7 Essential Steps to Implement Cybersecurity Measures for Financial Data Protection

What if you woke up to find your company’s financial data compromised?

Imagine a small accounting firm that recently faced a data breach, exposing sensitive client information. Protecting financial data through cybersecurity is crucial in today’s digital age.

As a life coach, I’ve helped many professionals navigate these cybersecurity challenges. In my experience, accountants face unique risks in protecting sensitive financial data and ensuring compliance with financial regulations.

In this article, you’ll discover specific strategies to protect financial data with cybersecurity measures. We’ll cover multi-factor authentication, data encryption techniques, and more.

Let’s dive in.

Understanding the Cybersecurity Challenges in Finance

Digital integration in financial services has skyrocketed, but so have cyber threats. With every new technology, new vulnerabilities emerge, making it crucial to protect financial data cybersecurity.

Accountants face unique challenges in protecting sensitive financial data. Many clients struggle with the complexity of managing multiple security protocols, including data encryption techniques and secure cloud storage solutions.

Imagine the impact of a data breach. It can lead to loss of trust, financial penalties, and major operational disruptions, highlighting the importance of intrusion detection systems and endpoint protection strategies.

In my experience, people often underestimate the consequences. The aftermath can be devastating, emphasizing the need for robust network firewall configuration and multi-factor authentication.

Taking proactive measures is essential. But it’s not easy, requiring a focus on employee cybersecurity training and data breach response planning.

Key Steps to Implement Cybersecurity for Financial Data Protection

Overcoming this challenge requires a few key steps to protect financial data cybersecurity. Here are the main areas to focus on to make progress.

- Implement Multi-Factor Authentication (MFA): Enhance security by adding extra layers of verification for financial data protection.

- Encrypt Sensitive Data at Rest and in Transit: Use AES/RSA data encryption techniques for financial information stored and during secure file transfer protocols.

- Conduct Regular Cybersecurity Risk Assessments: Identify and address vulnerabilities periodically to ensure financial compliance regulations are met.

- Train Employees on Cybersecurity Best Practices: Ensure continuous employee cybersecurity training on threat awareness.

- Deploy and Update Robust Antivirus Software: Protect systems with comprehensive endpoint protection strategies.

- Establish and Test an Incident Response Plan: Be prepared for breaches with a detailed data breach response planning strategy.

- Use Secure Cloud Services for Data Storage: Employ reputable secure cloud storage solutions with strong security measures, including network firewall configuration and intrusion detection systems.

Let’s dive in to protect financial data cybersecurity!

1: Implement multi-factor authentication (MFA)

Implementing multi-factor authentication (MFA) is a vital step to protect financial data and enhance cybersecurity against unauthorized access.

Actionable Steps:

- Assess current authentication methods: Identify areas where MFA can be integrated to enhance security and protect financial data.

- Select the right MFA solution: Choose an MFA method that fits your firm’s needs, such as SMS, app-based, or hardware tokens, aligning with financial compliance regulations.

- Roll out MFA in phases: Start with high-risk accounts, monitor adoption, and adjust based on feedback to strengthen your cybersecurity strategy.

Explanation:

These steps are crucial for securing sensitive financial data. MFA adds an extra layer of protection, significantly reducing the risk of unauthorized access and enhancing cybersecurity measures.

According to the SentinelOne, using MFA is a key tactic in combating cyber threats. By following these actionable steps, you align with industry standards and enhance your firm’s overall cybersecurity posture to protect financial data.

Taking these steps will bolster your defenses against cyber threats and ease your transition to more secure systems, ultimately improving your ability to protect financial data through robust cybersecurity measures.

2: Encrypt sensitive data at rest and in transit

Encryption is crucial for protecting financial data from unauthorized access, both while stored and during transmission. Implementing robust data encryption techniques is a key step to protect financial data cybersecurity.

Actionable Steps:

- Conduct a data inventory: Identify all data storage and transmission methods within your firm, including secure cloud storage solutions.

- Implement AES/RSA encryption: Apply encryption to data stored on servers and during transfers, utilizing secure file transfer protocols.

- Regularly update protocols: Ensure your encryption methods meet current standards and are frequently reviewed to comply with financial compliance regulations.

Explanation:

These steps are vital for securing sensitive financial data. Encrypting data both at rest and in transit ensures its protection against cyber threats and supports endpoint protection strategies.

According to the IRS, using robust encryption standards is essential for compliance and security. By following these steps, you enhance your firm’s defense against potential data breaches and strengthen your overall approach to protect financial data cybersecurity.

Taking these actions will significantly reduce the risk of unauthorized data access and support your overall cybersecurity strategy, complementing other measures such as network firewall configuration and intrusion detection systems.

3: Conduct regular cybersecurity risk assessments

Conducting regular cybersecurity risk assessments is crucial to identify and address vulnerabilities in your firm’s security posture and protect financial data cybersecurity.

Actionable Steps:

- Schedule quarterly risk assessments: Plan and perform assessments every three months to stay ahead of potential threats and ensure compliance with financial compliance regulations.

- Use industry-standard frameworks: Follow frameworks like NIST to ensure comprehensive and consistent evaluations of data encryption techniques and secure cloud storage solutions.

- Document findings and create action plans: Record vulnerabilities and develop actionable steps to mitigate identified risks, including multi-factor authentication and network firewall configuration.

Explanation:

These steps are vital for maintaining a robust cybersecurity strategy to protect financial data. Regular risk assessments help you stay proactive in addressing security gaps and implementing endpoint protection strategies.

According to the NIST Cybersecurity Framework, consistent evaluations are essential for effective risk management. By implementing these measures, you can better protect sensitive financial data and align with industry best practices, including secure file transfer protocols.

Key benefits of regular risk assessments include:

- Early detection of vulnerabilities

- Improved compliance with regulations

- Enhanced overall security posture

Staying vigilant with regular assessments will fortify your defenses against emerging cyber threats and improve your data breach response planning.

4: Train employees on cybersecurity best practices

Training employees on cybersecurity best practices is crucial for protecting financial data and enhancing cybersecurity measures.

Actionable Steps:

- Organize regular training sessions: Schedule mandatory cybersecurity training for all employees to stay updated on the latest threats and learn data encryption techniques.

- Develop a mentorship program: Pair experienced employees with newcomers to guide them on best practices, security protocols, and financial compliance regulations.

- Implement monthly cybersecurity drills: Conduct drills to keep awareness high and ensure preparedness for potential threats, including simulations of data breach response planning.

Explanation:

These steps are vital to maintaining a strong cybersecurity posture to protect financial data. Regular training sessions and mentorship can significantly enhance your team’s readiness in areas such as multi-factor authentication and secure file transfer protocols.

According to DivergeIT, continuous education is key to protecting against evolving cyber threats. By following these measures, you align with industry best practices and enhance your firm’s overall security, including network firewall configuration and endpoint protection strategies.

Investing in employee cybersecurity training will fortify your defenses and ensure everyone is prepared to handle cybersecurity risks effectively, contributing to the protection of financial data.

5: Deploy and update robust antivirus software

Deploying and updating robust antivirus software is essential to protect financial data from malware and other cyber threats. This is a crucial step in implementing effective endpoint protection strategies.

Actionable Steps:

- Research and select an antivirus solution: Find a comprehensive antivirus product tailored to your firm’s needs to protect financial data and enhance cybersecurity.

- Schedule automatic updates and regular scans: Ensure continuous protection by setting your software to update and scan automatically, strengthening your intrusion detection systems.

- Perform quarterly reviews: Assess your antivirus software’s effectiveness every quarter and adjust as needed to maintain compliance with financial compliance regulations.

Explanation:

These steps are critical for maintaining a secure environment for sensitive financial data. Regular updates and scans help identify and eliminate threats, supporting your overall strategy to protect financial data cybersecurity.

According to the NIST Cybersecurity Framework, staying current with antivirus software is essential for effective risk management. By following these measures, you align with industry standards and enhance your firm’s cybersecurity defenses, including network firewall configuration and secure file transfer protocols.

Investing in robust antivirus software will help protect your systems and ensure data integrity, complementing other measures such as data encryption techniques and multi-factor authentication.

6: Establish and test an incident response plan

Creating and testing an incident response plan is essential to effectively handle cybersecurity breaches and minimize damage when protecting financial data.

Actionable Steps:

- Develop a detailed incident response plan: Outline specific steps to take during a data breach, including roles and responsibilities for protecting financial data cybersecurity.

- Conduct bi-annual simulations: Test the plan’s effectiveness twice a year and make necessary improvements based on the results, including data breach response planning.

- Designate an incident response team: Assign a dedicated team and provide them with specialized training to handle breaches efficiently and ensure compliance with financial compliance regulations.

Explanation:

These steps are crucial for ensuring your firm is prepared for potential cybersecurity incidents. Regular simulations and a well-trained response team can significantly reduce the impact of a breach and protect financial data cybersecurity.

According to the NIST Cybersecurity Framework, having a robust incident response plan is vital for effective risk management. By following these measures, you align with industry best practices and enhance your firm’s overall cybersecurity posture, including the use of intrusion detection systems.

Essential components of an effective incident response plan:

- Clear communication protocols

- Defined roles and responsibilities

- Detailed recovery procedures

Being prepared with an incident response plan will help you mitigate risks and quickly recover from any breaches, ensuring the protection of financial data cybersecurity.

7: Use secure cloud services for data storage

Using secure cloud services for data storage is crucial to protect financial data and enhance cybersecurity in today’s digital landscape.

Actionable Steps:

- Research and select a secure cloud provider: Choose a cloud storage solution with strong security measures and financial compliance regulations certifications.

- Migrate sensitive data to the cloud: Transfer your financial data to the selected cloud service, ensuring proper data encryption techniques during the process.

- Regularly audit cloud security practices: Conduct periodic audits to verify that the cloud provider maintains high-security standards and robust endpoint protection strategies.

Explanation:

These steps are essential for ensuring the security and integrity of your firm’s financial data. A secure cloud provider offers robust protection and compliance with industry standards to protect financial data cybersecurity.

According to NIST, leveraging cloud services can enhance data security and operational efficiency. By following these steps, you align with best practices and mitigate risks associated with data breaches.

Key advantages of using secure cloud services:

- Enhanced data accessibility

- Scalable storage solutions

- Improved disaster recovery capabilities

Prioritizing secure cloud services fortifies your data protection strategy and supports your firm’s overall efforts to protect financial data cybersecurity.

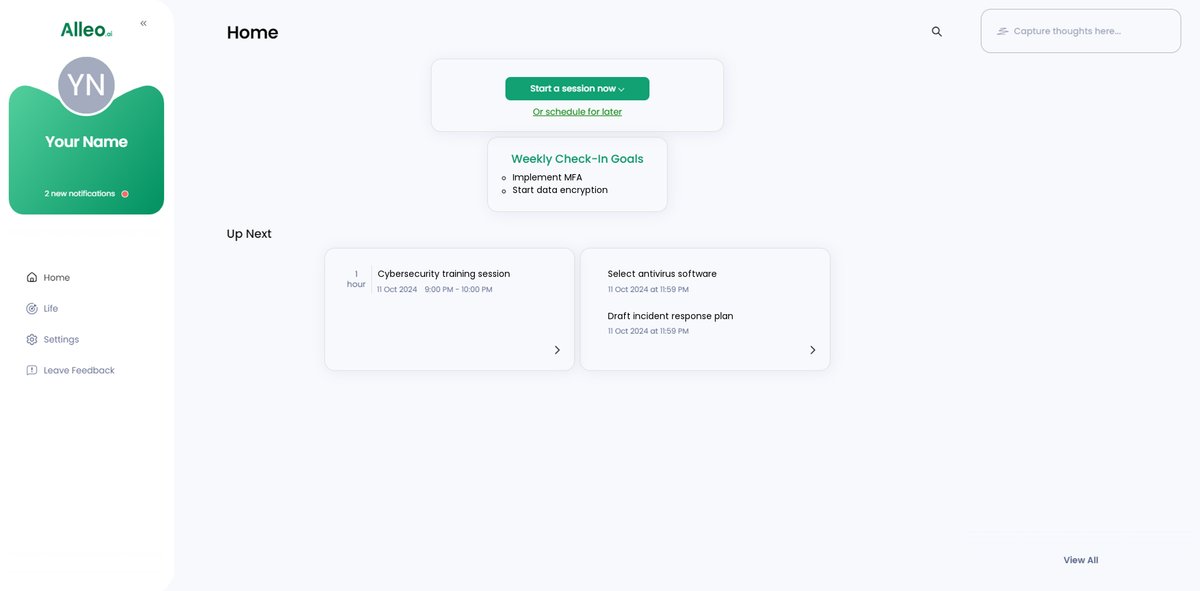

Partner with Alleo on Your Cybersecurity Journey

We’ve explored the challenges of implementing cybersecurity measures to protect financial data. Solving them benefits your firm and enhances your data encryption techniques.

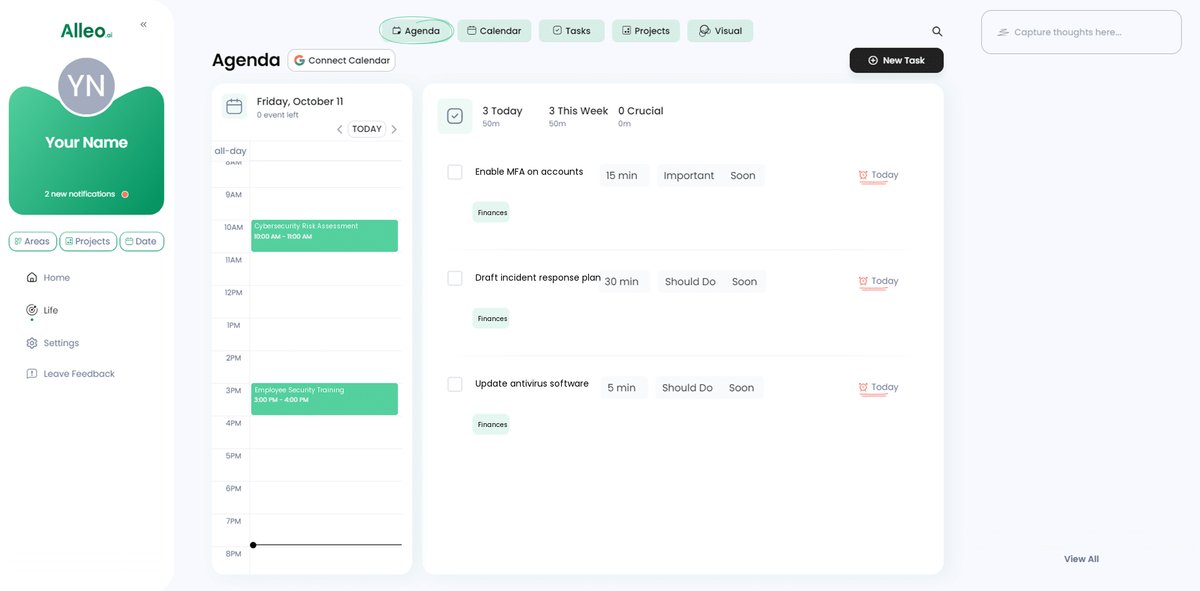

But did you know you can work directly with Alleo to make this journey easier and faster, ensuring compliance with financial regulations?

Setting up an account is simple. Start with a free 14-day trial—no credit card required. Experience our secure cloud storage solutions firsthand.

Alleo helps create a personalized cybersecurity plan tailored to your needs, including multi-factor authentication and network firewall configuration.

The Alleo AI coach provides comprehensive coaching sessions, just like a human coach. The coach follows up on progress, handles changes, and keeps you accountable through text and push notifications, reinforcing employee cybersecurity training.

Ready to get started for free and strengthen your intrusion detection systems?

Let me show you how to protect financial data with cybersecurity!

Step 1: Log In or Create Your Account

To begin your cybersecurity journey with Alleo, Log in to your account or create a new one to access personalized guidance on protecting your financial data.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start developing consistent cybersecurity practices that will protect your financial data and strengthen your firm’s overall security posture.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to directly address your cybersecurity concerns and protect your financial data, aligning with the strategies discussed in the article to safeguard your accounting firm’s sensitive information.

Step 4: Starting a coaching session

Begin your cybersecurity journey with an intake session to set up your personalized plan, allowing the AI coach to understand your firm’s specific needs and guide you through implementing robust financial data protection measures.

Step 5: Viewing and managing goals after the session

After your cybersecurity coaching session, you’ll find the goals you discussed displayed on the home page of the Alleo app, allowing you to easily track and manage your progress in implementing crucial data protection measures.

Step 6: Adding events to your calendar or app

Use the calendar and task features in the Alleo app to schedule and track your cybersecurity activities, such as employee training sessions, risk assessments, and incident response drills, ensuring you stay on top of your data protection efforts.

Wrapping Up Your Cybersecurity Journey

As we’ve explored, implementing strong cybersecurity measures is essential for safeguarding sensitive financial data. It’s challenging, but necessary to protect financial data with cybersecurity strategies.

I understand the complexities you face. However, with the right strategies, you can protect your firm’s data using secure cloud storage solutions and data encryption techniques.

Start by implementing multi-factor authentication and encrypting your data. Conduct regular risk assessments and provide employee cybersecurity training consistently.

Deploy robust antivirus software and have a solid data breach response plan in place. Use secure cloud services to store your financial data safely while adhering to financial compliance regulations.

Remember, you’re not alone in this journey to protect financial data with cybersecurity. Alleo can guide you every step of the way.

Take the first step today. Start your free 14-day trial with Alleo and secure your financial data.