personalized risk profiles using automated financial planning platforms.

- Adopt values-based investing platforms: Align portfolios with client values through specialized platforms, considering robo-advisor integration.

Let’s dive in!

1: Assess and prioritize key fintech tools for financial advisors

Identifying and prioritizing the right fintech tools for financial advisors is crucial for enhancing client management and operational efficiency in wealth management.

Actionable Steps:

- Conduct a thorough needs assessment: Evaluate your current technology stack to identify gaps and areas for improvement in financial technology for wealth management.

- Research and compile potential tools: Create a list of fintech tools that align with your identified needs, such as client relationship management software and digital portfolio management tools, and have positive reviews.

- Prioritize based on impact: Rank these fintech tools for financial advisors by their potential to improve client management and efficiency, considering options like robo-advisor integration and automated financial planning platforms.

Explanation:

Taking these steps ensures you invest in fintech tools that will provide the most value to your practice. For example, a thorough needs assessment can reveal gaps in your current setup, and researching tools can help you find the best solutions, including data analytics for financial advisors.

Prioritizing tools based on their impact helps streamline operations and improve client satisfaction. For more detailed guidance, you can refer to this Investopedia article on the best tools for financial advisors.

Key benefits of assessing and prioritizing fintech tools for financial advisors:

- Optimizes resource allocation

- Enhances operational efficiency

- Improves client satisfaction

These initial steps set the foundation for successfully integrating new fintech tools into your practice, including mobile apps for client communication and AI-powered financial forecasting.

2: Enroll in targeted online training courses

Enrolling in targeted online training courses is essential for mastering new fintech tools for financial advisors and staying competitive in wealth management.

Actionable Steps:

- Sign up for relevant courses: Choose online courses that focus on the high-priority fintech tools identified in your needs assessment, such as client relationship management software and digital portfolio management tools.

- Schedule regular study sessions: Allocate specific time slots each week for studying and practicing new skills related to financial technology for wealth management.

- Engage in webinars and workshops: Participate in webinars and virtual workshops to gain hands-on experience with data analytics for financial advisors and network with peers.

Explanation:

These steps ensure you gain the necessary skills to effectively use new fintech tools for financial advisors. Regular study sessions help you stay consistent, while webinars offer practical insights into automated financial planning platforms and networking opportunities.

For example, many financial advisors find value in targeted learning through courses and webinars that enhance their expertise in areas like robo-advisor integration and AI-powered financial forecasting. By continuously learning about fintech tools, you stay ahead of industry trends and improve client satisfaction.

These training efforts will prepare you for the next step in mastering fintech tools for financial advisors.

3: Practice with demo versions of chosen tools

Practicing with demo versions of fintech tools for financial advisors allows you to explore features without committing financially.

Actionable Steps:

- Register for trial periods: Sign up for demo versions of your shortlisted financial technology for wealth management to test their features.

- Create a sandbox environment: Set up a controlled space to experiment with digital portfolio management tools and assess their functionalities.

- Gather feedback: Ask colleagues or mentors for their input on the client relationship management software to refine your usage.

Explanation:

These steps help you gain hands-on experience with fintech tools for financial advisors and ensure they meet your needs.

By gathering feedback, you can make informed decisions about full adoption of automated financial planning platforms.

For a comprehensive list of tools to consider, check out this Investopedia article on the best tools for financial advisors.

This practical exploration prepares you for effective integration of fintech tools for financial advisors into your workflow.

4: Integrate AI-powered meeting support tools

Integrating AI-powered meeting support tools, a key component of fintech tools for financial advisors, can significantly enhance your efficiency by streamlining meeting preparation and follow-up.

Actionable Steps:

- Select a suitable AI tool: Choose an AI-powered tool that aligns with your meeting protocols, client needs, and enhances your financial technology for wealth management.

- Customize settings: Adjust the tool’s settings to match your workflow and ensure it captures essential details, similar to how you’d set up client relationship management software.

- Monitor performance: Regularly review the tool’s effectiveness and make necessary adjustments to optimize its use, much like you would with digital portfolio management tools.

Explanation:

These steps help you make the most of AI tools, improving your workflow and client satisfaction. By customizing and monitoring the tool, you ensure it meets your needs and enhances productivity, similar to how automated financial planning platforms function.

For more insights on integrating AI in financial services, check out this resource on hyper-personalization in financial advice.

Implementing AI-powered meeting support tools, a crucial aspect of fintech tools for financial advisors, prepares you for the next step in enhancing client management.

5: Implement a cloud-based CRM system

Implementing a cloud-based CRM system is crucial for efficient client management and seamless integration with other fintech tools for financial advisors.

Actionable Steps:

- Choose a robust CRM: Select a cloud-based CRM that offers comprehensive features and integrates well with your existing financial technology for wealth management.

- Migrate existing data: Transfer your current client data to the new client relationship management software with a focus on ensuring data accuracy and completeness.

- Train your team: Conduct workshops and provide ongoing support to help your team effectively use the new CRM system and other fintech tools for financial advisors.

Explanation:

These steps ensure a smooth transition to a cloud-based CRM, boosting your practice’s efficiency and client satisfaction.

For instance, selecting a robust CRM can streamline your operations and enhance client interactions. Additionally, training your team is essential for maximizing the CRM’s potential and leveraging other digital portfolio management tools.

For more insights, check out this Investopedia article on top software programs used by financial advisors.

Key advantages of cloud-based CRM systems:

- Centralized client data management

- Enhanced collaboration among team members

- Improved client communication and follow-ups

Transitioning to a cloud-based CRM system sets the stage for improved client management and operational efficiency in wealth management.

6: Use risk assessment software for portfolios

Using risk assessment software for portfolios is crucial for enhancing decision-making and tailoring investment strategies. As one of the essential fintech tools for financial advisors, it plays a key role in digital portfolio management.

Actionable Steps:

- Identify a suitable risk assessment tool: Choose a software that aligns with your firm’s investment strategy and goals, considering options within financial technology for wealth management.

- Incorporate the tool into your review process: Use it to evaluate client risk tolerance and adjust portfolios accordingly, integrating it with your client relationship management software.

- Create personalized risk profiles: Tailor investment strategies based on the software’s analysis to meet individual client needs, leveraging data analytics for financial advisors.

Explanation:

These steps help you leverage fintech tools for financial advisors to make informed decisions and provide personalized advice. By incorporating a risk assessment tool, you can enhance your portfolio management process and complement automated financial planning platforms.

For more insights, check out this Investopedia article on top software programs used by financial advisors.

Integrating such tools ensures you stay competitive and meet client expectations in the evolving landscape of financial technology for wealth management.

7: Adopt values-based investing platforms

Adopting values-based investing platforms, a key component of fintech tools for financial advisors, allows you to align portfolios with your clients’ values, enhancing personalization and satisfaction.

Actionable Steps:

- Select a platform that aligns with client preferences: Choose a values-based investing platform that supports the values and goals of your clients, leveraging digital portfolio management tools.

- Educate clients on the platform’s benefits: Explain how values-based investing aligns with their financial and ethical goals, enhancing their investment experience through financial technology for wealth management.

- Regularly review and adjust portfolios: Continuously monitor and update portfolios using data analytics for financial advisors to ensure they meet clients’ evolving values and objectives.

Explanation:

These steps are crucial for providing personalized investment strategies that resonate with your clients’ values. By selecting the right fintech tools for financial advisors and educating your clients, you enhance their investment experience and satisfaction.

Continuous portfolio review ensures alignment with clients’ evolving goals. For more insights, explore this resource on values-based investing platforms.

Benefits of values-based investing:

- Increased client engagement and loyalty

- Alignment of financial goals with personal values

- Potential for positive societal impact

This approach, supported by fintech tools for financial advisors, will help you meet and exceed client expectations, fostering long-term relationships.

Partner with Alleo to Master Fintech Tools

We’ve explored the challenges of mastering new fintech tools for financial advisors, their benefits, and the steps to achieve success. But did you know you can work directly with Alleo to make this journey easier and faster?

Set up an Alleo account in minutes. Create a personalized plan tailored to your specific needs, including financial technology for wealth management and client relationship management software.

Work with Alleo’s AI coach to bridge your technology skills gap, including mastering digital portfolio management tools and robo-advisor integration. The coach will keep you accountable with text and push notifications.

It also handles changes and tracks your progress in adopting automated financial planning platforms and data analytics for financial advisors.

Ready to get started for free with fintech tools for financial advisors? Let me show you how!

Step 1: Logging in or Creating an Account

To begin your journey with Alleo’s AI coach, simply Log in to your account or create a new one if you’re a first-time user.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to focus on developing consistent practices for mastering new fintech tools, which will help you overcome the technical skills gap and enhance your client management efficiency.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to align with your goal of mastering fintech tools for client management, enabling Alleo’s AI coach to provide targeted guidance on improving your financial advisory skills and technology adoption.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll collaborate with our AI coach to create a personalized plan for mastering fintech tools and enhancing your financial advisory practice.

Step 5: Viewing and managing goals after the session

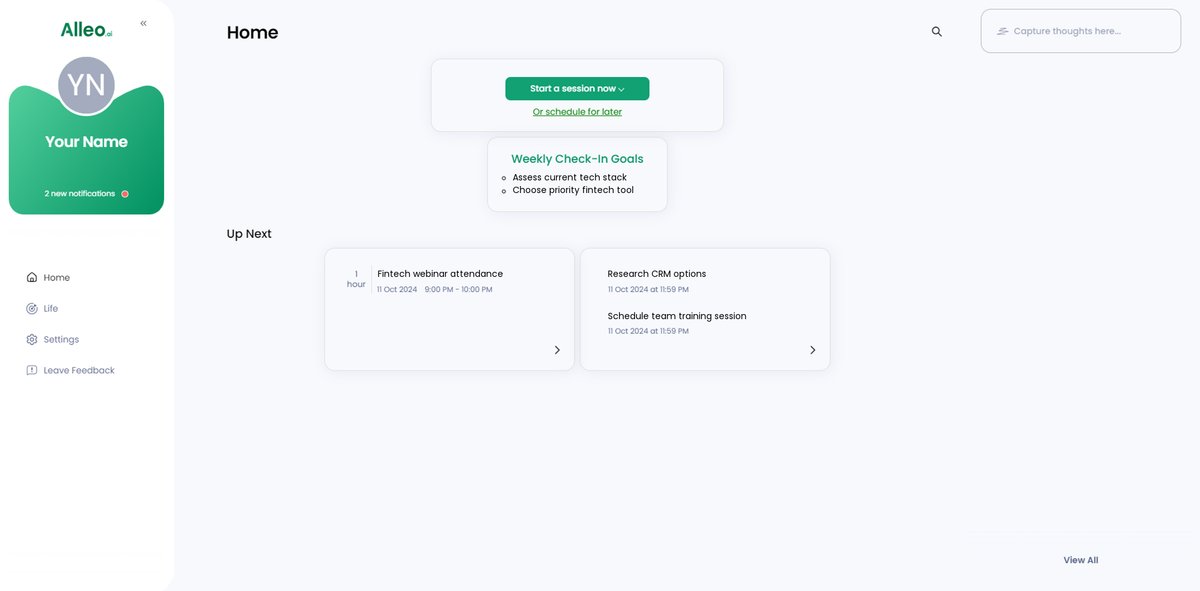

After your coaching session, open the Alleo app to find your discussed goals conveniently displayed on the home page, where you can easily track and manage your progress towards mastering new fintech tools.

Step 6: Adding events to your calendar or app

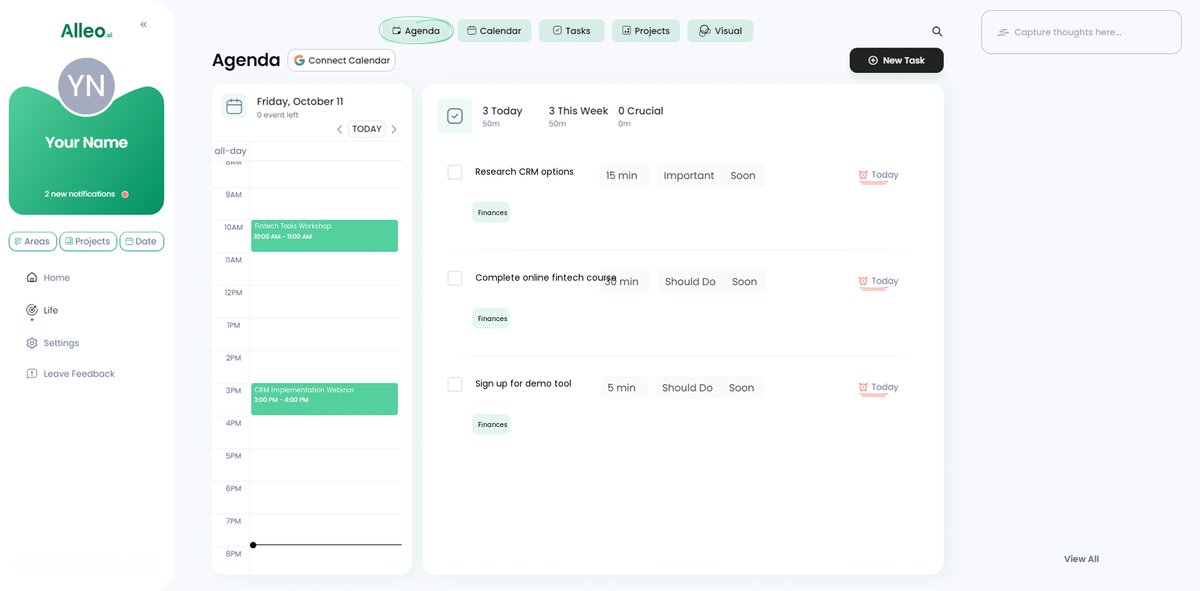

Use the calendar and task features in the Alleo app to schedule and track your progress in mastering new fintech tools, ensuring you stay on top of your learning journey and can easily monitor your advancement in bridging the technology skills gap.

Wrapping Up Your Fintech Journey

As we conclude, remember that mastering new fintech tools for financial advisors can transform your practice. It’s a journey worth taking in the realm of financial technology for wealth management.

Empathizing with the technical skills gap, I’ve shared actionable steps to bridge it. By assessing, prioritizing, and integrating these tools, including client relationship management software and digital portfolio management tools, you can enhance client management and operational efficiency.

Remember, continuous learning and practice are key. Don’t shy away from enrolling in training courses and using demo versions of tools, such as automated financial planning platforms and data analytics for financial advisors.

Finally, adopting AI-powered financial forecasting solutions and values-based investing platforms can elevate your client offerings in the fintech landscape.

Ready to take the next step in your fintech journey? Try Alleo for free today and make your exploration of fintech tools for financial advisors smoother.