Freelancer’s Guide: 6 Strategies for Staying Committed to Financial Independence

Imagine a life where financial stress is a distant memory, and you have the freedom to choose projects that truly inspire you. This is the essence of financial independence for freelancers.

As a life coach, I’ve helped many freelancers navigate these challenges, including managing irregular income and long-term financial planning for the self-employed. In my experience, maintaining consistency and trust in the financial independence process is crucial.

In this post, you’ll discover practical strategies to stay committed to financial independence for freelancers despite income fluctuations. We’ll cover building an emergency fund, diversifying income streams, automating savings, and more. These freelance budgeting tips will help you work towards retirement savings and tax planning as an independent contractor.

Let’s dive in and explore how you can achieve work-life balance for sustainable freelancing while working towards your financial freedom.

Understanding the Financial Challenges Freelancers Face

Freelancers often grapple with unique financial dilemmas on their path to financial independence. Income volatility and the absence of traditional benefits make long-term financial planning for the self-employed tough.

Many initially find it hard to maintain savings and manage irregular income due to unpredictable cash flow. This instability can lead to mounting stress and affect both personal and professional life, impacting work-life balance for sustainable freelancing.

In my experience, freelancers frequently struggle to stay committed to their financial goals. The lack of a steady paycheck means they must be extra vigilant with freelance budgeting tips and emergency fund strategies.

Moreover, it’s common to feel overwhelmed by the need to constantly adapt to changing financial situations. This can be exhausting and disheartening, especially when considering retirement savings for freelancers and tax planning for independent contractors.

However, with the right strategies, you can overcome these challenges and work towards financial independence for freelancers. Let’s explore some practical approaches to help you stay on track, including diversifying income streams and cutting business expenses.

Key Strategies for Achieving Financial Independence as a Freelancer

Overcoming financial challenges requires a few key steps for freelancers seeking financial independence. Here are the main areas to focus on to make progress towards long-term financial planning for the self-employed.

- Create a Robust Emergency Fund for Lean Months: Save at least six months’ worth of essential expenses in a high-yield savings account. This emergency fund strategy is crucial for managing irregular income.

- Diversify Income Streams to Reduce Volatility: Explore additional freelance platforms and develop passive income streams. This approach is essential for financial independence for freelancers.

- Automate Savings and Investments for Consistency: Use budgeting apps and set up automatic contributions to retirement savings for freelancers.

- Regularly Review and Adjust Your Financial Goals: Schedule monthly financial check-ins and adjust goals based on changes, incorporating tax planning for independent contractors.

- Network and Nurture Client Relationships: Attend industry events and maintain relationships with past clients to ensure sustainable freelancing and work-life balance.

- Prioritize Continuous Learning and Skill Development: Enroll in online courses and seek mentorship from experienced freelancers to enhance your earning potential and achieve financial freedom.

Let’s dive in to explore these freelance budgeting tips and strategies for financial independence!

1: Create a robust emergency fund for lean months

Having a robust emergency fund is crucial for freelancers to navigate financial uncertainties and maintain stability on the path to financial independence for freelancers.

Actionable Steps:

- Calculate your monthly essential expenses and aim to save at least six months’ worth, a key aspect of freelance budgeting tips.

- Open a high-yield savings account specifically for your emergency fund, supporting long-term financial planning for self-employed.

- Set up automatic transfers to this account from your primary income source, helping with managing irregular income.

Explanation: Establishing an emergency fund ensures you have a financial cushion during lean months, reducing stress and enabling you to focus on your work. This is a crucial emergency fund strategy for financial independence for freelancers.

According to Money with Katie, freelancers should prioritize building a substantial emergency fund due to income instability.

This foundation will empower you to manage fluctuations and stay committed to your financial goals, supporting your journey towards financial independence for freelancers.

2: Diversify income streams to reduce volatility

Diversifying income streams is essential for maintaining financial stability as a freelancer and is a key step towards financial independence for freelancers.

Actionable Steps:

- Identify additional freelance platforms or gigs that complement your skills. Explore websites like Upwork or Fiverr to expand your opportunities and diversify income streams.

- Develop a passive income stream, such as creating an online course or writing an eBook. This can provide a steady revenue source even during slower periods, aiding in long-term financial planning for self-employed individuals.

- Network with other freelancers to exchange job leads and opportunities. Join online communities or attend industry events to build valuable connections and enhance your work-life balance for sustainable freelancing.

Key benefits of income diversification:

- Reduced financial risk

- Increased earning potential

- Enhanced professional growth

Explanation: By diversifying your income, you reduce the risk of relying on a single source of revenue. This approach ensures a more stable financial foundation and helps in managing irregular income.

For example, Park University highlights the importance of multiple income streams in mitigating income instability. Taking these steps helps you manage financial fluctuations and achieve long-term financial independence for freelancers.

Diversifying your income will empower you to navigate financial ups and downs with greater confidence, supporting your journey towards financial independence as a freelancer.

3: Automate savings and investments for consistency

Automating your savings and investments is vital for maintaining financial stability and achieving long-term goals, especially when pursuing financial independence for freelancers.

Actionable Steps:

- Set up automatic contributions to a retirement account, such as a Roth IRA or Solo 401(k). This ensures a steady investment flow and supports retirement savings for freelancers.

- Use budgeting apps to track your income and expenses, making sure you save consistently. Tools like Mint or YNAB can help with freelance budgeting tips and managing irregular income.

- Schedule automatic transfers from your primary income source to a high-yield savings account dedicated to your emergency fund, an essential part of long-term financial planning for self-employed individuals.

Explanation: Automating your savings and investments removes the guesswork and ensures consistency in your journey towards financial independence for freelancers.

According to Morehouse College, automation helps you stay disciplined and reach your financial independence goals. This approach aligns with industry trends and reduces the risk of missing contributions, which is crucial for investing for financial freedom.

Consistent automation provides peace of mind and allows you to focus more on your work, contributing to work-life balance for sustainable freelancing.

4: Regularly review and adjust your financial goals

Regularly reviewing and adjusting your financial goals is key to staying on track towards financial independence for freelancers.

Actionable Steps:

- Schedule monthly financial check-ins to review your freelance budgeting tips and savings progress.

- Adjust your long-term financial planning for self-employed based on changes in income or expenses.

- Use financial planning tools to forecast future financial scenarios and adjust plans accordingly, especially for managing irregular income.

Explanation: Consistent reviews and adjustments help you stay aligned with your financial goals despite changes in your freelance career.

According to Money with Katie, freelancers should prioritize regular financial reviews to adapt to their variable income and maintain work-life balance for sustainable freelancing.

This proactive approach ensures you remain on track and can make informed decisions about retirement savings for freelancers and emergency fund strategies.

Regularly reviewing your goals keeps you motivated and prepared for financial fluctuations in your journey towards financial independence for freelancers.

5: Network and nurture client relationships

Building and maintaining strong client relationships is crucial for long-term financial planning for self-employed professionals and achieving financial independence for freelancers.

Actionable Steps:

- Attend industry events to meet potential clients and collaborators. This helps expand your network and opens up new opportunities for diversifying income streams.

- Follow up with past clients regularly to maintain relationships and seek new projects. A simple check-in email can lead to more work and contribute to managing irregular income.

Effective networking strategies for freelancers aiming for financial independence:

- Develop a compelling elevator pitch

- Utilize social media platforms strategically

- Offer value through content sharing or collaborations

Explanation: Consistent networking and nurturing client relationships can significantly impact your financial stability and contribute to your freelance budgeting tips.

According to Nathan Sevedge on LinkedIn, freelancers benefit from building a robust network to reduce income volatility and secure steady work, which is essential for financial independence for freelancers.

By focusing on relationships, you can create a reliable client base and ensure a more consistent income stream, supporting your long-term financial planning as a self-employed professional.

6: Prioritize continuous learning and skill development

Continuously improving your skills is essential to remain competitive and adaptable in the freelancing world, a key aspect of achieving financial independence for freelancers.

Actionable Steps:

- Enroll in online courses or certifications to stay updated with industry trends and skills. Look for platforms like Coursera or LinkedIn Learning for long-term financial planning for self-employed professionals.

- Join professional organizations or groups for networking and learning opportunities. Engage in online forums or attend webinars focused on managing irregular income and diversifying income streams.

- Seek mentorship from experienced freelancers or industry experts. Connect with potential mentors through networking events or social media to learn about tax planning for independent contractors and investing for financial freedom.

Key areas for skill development in freelancing:

- Technical skills relevant to your niche

- Business management and client communication

- Time management and productivity techniques for work-life balance in sustainable freelancing

Explanation: Prioritizing skill development ensures you stay relevant and competitive. According to Money with Katie, continuous learning can open new opportunities and mitigate income instability, which is crucial for freelance budgeting tips.

Staying updated with industry trends and expanding your skill set will help you attract more clients and diversify your income sources, contributing to your emergency fund strategies and retirement savings for freelancers.

Adapting and learning continuously will keep you ahead in the freelancing industry, helping you cut business expenses and work towards financial independence for freelancers.

Achieve Financial Independence with Alleo

We’ve explored the challenges of staying committed to financial independence for freelancers. But did you know you can work directly with Alleo to make this journey easier and faster?

Set up an account with Alleo in just a few minutes. Create a personalized financial plan tailored to your unique needs, including long-term financial planning for self-employed individuals.

Alleo’s AI coach will guide you through building an emergency fund, diversifying income streams, and automating savings and investments for financial freedom.

Our coach checks your progress, handles changes, and keeps you accountable. You’ll receive text and push notifications to stay on track with your freelance budgeting tips and goals.

Alleo provides full coaching sessions, just like a human coach, with a free 14-day trial and no credit card required. We can help you with managing irregular income and tax planning for independent contractors.

Ready to get started for free? Let me show you how to achieve financial independence for freelancers!

Step 1: Log In or Create Your Alleo Account

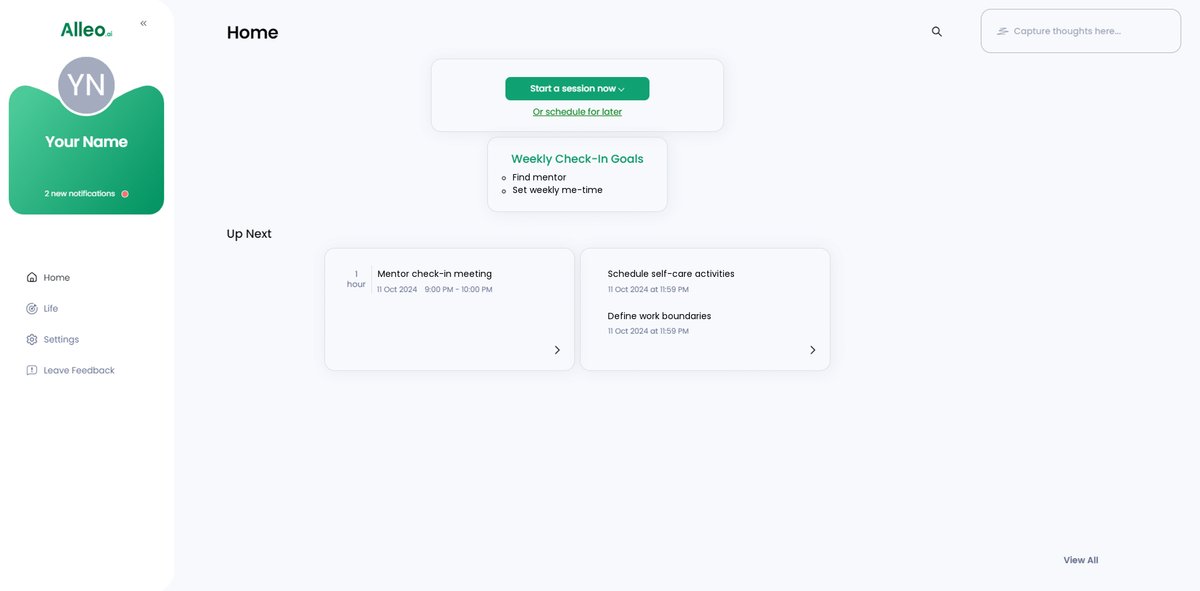

To begin your journey towards financial independence, log in to your existing Alleo account or create a new one in just a few minutes to access personalized guidance from our AI coach.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to establish consistent financial practices that will help you overcome income fluctuations and stay committed to your path towards financial independence as a freelancer.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to receive tailored guidance on building emergency funds, diversifying income streams, and automating savings – key strategies for achieving financial independence as a freelancer.

Step 4: Starting a Coaching Session

Begin your financial independence journey with Alleo by initiating an intake session, where you’ll work with our AI coach to create a personalized plan tailored to your freelance income and goals.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the Alleo app’s home page to review and manage the financial goals you discussed, allowing you to track your progress towards financial independence as a freelancer.

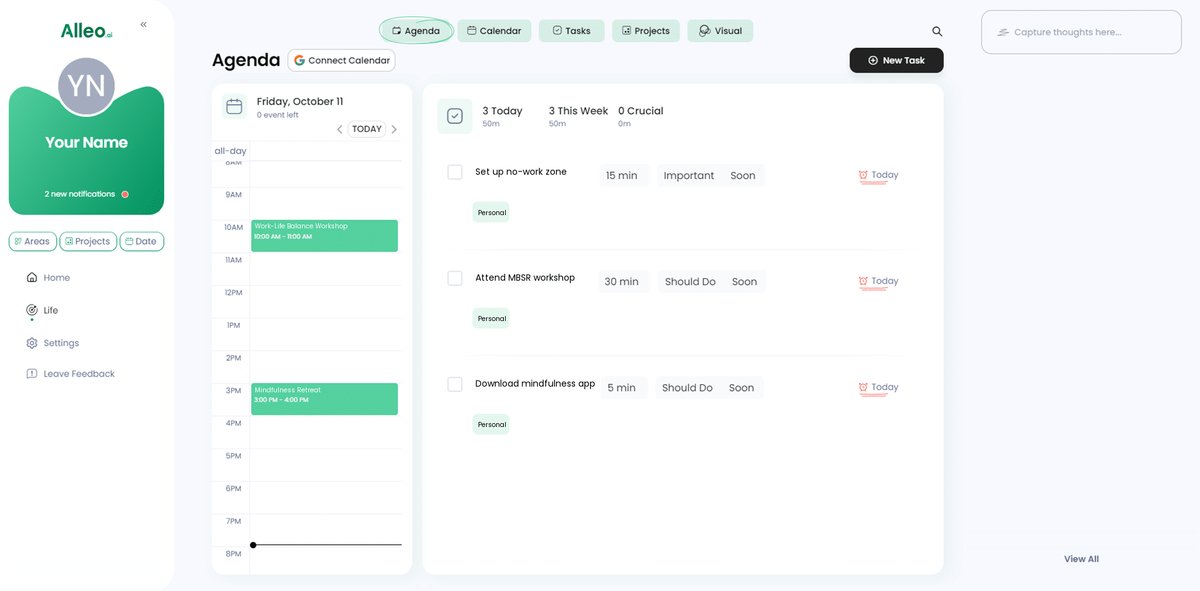

Step 6: Adding Events to Your Calendar or App

Use Alleo’s calendar and task features to track your progress towards financial independence by adding key events like monthly financial check-ins, skill development courses, and networking opportunities, ensuring you stay accountable to your goals.

Wrapping Up: Your Path to Financial Independence

As we wrap up, remember that achieving financial independence for freelancers is entirely within your reach.

By building an emergency fund, diversifying income streams, automating savings, and regularly reviewing your goals, you can create a stable financial future while managing irregular income.

Networking and continuous learning will further enhance your resilience and opportunities in long-term financial planning for self-employed professionals.

I know it can be challenging, but with the right approach to freelance budgeting tips and tax planning for independent contractors, you can overcome these hurdles.

Alleo is here to support you every step of the way on your journey to financial independence for freelancers.

Imagine the peace of mind and freedom you’ll gain through investing for financial freedom.

Start your journey today with Alleo, and take the first step toward financial independence while maintaining work-life balance for sustainable freelancing.