Financial Advisors: Master LinkedIn Branding ROI Measurement for Success

Are you spending countless hours perfecting your LinkedIn presence, only to wonder if it’s truly making a difference? Measuring LinkedIn ROI for advisors can be challenging, but it’s crucial for optimizing your digital marketing efforts.

As a life coach, I’ve helped many professionals, like you, navigate these uncertainties. In my experience, the long-term effectiveness of LinkedIn personal branding can be elusive, especially when it comes to quantifying social media success in finance.

In this article, we’ll explore actionable steps for measuring LinkedIn ROI for advisors, specifically tailored for financial advisors. You’ll discover how to track engagement using LinkedIn metrics for financial advisors, measure leads through LinkedIn lead generation for finance professionals, and calculate ROI effectively to assess your financial advisor digital marketing ROI.

Let’s dive into the world of LinkedIn content strategy for advisors and financial advisor personal branding analytics.

The Struggles of Measuring LinkedIn Success

Many financial advisors invest significant time on LinkedIn, yet they often remain unsure of its true impact when measuring LinkedIn ROI for advisors. It’s frustrating to pour effort into crafting posts and engaging with connections without clear indicators of success in social media ROI for financial services.

In my experience, tracking engagement and measuring financial advisor brand impact can be particularly challenging in the financial industry. Without concrete LinkedIn metrics for financial advisors, it’s hard to justify the time spent on LinkedIn content strategy for advisors.

Several clients report difficulties in understanding whether their LinkedIn efforts translate into actual business opportunities, struggling with quantifying social media success in finance. This uncertainty can lead to questioning the value of personal branding analytics on LinkedIn for financial advisors.

Clear metrics are essential to validate your efforts and ensure you’re on the right path with your financial advisor digital marketing ROI.

Steps to Measure LinkedIn Branding ROI for Financial Advisors

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in measuring LinkedIn ROI for advisors:

- Track LinkedIn engagement metrics consistently: Use LinkedIn Analytics and third-party tools to monitor performance regularly, focusing on LinkedIn metrics for financial advisors.

- Measure inbound leads from LinkedIn activity: Set up Lead Gen Forms and track direct messages to capture leads, enhancing LinkedIn lead generation for finance professionals.

- Calculate ROI by comparing costs to new business: Track your LinkedIn marketing costs and compare them to revenue from new clients, quantifying social media success in finance.

Let’s dive into these steps for measuring LinkedIn ROI for advisors!

1: Track LinkedIn engagement metrics consistently

Tracking LinkedIn engagement metrics consistently is crucial for measuring LinkedIn ROI for advisors and assessing the effectiveness of your personal branding efforts.

Actionable Steps:

- Use LinkedIn Analytics to monitor post performance regularly.

- Review LinkedIn metrics for financial advisors such as likes, shares, comments, and profile views weekly.

- Utilize third-party tools like Hootsuite for deeper insights into financial advisor digital marketing ROI.

- Track performance trends over time to identify high-performing content for your LinkedIn content strategy for advisors.

- Create a tracking spreadsheet for your posts.

- Log key engagement metrics and adjust your content strategy based on data to improve social selling ROI for financial advisors.

Key metrics to focus on for measuring LinkedIn ROI for advisors include:

- Post reach and impressions

- Engagement rate (likes, comments, shares)

- Profile views and new connections for LinkedIn lead generation for finance professionals

Explanation: Consistent tracking of engagement metrics helps you understand what resonates with your audience. This ensures your LinkedIn efforts are effective in quantifying social media success in finance.

Tools like LinkedIn Analytics provide valuable insights that can guide your strategy for measuring financial advisor brand impact.

By consistently tracking these metrics, you can make informed decisions and optimize your LinkedIn presence, improving your social media ROI for financial services.

2: Measure inbound leads from LinkedIn activity

Tracking inbound leads from LinkedIn activity is crucial to understanding the ROI of your branding efforts, especially when measuring LinkedIn ROI for advisors.

Actionable Steps:

- Set up LinkedIn Lead Gen Forms for financial advisor digital marketing ROI.

- Integrate these forms with your CRM to capture leads directly from LinkedIn.

- Track the source of each lead to measure LinkedIn’s contribution to your social media ROI for financial services.

- Use UTM parameters in LinkedIn posts as part of your LinkedIn content strategy for advisors.

- Add UTM codes to links to track clicks and conversions, enhancing your LinkedIn metrics for financial advisors.

- Analyze Google Analytics to see which posts drive the most traffic and leads, helping quantify social media success in finance.

- Monitor direct messages and connection requests to assess social selling ROI for financial advisors.

- Track conversations initiated through LinkedIn to measure financial advisor brand impact.

- Log potential leads and follow up to gauge interest and conversion, supporting LinkedIn lead generation for finance professionals.

Explanation: These steps matter because they provide clear, measurable ways to track leads generated from LinkedIn when measuring LinkedIn ROI for advisors.

By integrating Lead Gen Forms and using UTM parameters, you can accurately attribute leads to specific LinkedIn activities, enhancing your financial advisor personal branding analytics.

Tools like Lead Gen Forms offer a streamlined way to capture and analyze lead data, ensuring your efforts are driving tangible results in measuring LinkedIn ROI for advisors.

Benefits of effective lead tracking:

- Improved attribution of marketing efforts

- Better understanding of content performance and LinkedIn engagement metrics for finance

- Enhanced ability to optimize strategies for measuring LinkedIn ROI for advisors

This structured approach will help you refine your LinkedIn strategy and maximize your ROI in the financial services sector.

3: Calculate ROI by comparing costs to new business

Understanding the financial impact of your LinkedIn efforts is crucial for measuring LinkedIn ROI for advisors and justifying the time and resources spent.

Actionable Steps:

- Track your LinkedIn marketing costs for financial advisors.

- Include time spent, ad spend, and third-party tool costs.

- Create a monthly or quarterly cost report for accurate tracking of LinkedIn metrics for financial advisors.

- Calculate the revenue from new clients acquired through LinkedIn.

- Track the revenue generated from leads sourced via LinkedIn lead generation for finance professionals.

- Compare this revenue against your marketing costs to determine social media ROI for financial services.

Explanation: These steps matter because they provide a clear framework for assessing the financial return on your LinkedIn efforts. By comparing costs to new business revenue, you can identify the effectiveness of your strategies and measure financial advisor brand impact.

This approach aligns with industry trends emphasizing data-driven decision-making. For instance, using insights from LinkedIn advertising budgets can help optimize your spending and maximize ROI for your LinkedIn content strategy for advisors.

Factors to consider in ROI calculation:

- Customer lifetime value

- Conversion rates from leads to clients

- Time investment in content creation and engagement for financial advisor digital marketing ROI

This structured process ensures that your LinkedIn activities are not just productive but also profitable, helping quantify social media success in finance and improve financial advisor personal branding analytics.

Partner with Alleo to Measure Your LinkedIn Branding ROI

We’ve explored the challenges of measuring LinkedIn ROI for advisors and the steps to achieve it. But did you know you can work directly with Alleo to simplify this process of quantifying social media success in finance?

Setting up an account is easy. Create a personalized plan tailored to your LinkedIn content strategy for advisors and financial advisor digital marketing ROI goals.

Alleo’s AI coach will help you track engagement, measure leads, and calculate ROI. The coach follows up on your progress, handles changes, and keeps you accountable with text and push notifications, helping you master LinkedIn metrics for financial advisors.

Ready to get started for free and boost your LinkedIn lead generation for finance professionals? Let me show you how!

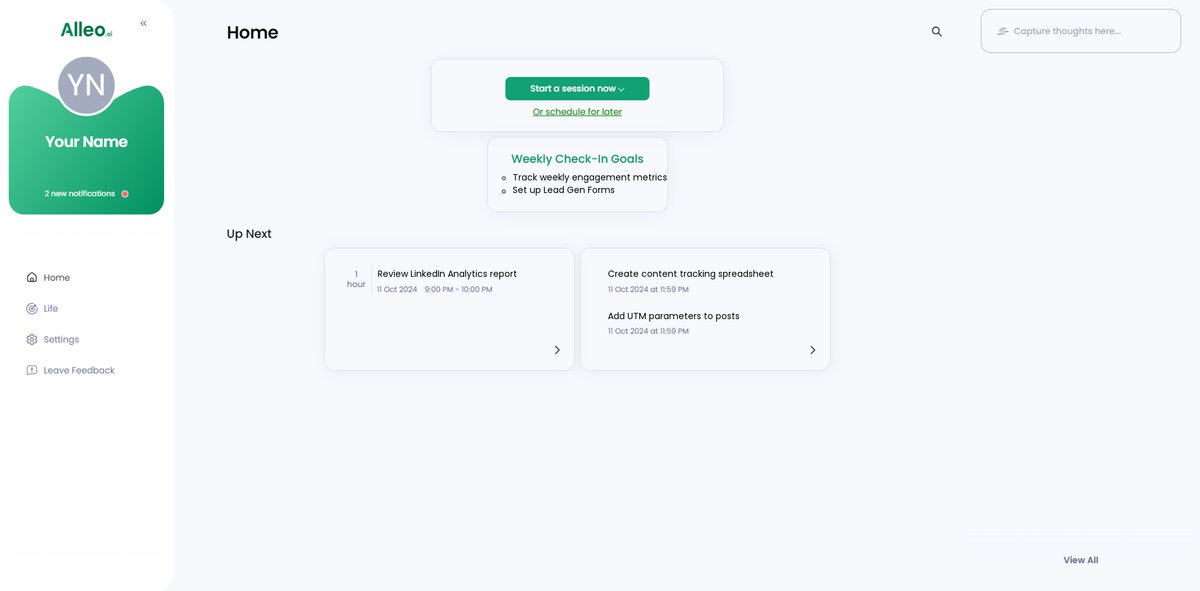

Step 1: Log in or Create Your Account

To begin measuring your LinkedIn branding ROI with our AI coach, log in to your existing account or create a new one in just a few clicks.

Step 2: Choose Your LinkedIn Branding Goal

Select “Setting and achieving personal or professional goals” to focus your efforts on improving your LinkedIn branding ROI. This goal aligns with the article’s emphasis on measuring and optimizing your LinkedIn presence for tangible results as a financial advisor.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to align with your goals of measuring LinkedIn branding ROI as a financial advisor, allowing Alleo’s AI coach to provide tailored strategies for tracking engagement, leads, and calculating the financial impact of your LinkedIn efforts.

Step 4: Starting a coaching session

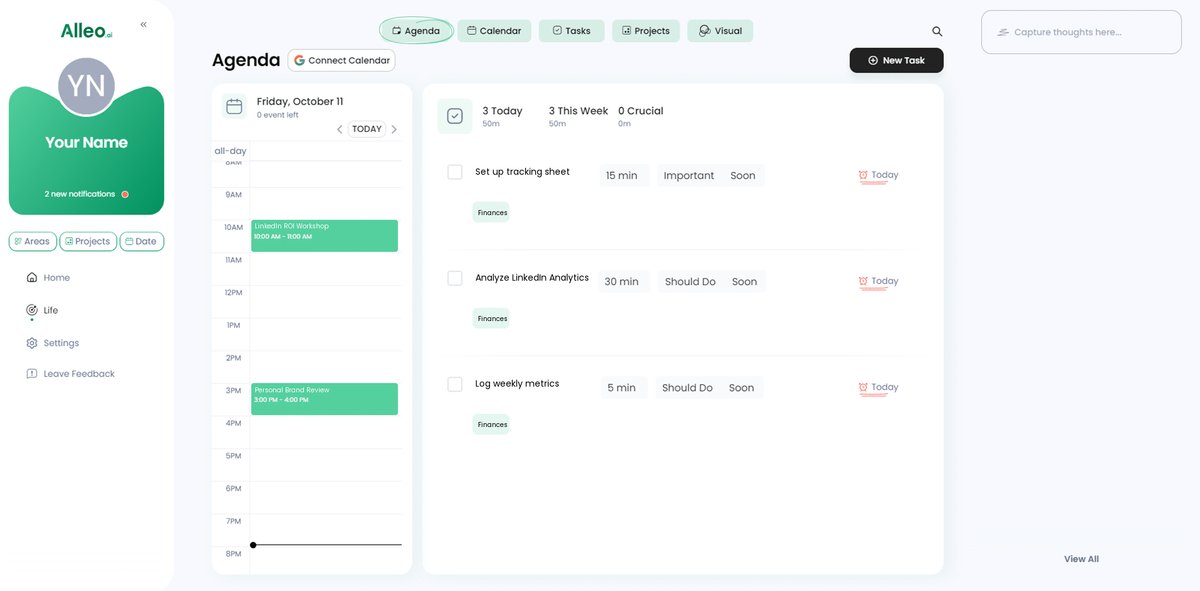

Begin your LinkedIn optimization journey by scheduling an initial intake session with Alleo’s AI coach to establish your personalized plan for tracking engagement, measuring leads, and calculating ROI.

Step 5: Viewing and managing goals after the session

After your coaching session, check the app’s home page to review and manage the LinkedIn branding goals you discussed, allowing you to track your progress and stay accountable to your ROI measurement strategy.

Step 6: Adding events to your calendar or app

Use the calendar and task features in Alleo to schedule and track your LinkedIn activities, helping you monitor your progress in measuring engagement, leads, and ROI for your financial advisor branding efforts.

Bringing It All Together: Measuring Your LinkedIn Branding ROI

You’ve learned how to track engagement, measure leads, and calculate ROI, all crucial for measuring LinkedIn ROI for advisors and financial professionals.

Now, it’s time to put these steps into action for your LinkedIn content strategy for advisors.

Remember, the effort you invest in LinkedIn can truly pay off in terms of social selling ROI for financial advisors.

By consistently tracking your LinkedIn metrics for financial advisors, you can adjust your strategy to maximize results.

Don’t let uncertainty hold you back from quantifying social media success in finance.

You deserve to see the tangible benefits of your hard work in financial advisor digital marketing ROI.

Using Alleo’s tools can simplify this process of measuring financial advisor brand impact and keep you on track.

Take the first step towards a more effective LinkedIn strategy for measuring LinkedIn ROI for advisors.

Start implementing these steps today and see the difference in your financial advisor personal branding analytics.

Ready to make your LinkedIn efforts count? Try Alleo for free and achieve your branding goals while improving LinkedIn lead generation for finance professionals.