4 Proven Strategies for Financial Advisors to Build Lasting Client Relationships and Secure Repeat Business

Are you struggling to maintain long-term relationships with clients after the initial lead generation? Building lasting financial advisor relationships is crucial for success in the industry.

As a life coach, I’ve helped many financial advisors navigate these challenges. In my experience, maintaining lasting client relationships is essential for ensuring repeat business and fostering trust-building in financial advising.

In this article, you’ll discover strategies for developing personalized financial services, regular client check-ins, engaging educational content for client education in finance, and effective communication with clients. These client retention strategies are key to long-term financial planning success.

Let’s dive into these wealth management relationships techniques.

The Challenge of Sustaining Client Relationships

Building lasting financial advisor relationships isn’t easy. Many financial advisors struggle to keep clients engaged after the initial lead generation, making client retention strategies crucial.

In my experience, people often find maintaining these relationships crucial for repeat business. Without strong, long-term financial planning connections, the risk of losing clients and referrals increases significantly.

Several clients report frustration when their advisors fail to provide regular updates. This lack of effective communication with clients can lead to a breakdown in trust-building in financial advising.

Furthermore, the absence of personalized financial services can make clients feel undervalued. This often results in them seeking wealth management relationships elsewhere.

Building lasting financial advisor relationships requires continuous effort. It’s not a one-time task but an ongoing commitment to understanding and addressing client needs through regular client check-ins and value-added financial services.

Key Steps to Building Lasting Client Relationships

Overcoming this challenge in building lasting financial advisor relationships requires a few key steps. Here are the main areas to focus on to make progress:

- Develop Personalized Financial Wellness Programs: Tailor wellness programs to each client’s specific needs with financial assessments and targeted workshops, enhancing long-term financial planning efforts.

- Implement Regular Client Check-Ins and Updates: Schedule quarterly reviews, send monthly newsletters, and set automated reminders for milestones to maintain effective communication with clients.

- Create Engaging, Educational Content for Clients: Develop a content calendar, host Q&A sessions, and provide downloadable guides to boost client education in finance.

- Build Trust through Clear Communication and Empathy: Practice active listening, follow up on inquiries, and share personal stories to strengthen trust-building in financial advising.

Let’s dive in to explore these client retention strategies for building lasting financial advisor relationships!

1: Develop personalized financial wellness programs

Personalized financial wellness programs are essential for building lasting financial advisor relationships and meeting each client’s unique needs while maintaining long-term relationships.

Actionable Steps:

- Conduct individual financial assessments to tailor wellness programs to each client’s specific needs, fostering trust-building in financial advising.

- Use surveys and one-on-one interviews to gather detailed financial information for effective communication with clients.

- Offer targeted financial education workshops based on client interests and needs, enhancing client education in finance.

- Schedule workshops on topics like long-term financial planning, tax strategies, and investment basics.

- Implement financial goal-setting sessions with clients as part of wealth management relationships.

- Set measurable goals and provide regular client check-ins to keep clients engaged and build lasting financial advisor relationships.

Explanation: Personalized financial services help clients feel valued and understood. By offering tailored advice and resources, you can enhance client retention strategies and loyalty.

According to a study, financial institutions with personalized programs report higher client acquisition rates, especially among younger demographics who value financial education (source).

Key benefits of personalized financial wellness programs:

- Increased client engagement and satisfaction in building lasting financial advisor relationships

- Better alignment with individual financial goals through long-term financial planning

- Enhanced trust and loyalty in the advisor-client relationship

Implementing these steps ensures clients receive relevant and timely guidance, fostering stronger relationships and repeat business as part of effective client retention strategies.

2: Implement regular client check-ins and updates

Regular client check-ins and updates are essential for building lasting financial advisor relationships and ensuring client satisfaction.

Actionable Steps:

- Schedule quarterly reviews to discuss financial progress and adjust long-term financial planning as needed.

- Use a standardized agenda to ensure all key areas are covered in wealth management relationships.

- Send monthly newsletters with market updates and personalized financial services advice.

- Include sections on recent financial news, upcoming events, and tailored tips for trust-building in financial advising.

- Utilize automated reminders for important milestones and updates as part of client retention strategies.

- Set up reminders for tax deadlines, investment reviews, and goal check-ins to enhance effective communication with clients.

Explanation: Regular check-ins and updates keep clients informed and engaged, building trust and loyalty. Consistent communication helps manage expectations and ensures clients feel valued, which is crucial for building lasting financial advisor relationships.

According to experts, clear communication is crucial in financial advising for mitigating risk and enhancing client relationships (source). Implementing these steps will foster long-term relationships and encourage repeat business through value-added financial services.

Regular updates and check-ins are a proactive way to show clients you care about their financial well-being and are committed to client education in finance.

3: Create engaging, educational content for clients

Creating engaging, educational content for clients is crucial for building lasting financial advisor relationships and keeping them informed and invested in their financial journey.

Actionable Steps:

- Develop a content calendar featuring blogs, videos, and webinars on relevant financial topics for effective communication with clients.

- Plan content around seasonal events and client interests to enhance long-term financial planning.

- Host interactive Q&A sessions to address client questions and concerns, fostering trust-building in financial advising.

- Use platforms like Zoom or social media for real-time engagement and client education in finance.

- Provide downloadable guides and e-books on complex financial concepts as part of personalized financial services.

- Create easy-to-understand resources on topics like estate planning and portfolio diversification to strengthen wealth management relationships.

Essential elements of effective educational content for building lasting financial advisor relationships:

- Clear, jargon-free explanations of financial concepts

- Practical examples and case studies

- Interactive elements to boost engagement and support client retention strategies

Explanation: Engaging content helps clients understand financial concepts better, fostering trust and loyalty. By offering varied content, you can cater to different learning preferences and keep clients consistently engaged, which is key to building lasting financial advisor relationships.

For instance, financial institutions with personalized educational content see higher client satisfaction scores (source).

This approach ensures clients feel valued and informed, leading to stronger, long-term relationships and enhancing financial advisor loyalty programs through regular client check-ins and value-added financial services.

![]()

4: Build trust through clear communication and empathy

Building trust through clear communication and empathy is essential for maintaining long-term client relationships and building lasting financial advisor relationships.

Actionable Steps:

- Practice active listening during all client interactions to understand their needs and concerns in wealth management relationships.

- Use open-ended questions and reflective listening techniques for effective communication with clients.

- Follow up promptly on client inquiries and feedback as part of client retention strategies.

- Set a standard response time for client communications and regular client check-ins.

- Share personal stories and experiences to create a more relatable and trustworthy advisor-client relationship in long-term financial planning.

- Illustrate financial concepts with real-world examples and success stories for client education in finance.

Explanation: Clear communication and empathy help clients feel understood and valued, fostering trust and loyalty in building lasting financial advisor relationships. Active listening and timely follow-ups show clients that their concerns matter in personalized financial services.

Sharing personal stories can make complex financial concepts more relatable in trust-building in financial advising. According to experts, clear communication in financial advising is crucial for mitigating risk and enhancing client relationships (source).

Key characteristics of empathetic communication in building lasting financial advisor relationships:

- Genuine interest in client’s concerns and goals for long-term financial planning

- Patience in explaining complex financial concepts as part of value-added financial services

- Flexibility in adapting to different communication styles in wealth management relationships

By implementing these steps, you can build stronger, long-term relationships with your clients and improve client retention strategies.

Partner with Alleo to Strengthen Client Relationships

We’ve explored the challenges of building lasting financial advisor relationships and how to overcome them. Did you know you can work directly with Alleo to make this journey easier and faster for effective communication with clients?

Setting up an account with Alleo is simple. Create a personalized plan tailored to your needs, focusing on trust-building in financial advising and long-term financial planning.

Alleo’s AI coach will provide affordable, tailored coaching support for client retention strategies. You’ll get full coaching sessions like any human coach and a free 14-day trial, no credit card required, to enhance your wealth management relationships.

The coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications, ensuring regular client check-ins and personalized financial services.

Ready to get started for free and enhance your value-added financial services? Let me show you how!

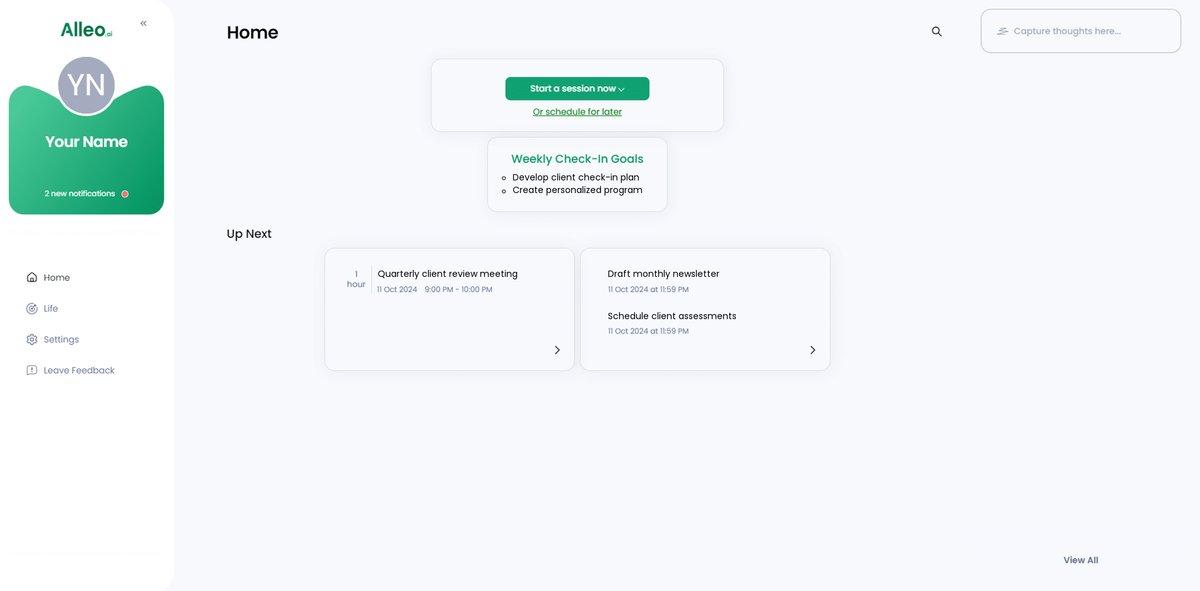

Step 1: Log In or Create Your Account

To start building lasting client relationships with AI-powered support, log in to your account or create a new one to access Alleo’s personalized financial advisor coaching tools.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to focus on developing consistent practices that will help you maintain strong, long-term client relationships and improve your financial advising skills.

Step 3: Selecting the life area you want to focus on

Choose “Finances” as your focus area to align with your goal of maintaining long-term client relationships as a financial advisor. This selection will tailor Alleo’s AI coaching to provide strategies for developing personalized financial wellness programs, implementing regular client check-ins, and improving communication skills specific to financial advising.

Step 4: Starting a coaching session

Begin your AI coaching journey with an initial intake session to establish your personalized plan for strengthening client relationships and improving your financial advisory practice.

Step 5: Viewing and managing goals after the session

After your coaching session, easily access and manage the goals you discussed by checking the home page of the Alleo app, where they will be displayed for your ongoing reference and progress tracking.

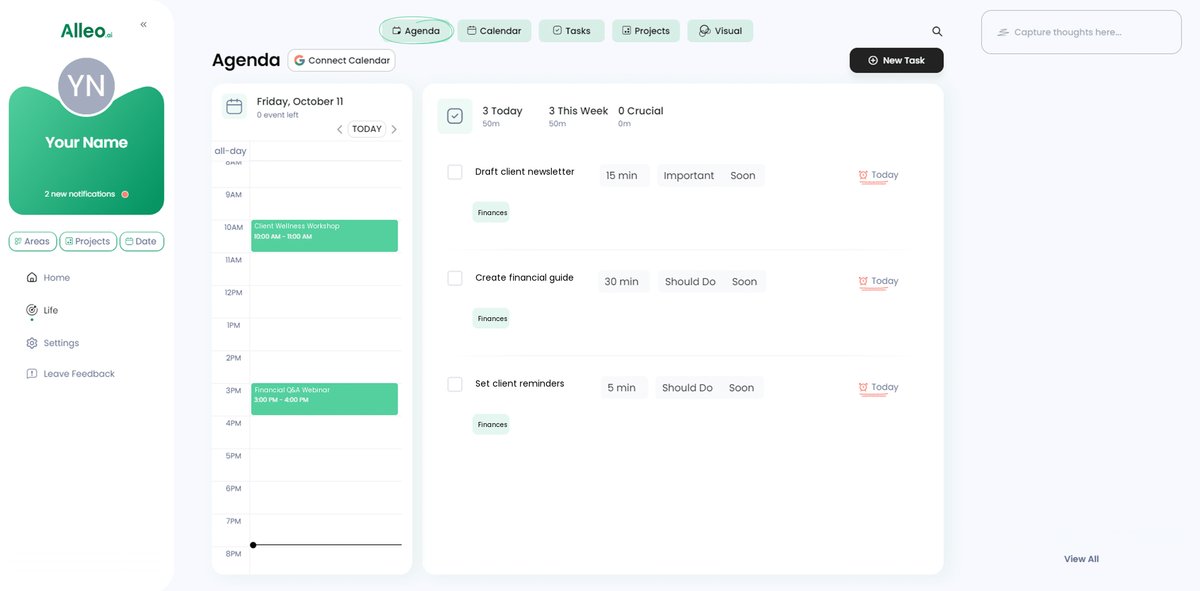

Step 6: Adding events to your calendar or app

Use the calendar and task features in the Alleo app to schedule and track important client meetings, financial reviews, and content creation deadlines, helping you stay organized and proactive in maintaining strong client relationships.

Wrapping Up: Strengthening Client Relationships for Success

As we conclude, it’s clear that building lasting financial advisor relationships is essential for repeat business.

Implementing personalized financial services and wellness programs ensures each client feels valued and understood. Regular client check-ins and updates keep the communication lines open and build trust in financial advising.

Engaging educational content helps maintain their interest and provides valuable insights for long-term financial planning.

Lastly, effective communication with clients and empathy solidify these wealth management relationships.

I understand the challenges you face in client retention strategies. You’re not alone in this journey.

Why struggle alone when you can partner with Alleo? Alleo simplifies these steps, helping you build and maintain strong client relationships in financial advising.

Try Alleo for free and see the difference. Let’s elevate your building lasting financial advisor relationships together.