How to Create a Shared Retirement Plan: 4 Essential Steps for Couples

Are you and your partner ready to navigate the journey of creating a shared retirement plan together?

As a life coach, I’ve guided many couples through the complexities of aligning their retirement goals and developing joint retirement savings strategies. This can be particularly daunting for empty nesters focusing on their future after years of raising children, especially when it comes to balancing retirement goals in marriage.

In this blog, you’ll discover a roadmap to create a shared retirement plan that aligns with both your goals. We’ll delve into setting shared goals, fostering financial literacy, and ensuring accountability. We’ll explore strategies for synchronizing retirement timelines and managing retirement investments as a couple.

Let’s dive in.

Understanding the Challenges in Creating a Shared Retirement Plan

Creating a shared retirement plan isn’t easy. Many couples face hurdles like differing retirement timelines and varying levels of financial literacy when planning for retirement together.

In my experience, a lack of communication often compounds these issues in retirement planning for couples.

Failing to align on a plan can lead to financial insecurity and strain your relationship. Several clients report feeling overwhelmed by the sheer complexity of joint retirement savings strategies.

The consequences are significant. Without a shared plan, you may find yourselves unprepared for retirement’s financial demands, including managing retirement investments as a couple.

This can jeopardize your future stability and impact your ability to maximize Social Security benefits for couples.

Many struggle with where to start balancing retirement goals in marriage. But understanding these challenges is the first step toward overcoming them and developing effective communication strategies for shared retirement goals.

Roadmap to Creating a Shared Retirement Plan

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in creating a shared retirement plan:

- Set Shared Retirement Goals and Timeline: Establish and prioritize both individual and collective retirement dreams. Create a timeline that aligns with both partners’ desired retirement milestones, synchronizing retirement timelines for a cohesive approach.

- Create a Joint Financial Literacy Plan: Enroll in financial courses and seek advice to enhance your financial knowledge together, focusing on retirement planning for couples and joint retirement savings strategies.

- Establish Regular Retirement Check-in Meetings: Schedule monthly meetings to review financial status, discuss spousal IRA contributions, and adjust plans as needed, improving communication strategies for shared retirement goals.

- Divide Retirement Planning Responsibilities: Assign tasks based on each partner’s strengths and ensure transparency with shared tools, balancing retirement goals in marriage effectively.

Let’s dive in to explore these strategies for creating a shared retirement plan!

1: Set shared retirement goals and timeline

Setting shared retirement goals and a timeline is essential for creating a shared retirement plan and aligning your financial future.

Actionable Steps:

- Discuss and list: Sit down together and list individual and shared retirement dreams. Use a vision board to visualize these goals, focusing on retirement planning for couples.

- Prioritize and timeline: Rank these goals and establish a timeline. Create a retirement timeline that includes both partners’ desired retirement ages and milestones, synchronizing retirement timelines effectively.

- Negotiate and align: Discuss and negotiate to ensure both partners’ goals are reflected. Use financial planning software to simulate different scenarios and find a compromise, balancing retirement goals in marriage.

Key benefits of setting shared goals:

- Increased motivation and focus

- Better alignment of financial decisions

- Clearer path to achieving retirement dreams

Explanation: Setting shared goals helps you both stay focused and motivated. By visualizing and prioritizing your dreams, you can create a realistic plan that considers both partners’ aspirations, enhancing your joint retirement savings strategies.

Utilizing tools like financial planning software can assist in finding a balanced approach to creating a shared retirement plan. For more insights, refer to the American Society of Pension Professionals & Actuaries.

These steps set the foundation for a secure and satisfying retirement journey, paving the way for effective retirement income planning for partners.

2: Create a joint financial literacy plan

Developing a joint financial literacy plan is crucial for creating a shared retirement plan and ensuring both partners are well-informed and aligned in their financial decisions.

Actionable Steps:

- Enroll in a course: Sign up for a financial literacy course together, such as Income Planning for Retirees, to improve your retirement planning for couples.

- Weekly discussions: Read and discuss financial books or articles weekly to stay updated and informed on joint retirement savings strategies and communication strategies for shared retirement goals.

- Consult an advisor: Seek advice from a financial advisor specializing in retirement income planning for partners and schedule periodic consultations to review and adjust your shared retirement plan.

Explanation: Enhancing your financial knowledge together ensures both partners make informed decisions, reducing the risk of financial missteps when creating a shared retirement plan.

According to Wharton School, financial literacy is crucial for effective retirement planning.

Staying informed and seeking expert advice helps you align your financial goals, balance retirement goals in marriage, and secure your future.

Implementing these steps will strengthen your financial partnership, ensuring you both are prepared for a successful retirement while maximizing Social Security benefits for couples.

3: Establish regular retirement check-in meetings

Regular check-ins are vital for creating a shared retirement plan and keeping your retirement goals on track while ensuring both partners are aligned.

Actionable Steps:

- Schedule monthly sessions: Set up monthly meetings to review your financial status and progress towards your retirement goals. Use a shared calendar to set reminders for these joint retirement savings strategy sessions.

- Discuss changes: During each meeting, talk about any changes in income, expenses, or life circumstances that may impact your plan for balancing retirement goals in marriage.

- Set measurable targets: Establish specific, measurable targets for each meeting, like saving a certain percentage of your income or reducing discretionary spending by a set amount to support your shared retirement plan.

Key topics to cover in check-in meetings:

- Progress towards savings goals

- Recent financial decisions and their impact on retirement planning for couples

- Upcoming major expenses or life changes affecting your retirement income planning for partners

Explanation: Consistent check-ins help you stay accountable and adapt to financial changes. This practice ensures you both remain engaged in the planning process for creating a shared retirement plan.

According to the American Society of Pension Professionals & Actuaries, regular updates are essential for successful retirement planning. Staying aligned helps prevent potential financial surprises and supports synchronizing retirement timelines.

Scheduling check-ins keeps you proactive and prepared for your financial future, enhancing your communication strategies for shared retirement goals.

4: Divide retirement planning responsibilities

Dividing responsibilities ensures both partners contribute based on their strengths when creating a shared retirement plan.

Actionable Steps:

- Identify strengths: Evaluate each partner’s skills and interests. Assign tasks like retirement investments to one and budgeting to the other.

- Use tools: Implement financial management tools to track progress and maintain transparency in joint retirement savings strategies. Shared documents help both partners stay informed.

- Regular updates: Create a shared document for noting progress and concerns. Review this during your check-in meetings to synchronize retirement timelines.

Benefits of dividing responsibilities in retirement planning for couples:

- Maximizes each partner’s strengths

- Increases engagement in the planning process

- Promotes shared ownership of financial goals

Explanation: Dividing tasks allows you to leverage each other’s strengths, making the shared retirement plan process efficient.

According to the MIT Sloan, understanding household decision-making can improve financial outcomes. Regular updates ensure you’re both aligned and proactive in your retirement income planning for partners.

Taking these steps helps streamline your retirement planning, ensuring both partners are engaged and informed in managing retirement investments as a couple.

Partner with Alleo on Your Retirement Journey

We’ve explored the challenges of creating a shared retirement plan and the steps to achieve it. But did you know you can work directly with Alleo to make this journey easier and faster when retirement planning for couples?

Setting up your account with Alleo is simple. Start by signing up for a free 14-day trial—no credit card required. It’s a great way to begin synchronizing retirement timelines with your partner.

Alleo helps you create a personalized retirement plan tailored to your unique goals, including joint retirement savings strategies and balancing retirement goals in marriage.

Alleo’s AI coach provides full coaching sessions, just like a human coach. It offers affordable, tailored support for your retirement planning needs, including guidance on spousal IRA contributions and maximizing Social Security benefits for couples.

Alleo keeps you accountable with regular follow-ups and prompts via text and push notifications, enhancing communication strategies for shared retirement goals.

Ready to get started for free? Let me show you how to begin creating a shared retirement plan!

Step 1: Log In or Create Your Account

To begin your shared retirement planning journey with Alleo, simply log in to your existing account or create a new one to access personalized AI coaching and tools tailored to your retirement goals.

Step 2: Choose Your Retirement Planning Focus

Select “Setting and achieving personal or professional goals” to align your individual aspirations with your shared retirement vision, ensuring both partners’ dreams are incorporated into your financial planning journey.

Step 3: Select ‘Finances’ as Your Focus Area

Choose ‘Finances’ as your primary focus area in Alleo to align with your retirement planning goals. This selection will tailor the AI coach’s guidance to help you and your partner create a shared financial strategy, improve your financial literacy, and work towards a secure retirement together.

Step 4: Starting a coaching session

Begin your retirement planning journey with Alleo by initiating an intake session, where you’ll set up your personalized plan and goals for a secure financial future together.

Step 5: Viewing and managing goals after the session

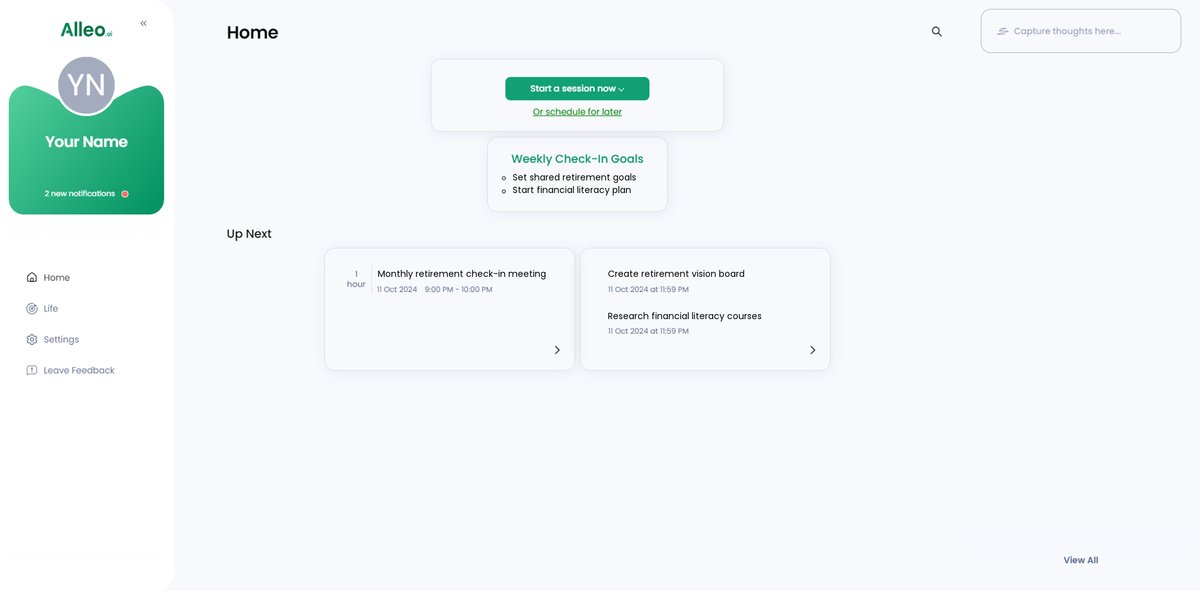

After your coaching session, easily access and manage the retirement goals you discussed by checking the home page of the Alleo app, where they’ll be prominently displayed for your ongoing review and adjustment.

Step 6: Adding events to your calendar or app

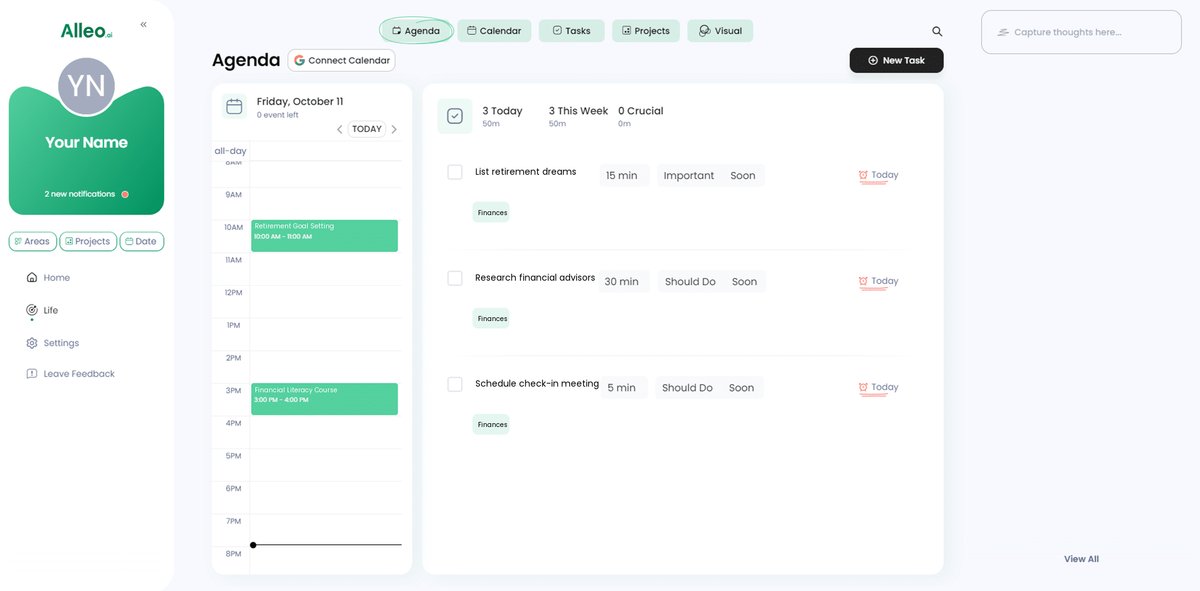

To keep your retirement planning on track, use the Alleo app’s calendar and task features to schedule your regular check-in meetings and track your progress towards financial goals, ensuring you and your partner stay aligned and accountable throughout your shared retirement journey.

Your Path to a Shared and Secure Retirement

We’ve come a long way in understanding how to create a shared retirement plan together.

Setting shared goals, fostering financial literacy, and holding regular check-ins are vital for creating a shared retirement plan. Dividing responsibilities based on strengths ensures a balanced approach to retirement planning for couples.

Remember, you’re not alone in this journey. Alleo can guide you every step of the way in balancing retirement goals in marriage.

It’s time to take action on your joint retirement savings strategies.

Start your retirement planning today with Alleo. Together, you can achieve your dreams and secure your future through effective retirement income planning for partners.

Try Alleo for free and experience the difference in your retirement planning journey, including maximizing Social Security benefits for couples.