4 Powerful Strategies for Financial Advisors to Handle Difficult Client Conversations with Confidence

Are you struggling with handling difficult client conversations confidently as a financial advisor?

As a life coach, I’ve seen many professionals face these challenges in client communication strategies.

In this post, you’ll learn proven strategies to handle difficult client conversations confidently. We’ll explore how to build empathy, communicate clearly, and manage stress effectively, focusing on emotional intelligence for financial advisors and active listening techniques.

By following these steps, you’ll strengthen your client relationships, boost satisfaction, and improve your skills in navigating sensitive financial topics.

Let’s dive into managing client expectations and conflict resolution in financial advising.

Understanding the Challenge of Difficult Conversations

Handling difficult client conversations confidently can be daunting. Many of my clients initially struggle with maintaining composure and confidence when navigating sensitive financial topics.

Deflecting these conversations can lead to a loss of trust and client satisfaction. This is why it’s crucial to face these challenges head-on, utilizing effective client communication strategies.

For instance, several clients report feeling overwhelmed when discussing portfolio losses. In my experience, avoiding these discussions only exacerbates the problem. Active listening techniques and emotional intelligence for financial advisors are key in these situations.

Let’s explore why overcoming this tendency is so important. By addressing these issues directly, you can build stronger, more resilient client relationships, effectively managing client expectations.

Trust me, it’s worth the effort to develop professional communication skills for advisors.

Steps to Confidently Handle Difficult Client Conversations

Handling difficult client conversations confidently requires a few key steps. Here are the main areas to focus on to make progress in managing client expectations and improving client communication strategies.

- Practice active listening and empathy techniques: Schedule regular practice sessions to improve these skills, enhancing your emotional intelligence for financial advisors.

- Develop a toolkit of clear communication strategies: Create scripts and attend workshops to build professional communication skills for advisors.

- Roleplay difficult scenarios with colleagues: Organize roleplay sessions and review recordings to prepare for navigating sensitive financial topics.

- Implement stress management and self-care routines: Establish daily routines and seek professional support if needed to maintain composure when handling client objections in finance.

Let’s dive into these strategies for handling difficult client conversations confidently!

1: Practice active listening and empathy techniques

Developing active listening and empathy techniques is crucial for handling difficult client conversations confidently and managing client expectations effectively.

Actionable Steps:

- Schedule regular practice sessions to improve these skills.

- Consistently practice reflective listening to confirm understanding and summarize client concerns, enhancing your professional communication skills for advisors.

- Participate in empathy-building activities.

- Engage in role-playing exercises focusing on empathetic responses and keep a journal of client interactions to boost your emotional intelligence for financial advising.

- Seek feedback from clients and colleagues.

- Conduct anonymous surveys to gather feedback on your listening and empathy skills and track progress in navigating sensitive financial topics.

Explanation: These steps are vital because they help build trust with financial clients and show clients you genuinely care about their concerns. Reflective listening and empathy are essential in fostering strong client relationships and handling difficult client conversations confidently.

According to a recent study, emotional support and clear communication are crucial in caregiving planning, which translates well into financial advising and wealth management.

Key benefits of active listening and empathy:

- Builds stronger client relationships

- Increases client trust and loyalty

- Improves problem-solving capabilities and conflict resolution in financial advising

Enhancing your listening and empathy skills will set the foundation for successful client interactions and help in handling client objections in finance more effectively.

2: Develop a toolkit of clear communication strategies

Developing a toolkit of clear communication strategies is essential for handling difficult client conversations confidently in financial advising.

Actionable Steps:

- Create scripts for common difficult conversations in wealth management.

- Develop templates for discussing sensitive financial topics like market volatility and portfolio losses.

- Use key phrases and questions that promote clarity and understanding, enhancing client communication strategies.

- Attend communication workshops and training sessions to improve professional communication skills for advisors.

- Enroll in courses focusing on clear communication and conflict resolution in financial advising.

- Apply learned techniques in everyday client interactions to enhance your skills in managing client expectations.

- Utilize visual aids and tools for navigating sensitive financial topics.

- Use charts, graphs, and other visuals to simplify complex financial information when handling difficult client conversations confidently.

- Explain the relevance and application of these tools to ensure client understanding and build trust with financial clients.

Explanation: These steps are crucial as they help financial advisors communicate more effectively, reducing misunderstandings and building trust with financial clients.

Clear communication is vital in maintaining strong client relationships and ensuring client satisfaction while handling client objections in finance.

According to a recent study, effective communication significantly impacts client retention and referrals.

By developing a toolkit of clear communication strategies, you can navigate difficult conversations in wealth management with ease, employing emotional intelligence for financial advisors and active listening techniques.

3: Roleplay difficult scenarios with colleagues

Roleplaying difficult scenarios with colleagues is essential for building confidence and honing your skills in handling difficult client conversations confidently.

Actionable Steps:

- Organize regular roleplay sessions.

- Collaborate with colleagues to simulate challenging client conversations and practice conflict resolution in financial advising.

- Rotate roles to gain different perspectives and insights on managing client expectations.

- Analyze and debrief after each roleplay.

- Discuss what went well and areas for improvement in client communication strategies.

- Incorporate constructive feedback into future practice sessions to enhance professional communication skills for advisors.

- Record and review roleplay sessions.

- Use video recording to capture and review interactions, focusing on active listening techniques.

- Identify body language, tone, and phrasing that can be improved when handling difficult client conversations confidently.

Explanation: Practicing with colleagues helps you prepare for real client interactions, reducing anxiety and improving response strategies for navigating sensitive financial topics.

Regular roleplay sessions enable you to refine your approach and build confidence in handling difficult conversations in wealth management.

According to a recent article, powerful questions and roleplaying can uncover hidden objections and reinforce trust with financial clients.

Key elements to focus on during roleplay:

- Body language and non-verbal cues

- Tone of voice and pacing

- Handling unexpected objections and developing emotional intelligence for financial advisors

By continually practicing and reviewing your performance, you can handle difficult client conversations more effectively and confidently.

![]()

4: Implement stress management and self-care routines

Managing stress and prioritizing self-care are essential for handling difficult client conversations confidently in financial advising.

Actionable Steps:

- Establish a daily self-care routine.

- Incorporate activities like meditation, exercise, and hobbies to reduce stress.

- Set aside time each day for relaxation and reflection to improve emotional intelligence for financial advisors.

- Develop stress management techniques.

- Learn and practice breathing exercises and mindfulness techniques for navigating sensitive financial topics.

- Use these techniques before and after difficult conversations in wealth management to maintain composure.

- Seek professional support if needed.

- Work with a therapist or coach to develop personalized client communication strategies.

- Join support groups for financial advisors to share experiences and coping mechanisms for handling client objections in finance.

Explanation: These steps are crucial because they help you maintain emotional resilience and composure during challenging client interactions.

By incorporating self-care and stress management, you can improve your overall effectiveness and client satisfaction when handling difficult client conversations confidently.

According to a recent article, focusing on empathy and clear communication is vital during volatile periods, which is supported by effective stress management and active listening techniques.

Benefits of effective stress management:

- Improved decision-making abilities for managing client expectations

- Enhanced emotional regulation for conflict resolution in financial advising

- Increased overall job satisfaction and professional communication skills for advisors

By investing in self-care and stress management, you’ll be better prepared for handling difficult client conversations confidently and building trust with financial clients.

Partner with Alleo to Master Difficult Client Conversations

We’ve discussed how to handle difficult client conversations confidently. Now, let’s explore how Alleo can make this journey easier and faster for you in mastering client communication strategies.

Set up your Alleo account today and create your personalized plan for handling difficult client conversations confidently. Alleo’s AI coach provides tailored coaching support, just like a human coach, helping you build trust with financial clients.

With Alleo, you can schedule regular practice sessions for active listening techniques and empathy. Access scripts and visual aids for clearer communication strategies in navigating sensitive financial topics.

Roleplay difficult scenarios using AI-driven simulations to improve your conflict resolution skills in financial advising.

Alleo will follow up on your progress, handle changes, and keep you accountable as you develop professional communication skills for advisors.

Ready to get started for free and enhance your emotional intelligence for financial advising? Let me show you how!

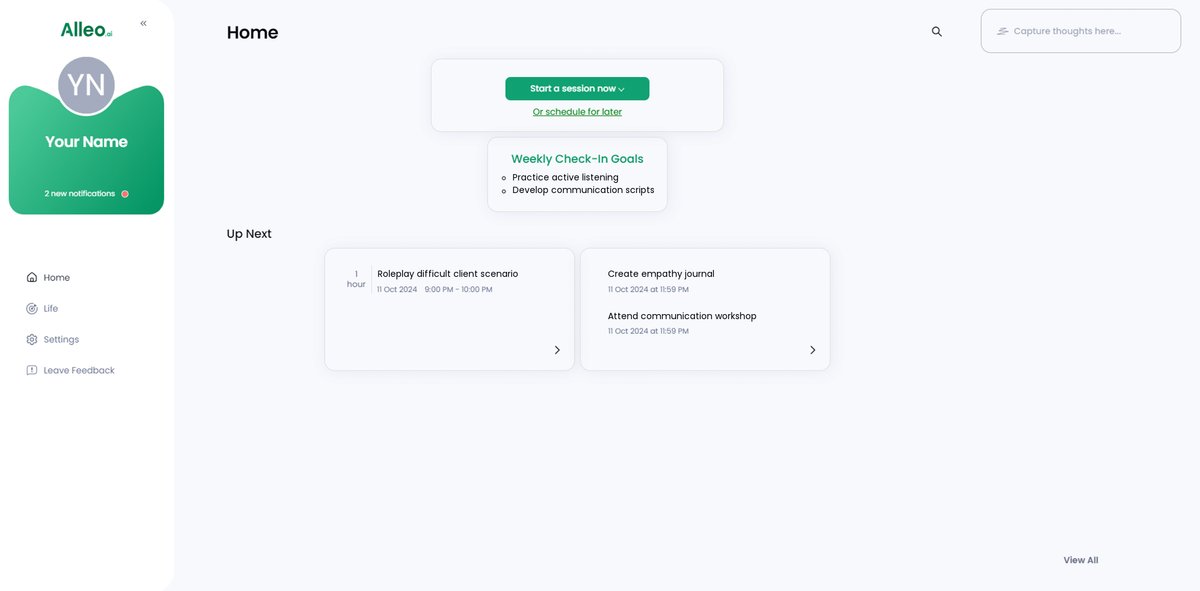

Step 1: Log In or Create Your Account

To start mastering difficult client conversations with Alleo’s AI coach, log in to your existing account or create a new one if you’re new to the platform.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” as your goal to develop consistent practices for handling difficult client conversations and managing stress effectively, which are crucial for improving your performance as a financial advisor.

Step 3: Select “Career” as Your Focus Area

Choose “Career” as your focus area in Alleo to specifically address challenges in client conversations, allowing you to develop the communication skills and confidence needed to excel as a financial advisor.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session to create your personalized plan for mastering difficult client conversations, setting the foundation for your ongoing coaching and skill development.

Step 5: Viewing and managing goals after the session

After your coaching session on handling difficult client conversations, check your Alleo app’s home page to view and manage the personalized goals you discussed, helping you track your progress in improving client interactions and communication skills.

Step 6: Adding events to your calendar or app

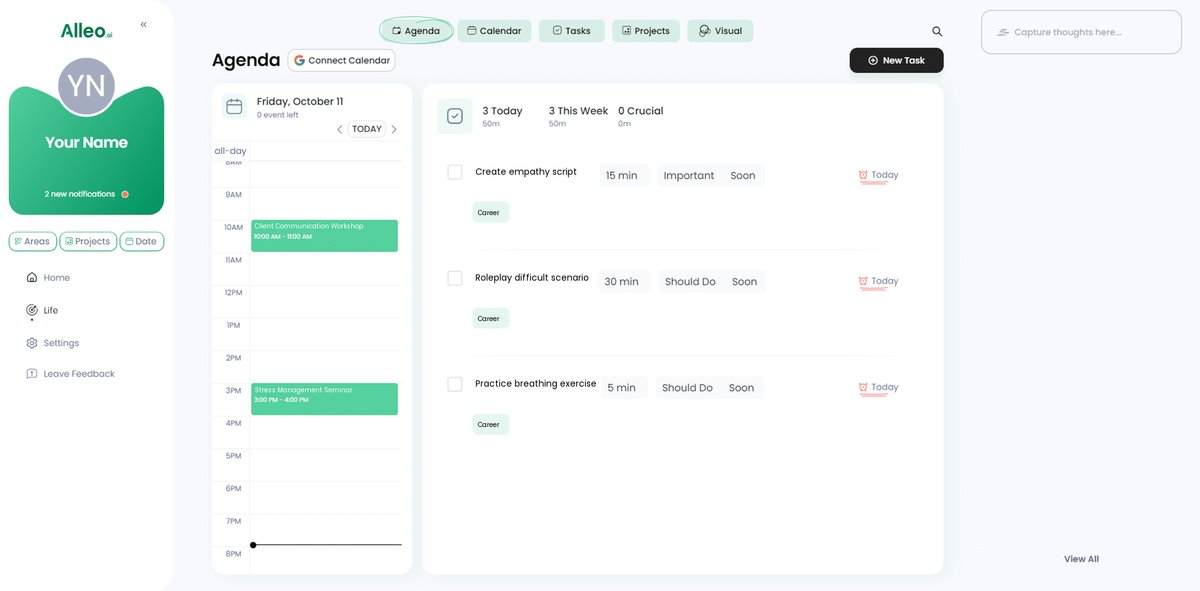

Use Alleo’s calendar and task features to schedule and track your progress on practicing active listening, developing communication strategies, roleplaying scenarios, and implementing stress management routines, ensuring you stay accountable to your goals of mastering difficult client conversations.

Wrapping Up: Your Path to Confident Client Conversations

Taking control of difficult client conversations is crucial for your success as a financial advisor. By practicing active listening techniques, developing clear client communication strategies, roleplaying scenarios, and managing stress, you can handle these challenges with confidence. Handling difficult client conversations confidently is a key skill in navigating sensitive financial topics.

Remember, it’s about building trust with financial clients and showing empathy. It’s okay to seek support and continually refine your professional communication skills for advisors. Emotional intelligence for financial advisors plays a vital role in managing client expectations.

You don’t have to do this alone. Alleo is here to help you every step of the way in handling difficult client conversations confidently.

Set up your free Alleo account today and start transforming your client interactions. Improve your conflict resolution in financial advising and learn effective strategies for handling client objections in finance.

You’re ready to excel in difficult conversations in wealth management. Let’s make it happen together.