The Ultimate Guide: How Financial Advisors Can Build Client Trust During Market Volatility

Are you struggling with building client trust during volatility in the financial markets?

As a life coach, I’ve helped many professionals navigate these challenges in economic uncertainty. I understand the importance of maintaining client relationships and keeping clients confident in unpredictable financial landscapes.

In this article, you’ll discover strategies for building client trust during volatility, such as regular communication, personalized long-term investment planning, and the use of visual tools to illustrate portfolio diversification strategies. These approaches can help you manage your clients’ concerns effectively and provide emotional support for investors.

Let’s dive in to explore these market downturn strategies and risk management techniques.

The Challenges of Maintaining Client Trust in Volatile Markets

When markets become unpredictable, financial advisors face immense challenges in building client trust during volatility. Many clients initially struggle with understanding market fluctuations and feel uneasy about their investments.

This uncertainty can greatly impact their confidence and trust in your guidance, making transparent communication in finance essential.

Furthermore, market volatility can lead to emotional and irrational decisions. Clients might panic and consider drastic actions, like liquidating their portfolios, highlighting the need for risk management techniques.

As an advisor, it’s crucial to provide reassurance and maintain trust during these turbulent times, focusing on long-term investment planning.

In my experience, regular and transparent communication is key to building client relationships. When clients feel informed and understood, they are less likely to make impulsive decisions during market downturns.

This is where personalized strategies and constant updates play a vital role in navigating economic uncertainty.

By addressing these challenges head-on, you can build stronger, more resilient relationships with your clients, emphasizing portfolio diversification strategies and regular client check-ins.

Key Strategies to Build Client Trust During Market Volatility

Overcoming this challenge of building client trust during volatility requires a few key steps. Here are the main areas to focus on to make progress in navigating economic uncertainty.

- Communicate regularly with clear market updates: Schedule regular client check-ins to keep clients informed and reassured through transparent communication in finance.

- Personalize strategies to client risk tolerance: Tailor investment plans and portfolio diversification strategies according to each client’s unique risk profile.

- Educate clients on long-term investing principles: Provide financial education for clients on long-term investment planning to manage expectations and reduce anxiety.

- Use visual tools to explain market trends: Utilize visual aids to make complex financial concepts and market downturn strategies more accessible.

Let’s dive into these building client relationships techniques!

1: Communicate regularly with clear market updates

Regular communication with clients is crucial during market volatility to maintain their trust and confidence, playing a key role in building client trust during volatility.

Actionable Steps:

- Schedule bi-weekly market update calls with clients for building client relationships.

- Set clear agendas and provide concise market summaries.

- Use video conferencing for a more personal touch.

- Create and distribute a monthly market newsletter as part of market downturn strategies.

- Include market analysis, insights, and personalized messages.

- Utilize email marketing tools to track engagement and feedback.

- Host quarterly webinars on market trends, focusing on transparent communication in finance.

- Invite guest speakers to provide expert opinions on risk management techniques.

- Record sessions for clients who cannot attend live.

Key benefits of regular communication:

- Builds trust and transparency

- Reduces client anxiety during volatility

- Demonstrates your commitment and expertise in long-term investment planning

Explanation: Regular communication ensures that clients feel informed and reassured, reducing the likelihood of impulsive decisions and building client trust during volatility.

According to Investopedia, staying connected with clients can help build long-term relationships and trust.

By keeping clients updated, you address their concerns and demonstrate your commitment to their financial well-being, offering emotional support for investors.

These steps pave the way for stronger client relationships by ensuring they feel heard and understood during uncertain times, incorporating financial education for clients and portfolio diversification strategies.

2: Personalize strategies to client risk tolerance

Personalizing strategies according to each client’s risk tolerance is crucial to building client trust during volatility and maintaining their confidence in turbulent markets.

Actionable Steps:

- Conduct regular risk tolerance assessments.

- Use surveys and profiling tools to gauge client preferences.

- Adjust portfolios based on updated risk levels, focusing on portfolio diversification strategies.

- Develop customized investment plans.

- Align strategies with individual goals and risk profiles for long-term investment planning.

- Discuss plans in one-on-one meetings for personalized touch and building client relationships.

- Offer tailored portfolio reviews.

- Provide detailed performance reports and future projections, emphasizing transparent communication in finance.

- Discuss potential adjustments based on market conditions and client feedback, incorporating market downturn strategies.

Explanation: Personalizing investment strategies helps clients feel more secure and understood, which is essential for building client trust during volatility.

According to Don Connelly, reliability and responsiveness are essential, especially during market volatility. Tailoring strategies ensures clients’ needs are met, reinforcing trust and confidence in your guidance when navigating economic uncertainty.

These steps will help you foster stronger, long-lasting relationships by addressing each client’s unique needs and providing emotional support for investors.

3: Educate clients on long-term investing principles

Educating clients on long-term investing principles is crucial for building client trust during volatility and maintaining their confidence in turbulent markets.

Actionable Steps:

- Create educational content on long-term investment planning.

- Develop blog posts, videos, and infographics explaining key concepts for navigating economic uncertainty.

- Share content through social media and email campaigns to enhance financial education for clients.

- Organize client workshops and seminars.

- Focus on topics like market cycles, risk management techniques, and compounding.

- Encourage interactive discussions and Q&A sessions to strengthen client relationships.

Essential long-term investing principles to teach:

- The power of compound interest

- Importance of portfolio diversification strategies

- Understanding market cycles and market downturn strategies

Explanation: Educating clients helps them understand the value of long-term investing, reducing their anxiety during volatile periods and building client trust during volatility.

According to Enrich, financial literacy empowers clients to participate in their financial journey actively. This approach builds trust and confidence, aligning their expectations with market realities.

These steps ensure clients feel informed and secure, reinforcing their trust in your guidance through transparent communication in finance and regular client check-ins.

4: Use visual tools to explain market trends

Using visual tools to explain market trends is vital for building client trust during volatility and helping clients grasp complex financial concepts.

Actionable Steps:

- Utilize Andex Charts in client meetings.

- Show historical market performance and trends visually.

- Help clients see the long-term investment planning perspective.

- Develop interactive financial dashboards.

- Allow clients to explore their portfolio performance in real-time.

- Use AI-powered tools to provide personalized insights and projections for navigating economic uncertainty.

- Incorporate visual aids in presentations.

- Use graphs, charts, and infographics to simplify complex concepts and market downturn strategies.

- Make information more accessible and engaging for clients, enhancing transparent communication in finance.

Effective visual tools for financial communication:

- Interactive charts and graphs for portfolio diversification strategies

- Infographics summarizing key data on risk management techniques

- Video explainers for complex topics in financial education for clients

Explanation: Visual tools make financial information more digestible and engaging for clients. This approach helps them understand market trends and remain confident in their investments, building client relationships even during volatility.

According to Enrich, visual aids are instrumental in sparking meaningful discussions, aiding informed financial decisions. These steps ensure that clients feel well-informed and secure, strengthening trust in your guidance through regular client check-ins.

With these tools, your clients will better understand market trends, enhancing their confidence in your expertise and providing emotional support for investors during uncertain times.

Partner with Alleo to Build Client Trust During Market Volatility

We’ve explored the challenges of building client trust during volatility. But did you know you can work directly with Alleo to make this journey of building client relationships easier and faster?

With Alleo, you can set up an account in minutes. Create a personalized plan tailored to your clients’ needs, incorporating long-term investment planning and portfolio diversification strategies.

Alleo’s coach will guide you through regular client check-ins, transparent communication in finance, and using visual tools to navigate economic uncertainty.

Alleo’s AI coach provides actionable advice on risk management techniques and follows up on your progress. It handles changes and keeps you accountable with text and push notifications, offering emotional support for investors.

Plus, enjoy a free 14-day trial with no credit card required, allowing you to explore market downturn strategies and financial education for clients.

Ready to get started for free in building client trust during volatility?

Let me show you how!

Step 1: Log In or Create Your Account

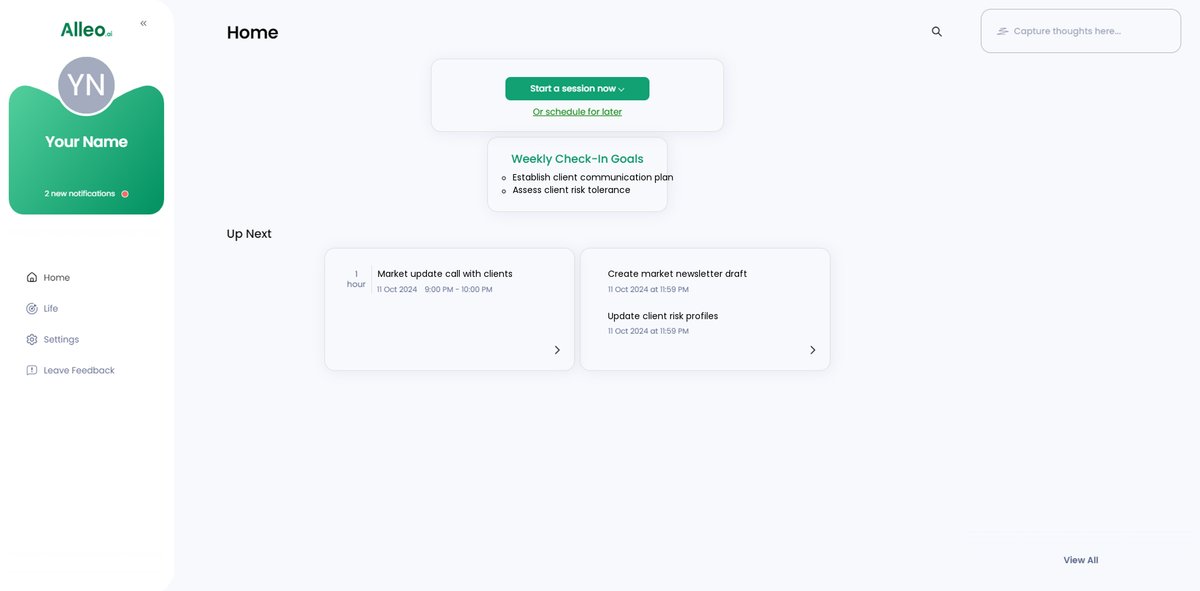

To start building client trust with Alleo’s AI coach, log in to your existing account or create a new one in just a few clicks, setting you on the path to improved client communication and personalized strategies during market volatility.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to focus on developing consistent practices that will help you maintain client trust during market volatility. This goal will guide you in creating a structured approach to regular client communication and implementing personalized strategies, essential for navigating uncertain financial landscapes.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area to address market volatility concerns and build stronger client relationships. This selection allows Alleo’s AI coach to provide tailored strategies for maintaining trust during financial uncertainties, aligning perfectly with your goal of supporting clients through turbulent markets.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your goals for maintaining client trust during market volatility and create a personalized plan to guide your future coaching sessions.

Step 5: Viewing and managing goals after the session

After your coaching session on maintaining client trust during market volatility, check the Alleo app’s home page to review and manage the personalized goals you discussed, ensuring you stay on track with your client communication and trust-building strategies.

Step 6: Adding events to your calendar or app

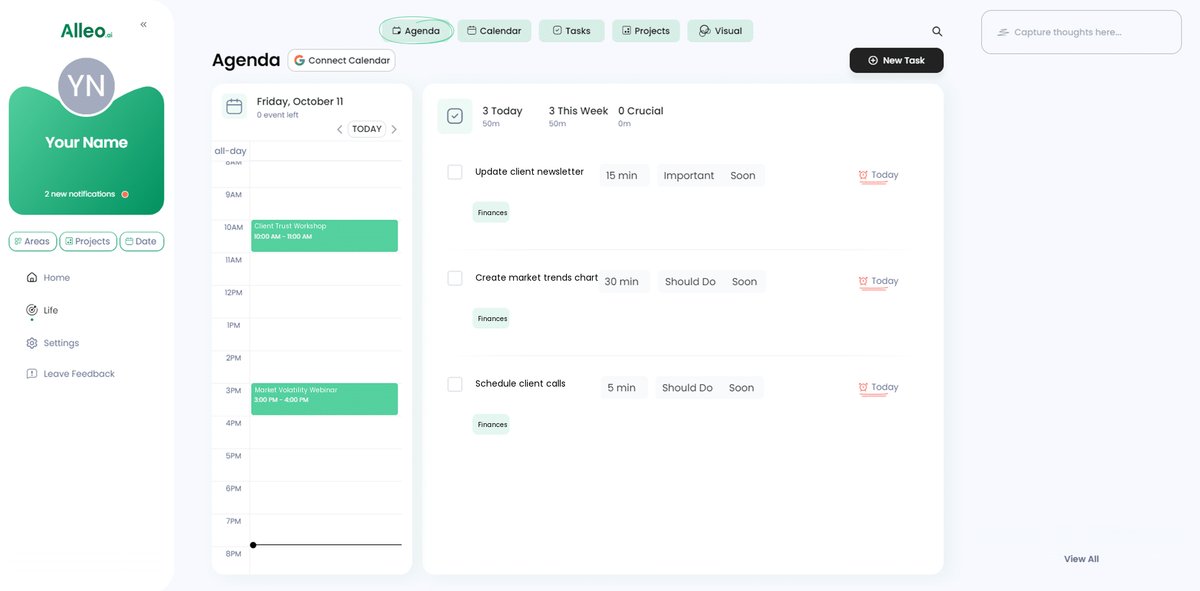

To track your progress in building client trust during market volatility, use the app’s calendar and task features to schedule regular client communications, portfolio reviews, and educational sessions. Adding these events to your calendar will help you stay organized and consistent in your efforts to maintain client confidence.

Wrapping Up: Building Client Trust in Uncertain Markets

In summary, building client trust during volatility is essential for financial advisors. By focusing on regular communication, personalized strategies, long-term investment planning, and visual tools, you can effectively address client concerns and navigate economic uncertainty.

Empathy and understanding go a long way in these efforts. Remember, your clients rely on you to guide them through challenging times and provide emotional support for investors during market downturns.

Consider leveraging Alleo to streamline these processes. Alleo’s tools can help you stay connected with your clients, implement risk management techniques, and provide valuable, personalized advice for building client relationships.

Take action today. Start using Alleo for free and strengthen your client relationships during these uncertain times by enhancing transparent communication in finance and offering financial education for clients.