7 Powerful Techniques to Increase Your Savings Rate for Early Retirement as a Millennial

Are you struggling to save for millennial early retirement savings?

As a life coach, I’ve helped many navigate the complexities of financial planning. I often see the unique challenges faced by millennials in maximizing their savings rate and pursuing early financial independence.

In this article, we’ll uncover millennial retirement strategies to increase your savings rate for early retirement. You’ll learn actionable steps such as:

- Automating savings and using high-yield savings accounts

- Tracking expenses and implementing budgeting tips for young adults

- Leveraging employer benefits for retirement planning in your 20s and 30s

Let’s dive into these millennial early retirement savings techniques.

The Financial Hurdles Millennials Face

Saving for retirement can feel overwhelming, especially when you’re juggling student loans, rent, and other expenses. Many millennials find it challenging to set aside money for millennial early retirement savings due to financial literacy gaps and rising living costs.

In my experience, people often underestimate the impact of starting early. The power of compound interest is tremendous, but you need to harness it by beginning your retirement planning in your 20s and 30s journey now.

Several clients report feeling stuck because their debts take priority over retirement savings. This situation can be frustrating and stressful, making it even harder to plan for early financial independence.

So, how can you overcome these hurdles?

Let’s explore actionable strategies for millennial early retirement savings.

Key Steps to Maximize Your Savings Rate for Early Retirement

Overcoming this challenge requires a few key steps. Here are the main areas to focus on for millennial early retirement savings and financial independence:

- Automate 15%+ of income to retirement accounts: Set up direct deposits to ensure consistent contributions, a crucial millennial retirement strategy.

- Track expenses and identify areas to cut back: Use budgeting apps to monitor spending, essential for budgeting tips for young adults.

- Increase income through side hustles or gigs: Explore opportunities in the gig economy for extra income.

- Maximize employer 401(k) match and HSA benefits: Ensure you get the full employer match, a key aspect of retirement planning in your 20s and 30s.

- Invest in low-cost index funds for growth: Choose diversified, low-cost funds with solid returns, an important strategy for investing for millennials.

- Live below means and avoid lifestyle inflation: Stick to a realistic budget and avoid unnecessary spending, embracing frugal living habits.

- Educate yourself on FIRE principles and strategies: Join FIRE communities and attend workshops to learn about early financial independence.

Let’s dive in!

1: Automate 15%+ of income to retirement accounts

Automating your savings is a crucial first step for Millennial early retirement savings to ensure a consistent contribution towards your retirement goals.

Actionable Steps:

- Set Up Direct Deposits: Schedule automatic transfers of at least 15% of your monthly income to your retirement accounts through your bank’s online tools, focusing on high-yield savings accounts for better returns.

- Utilize Employer Payroll Systems: Enroll in your employer’s payroll deduction plan to guarantee deductions from each paycheck go directly into your retirement account, a key millennial retirement strategy.

Explanation:

Automating your savings helps ensure that you consistently contribute to your retirement fund without having to think about it. This practice leverages the power of consistency and compound interest, essential for building a substantial retirement fund and achieving early financial independence.

According to the Bankrate retirement savings survey, consistent contributions can significantly increase your savings over time.

This method sets a strong foundation for your financial future, especially for retirement planning in your 20s and 30s.

2: Track expenses and identify areas to cut back

Tracking your expenses and identifying areas to cut back is vital for maximizing your savings rate for millennial early retirement savings.

Actionable Steps:

- Use Expense Tracking Apps: Download and use budgeting apps like Mint or YNAB to monitor all your expenditures and categorize them effectively, supporting your millennial retirement strategies.

- Implement the 30-Day Rule: Wait 30 days before making non-essential purchases to curb impulse spending and reassess the necessity of the purchase after the waiting period, promoting frugal living habits.

- Review Monthly Statements: Regularly review your credit card and bank statements to spot unnecessary expenses and subscriptions that can be canceled, aiding in debt reduction techniques.

Explanation:

Tracking expenses helps you become more aware of your spending habits, enabling you to make informed decisions about where to cut back. This practice is crucial in managing your finances and achieving your early financial independence goals.

According to the Frontiers in Education article, financial literacy programs significantly enhance financial knowledge and behavior, which is essential for effective expense management and retirement planning in your 20s and 30s.

Taking control of your spending is the first step towards financial freedom and millennial early retirement savings.

![]()

3: Increase income through side hustles or gigs

Increasing your income through side hustles or gigs can significantly boost your savings rate for millennial early retirement savings.

Actionable Steps:

- Explore Gig Economy Opportunities: Identify side hustles for extra income that align with your skills, such as freelancing or ride-sharing. Set measurable income goals each month from these gigs to support your early financial independence.

- Monetize Hobbies: Turn hobbies into income streams, such as selling handmade crafts or offering tutoring. Dedicate specific hours each week to your side hustle as part of your millennial retirement strategies.

Explanation:

These steps matter because they help diversify your income sources, making it easier to save more for millennial early retirement savings.

According to Bankrate, leveraging side hustles can alleviate financial stress and enhance savings, which is crucial for retirement planning in your 20s and 30s.

By increasing your income through side gigs, you can accelerate your journey to financial independence and early retirement, a key goal for many millennials investing for their future.

Taking these steps can set you on the path to achieving your financial goals faster, combining frugal living habits with increased income for optimal savings.

4: Maximize employer 401(k) match and HSA benefits

Maximizing your employer 401(k) match and HSA benefits can significantly boost your Millennial early retirement savings.

Actionable Steps:

- Contribute Enough to Get the Full Match: Ensure you are contributing at least the amount required to receive your employer’s full 401(k) match each year, a crucial step in retirement planning in your 20s and 30s.

- Maximize HSA Contributions: Contribute the maximum allowed to your Health Savings Account (HSA) if you are eligible and use these funds for qualified medical expenses, supporting your journey to early financial independence.

Explanation:

These steps are crucial because they leverage employer benefits to increase your retirement savings without additional effort, aligning with effective millennial retirement strategies.

According to Synchrony Financial, maximizing employer contributions can significantly increase your savings over time.

By fully utilizing your employer’s match and HSA benefits, you ensure that you are not leaving any free money on the table, a key aspect of investing for millennials.

Taking advantage of these benefits can provide a substantial boost to your retirement fund, supporting your Millennial early retirement savings goals.

5: Invest in low-cost index funds for growth

Investing in low-cost index funds is essential for achieving long-term financial growth and securing millennial early retirement savings.

Actionable Steps:

- Research Low-Cost Index Funds: Identify diversified, low-cost index funds with a proven track record of solid returns. Look for funds that align with your risk tolerance and retirement planning in your 20s and 30s.

- Set Up Automatic Investments: Schedule monthly contributions to your selected index funds through your brokerage account. This ensures consistent investing for millennials without needing to manage it manually.

- Rebalance Your Portfolio Annually: Review and adjust your investment portfolio each year to maintain your desired asset allocation. This helps manage risk and optimize returns, supporting your journey to early financial independence.

Key benefits of index fund investing include:

- Lower fees compared to actively managed funds

- Broad market exposure and diversification

- Potential for consistent long-term growth

Explanation:

These steps matter because they help you build a diversified investment portfolio that grows over time. By investing in low-cost index funds, you minimize fees and maximize returns, crucial for millennial early retirement savings.

According to ChooseFI, the stock market historically earns over 11% annually, making it a valuable tool for growing your retirement savings.

Consistent investing and periodic rebalancing ensure your portfolio remains aligned with your goals, supporting effective millennial retirement strategies.

Taking these steps can significantly enhance your financial stability and accelerate your journey to early retirement, complementing other approaches like frugal living habits and side hustles for extra income.

6: Live below means and avoid lifestyle inflation

Living below your means and avoiding lifestyle inflation is crucial for maximizing your millennial early retirement savings rate for financial independence.

Actionable Steps:

- Create and Stick to a Realistic Budget: Develop a detailed budget that prioritizes essential expenses and savings. Regularly review and adjust it as needed, incorporating budgeting tips for young adults.

- Practice Mindful Spending: Resist the urge to increase spending with income increases. Focus on long-term financial goals rather than short-term gratification, adopting frugal living habits.

Explanation:

These steps matter because they help you maintain control over your finances and avoid unnecessary expenses. By sticking to a realistic budget and practicing mindful spending, you can allocate more money towards your millennial early retirement savings.

According to the Synchrony Financial report, consistent and mindful spending significantly impacts your ability to save more.

Strategies for avoiding lifestyle inflation:

- Prioritize experiences over material possessions, embracing minimalism and saving money

- Delay gratification and save for big-ticket items, considering high-yield savings accounts

- Find low-cost alternatives for entertainment and leisure, exploring side hustles for extra income

Taking these actions can help you achieve early financial independence faster, supporting your retirement planning in your 20s and 30s.

7: Educate yourself on FIRE principles and strategies

Understanding FIRE principles and strategies is essential for achieving financial independence and early retirement, especially for millennials seeking early retirement savings.

Actionable Steps:

- Join FIRE Communities: Participate in online forums and local meetups focused on FIRE strategies and millennial retirement strategies. Learn from the experiences and tips shared by fellow FIRE enthusiasts.

- Attend Financial Workshops and Webinars: Enroll in workshops and webinars that cover topics like investing for millennials, budgeting tips for young adults, and early financial independence. Apply the knowledge gained to your personal financial plan.

Explanation:

These steps matter because they provide valuable insights and support from others who share the same financial goals. By engaging with FIRE communities and attending educational events, you stay informed and motivated on your path to millennial early retirement savings.

According to the National Endowment for Financial Education, continuous learning enhances financial well-being and decision-making.

Core FIRE principles to focus on:

- Aggressive saving and frugal living habits

- Smart investing for long-term growth, including high-yield savings accounts

- Developing multiple income streams through side hustles for extra income

Taking these steps can help you stay on track with your financial goals and adapt to new strategies for retirement planning in your 20s and 30s.

Stay informed and connected to keep your financial journey towards millennial early retirement savings on the right path.

Boost Your Savings Rate with Alleo

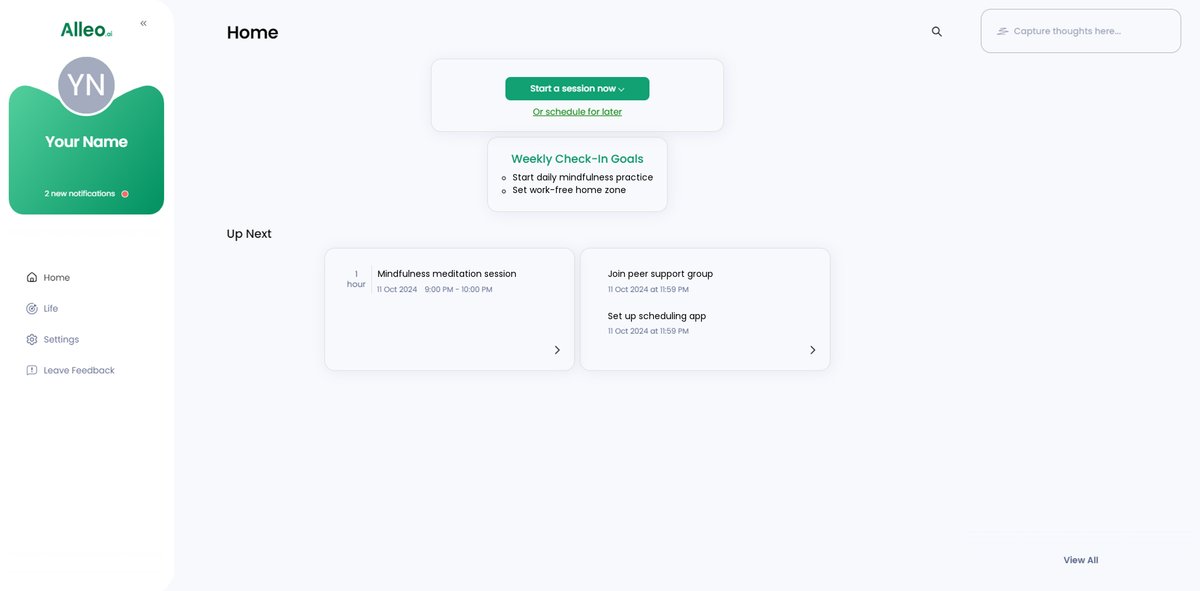

We’ve explored the challenges of increasing your savings rate for millennial early retirement. Did you know you can work with Alleo to make this journey towards early financial independence easier?

Set and Achieve Goals with Alleo:

Use Alleo’s goal-setting feature to automate your 15% income contribution for millennial early retirement savings and track your progress.

Alleo helps you identify and cut back on unnecessary expenses through personalized recommendations, supporting frugal living habits.

Plan Your Schedule for Side Hustles:

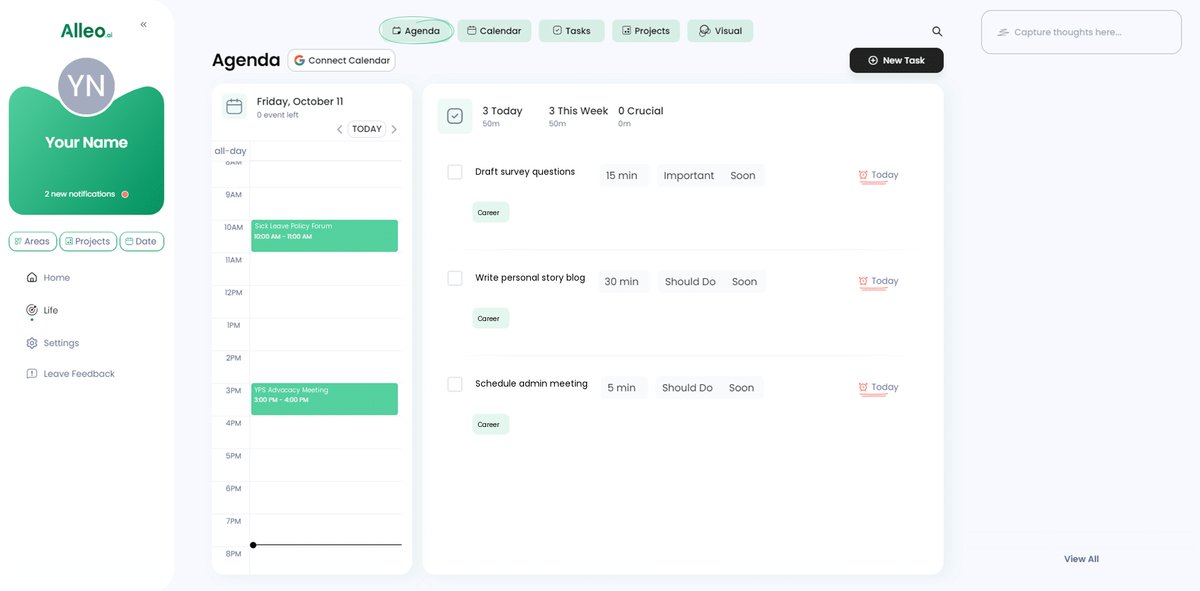

Leverage Alleo’s scheduling tool to allocate time for side hustles for extra income while maintaining a balanced lifestyle.

Get reminders and tips on maximizing your employer 401(k) match and HSA benefits, crucial for retirement planning in your 20s and 30s.

Build Financial Habits:

Utilize Alleo to build and maintain healthy financial habits, such as regular investing for millennials and mindful spending, essential for millennial retirement strategies.

Stay informed with Alleo’s curated content on FIRE principles and strategies for early financial independence.

Ready to get started for free?

Let me show you how!

Step 1: Log In or Create Your Account

To start boosting your savings rate with Alleo, log in to your existing account or create a new one to access personalized financial guidance tailored to your early retirement goals.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start developing consistent financial practices that will boost your savings rate and support your early retirement goals, such as automated saving and expense tracking.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to align your goals with the strategies for increasing your savings rate and achieving early retirement. By selecting this life area, you’ll gain access to tailored tools and guidance specifically designed to help you automate savings, track expenses, and maximize your investment potential, putting you on the fast track to financial independence.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session to create a personalized financial plan that aligns with your early retirement goals and maximizes your savings rate.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the Alleo app’s home page to view and manage the financial goals you discussed, including your savings rate targets and investment plans for early retirement.

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track your financial activities, such as budgeting sessions, investment reviews, and side hustle work hours, helping you stay on top of your early retirement savings goals.

Take Control of Your Financial Future

You’re now equipped with millennial retirement strategies to boost your savings rate for early retirement.

Remember, it’s about making small but impactful changes for early financial independence.

By automating your savings, tracking expenses, and leveraging side hustles for extra income, you can make significant progress towards millennial early retirement savings.

Maximizing employer benefits and investing for millennials will further enhance your financial growth.

Living below your means with frugal living habits and educating yourself on FIRE principles will keep you on track.

Empower yourself to take these budgeting tips for young adults today.

If you need a helping hand with retirement planning in your 20s and 30s, Alleo is here to support you.

Start your journey to financial independence with Alleo.

Ready to begin your millennial early retirement savings plan? Let’s make it happen!