3 Essential Ways Accountants Can Master Cloud-Based Financial Tools

Are you struggling to keep up with the rapid technological changes in the accounting field, especially with the rise of cloud accounting tools for accountants?

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, adapting to new tools is key for career longevity and efficiency, particularly in the era of digital transformation in finance.

In this article, you’ll discover strategies to transition from traditional methods to cloud-based and AI-driven financial tools. You’ll learn about training programs for cloud accounting software, data analytics, and AI competencies that are essential for remote financial management and automation in accounting.

Let’s dive in.

The Challenges of Transitioning to Cloud-Based Accounting Tools

Switching from traditional accounting methods to cloud accounting tools for accountants isn’t easy. Many clients initially struggle with the lack of training and fear of new technology in the digital transformation of finance.

This can lead to significant data security concerns in cloud finance and hesitation.

Staying behind impacts productivity and accuracy. Accountants who don’t adapt to cloud accounting software may find it difficult to deliver timely financial insights through real-time financial reporting.

This can hinder career growth and client satisfaction in remote financial management.

In my experience, embracing cloud technology is essential. It’s not just about using new tools but about transforming your entire approach to accounting through automation in accounting and streamlining financial processes.

Adapting is crucial for staying relevant and efficient in today’s fast-paced digital environment, which includes upskilling for cloud accounting and integrating cloud-based tools for collaborative accounting practices.

Effective Strategies for Adapting to Cloud-Based Financial Tools

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress with cloud accounting tools for accountants.

- Enroll in cloud accounting software training: Gain essential skills by taking courses on platforms like Xero or QuickBooks Online, leading to digital transformation in finance.

- Integrate data analytics into financial processes: Learn tools like Power BI or Tableau to analyze financial data effectively, enhancing remote financial management capabilities.

- Develop AI and machine learning competencies: Understand AI basics and use AI-powered tools to automate repetitive tasks, streamlining financial processes.

Let’s dive into these cloud accounting tools for accountants!

1: Enroll in cloud accounting software training

Enrolling in cloud accounting software training is essential for accountants to remain competitive and efficient in using cloud accounting tools for accountants.

Actionable Steps:

- Research and select a reputable training program. Choose programs with comprehensive reviews and a curriculum covering key cloud accounting software like Xero and QuickBooks Online.

- Schedule dedicated time each week to complete the training. Allocate 2-3 hours per week to ensure consistent progress and retention of new skills in remote financial management.

- Apply learned skills in a controlled environment. Practice using cloud accounting tools for accountants with sample data before implementing them in real scenarios.

Explanation:

These steps matter because they ensure a structured and effective approach to mastering cloud accounting tools. By completing reputable training programs, accountants can enhance their skills in digital transformation in finance and stay ahead in a rapidly evolving industry.

According to CareerVillage, proficiency in software like QuickBooks is essential for managing financial records and payroll.

Key benefits of cloud accounting software training include:

- Improved efficiency in real-time financial reporting

- Enhanced collaborative accounting practices with clients and team members

- Real-time access to financial data from anywhere, supporting remote financial management

Taking these steps will prepare you for the next phase: integrating data analytics into your financial processes and streamlining financial processes through cloud accounting tools for accountants.

2: Integrate data analytics into financial processes

Integrating data analytics into financial processes is vital for gaining deeper insights and improving decision-making, especially when leveraging cloud accounting tools for accountants.

Actionable Steps:

- Learn data analytics tools. Enroll in courses for tools like Power BI or Tableau to analyze financial data effectively, enhancing your skills in cloud accounting software.

- Develop a data-driven mindset. Start incorporating data analytics into monthly reports to identify important trends, facilitating digital transformation in finance.

- Collaborate with a mentor or group. Engage with peers or mentors who have successfully used data analytics in their accounting processes, improving collaborative accounting practices.

Explanation:

These steps are essential for staying competitive and providing accurate financial insights through remote financial management.

By learning data analytics tools, you can enhance your ability to analyze and interpret financial data, streamlining financial processes. According to CareerVillage, proficiency in tools like Tableau is crucial for effective financial data analysis and automation in accounting.

Following these steps will prepare you for the next phase: developing AI and machine learning competencies, further advancing your use of cloud accounting tools for accountants.

3: Develop AI and machine learning competencies

Developing AI and machine learning competencies is essential for staying ahead in the evolving field of accounting, especially as cloud accounting tools for accountants become more prevalent.

Actionable Steps:

- Enroll in introductory AI and machine learning courses. Choose beginner-friendly courses that cover AI basics and their applications in finance, including cloud accounting software, dedicating 1-2 hours per week.

- Experiment with AI tools. Use AI-powered financial tools to automate tasks like bank reconciliation and invoice processing, contributing to the digital transformation in finance.

- Stay updated with industry trends. Subscribe to industry newsletters and attend webinars on AI advancements in accounting and remote financial management.

Explanation:

These steps are crucial for accountants to stay competitive and efficient. By learning AI and machine learning, you’ll be able to automate repetitive tasks and focus on higher-value activities, enhancing your ability to use cloud accounting tools for accountants effectively.

According to House of Companies, AI-powered automation is transforming financial task management, enabling accountants to concentrate on complex responsibilities.

AI and machine learning offer several advantages in accounting:

- Faster and more accurate data processing through automation in accounting

- Improved fraud detection capabilities and data security in cloud finance

- Enhanced predictive financial modeling and real-time financial reporting

Taking these steps will prepare you to effectively integrate AI into your accounting processes and leverage cloud accounting tools for accountants.

Partner with Alleo on Your Cloud Transition Journey

We’ve explored the challenges of adapting to cloud accounting tools for accountants, the benefits, and the steps to achieve digital transformation in finance. But did you know you can work directly with Alleo to make this journey easier and faster?

Alleo offers personalized coaching to help you master cloud accounting software. Setting up an account is simple, and creating a personalized plan for remote financial management is seamless.

With Alleo, you’ll receive tailored coaching sessions just like a human coach. The AI coach will follow up on your progress and handle changes efficiently, supporting your integration of cloud-based tools.

You’ll stay accountable with text and push notifications, ensuring consistent development in automation in accounting and streamlining financial processes.

Ready to get started for free? Let me show you how to begin your journey with cloud accounting tools for accountants!

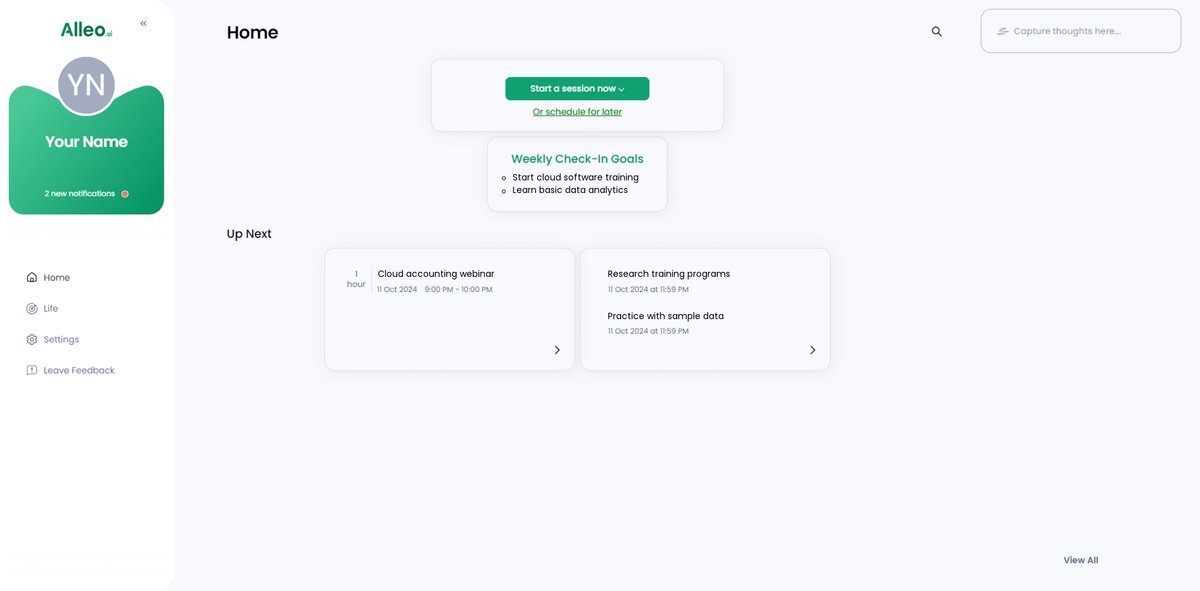

Step 1: Log In or Create Your Alleo Account

To begin your cloud accounting journey, log in to your existing Alleo account or create a new one in just a few clicks, setting the foundation for your personalized AI coaching experience.

Step 2: Choose Your Goal – Building Better Habits and Routines

Select “Building better habits and routines” as your goal to develop consistent practices for mastering cloud-based accounting tools, enhancing your productivity and adapting more efficiently to new technologies in the field.

Step 3: Select “Career” as Your Focus Area

Choose “Career” as your focus area to address the challenges of adapting to cloud-based accounting tools and AI technologies, which will help you stay competitive and efficient in the rapidly evolving field of accounting.

Step 4: Starting a coaching session

Begin your cloud transition journey by scheduling an intake session with your Alleo AI coach to create a personalized plan for mastering cloud-based accounting tools and integrating data analytics into your workflow.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the app’s home page to review and manage the goals you discussed, allowing you to track your progress in mastering cloud-based accounting tools and implementing data analytics in your financial processes.

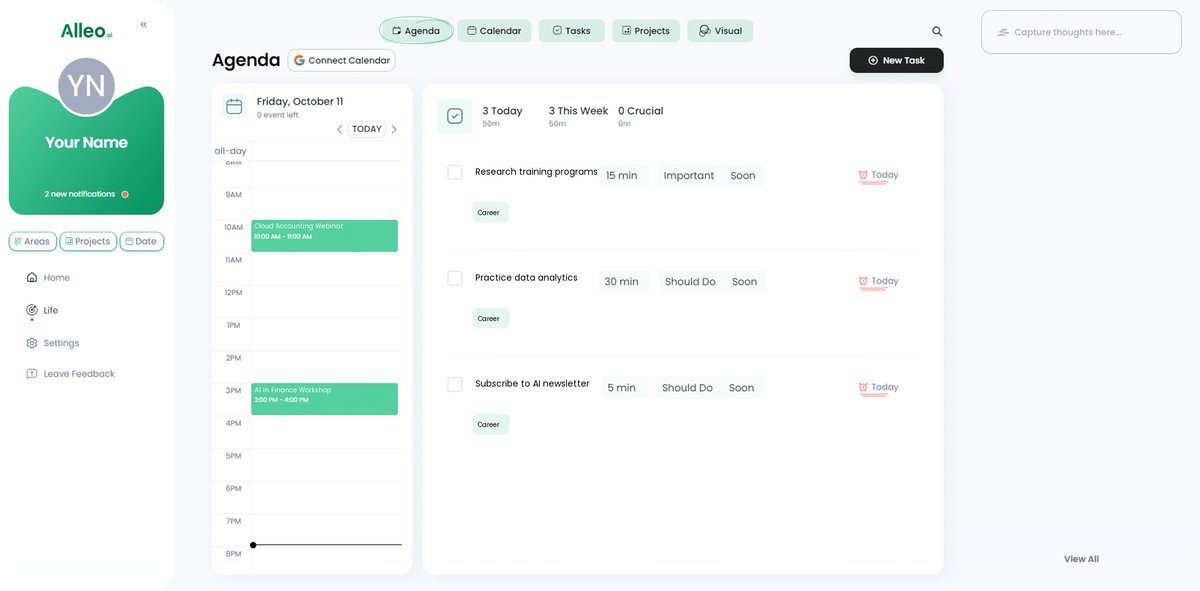

Step 6: Adding Events to Your Calendar or App

Use Alleo’s calendar and task features to schedule your cloud accounting training sessions and track your progress in mastering new financial tools, ensuring you stay on top of your learning journey and can easily monitor your advancement in adapting to modern accounting practices.

Wrapping Up Your Cloud Transition Journey

Transitioning to cloud accounting tools for accountants is a challenging yet rewarding journey.

Remember, you’re not alone in facing these changes. Many accountants struggle with similar issues in digital transformation in finance.

Embrace cloud accounting software to stay competitive and efficient in remote financial management.

Take the steps we’ve discussed:

- Enroll in training for cloud accounting tools

- Integrate data analytics for real-time financial reporting

- Develop AI skills for automation in accounting

Each step brings you closer to mastering modern cloud accounting tools for accountants.

Don’t forget, Alleo is here to support you. Our personalized coaching can make this transition to cloud-based tools smoother.

So, why wait? Start your journey with Alleo today for free and transform your accounting approach with streamlining financial processes.

You’ve got this!