How to Deliver Reliable Financial Advice During System Outages: The Ultimate Guide

What if your financial advice system reliability could be compromised by a sudden system failure during an economic crisis?

As a life coach, I’ve helped many professionals navigate financial planning challenges. I understand the crucial role reliable information systems play in financial advising, especially during economic uncertainty. Data reliability in finance is paramount for accurate financial forecasting methods.

In this article, you’ll discover strategies to deliver timely financial advice despite unreliable systems. We’ll explore approaches like redundant backups, offline tools, and manual verification. These financial advisor best practices can help in overcoming information system failures and maintaining real-time financial guidance.

Let’s dive in to discuss contingency planning for financial professionals and adapting to financial data inconsistencies.

Understanding the Challenges of Unreliable Information Systems

When information systems fail, financial advisors like you face immense challenges in maintaining financial advice system reliability. Imagine trying to provide timely advice during an economic downturn, only for your system to crash, disrupting real-time financial guidance.

System outages are particularly disruptive. They can delay critical decisions and erode client trust, highlighting the importance of contingency planning for financial professionals.

During economic uncertainty, the pressure to deliver accurate financial forecasting methods intensifies.

Many advisors I’ve worked with find themselves scrambling. They struggle to gather and verify data manually, often with incomplete information, exemplifying financial planning challenges.

This is a significant pain point. It hampers your ability to offer timely and precise financial guidance, which is crucial during volatile markets and underscores the need for data reliability in finance.

Addressing these issues head-on is essential. By understanding the challenges, you can better prepare and mitigate the impact of unreliable systems, improving overall financial advice system reliability.

Pursuing solutions like redundant backups, offline tools, and manual verification can make a difference in overcoming information system failures.

Let’s explore how you can overcome these obstacles effectively, focusing on financial advisor best practices and adapting to financial data inconsistencies.

Key Steps to Overcoming Unreliable Information Systems

Overcoming this challenge in financial advice system reliability requires a few key steps. Here are the main areas to focus on to make progress in addressing technology issues in financial advising:

- Implement Redundant Data Backup Systems: Ensure data is always up-to-date and easily accessible during outages, enhancing real-time financial guidance capabilities.

- Develop Offline Financial Analysis Tools: Equip advisors with tools that function without internet connectivity, supporting accurate financial forecasting methods even during system failures.

- Create a Manual Information Verification Process: Establish procedures to verify data manually during system failures, a crucial financial advisor best practice for overcoming information system failures.

Let’s dive into these strategies for adapting to financial data inconsistencies!

1: Implement redundant data backup systems

Implementing redundant data backup systems is crucial to ensure your financial data remains secure and accessible during system outages, enhancing financial advice system reliability.

Actionable Steps:

- Schedule automatic daily backups: Set up daily automatic backups to keep your data updated, addressing financial planning challenges.

- Use both cloud and local servers: Diversify storage by utilizing cloud-based and local servers for enhanced security and data reliability in finance.

- Train staff on backup procedures: Conduct regular training sessions to ensure staff can initiate and retrieve backups manually, improving real-time financial guidance capabilities.

Key benefits of redundant data backup systems include:

- Enhanced data security and integrity

- Minimized downtime during system failures, overcoming information system failures

- Improved compliance with regulatory requirements

Explanation:

These steps are vital to maintaining data integrity and accessibility during system failures. By diversifying storage and ensuring regular backups, you safeguard essential financial information and support accurate financial forecasting methods.

For more detailed guidance, check out the FDIC’s cybersecurity resources.

Taking these precautions helps maintain client trust and ensures you can provide timely advice even during technical issues, aligning with financial advisor best practices and facilitating client communication during system outages.

2: Develop offline financial analysis tools

Developing offline financial analysis tools is essential to ensure you can continue providing accurate financial advice during system outages, enhancing financial advice system reliability.

Actionable Steps:

- Invest in standalone financial analysis software: Choose tools that can operate offline and sync with online systems once connectivity is restored, addressing technology issues in financial advising.

- Maintain updated financial data libraries: Regularly update offline data repositories with the latest financial information to ensure accuracy and overcome information system failures.

- Train advisors on using offline tools: Provide comprehensive training on using offline tools and develop quick-reference guides for troubleshooting, improving financial advisor best practices.

Explanation:

These steps are crucial to maintaining functionality and accuracy during system failures. By investing in offline tools and keeping data updated, you ensure that critical financial analysis can continue uninterrupted, supporting real-time financial guidance even in challenging situations.

For more insights, explore the Commonwealth Fund’s recommendations on maintaining essential services during disruptions.

Implementing these measures helps you stay prepared and maintain client trust during unpredictable situations, addressing financial planning challenges and ensuring data reliability in finance.

3: Create a manual information verification process

In the event of a system failure, having a manual information verification process is crucial for maintaining the accuracy of your financial advice and ensuring financial advice system reliability.

Actionable Steps:

- Develop a standardized verification checklist: Create a checklist for critical financial data, ensuring it covers all essential data points and sources to overcome information system failures.

- Establish a verification team: Form a dedicated team responsible for manually verifying data during system outages, and train them on efficient techniques for adapting to financial data inconsistencies.

Key components of an effective manual verification process for financial advisor best practices:

- Clear documentation of verification steps for accurate financial forecasting methods

- Regular drills to practice manual procedures and address financial planning challenges

- Designated roles and responsibilities for team members to maintain data reliability in finance

Explanation:

These steps are essential for maintaining data integrity during system failures. A standardized checklist and a trained verification team ensure accurate financial information and real-time financial guidance.

For more insights on technology issues in financial advising, explore the FedRAMP guidelines on data integrity.

By implementing these measures, you can confidently navigate system outages, maintain client trust, and improve contingency planning for financial professionals.

Partner with Alleo to Deliver Timely Financial Advice

We’ve explored the challenges of providing financial advice despite unreliable systems. Did you know you can work directly with Alleo to make this journey easier and faster, enhancing your financial advice system reliability?

How Alleo Helps:

Goal Setting and Task Management:

- Use Alleo to set and track backup schedules, ensuring no step is missed in overcoming information system failures.

- Plan and schedule regular training sessions and data updates to address financial planning challenges.

Decision-Making Support:

- Alleo can analyze data trends and help prioritize which financial data to verify first, improving data reliability in finance.

- Provide real-time financial guidance on the most critical actions to take during system outages.

Building Healthy Habits:

- Encourage consistent use of offline tools and manual verification through habit-building features, addressing technology issues in financial advising.

- Use motivational reminders to keep the team engaged and proactive in adapting to financial data inconsistencies.

Getting Started:

- Sign Up: Start by setting up an account on our platform to enhance your financial advice system reliability.

- Create a Plan: Work with Alleo to create a personalized coaching plan for accurate financial forecasting methods.

- Stay Accountable: Alleo follows up on your progress and handles changes via text and push notifications, supporting financial advisor best practices.

Ready to get started for free? Let me show you how to improve your financial advice system reliability!

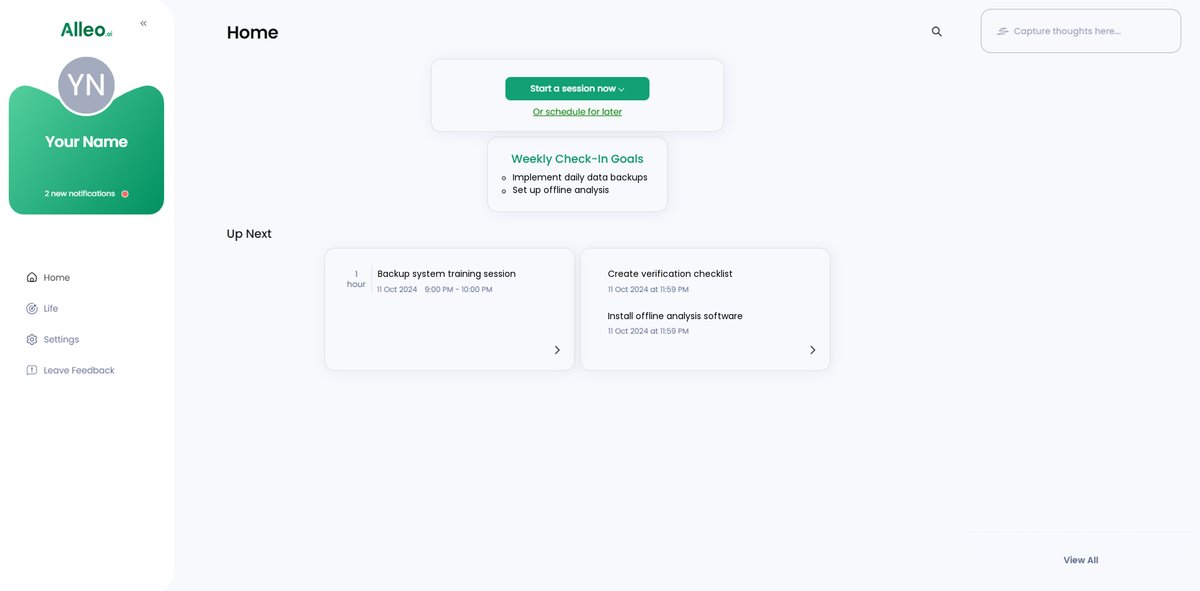

Step 1: Log in or Create Your Account

To start safeguarding your financial advice against system failures, log in to your existing Alleo account or create a new one to access our AI coaching platform for implementing reliable backup and verification strategies.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to develop consistent practices for data backup, offline tool usage, and manual verification, ensuring you can provide reliable financial advice even during system outages.

Step 3: Selecting the life area you want to focus on

Choose “Finances” as your focus area to tackle the challenges of providing reliable financial advice during system failures, allowing Alleo to guide you through implementing backup systems, developing offline tools, and creating manual verification processes.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session to discuss your financial advising challenges and set up a personalized plan for maintaining reliable systems and processes during economic uncertainties.

Step 5: Viewing and Managing Goals After the Session

After your coaching session on improving financial advice delivery during system outages, check the Alleo app’s home page to view and manage the goals you discussed, such as implementing redundant backups or developing offline analysis tools.

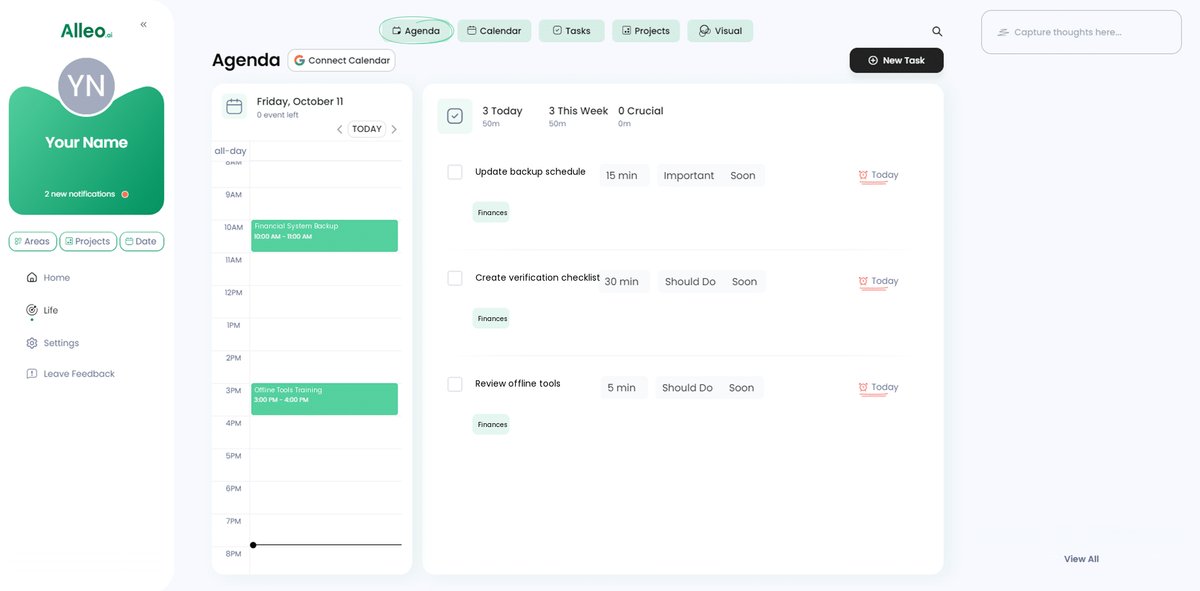

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track important events like system backups, data updates, and training sessions, helping you stay on top of your financial advice reliability efforts even during uncertain times.

Wrap-Up: Ensuring Reliable Financial Advice

We’ve covered the challenges of unreliable information systems and how they impact financial advising, highlighting the importance of financial advice system reliability.

Implementing redundant backups, developing offline tools, and creating a manual verification process can significantly help overcome technology issues in financial advising.

These steps ensure you maintain accuracy and trust, even during system failures, which is crucial for accurate financial forecasting methods.

You can do this.

Remember, you don’t have to face these financial planning challenges alone.

Alleo can support you in managing tasks, making decisions, and building healthy habits to enhance data reliability in finance.

Embrace these strategies and tools to confidently provide timely real-time financial guidance, even amid uncertainty.

Take the first step with Alleo today to improve your financial advice system reliability.

Start for free and see the difference it can make in adapting to financial data inconsistencies.