3 Powerful Strategies for Financial Advisors to Stay Ahead of Fintech Trends and Elevate Client Service

Are you struggling to keep up with the latest fintech trends and their impact on your client portfolios? As financial advisors, fintech strategies are becoming increasingly crucial in today’s digital landscape.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, staying updated on technology is crucial for financial advisors. This includes understanding fintech innovations in wealth management and exploring digital tools for financial planning.

In this article, you’ll discover strategies to stay ahead in the fintech landscape. We’ll explore community engagement, continuous learning, and leveraging AI-driven investment strategies. From blockchain in financial advisory services to robo-advisors and human advisors collaboration, we’ll cover key aspects of financial advisors’ fintech strategies.

Let’s dive in.

The Challenge of Keeping Up with Fintech Trends

Navigating the rapidly evolving world of fintech can be daunting for financial advisors. Many clients initially struggle with the speed at which new technologies emerge, including fintech innovations in wealth management.

This constant evolution impacts investment strategies and client portfolios, making it hard for financial advisors to stay ahead with fintech strategies.

Falling behind in technology adoption can have significant consequences. Financial advisors risk losing clients to more tech-savvy competitors who leverage digital tools for financial planning.

Moreover, outdated methods can lead to inefficiencies and missed opportunities in portfolio management, especially when it comes to AI-driven investment strategies.

In my experience, financial advisors often find it challenging to integrate new tools into their practice. You need to balance learning about new technologies, such as blockchain in financial advisory services, while maintaining high levels of client service.

It’s a tough balancing act, but essential for success in developing effective financial advisors fintech strategies.

Effective Strategies to Stay Ahead in Fintech

Overcoming this challenge requires a few key steps. Here are the main areas for financial advisors’ fintech strategies to focus on to make progress:

- Join fintech communities and online forums: Engage in discussions and network with professionals on platforms like Reddit’s r/fintech to stay updated on fintech innovations in wealth management.

- Attend webinars on AI and blockchain in finance: Register for events hosted by reputable organizations to learn about the latest trends in AI-driven investment strategies and blockchain in financial advisory services.

- Use AI-powered tools to automate client tasks: Implement AI tools to streamline your workflow and improve efficiency in digital tools for financial planning.

Let’s dive into these financial advisors’ fintech strategies!

1: Join fintech communities and online forums

Joining fintech communities and online forums is essential for financial advisors seeking fintech strategies to stay updated on industry trends and network with peers.

Actionable Steps:

- Identify and join relevant online forums: Search for and join forums like Reddit’s r/fintech and LinkedIn groups focusing on fintech innovations in wealth management. Aim to join at least three communities.

- Engage in discussions and network: Participate actively by sharing experiences, asking questions about digital tools for financial planning, and providing advice. Set a goal to contribute to three discussions weekly.

- Follow industry leaders: Use social media to follow at least five industry experts in AI-driven investment strategies and interact with their content regularly.

Explanation:

Participating in fintech communities allows financial advisors to stay informed about the latest trends and innovations in financial technology. Engaging with professionals and industry leaders helps you gain diverse insights and practical knowledge on topics like blockchain in financial advisory services.

For instance, joining forums like Kitces can provide significant value and networking opportunities for financial advisors exploring fintech strategies. This engagement ensures you stay ahead in the rapidly evolving fintech landscape, including areas like robo-advisors and human advisors collaboration.

Key benefits of joining fintech communities include:

- Access to insider knowledge and trends on cybersecurity in financial advisory firms

- Opportunities for collaboration and partnerships in developing mobile apps for client portfolio management

- Exposure to diverse perspectives and problem-solving approaches in big data analytics for financial advising

Engaging with these communities is a proactive step towards enhancing your professional growth and staying competitive in implementing financial advisors fintech strategies.

2: Attend webinars on AI and blockchain in finance

Attending webinars on AI and blockchain in finance is crucial for financial advisors’ fintech strategies to stay ahead in the fintech landscape.

Actionable Steps:

- Register for upcoming webinars and virtual conferences: Look for events hosted by reputable organizations like the Financial Technology Association. Aim to attend at least one webinar per month focusing on fintech innovations in wealth management and digital tools for financial planning.

- Take detailed notes and summarize key takeaways: Focus on practical applications of AI-driven investment strategies and blockchain in financial advisory services. Create a summary document for each webinar to refer back to and share with colleagues.

- Apply learnings through small-scale projects or experiments: Implement new tools or strategies learned during webinars in your practice, such as robo-advisors and human advisors collaboration. Track results and adjust based on feedback and outcomes.

Explanation:

Attending webinars keeps financial advisors updated on the latest fintech trends and their practical applications. By actively participating, you gain insights that can improve your client service through personalized financial solutions through fintech.

According to Artsyl Technologies, AI and blockchain are pivotal in fintech innovations, making these webinars invaluable. Engaging in these learning activities ensures you stay competitive and informed in a rapidly evolving industry, including areas like cybersecurity in financial advisory firms and big data analytics in financial advising.

Incorporating these steps into your routine will help you stay ahead in the fintech landscape and enhance your financial advisors’ fintech strategies.

3: Use AI-powered tools to automate client tasks

Incorporating AI-powered tools can significantly enhance your efficiency and client service, making it a crucial financial advisors fintech strategy.

Actionable Steps:

- Evaluate and select AI tools that fit your practice: Compare features, pricing, and user reviews to make an informed decision. Start with tools for meeting agendas and marketing material generation, focusing on fintech innovations in wealth management.

- Integrate chosen tools into your daily workflow: Begin with one or two tools to avoid overwhelming your team. Monitor performance and make necessary adjustments, particularly in AI-driven investment strategies.

- Train your team on using these tools effectively: Conduct regular training sessions and provide resources for ongoing learning. Measure success by improved efficiency and client satisfaction, especially in robo-advisors and human advisors collaboration.

Explanation:

Using AI tools helps streamline tasks and improve efficiency, allowing you to focus more on client relationships and personalized financial solutions through fintech.

According to RipenApps, AI in fintech offers scalability, automation, and data-driven insights. These benefits are crucial for staying competitive and delivering superior client service in the realm of financial advisors fintech strategies.

Consider these AI-powered tools for your fintech practice:

- Automated portfolio rebalancing software

- Chatbots for customer support and inquiries

- Predictive analytics for risk assessment and big data analytics in financial advising

Embracing AI-powered tools will help you stay ahead in the rapidly evolving fintech landscape, particularly in digital tools for financial planning and mobile apps for client portfolio management.

Partner with Alleo to Stay Ahead in Fintech

We’ve explored the challenges of staying updated on fintech trends and the steps to overcome them. But did you know you can work directly with Alleo to make this journey easier and faster for financial advisors seeking fintech strategies?

Setting up an account with Alleo is simple. Start by creating a personalized plan tailored to your needs, incorporating the latest fintech innovations in wealth management.

Alleo’s AI coach will guide you through mastering fintech trends, providing actionable advice and support on digital tools for financial planning and AI-driven investment strategies.

The coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications, ensuring you stay informed about blockchain in financial advisory services and cybersecurity in financial advisory firms.

Ready to get started for free? Let me show you how to leverage fintech strategies for financial advisors!

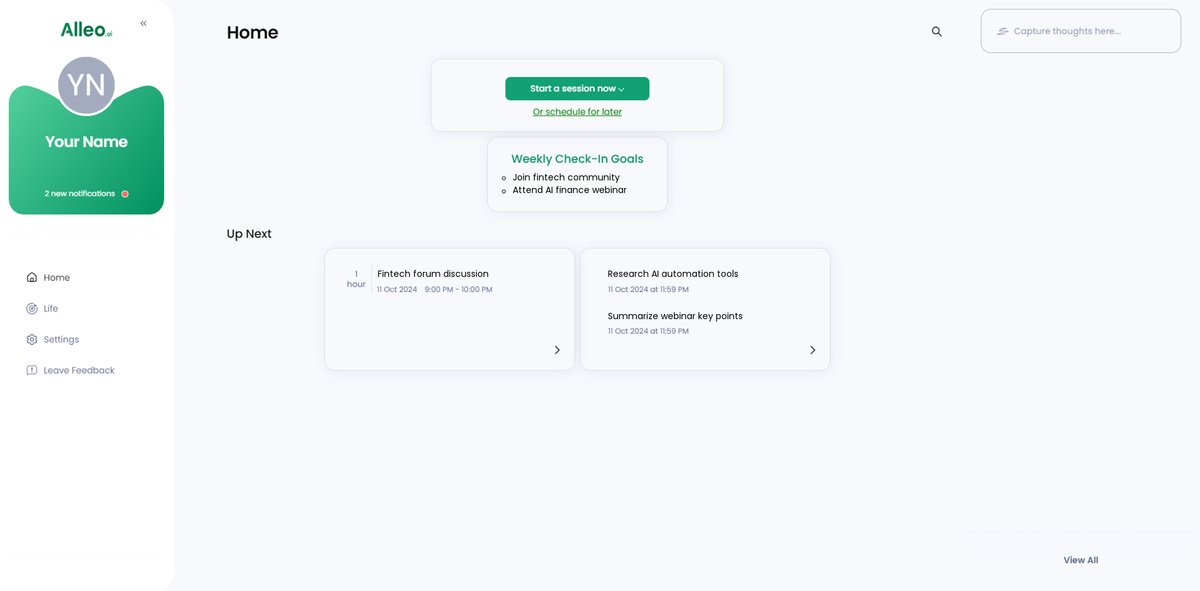

Step 1: Log In or Create Your Alleo Account

To start your fintech journey with Alleo, simply Log in to your account or create a new one to access personalized guidance on staying ahead in the rapidly evolving fintech landscape.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to establish a consistent system for staying updated on fintech trends, which will help you integrate new technologies into your practice more effectively and maintain your competitive edge in the rapidly evolving financial advisory landscape.

Step 3: Select “Career” as Your Focus Area

Choose “Career” as your life area to focus on improving your fintech knowledge and skills, helping you stay competitive in the rapidly evolving financial advisory landscape and better serve your clients.

Step 4: Starting a Coaching Session

Begin your fintech journey with Alleo by scheduling an intake session, where our AI coach will help you create a personalized plan to stay ahead of industry trends and enhance your client service.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the app’s home page to review and manage the fintech-related goals you discussed, allowing you to track your progress in staying updated on industry trends and implementing new technologies in your practice.

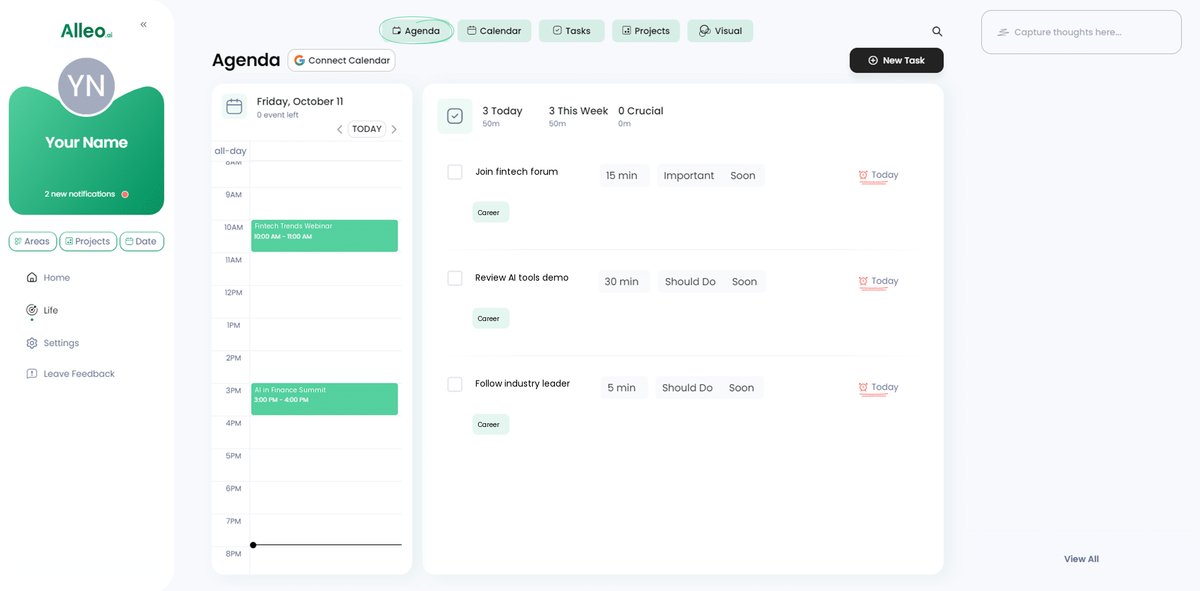

Step 6: Adding Events to Your Calendar or App

Use the Alleo app’s calendar and task features to schedule and track your fintech learning activities, such as webinars, community discussions, and AI tool experiments, ensuring you stay on top of your professional development and measure your progress in mastering the latest financial technologies.

Empowering Your Fintech Journey

Taking control of your fintech knowledge is crucial for financial advisors. Fintech strategies can help you stay ahead by focusing on community engagement, continuous learning, and AI-driven investment strategies.

Remember, these digital tools for financial planning are here to support you. You don’t have to navigate the world of fintech innovations in wealth management alone.

With Alleo, you have a partner to guide you through this evolving landscape of financial advisors’ fintech strategies.

Take the first step today.

Create your personalized plan with Alleo and transform your client service with the power of technology, including mobile apps for client portfolio management.

Stay proactive, stay informed, and elevate your practice with cutting-edge financial advisors’ fintech strategies.